Welcome to another update of the INCOME Synergy Fund! (The longest continuously running fund-style token on HIVE!) This is all for entertainment (are you not entertained?) and any talk of investments and profits, dividends and capital is just because that sort of subject is immensely entertaining!

Make sure to check out some of the previous updates:

Roadmap Complete!

Update to Linear Divvies

Fund Portfolio Update March 10, 2022

PsyberX Fund position Update

Fund automation projects and New Roadmap

Fund Portfolio Update October 6, 2021

Fund Reorg, final swaps from STEEM

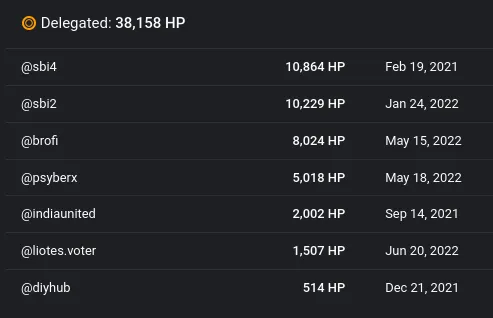

Here at the SYNERGY Fund, we continue working hard to solidify our position on HIVE, we want a rock solid base as we move forward into new phases of the crypto universe of cycles. We are mostly using our HIVE POWER to generate enough weekly cashflow to manage daily 'divvies', new user faucet, and the dcity digest rewards, I am very happy about our current crop of HP delegations:

Speaking of dividends, we have completely overhauled them and they are working as expected now - everyone with at least 1 INCOME token should be seeing daily divvy payouts. With smaller amounts there is some rounding error, but INCOME is currently paying 13% apr based on a 5.2 HIVE price currently available on the market. And I have it on good authority that we are going to bump that up soon.

But that's not what this post is about.

ABV = Asset backed value

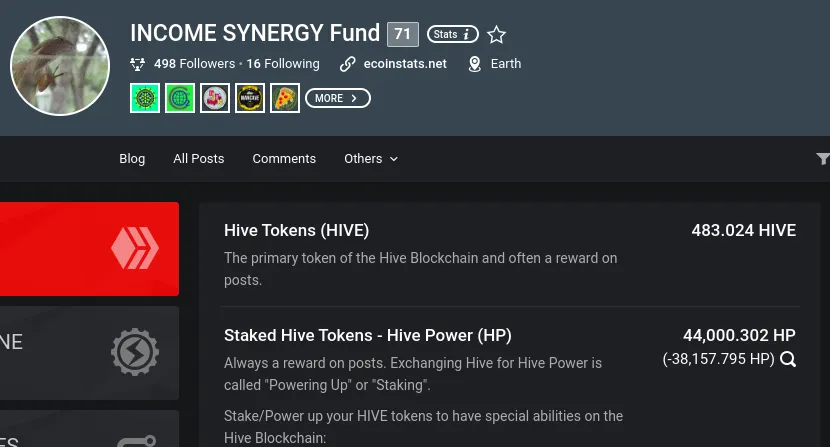

One thing I love about a 'fund-style token' is that everything is calculable. Its easy to see on an open chain, what are the assets backing up the fund. Let's take a look at our HIVE POWER and liquid HIVE positions:

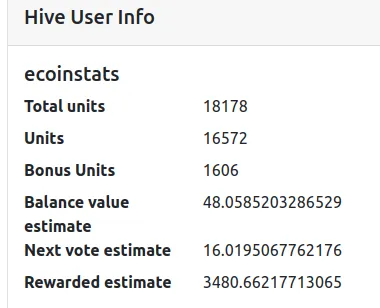

We can see that there is 44,483.326 HIVE and HIVE Power backing up the Synergy Fund of 10k tokens, meaning in just HIVE, there is a 'strict-HIVE' backed value of 4.448 for each INCOME token out there. I like to add to this the HIVE SBI value on the account, which is viewable in the peakd wallet but also in the new HIVEsbi site.

Our fund values each HIVE SBI unit at 0.5 HIVE of value.

The sum of Liquid HIVE, HIVE Power and HIVE SBI together form the backbone of our hard 'hive-based' assets, and this totals 53,572.326 HIVE at the time of posting, giving a more complete HIVE-backed value of 5.357 HIVE per INCOME token.

But there's more.

Hive-Engine 'speculative' values

Our positions on HIVE-ENGINE are of course speculative, they can go up and down, and often do. Generally when they go up, we sell them, and if they go down, and we still believe in them, we can buy more.

Here is an estimate of our total Hive-Engine portfolio in HIVE (and USD and LEO) terms.

Our main positions are concentrated in BRO, ECOBANK, WORKERBEE and LVL, with relatively minor positions in ARCHONM, DHEDGE, SEED, UTOPIS and BYT.

From here, the positions get much more minor, but of course all count towards the totals, including ARCHON, VIP, EDENBUXX, LEO, CARTEL, SIM, NEOXAG, ONEUP and LBI (which we are buying underpriced right now):

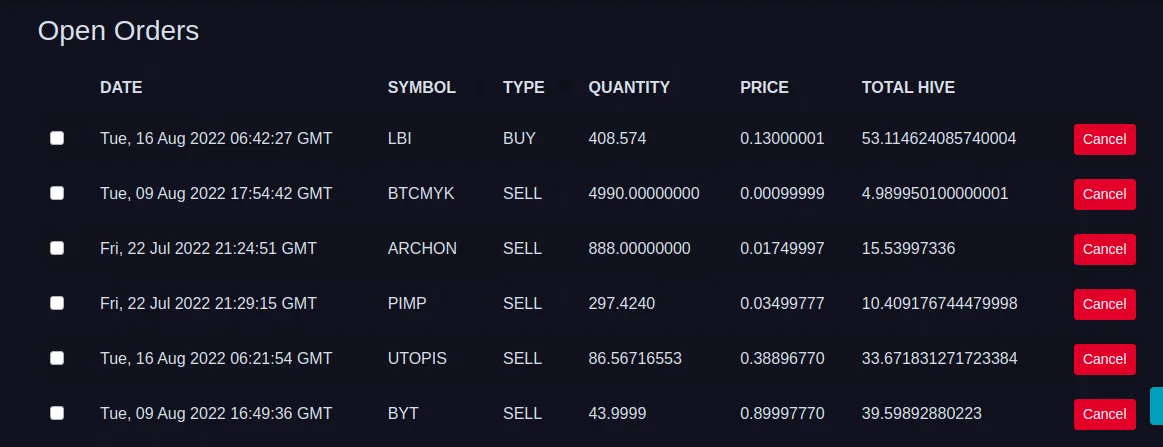

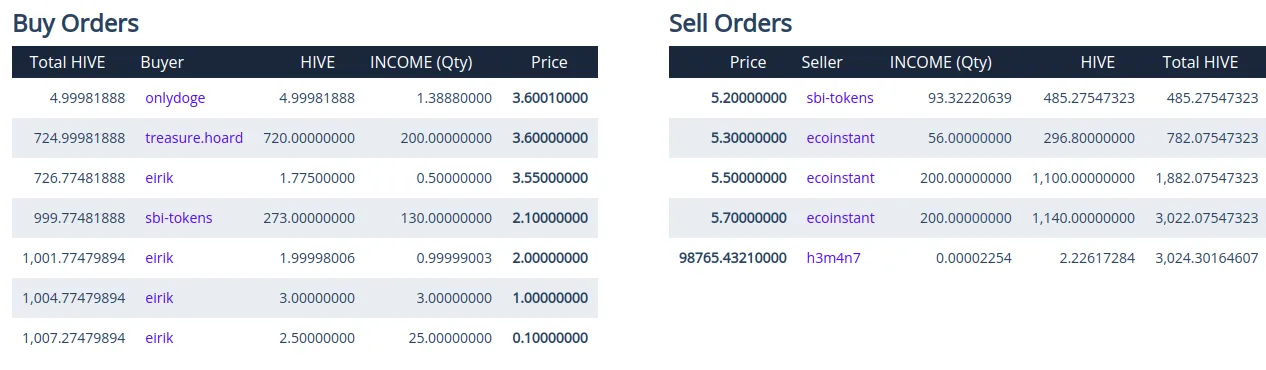

Of course, we can't forget the open orders, these, although mostly minor, are not included in estimated wallet values, and include 53 swap.HIVE in an LBI buy order and 5 possible sales that could turn into as much as 103 HIVE as well. We will leave these out of the calculation to be a bit more conservative, but include them here for completeness.

HBD

We also have 267.032 HBD on hand between savings and a internal market order listed right now waiting to hopefully buy some more HIVE at the right price. This has an estimated HIVE value right now of 430.7 HIVE with a HIVE price at time of writing of 62 cents.

Liquidity Pools

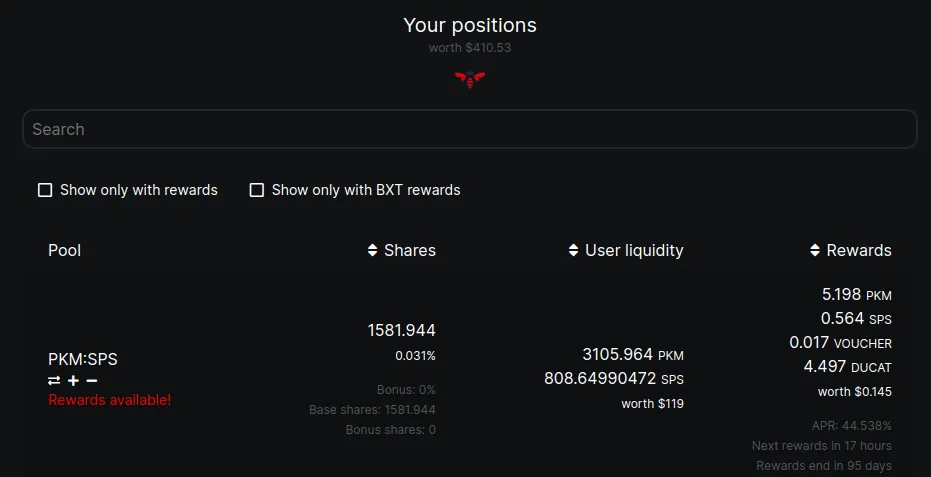

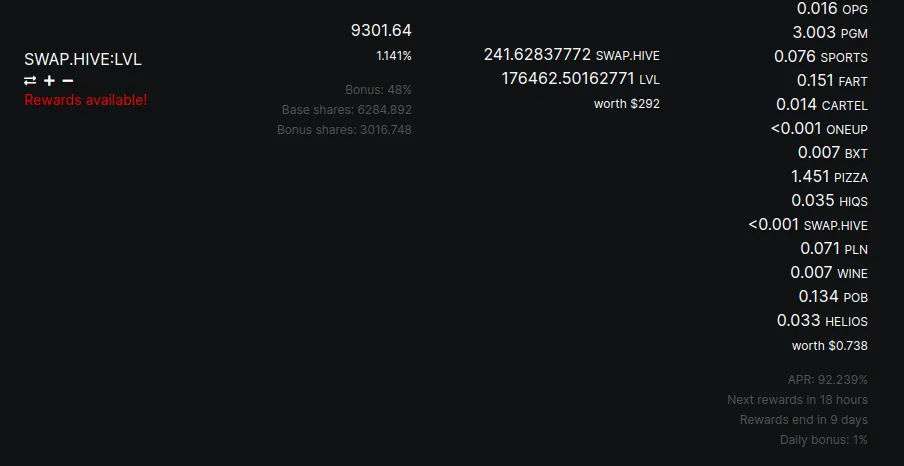

Our last 'main' position are in two liquidity pools, currently PKM:SPS and SWAP.HIVE:LVL. Our positions are currently worth an estimated $410.53, which at current HIVE price of 62 cents yields 662 HIVE.

The PKM token I find to be a very interesting project run by a great team (PeakMonsters), and the LP is the best and 'only' way to play the game, so we will stay in and keep compounding Splinterlands related rewards into this LP.

The SWAP.HIVE:LVL LP rewards are about to end soon, around which time we will probably withdraw our tokens from the LP. We put 200k LVL in and less Swap.HIVE than is in there now, so I consider it a success so far.

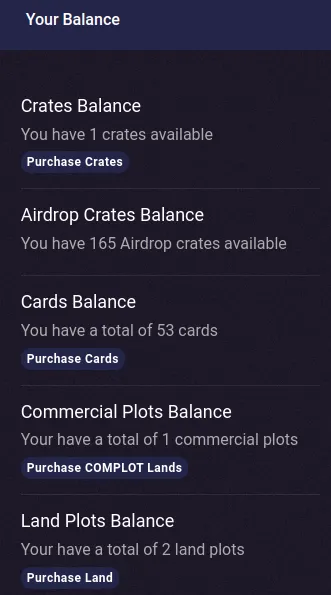

Due to our position in LVL, we also have a number of crates, titles and other NFTs associated with the @psyberx game. These are harder to value currently, but have some serious speculative value as we wait for a game that is currently being made (read more at the @psyberx blog).

Another hard-to-value asset that the fund has is some TARUK founder tokens for the WAX game RadaQuest, which has recently released its open Beta period. It seems exciting, I will try to do an update about what is going on over there (and what might be the future of our stake) within the near future, but don't hold your breath as I am quite busy - it could easily be September before I get around to it.

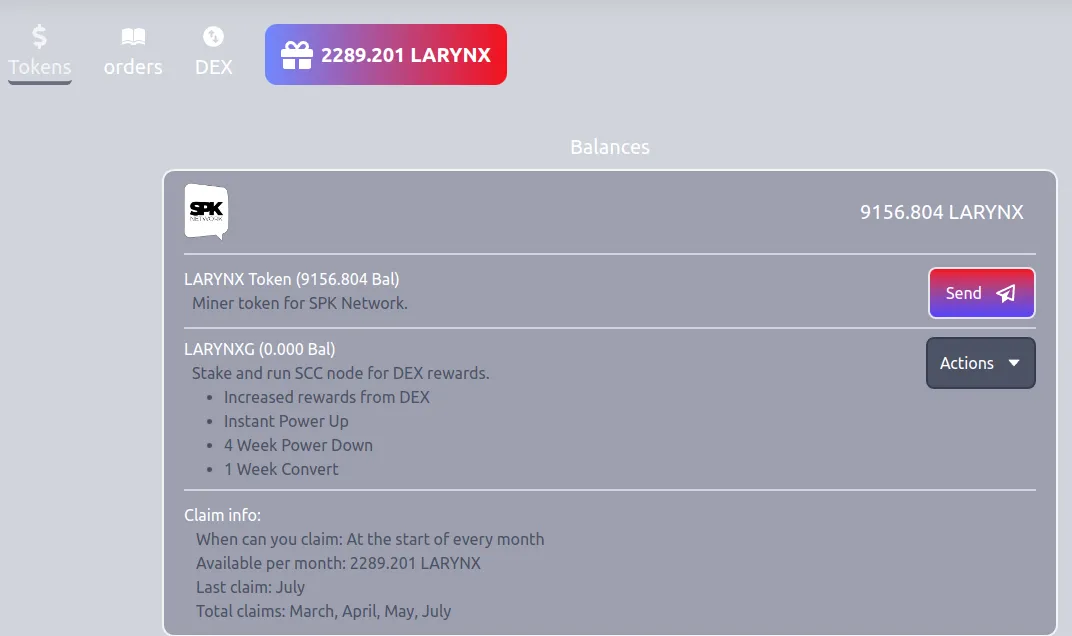

LARYNX and Ragnarok tokens

We continue to collect airdrops for LARYNX, and did claim whatever needed to be claimed for Ragnarok. We did miss June for the LARYNX claim, but have hit every other month so far including August, which we just claimed while making this post.

Currently on the internal market this amount of LARNYX can sell for at least 0.012 HIVE each, so our 11446 LARYNX tokens are worth at least 137 HIVEs.

Totals:

Hive Power: 44000.3 HIVE

Liquid HIVE: 483 HIVE

HIVE SBI: 9089 HIVE

HIVE-ENGINE: 22393 HIVE

LPs: 662 HIVE

HBD: 430.7 HIVE

LARYNX: 137 HIVE

TOTAL ABV: 77,195 HIVE / 7.719 HIVE per INCOME token

Not included: PsyberX assets, TARUK founders tokens, small amount of open token orders on HIVE-ENGINE, SBI 'balance', Splinterlands Spellbook, Ragnarok tokens.

With all that is not included in the value, its pretty clear that this ABV is more likely to be 7.7+, since there might be some major value coming out of these uncounted totals over time. The 165 Airdrop crates alone, if they were valued at $20 like a regular crate, would have a value of 3300 USD or over 5300 HIVE! But, since there is no way to liquidate them, its best to be conservative and just leave them in the 'uncounted, but super speculative value' section of the report.

Market price: 5.2 HIVE

Where else can you get exposure to 7.7+ HIVE worth of value for just 5.2 HIVE in price? Not only that, something that is paying 13% apr daily dividends, vastly undervalued to the ABV at market price, and the longest running fund on HIVE?

INCOME really is the most entertaining token on HIVE!

While we almost have sold the entire allocation at 5.3, for the time being there are some underpriced tokens at 5.2, I would encourage anyone interested to take advantage - of course our @ecobanker project is slowly buying them up, but you can feel free to buy 1 or more INCOME tokens to participate in this fund and start getting daily divvies and exposure to the speculative upside as we go.

@sbi-tokens made a great trade and picked up their INCOME tokens on the cheap (2 HIVE!), this is the way the market goes and not all participants need to be holders, @sbi-tokens is providing liquidity for the INCOME market and seems to be making a nice amount of profits doing it.

You can always check out our richlist here, as mentioned in previous posts, I am the largest holder of INCOME tokens, which makes some sense as I trust myself completely.

But for those of you on the fence, I also use the INCOME token as somewhat of an exclusive club, I offer advice and consulting to members of my fund, such as - project review, suggestions, recommendations for dCity or other advice as appropriate to the situation.

And if you are an INCOME holder, feel free to contact me on Discord with a friend request. Otherwise, leave all public questions and commentary here on this post! You, dear reader, are appreciated.