What is a yield curve?

A yield curve reflects the interest rates of bonds that have equal creditworthiness but different maturity dates. For instance, the most popularly tracked US Treasury yield curve reflects the relationship between these US government bonds with various maturities (from 1 month to 30 years). A normal curve (upward) reflects economic expansion, while an inverted (downward) curve means that the debt market expects recession. These yield curves indicate how investors perceive the macro risks and the economy

Source shorturl.at/xEJU8

What is paid-up capital?

Paid-up capital refers to the money that a company receives after selling its shares. For instance, if a company issues 200 shares at ₹10 per share, then its paid-up capital would be ₹2,000. These shares are fully paid and there is no amount pending to be received from the shareholders, unlike in the case of partly paid shares. Further, paid-up capital may be less than or equal to authorised share capital, which is the maximum amount of capital for which shares can be issued by a company

Source shorturl.at/cjvxN

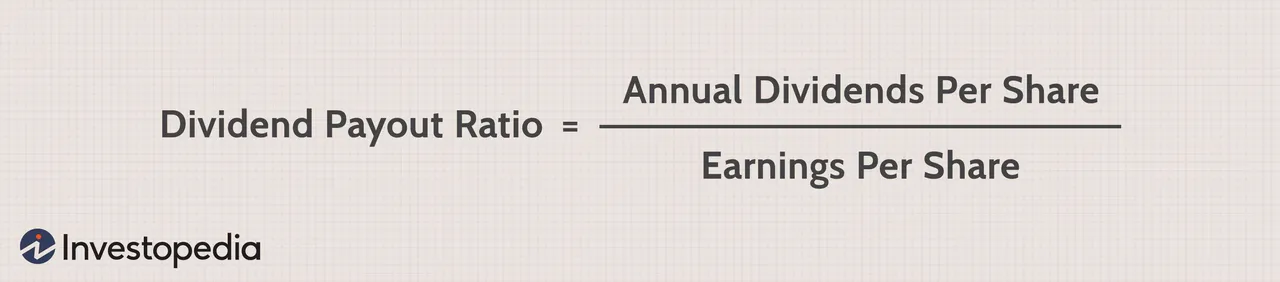

What is a dividend-payout ratio?

The dividend-payout ratio reveals how much of a company’s net profit is given out to its shareholders as dividend. It is calculated by dividing the dividend paid by the net profit. For instance, assume that a company’s net profit is ₹10 crore and it pays a dividend of ₹7 crore. This means the dividend-payout ratio is 70%. A higher dividend-payout ratio is usually good for investors, unless the company has better avenues to reinvest profits

Source https://rb.gy/ootmyq