As time passes HBD gets better. It has been working as designed in all of its exitance without any failures. Its has been improved in the age of Hive and has kept its peg ever since.

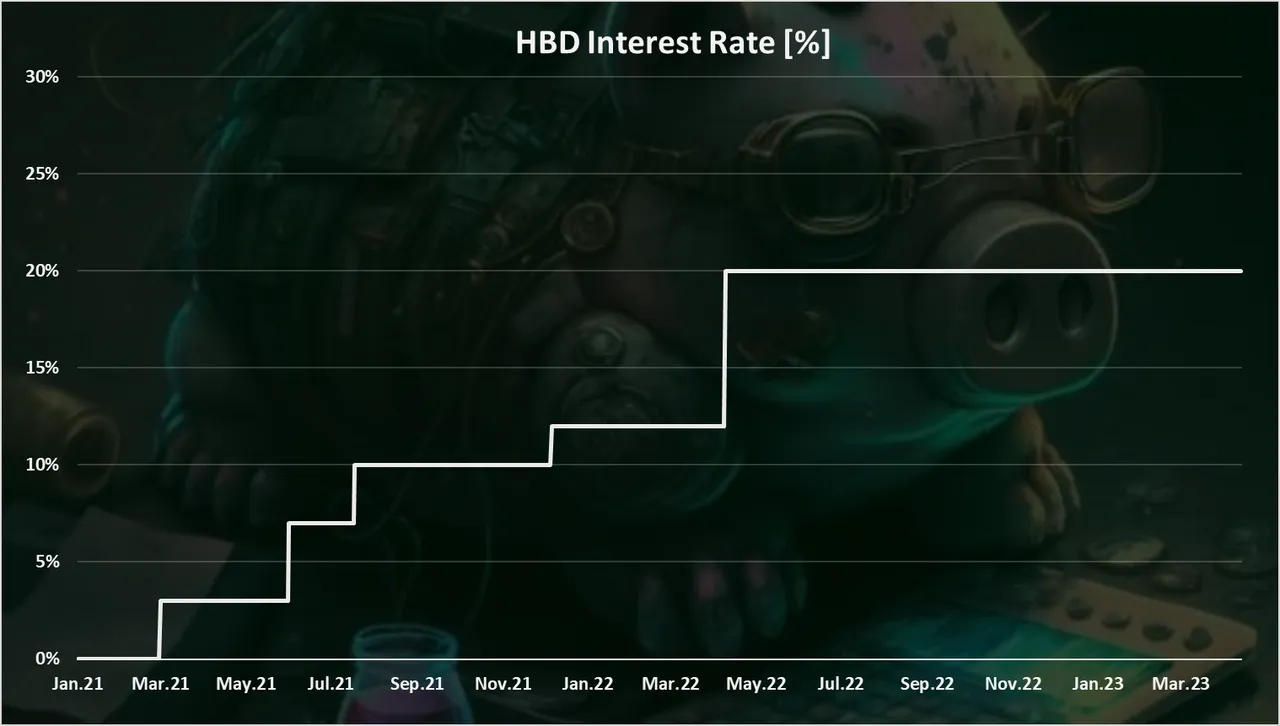

The HBD interest rate was set to 20% by the top Hive witnesses back in April 2022. A full year has passed how its paying out 20% interest on the HBD in savings.

The withdrawal from the savings account is three days. A reasonable period. It’s like staking with three days unlocking period.

When the interest on HBD was first set by the witnesses somewhere in March 2021 it was only 3%, then they push it to 10%, 12% and now a 20%! You can see what the interest rate is set by the witnesses here https://peakd.com/me/witnesses.

With the latest Hardfork the debt limit for HBD was pushed to 30%, allowing more HBD to be printed before the haircut rule is applied and HBD is devaluated.

Now let’s take a look at the data and see how much HBD has been transferred to savings and who is taking advantage of the HBD interest rate.

The period that we will be looking at is starting from 2021 to 2023 .

We will be looking at the following:

- HBD balance in savings

- HBD savings VS liquid balance

- Daily and monthly interest rewarded

- Cumulative interest

- Top accounts that hold HBD in savings

- Top accounts earning interest

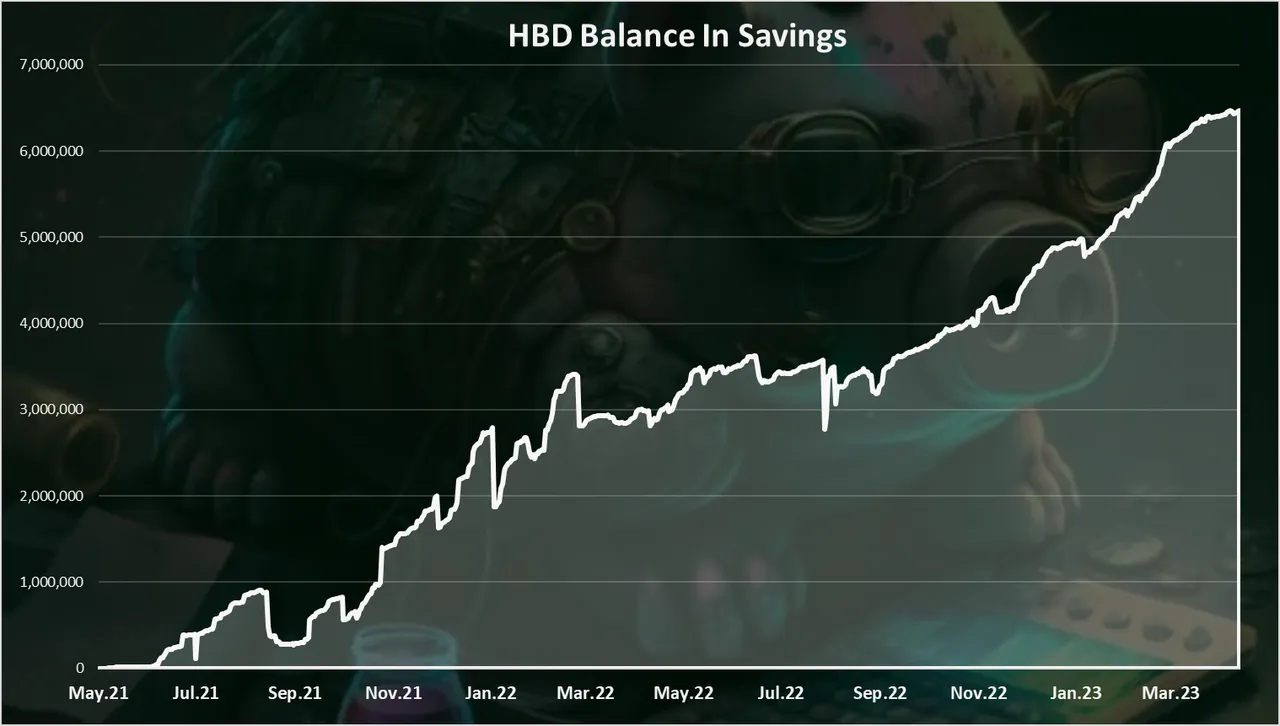

HBD Balance In Savings

Here is the chart for the HBD balance in savings in time.

A clear uptrend here with continues growth!

The HBD balance in savings stated growing in July 2021 and continue an aggressive expansion up until March 2022, with some bumps in the way. In March 2022 the ATH for HBD in savings was at 3.5M. In the period of April – October 2022, the HBD balance in the savings has stabilized around this number.

Then, from the end of the 2022 up until now, April 2023, again a more aggressive growth and we are now at 6.5M HBD in savings.

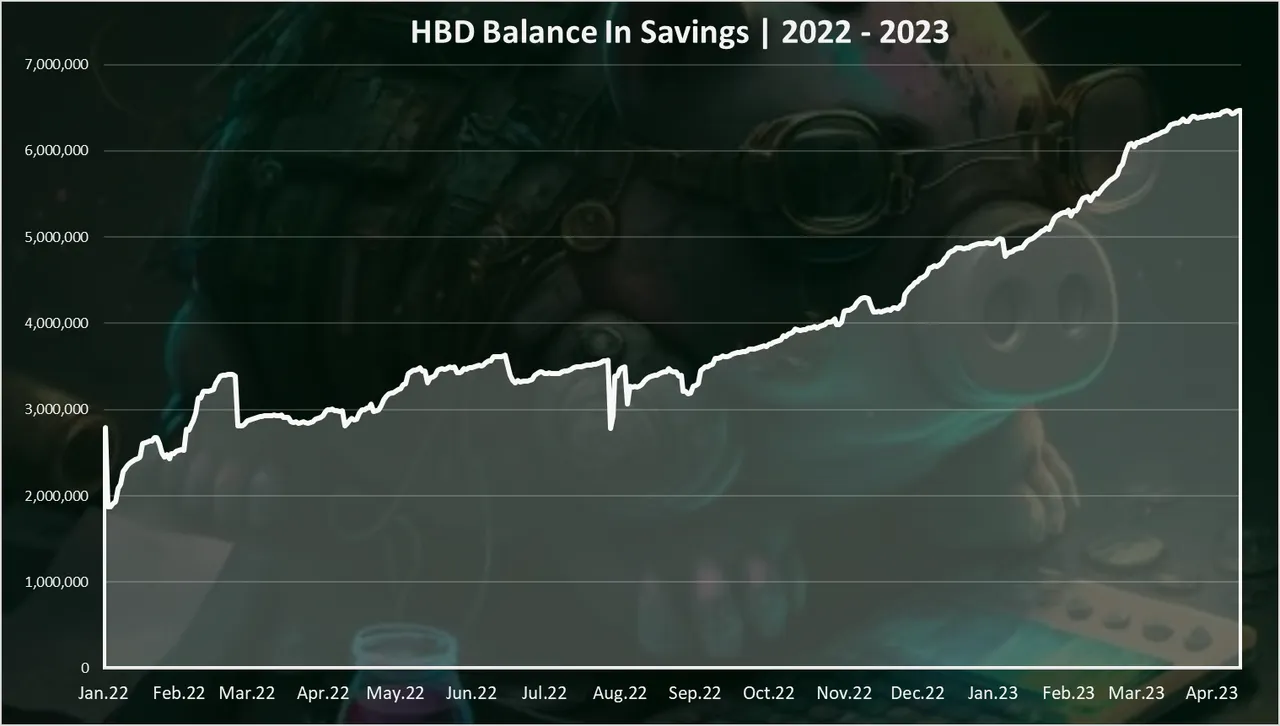

If we zoom in we get this.

A steady growth with some bumps usually when the price of HBD increases.

HBD Interest Rate [%]

Historically the interest rate for HBD has been as follows:

- Mar 2021 - 3%

- Jun 2021 - 7%

- Jul 2021 - 10%

- Dec 2021 - 12%

- Apr 2022 - now – 20%

We are now a full year with the 20% interest rate and it is the longest period in the Hive history to hold this percent.

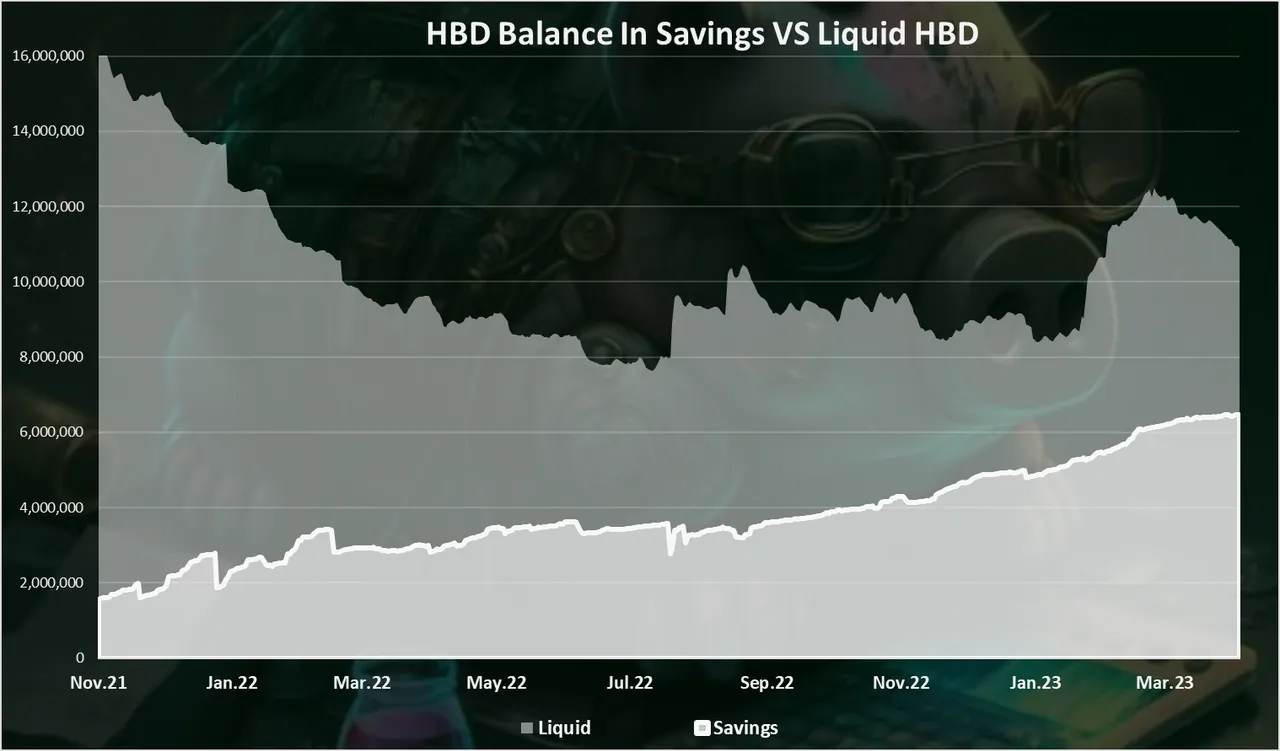

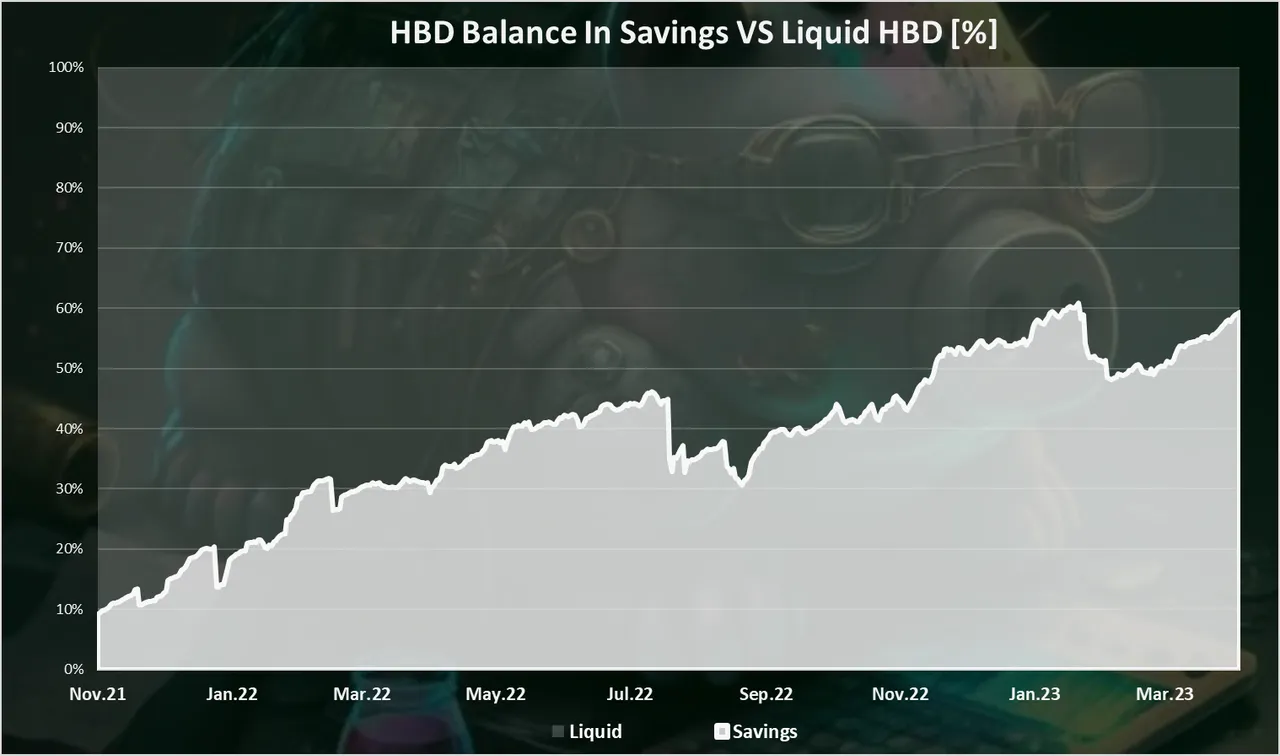

HBD Balance In Savings VS Liquid HBD

Here is the chart.

As we can notice the HBD balance in savings has kept growing, while the overall HBD balance has been going up and down. In 2022 the overall HBD balance has went down, while the HBD balance up, basically eating away most of the liquid HBD supply.

At the moment of writing this, there is 6.5M HBD in savings and 4.4M liquid HBD, or cumulative 10.9M HBD. More than 50% is in the savings. Note that this balance doesn’t include the HBD in the DHF fund, that are not freely circulating.

When we plot the chart above in percent we get this:

We can clearly see the trend here where more and more HBD share is locked in savings.

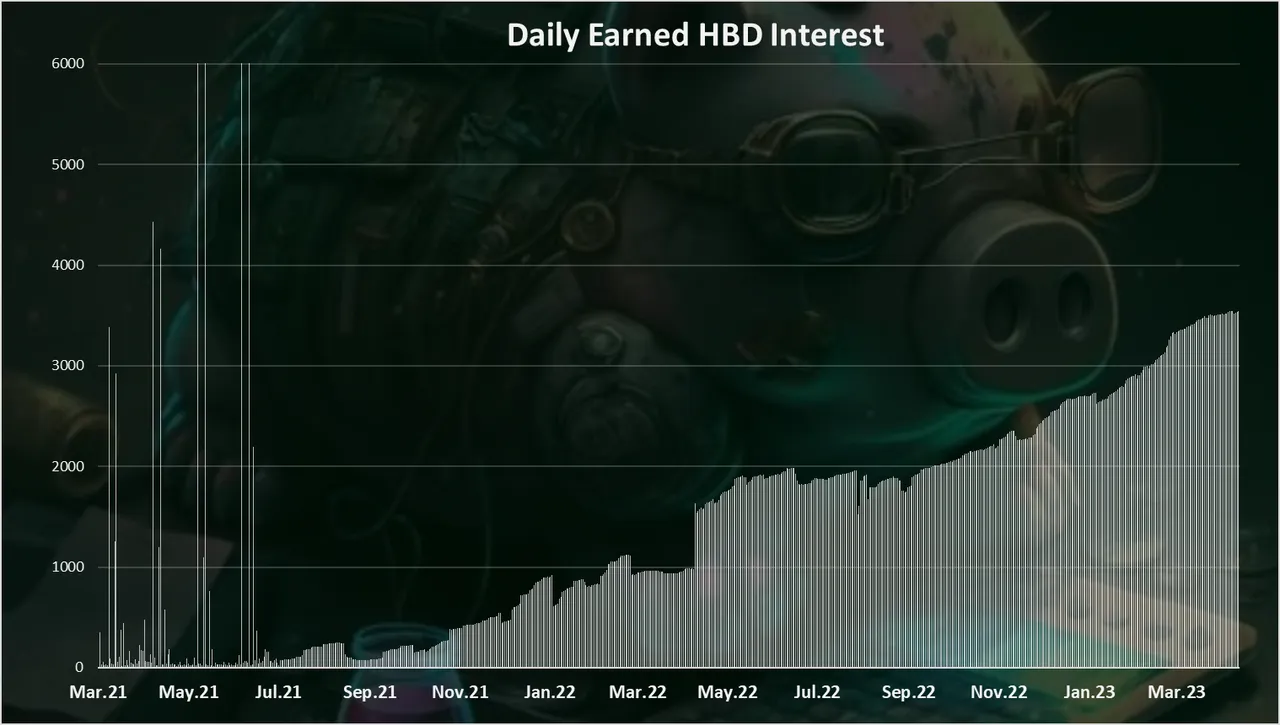

Daily Interest Rewarded

How much interest is paid to the HBD in savings? Here is the chart.

At first in 2021 the interest was paid to all the accounts that hold HBD, without the need to be put in savings. Then after the HF in June 2021, HBD interest is paid only for HBD in savings. We can notice the sharp drop at that time.

Since then the daily interest payouts depends on the amount of HBD in savings and the interest rate for HBD APR.

The payouts started growing and reached to around 1k HBD daily prior to April 2022. Then the APR increased to 20% and so did the interest increase and reached 2k shortly after. Since then, it has been constantly growing as the HBD balance in the savings increases and now we are around 3.5k HBD daily interest.

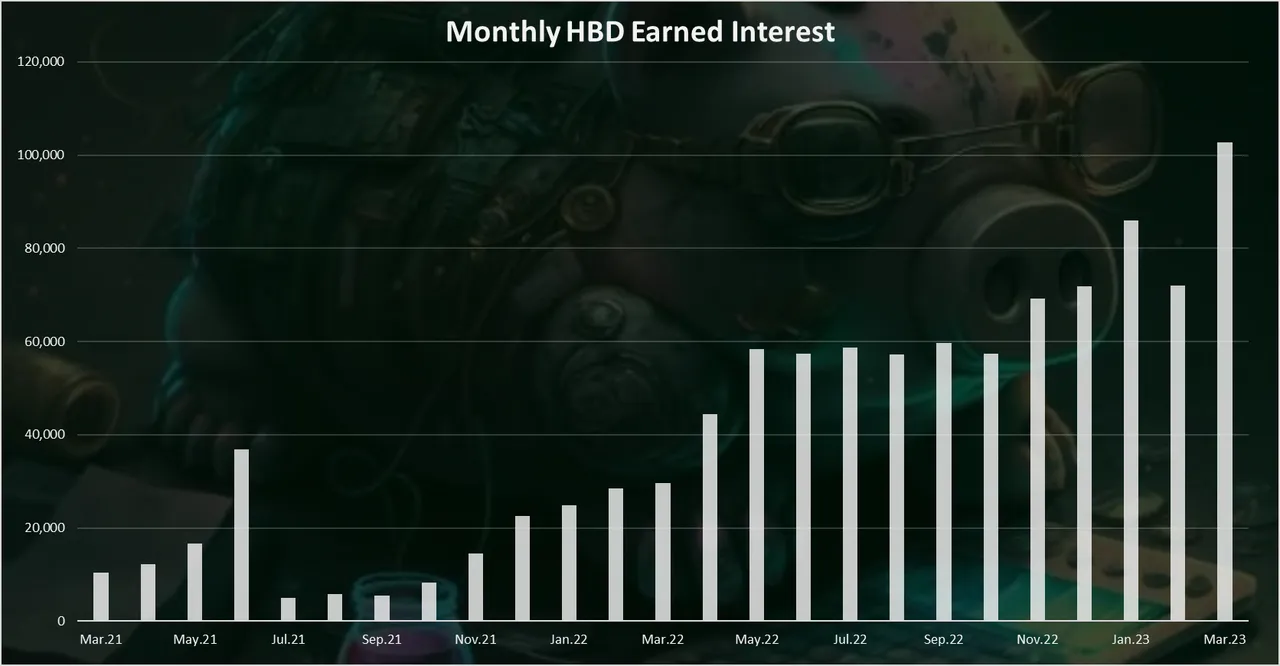

The monthly chart for the HBD interest looks like this:

March 2023 has seen the highest payouts in HBD interest with more than 100k HBD paid as interest in the month. Prior to this there was a period with around 60k HBD paid, then up to 80k and now 100k.

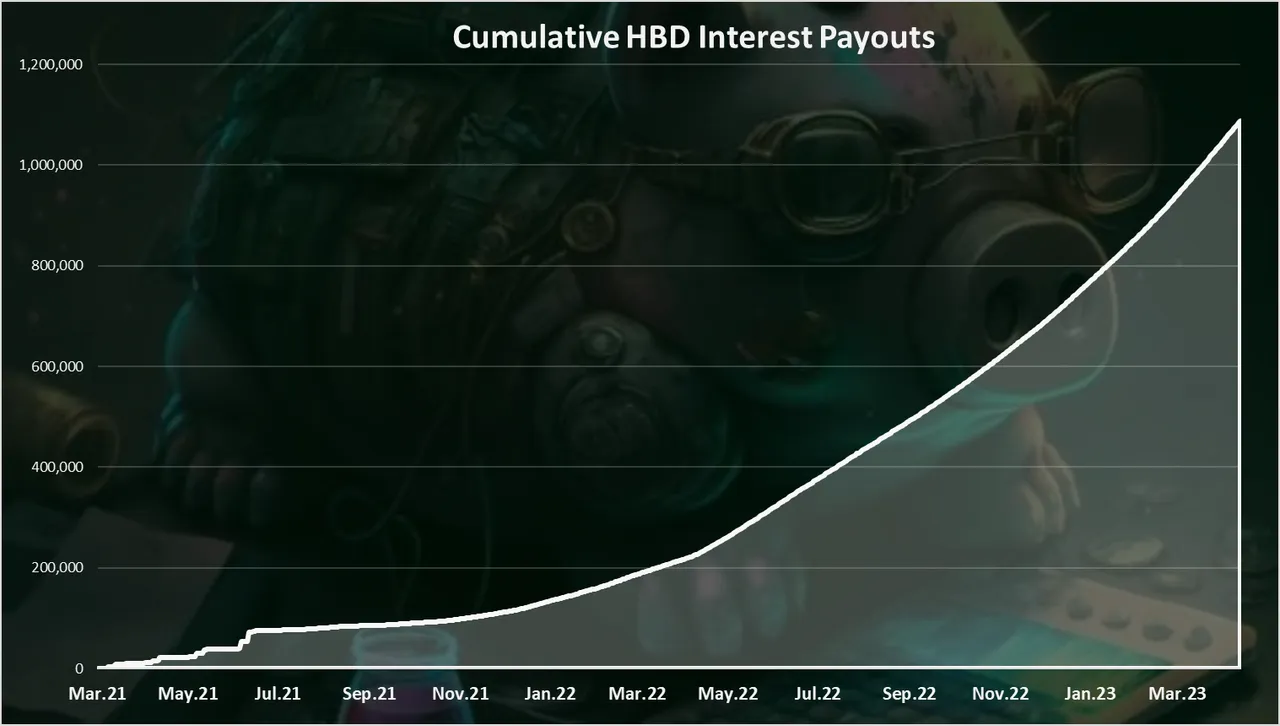

Cumulative HBD Interest Payouts

The chart for the all time cumulative HBD interest earned looks like this.

More than 1M HBD is paid in interest now from the Hive blockchain. This is in a period of two years’ time, with more heavy payouts in the last months.

Top Accounts That Hold HBD In Savings

Who has the most HBD put in savings? Here is the chart.

The @lazy-panda account has been staking a lot of HBD in the last period, especially in January 2023 and it is now dominant on the chart with just above 1M HBD in savings. @newsflash is on the second spot with 433k, followed by @muenchen.

@alpha is now on the top with almost 200k HBD in savings, followed by @muenchen. @mika is on the third spot now, after a long period of time when it was dominating the chart.

More than 7.3k accounts have at least 1HBD put in savings.

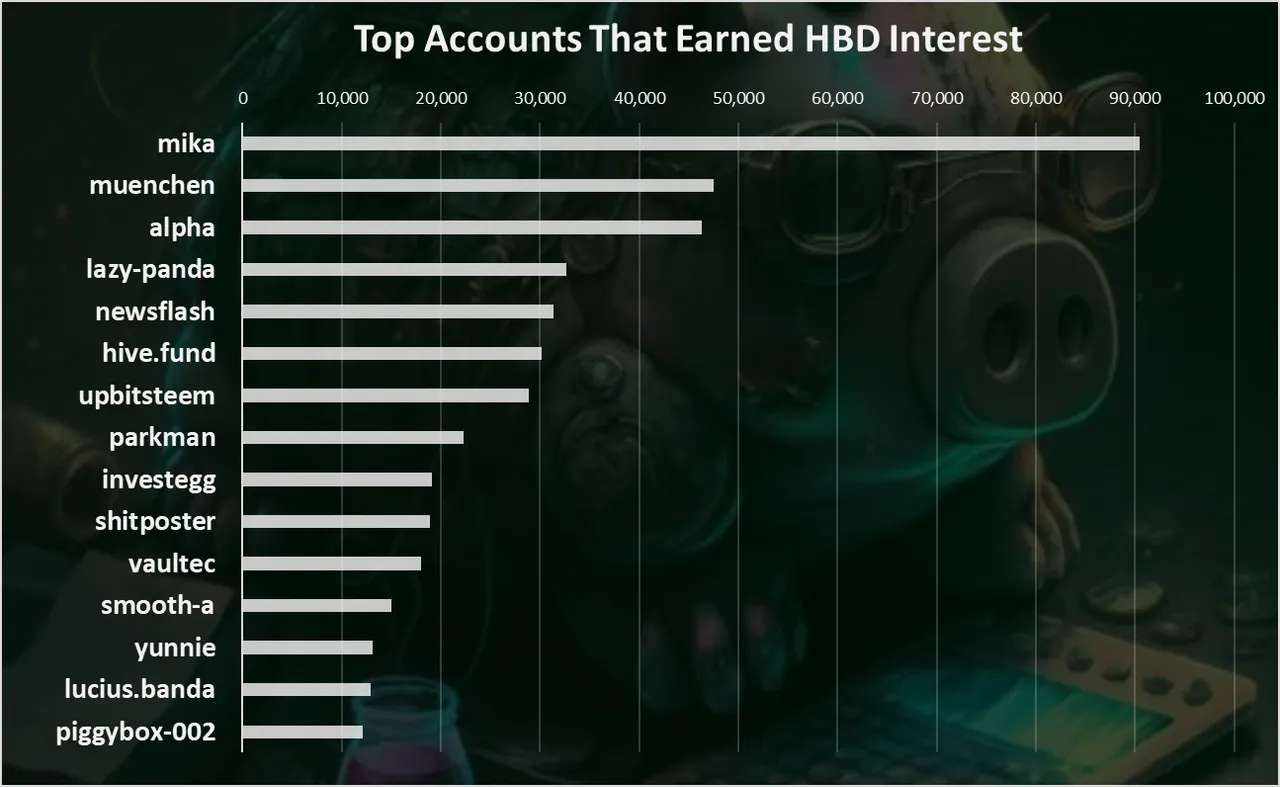

Top Accounts That Earned HBD Interest

The above was the current situation for accounts that hold HBD in savings. Some might have added and others removed. Who has earned the most in the past?

Here is the chart for interest earned.

Here is the chart for the all time interest earned from HBD in savings.

@mika comes on top here, followed by @muenchen and @alpha.

An overall uptrend for the HBD in savings, with more aggressive increase in 2023!

This is most probably because of the new 30% debt limit after the recent Hardfork. I expect for the HBD in savings to continue to grow as long as the 20% APR stands. This said it is worth debating what is the proper long term interest policy for HBD.

This steady growth for the HBD in savings is happening in a bear market. Meanwhile the overall HBD supply has decreased and the debt is now just around 6%.

HBD has proved to be resilient even under the bear market conditions of 2022.. As time progresses and the concept proves itself more, we will see more and more HBD put in savings, that will on the other hand put pressure on the HIVE price as well.

Not to forget that HBD savings are on L1 blockchain, not a defi app with third party risk. Payouts are in the native HBD token, not a secondary yield token. Much better security and stability. Other daps can build on top of this.

All the best

@dalz