The last run up was like nothing we've ever seen.

- It started in Uptober 2023 at $28k.

- We peaked on ETF approval around $48k in January.

- V-shaped sell-the-news dip down to $39k (-23%)

- From here it was essentially only up with no noteworthy dips all the way to $74k ATH.

Why is this significant?

Because traditionally bulls wait for a 30% dip to ape in, often with leverage. Last rally all these guys were left completely sidelined, and by the time a dip did come we were already in consolidation mode with no new all time highs to be had. Leverage has been flushed over and over again in these last 8 months and the alt market is a full-on struggle-bus. This has demoralized the vast majority of the ecosystem while giving maxis a false sense of security dominance as if Bitcoin is going to magically outperform everything next year. They are sorely mistaken.

30% dips are for sure not happening next rally.

In fact I don't even think we are going to see 20% dips on BTC. All those guys that got sidelined last time are going to make sure they get in while the gettin' is good. Personally I'll be shooting for something like 15%-18% dips because those are pretty easy to achieve just by flushing overleverage down the toilet. These will be easy x5 gambles because what are the odds that it dumps 20% farther and busts the position? Highly unlikely, I might even go 10x if I'm feeling a bit overconfident in the uptrend. Depending on the amount being risked I probably won't even care if I lose a couple.

OMG SUPER-CYCLE OMG S-CURVE

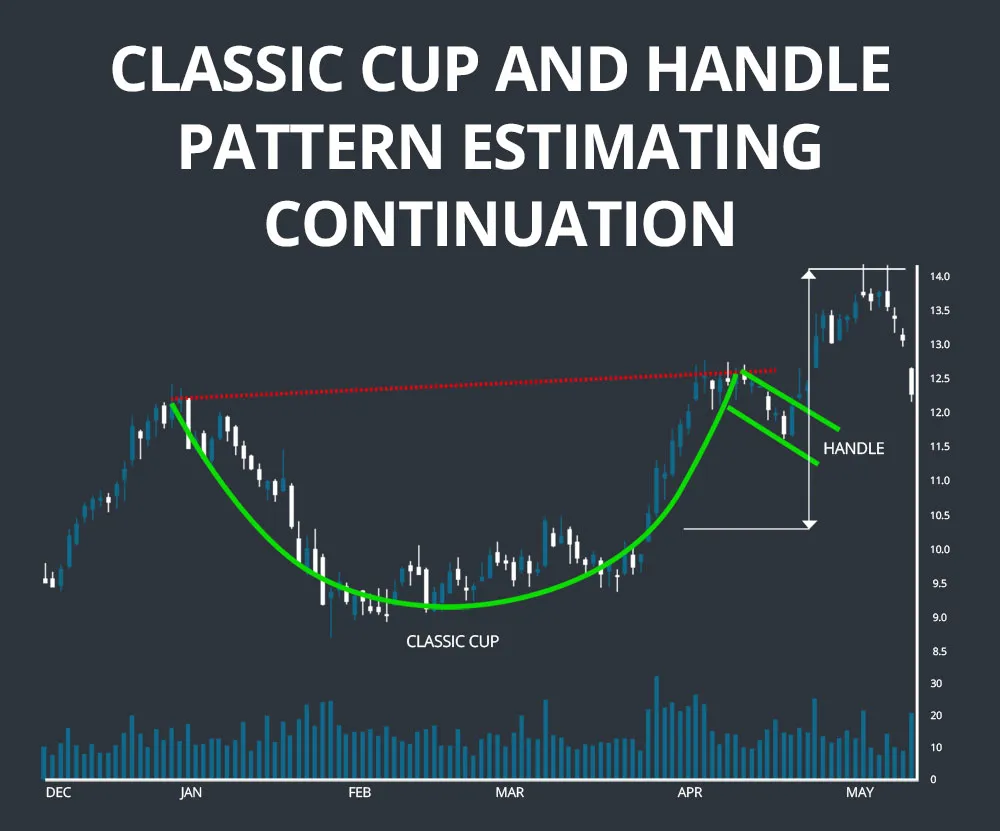

It's no secret we've been in consolidation mode for over half a year now. The chart has printed the most bullish cup-and-handle pattern I've ever seen. It spans across the entire cycle up until now. Three years later we are ready to breakout to glory. Operating under the assumption that there will also not really be any dips to speak of, in addition to the conviction of the most popular price model fad: we start to see that the FOMO of next uptrend is going to be nothing short of DELUSIONAL.

Imagine it:

The Power Law boys think they can time the top. They'll be selling heavy at around $200k-250k. Number will keep going up and there will be very few dip opportunities to buy. At this point in the game the older models start coming into play. People start talking about stock-to-flow, S-curve, and super-cycle. Eventually the super-cycle narrative will take root... which is the idea that price is NEVER going back down. That's when you know we've reached peak delusion. My guess is that BTC will be $500k or higher. Even $1M BTC would not surprise me considering the current environment.

Analysts are so sure of a thing that probably isn't happening.

When we look at BTC on the log scale we can see that every bull market was a little bit weaker than the previous one. It looks like Bitcoin is getting bogged down by its own market cap. More liquidity means the price is harder to move, right? Yes, well, I'm not convinced.

The amount of extrapolation and mental backflips one has to do to make these assumptions is quite significant. Nobody admits that we are making all of these guesses off of three data points. Three halving events; three bull markets; three peaks. This is all the data we have and analysts seem to believe it's all they need to predict the future. 3 points is nothing. It barely fits the lines of these models, and that's because the models force it using already collected data. When the info changes the model bends over backwards to refit the data.

Using 2021 as an anchor point is incorrect.

I'm still quite convinced that the 2021 bull market was cut down at the knees by overwhelming macroeconomic factors. COVID lockdowns were not good for Bitcoin. Bloodsucking the middle-class is not good for Bitcoin. Sanctions against Russia are not good for Bitcoin. And then after all that we had the systemic failure of three major institutions (3AC/UST/FTX) on top of the government waging a secret shadow-banking war dubbed Operation Choke Point 2.0. Think about how crazy all that was. And still BTC went from $4000 to $69420 in spite of all the nonsense. In the end attacks against Bitcoin hurt, but also inspire a certain kind of resilience.

Speaking of old metrics...

The one that I've been using this entire time, The Doubling Curve, is still very much in play and has not been invalidated... yet. We need to get well above the yellow line to get out from under the water we've been drowning in since the LUNA collapse.

Steady lads! Deploying more capital!

This model is similar to the power law but the slope is a little more aggressive and it doesn't do anything ridiculous like trying to put time on at log scale as well. Imagine trying to tame a technological curve by putting diminishing returns on time. Everyone understands this isn't a thing but Power Law bros are blindly convinced that time is going to matter less and less going forward. I guarantee they are wrong. Every technological trend since ever proves this. Gains are explosive and unrelenting.

If The Doubling Curve really is still in play it means we could EASILY have a 2017-strength run in 2025 because we have so much catching up to do. An 8-month consolidation period is basically the best stable-base we could have possibly asked for, as everyone complains about the crab. Going x20 from here is completely within the realm of possibility, just like BTC pulled a $1k >> $20k in 2017. That would bring us to an absurd valuation of $1.16M ($58k x 20). Will the $580k gang be a thing? Guess we'll find out.

What if it doesn't work out this way?

Well it's always good to have a plan in advance as my experience is sticking to that plan is pretty much always the best outcome rather than chopping ourselves up in the heat of the moment. All these moves have to occur in the year of our lord 2025. If we don't make it that high then we don't; it's not a big deal. We can hedge accordingly no matter hwat happens.

Conclusion

The endless permabull posting continues. The market has become complacent and needs a reminder that 40% god-candles can rip the faces off everyone and come out of nowhere. I do not approach any of this from a position of greed, but rather one of abundance and strategy. Number-go-up means we actually have the power to save the world from itself. Is that what will actually happen or will we all buy Lambos?

Guess we'll find out.