As a person that is new to crypto, there are a lot of things that I have to learn "on the go" so to say. Using wallets, transferring between the blockchains, with memo or without. And where to by what crypto. And that is just to mention a few of them. One thing you do come across inevitably is trading.

My first few run-ins with trading

Unless you are familiar with how it works from some other place. I was not. It is all pretty much looking like a jumble of lines. Sure I get the basic idea of charting price over time. But what is up with the different charts? Why do they call things "candles"? My questions were becoming way too many compared to the number of them I was able to solve by just looking and trying to figure things out on my own. It was quite overwhelming to try and take in and make sense of all that information at the same time.

Because of that, I decided to do the only sane thing I could think of at the time. Leave it alone. As the saying goes if it ain't broke don't fix it. And as I was not even sure what the "it" was, to begin with. I thought it was probably the smartest thing to do to leave it alone. But I did however swear that I would be back and then there would be a lot of "fixing it", I just needed to figure out the "it" part first.

Starting with the basics

I slowly started to learn this and that as I watched videos where they analyzed different charts. But I still felt like I was lacking all the foundation to stand on. It was more akin to putting up walls and roof but entirely skipping the floor. It might look nice to start off but it would probably fall apart pretty fast.

That lead me to do some research. And while I was looking into it, I thought that probably there were others in my situation. So I thought I would share what I pick up along the way. And hopefully, we can all become expert traders down the line. Or at least know our head from our a*s, that way we can put our best part forward. And if you looked at my picture you know it is not the head part I am talking about. ;)

The most basic thing of them all is to understand what the graphs show. Most of them show the same thing. I say most as there are probably a few that work differently. They have two axes, one that goes left to right, and one that goes up and down. The one that goes left and right is in math called the X-Axis. And the one that goes up and down is called the Y-Axis.

In trading, the X has been replaced with Time. This means if we move to the left we will go back in time. And unless we are looking at a historical graf we can not move to the right. As that would put us in the future. The Y has also been replaced. This time not by time, but by price. If we move up, the price increases, and if we move down the price decreases.

This is the very basis of how the graphs work in trading. What is important to note is the values on the time and price sides. As these can vary. Most of the price will be displayed in either your native currency or the USD, or any other main currency. And the increase and decrease steps can, in theory, be made as big or small as you like. But are generally kept in proportions that make sense. This is because no one is really interested in knowing the price of a Bitcoin down to the cent level. But if you take another coin with a low per coin price, then cents or even 1/100 of a cent can mean a huge deal in terms of % value.

Candle chart

We now move on to an actual chart type, there are several but the one I prefer. And think the most commonly used, is the Candle Chart. So this is the one we will look at. I assume it gets its name because each data point looks like a candle. And talking about data points, they look like this on a candle chart.

Each data point consists of two things, the main body, the candle. And the high and low points, the wick. nd there can be two wicks on each candle, one above and one below the main body.

The difference between the solid black body and the white body is the start and stop points for the body. The black body, often shown in red, has its open price up top. This means for the time duration the data is relevant the price has dropped. It is lower at the end of the time period than it was at the start.

And of course, the opposite is true for the white, often green, bodies candle. It has its Open Price at the bottom, and when the measured time was up, the price of closing was higher than at the start.

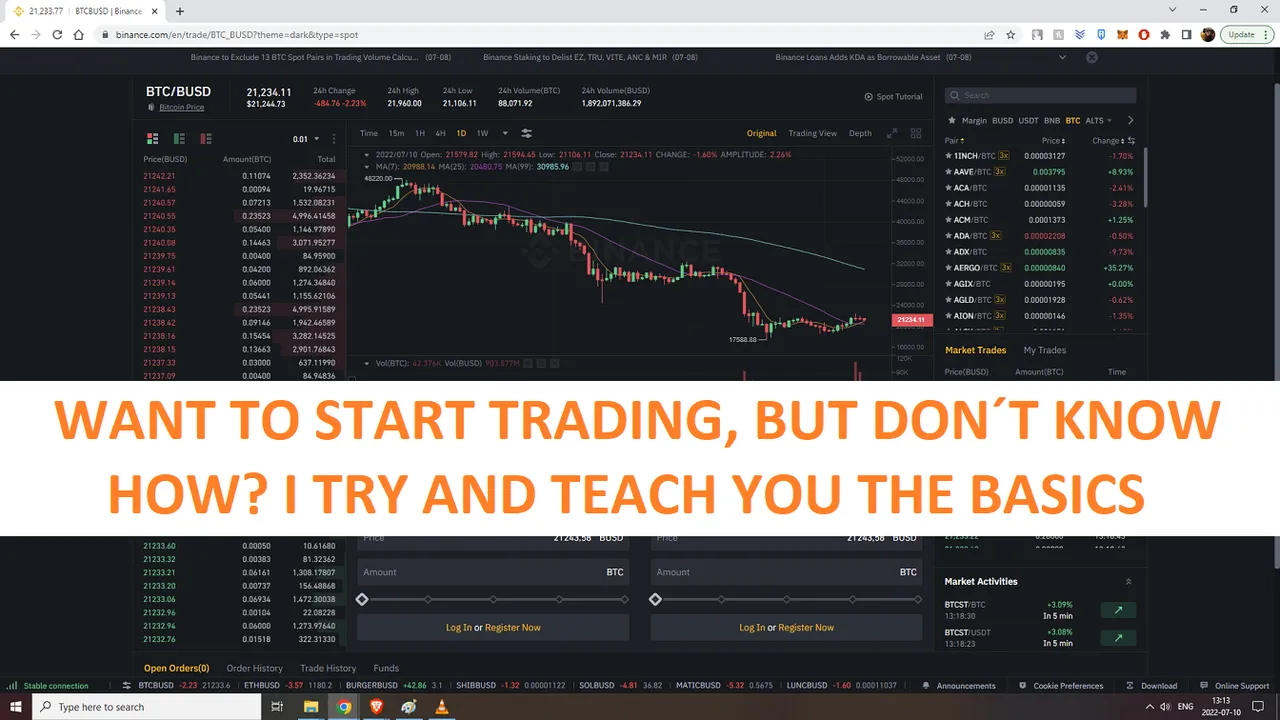

We will not take a look at the Bitcoin/BUSD trading view on Binance.

- Is the trading pair. It tells you what two commodities you can trade with each other. Here it is Bitcoin and BUSD.

- The time setting. This will allow you to change how much time each candle will represent. Here it is set to 1 day. Meaning each candle represents 24 hours.

- The x-axis, show you the time. When the setting is 1 day, each step on the x-axis is 1 day so that is why you see dates there.

- The y-axis, here you will see the price. The price is displayed in the trading pair. This means that 1 bitcoin will give you 21.234,11 BUSD at this time. It is important to note that the trading pair dictates the price. And if the pair would be Bitcoin/DOGE then the price would be vastly different because DOGE is valued much lower than $1 as BUSD is.

Trading pair

The trading pairs available on a site are often limited to a few. The more popular a cryptocurrency is the more available pair are available usually. And if you are looking for a certain par to trade then you might have to look at a few sites in order to find it. If it is available at all.

Most CEX, or Centralized Exchanges, have their own token or Coin. And they will premiere that of course. On Binance as an example, you would expect to be able to trade BUSD for basically anything that is available to trade. And by far the most common type of pair is any crypto paired with a stablecoin. But different CEX will premiere different stablecoins.

Making the trade

When you make a trade you are placing an order. You enter the price you want to buy or sell the crypto for, and how many you want to buy or sell. Then you confirm the order. It is then placed in the queue, depending on the price you have asked. If you look at the left side in the picture above you will see the trad queue. Here you can see all the buy and sell orders placed by others.

And as soon as someone places an order to either buy or sell the crypto for the asked price that order gets "filled" or executed. At the very bottom on the left side, you are able to see the text "Open Orders(0)". This tells you have many orders you have in queue. And if you scroll down you would be able to see the orders and cancel them if you would be so inclined.

As I use Binance as my main CEX and on-ramp. I felt it easier to use it as an example. And if you use another platform or dApp to trade the look might vary. But the general information will be the same. And if you look around a little and make yourself accustomed to it I am sure you will find that the exact same features will be there.

Now you are ready to start trading crypto. Or at least as ready as I am. There are many different types of trades you can make, but I have not, not yet at least, dug into how they work and what makes them different. And I see them as more of an advanced level.

I hope that you have found this post to be informative and educational. And if I have made any mistakes or errors please point them out so I can fix them. And if you have any questions post them as well in the comment section down below and I will try and answer them as best I can.

If you would like to support me and the content I make, please consider following me, reading my other posts, or why not do both instead. You can find my other posts here and here.

I have also just started a new series of weekly posts, that will go live every Friday. You can catch the ninth step here:

Buying my first crypto - My Journey to Financial Freedom

See you on the interwebs!

Picture provided by: Me =)