Tether, the first company to issue asset-backed stablecoins on Ethereum, reported a record $5 billion dollar profit in the first half of 2024.

In this post we cover Tether basics, its pros & cons, and how the company has been able to rake in such considerable profits.

What Is Tether

Tether issues dollar-backed digital tokens called USDT on public blockchains, allowing for fast, efficient, and relatively cheap payments.

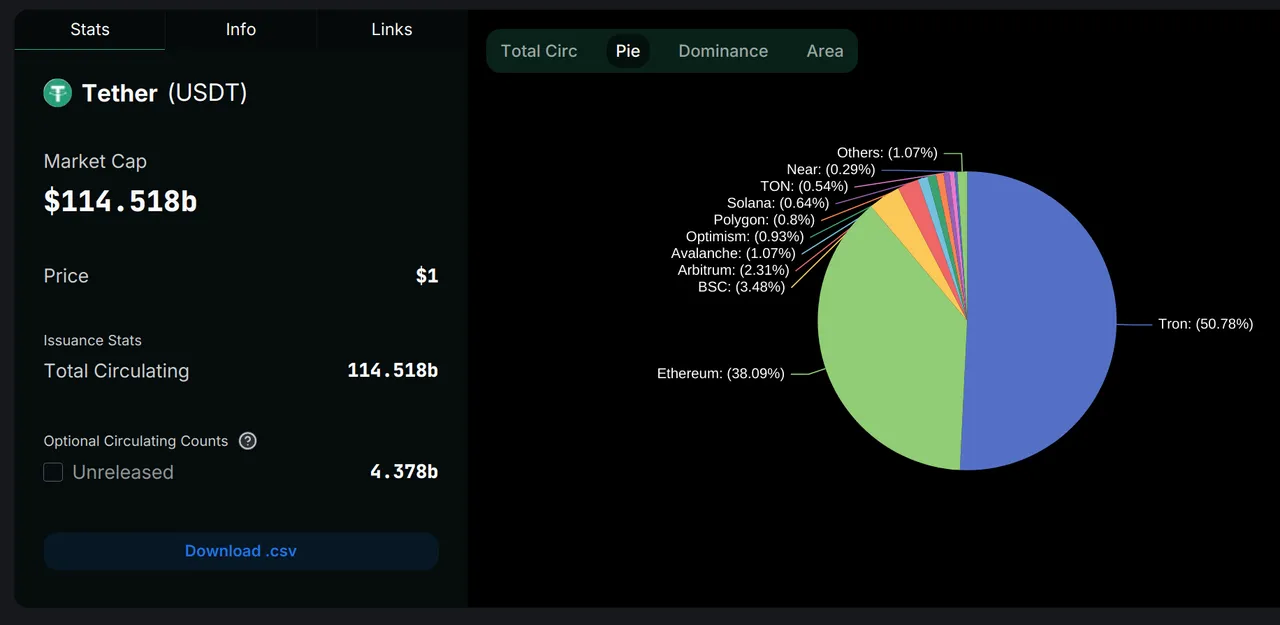

Originally launched on Ethereum back in 2017, USDT has since expanded to several other public blockchains. In fact, TRON currently holds 50% of the total supply of USDT.

Blockchains like Ethereum and TRON are permissionless, meaning that anyone can create an account by simply downloading and installing a wallet.

USDT tokens can then be transferred freely between wallets, the sender only having to pay a transaction fee in Ethereum (ETH) or Tron (TRX) to the network validators.

Benefits Of Tether

The primary benefit of using USDT is that you don't have to wait days or weeks for money transfers to complete, which is often the case with traditional banks.

For example, somebody in the United States could send ten thousand dollars worth of USDT to another person in Argentina almost instantaneously, avoiding any red tape.

Transfers are also much cheaper than using an international money transfer service. In the case of TRON, the fee to move USDT from one wallet to another is currently about $1.72, paid for in the blockhain's native TRX token.

Additionally, with Tether you can more easily swap in and out of cryptocurrencies. For example, if you can see that the dollar is about to take a dive, you can quickly swap out of USDT into ETH or TRX.

On the other hand, your freedom to transact is limited if you keep your dollars in a bank. The bank may impose transfer limits on you, or totally block you from buying crypto.

The Disadvantages Of Tether

One issue with Tether is that they can freeze USDT accounts if ordered to by an authority, possibly because you refuse experimental gene therapy or gender reassignment surgery for your child.

If this is of concern to you, the decentralized stablecoin DAI by MakerDAO or HIVE's HBD are both viable alternatives. Some people feel safer using regulated stablecoins like USDT or USDC, which have more liquidity.

Also keep in mind any stablecoin (whether USDT, USDC or DAI) will only remain "stable" so long as the dollars backing them retain their value.

How Does Tether Make Profit?

We covered that the transaction fees paid by the senders of USDT go directly to the miners or validators of the blockchain, so how does Tether earn revenue and make a profit?

Tether is an asset-backed stablecoin, meaning that each USDT token they issue must be backed by a real dollar in the banking system, and so far they have issued 114 billion dollars worth of stablecoins.

Tether uses the dollars backing their stablecoins to purchase US denominated securities, such as US treasuries, which are currently generating 5% interest. Over time, the interest adds up to billions of dollars worth of profit.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Until next time...

Resources

Cointelegraph Article [1]

Images Courtesy Of Venice AI [2]

Tether USDT Pie Chart [3]