The SEC claims that when it said 'crypto asset securities' it never meant tokens were actually securities

The gaslighting continues.

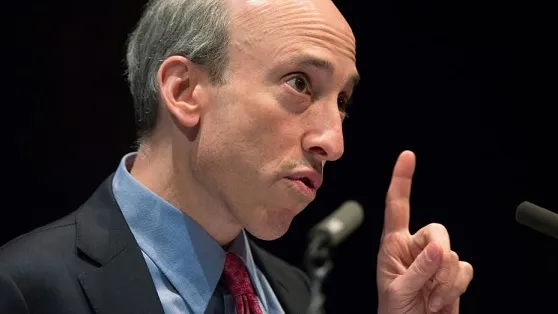

The Securities Exchange Commission has had all the time in the world to clarify their stance on cryptocurrency. Instead they insist on flexing power that was never granted to them and regulating by litigation. Only now do they admit that crypto tokens are not securities; something I've been blogging about for years now. The catch? Now they are trying to say they never implied otherwise.

These people have no shame.

The acknowledgment came in a footnote to its proposed amended complaint against Binance, having previously named tokens such as SOL, ADA and MATIC as securities in its lawsuit against the firm.

Yet now the agency is claiming — despite the clear use of the term “securities” — that it never meant to imply that any of these tokens are indeed securities.

Bitch Please

Everyone knows damn well the SEC has implied crypto tokens are securities over and over and over again. It was the primary point of contention in the Ripple Labs case that dragged on for years. Now they are like lol just kidding that never happened. Seriously what is wrong with these people? They're sociopaths. The only one of them with any integrity is Hester "Crypto Mom" Peirce.

https://x.com/DegenerateNews/status/1838592888642351112

We're trying to be ambiguous because the legal precision carries with it real implications.

Is the token itself a security?

By using imprecise language we've been able to suggest that the token itself is a security apart from [the original] investment contract.

We've fallen down on our duty as a regulator not to be precise.

Tucking into a footnote that yes we admit that now actually the token itself is not a security; that's something we should have admitted long ago.

Holy shit!?!

Somebody make this queen the new SEC chair.

Seriously though.

In a footnote in its proposed amended complaint against crypto exchange Binance, the agency said that when it refers to crypto asset securities, it’s not referring to the crypto asset itself but the full set of contracts, expectations and understandings of the sales of such assets. In fact, the agency just simply uses the term as a “shorthand.”

Seriously does anyone actually believe that heaping pile of bullshit?

Anyone who's actually experienced the SEC's tyrannical rule knows better.

This is just more unashamed lying through gritted teeth after being caught multiple times.

The agency also claimed it has always had this stance, referencing a supplement text in its case against Telegram. However, to clear things up, the agency said it will avoid using this shorthand going forward in the case against Binance and that it “regrets any confusion.”

Crypto pundits found this statement a little far fetched.

“I'm in shock,” Variant Fund Chief Legal Officer Jake Chervinsky said on X. “I didn't know it was even possible for gaslighting to be this extreme.”

Yep!

Ripple’s Chief Legal Officer Stuart Alderoty further criticized the SEC, stating it was time for the agency "to admit it has become a twisted pretzel of contradictions."

lol sick burn

@edicted/so-eth-is-legally-not-a-security-eh-

Taking a look at my most recent securities post on May 24th:

So even in the absolute worst case scenario of 100% of the tokens being premined by one person does securities law still not apply. Clearly this needs more explanation because most don't seem to understand why that would be.

Many people did not believe me when I made these claims.

I've obviously been right from the very beginning, and it only required like 10 hours of research into securities law over the last few years to become more qualified on the subject than the SEC chair himself. How is that possible? Because it isn't the job of the SEC chair to figure out the truth and honorably uphold the law. It's his job to be an unelected bureaucrat who's sole purpose is to pave the way for a Wall Street takeover of the shiny new thing. These three-letter agencies are corrupt to the core and do not serve the people.

Conclusion

The SEC will continue to be embarrassed in court as their regulatory overreach and contradictory positions over the years keeps getting exposed. It is not possible for an open-source project to qualify as a "common enterprise". The momentum of crypto has shifted and now every variable seems to be in our favor as we head into the bull market year of 2025. The rally we experience over the next 12 months will be nothing short of mindblowing. The SEC's teeth dentures have fallen out. Try not to fumble the bag.