Hello Hive,

Hope you are doing well. :)

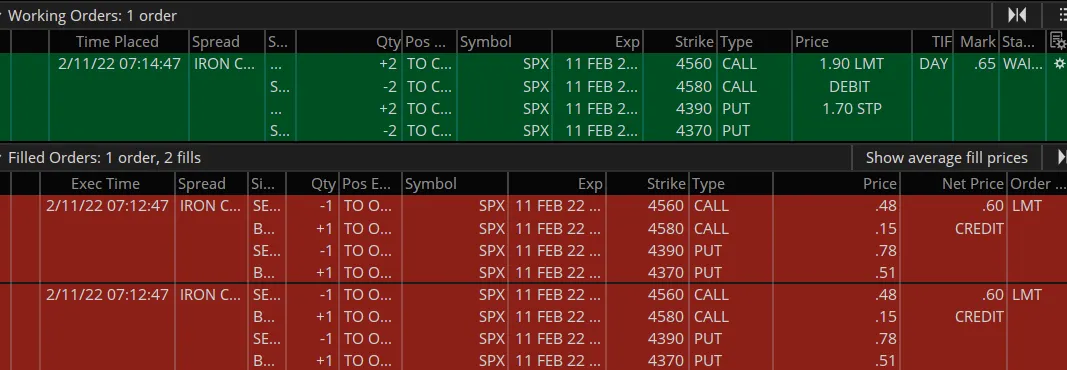

I traded, as I do on most all 0dte days (that's 0 days till expiration), and sold an option.. well, a combination of options that make up an iron condor.

Let me just show the final chart that shows where the trade got stopped out..

Price really moved down all of a sudden which cause an otherwise nice trade to get stopped out. I always use a 3x stop, which means it's 3 times the credit I received for selling the options. Since the broker gives me my credit up front, only twice the amount of credit is lost in the trade. so today I sold for .60 ($60) x two contracts for a total credit of 1.20 (really $120). I had my stop at 3 times the credit, so 1.80 times 2 contracts.. 3.60 ($360), then subtract the original credit of $120.. total loss is -$230

Here's my triggered order..

Things were looking good and price was moving nicely in a tight range..

As the morning went on, it got even better..

Alas, there were some big moves that caused a sharp drop and the trade was stopped out..

Sometimes the market just moves unexpectedly. (I blame the brokerages) :P We, as serious traders, are not here to win all of our trades, but to increase our trading accounts overall. Sometimes you don't know the outcome of the fight, but you just need to be in the game.. win the ones you can, and cut your losses when those happen.

So, I shoot for a win % of about 80%. That's 4 wins out of every 5 trades. This trade is my first lost in my latest cycle of wins, which I had 5 wins. Last year I was still learning this method and would win 2-3 times on average, before a loss came.

Of course you never WANT to lose, but I will gladly take 5 wins to 1 loss..

Here's my trades so far this year..

IC,PCS,CCS delta 2-8.. 12 wins/15 trades.. 80%

Do you have any questions for me or maybe a comment for me? Thanks,

:)