Even if we are not yet in a bull market, the hype continues to build up around promising projects and one that just kicked the exchanges was Arbitrum with its ARB cryptocurrency. As an Ethereum layer-2 network, Arbitrum's goal is to enable developers to build and deploy highly scalable smart contracts at low cost. Through the Arbitrum side chains, users will be able to do all the things they would've done on Ethereum — use Web3 apps, deploy smart contracts, etc., but the transactions will be cheaper and faster. The flagship product for the team, Arbitrum Rollup, is an Optimistic roll-up protocol that inherits Ethereum-level security. And as I've heard about it from a colleague at work that is hyper-passionate about crypto same as me, I couldn't stay on the sidelines and simply jumped on the opportunity.

It is worth mentioning that before hitting the market on Binance and Huobi, the ARB cryptocurrency was pretty hard airdropped to early adopters. The $ARB governance token was airdropped in around 12.75% of the token's total supply, which hit circulation on Thursday, 23 March 2023. Arbitrum airdropped a total of 112.834 million $ARB to DAOs, from which the Top 7 receivers are the one's below

1. Treasure DAO: Treasure is an Arbitrum-based decentralized network for blockchain-based metaverse projects. Through its NFT marketplace and gaming and staking platform, Bridgeworld, Treasure aims to bootstrap new, decentralized metaverses and support their growth. The Arbitrum Foundation airdropped 8 million $ARB to Treasure, the most ever received by a DAO.

2. GMX: On the next line is GMX, which also received 8 million $ARB. With GMX, you can trade both spot and perpetual assets for low swap fees and with close to no price impact. Liquidity providers earn fees from market making, swap fees, and leverage trading via this multi-asset pool.

3. Uniswap: Uniswap facilitates the automated trading of decentralized finance (DeFi) tokens through its decentralized trading protocol. Token trading on Uniswap is fully automated and open to anyone who owns tokens, while trading is more efficient than on traditional exchanges. Uniswap obtained 4.378 million $ARB.

4. Sushiswap: SUSHI is an automated market maker (AMM). An increasingly popular tool among cryptocurrency users, AMMs are decentralized exchanges that use smart contracts to create markets for any given pair of tokens. The protocol aims to diversify the AMM market and also add new features not found on Uniswap, such as an in-house token, SUSHI, that rewards network participants. Sushi DAO received 4.249 million $ARB.

5. Dopex: The Dopex protocol maximizes liquidity for option writers while minimizing losses for option buyers. Users may deposit base/quote for their respective pools, and earn passive income through writing and purchasing discounted options through liquidity pools. A total of 3.863 million $ARB was received by Dopex.

6. Curve: Curve manages liquidity using an automated market maker (AMM) on a decentralized exchange for stablecoins. In August, Curve launched a decentralized autonomous organization (DAO), using CRV as its underlying token. The DAO connects multiple smart contracts for users' deposited liquidity using the Ethereum-based Aragon creation tool. Curve received 3.476 million $ARB.

7. Radiant Protocol: Radiant has been designed to solve scale, parallelism, and Turing Complete programming problems associated with all existing blockchains. It is a peer-to-peer digital asset system that facilitates direct trade between users without requiring a central authority. Radiant Capital received 3.348 million $ARB.

Source: Arbitrum Airdrop: Which DAOs Received the Most $ARB?

While I've kept telling myself not to buy crypt anymore, I simply couldn't resist this wave of hype on Arbitrum. I moved some funds around and I could snap a bunch of $ARB tokens at $1.28, while it topped the floor with an All Time Low of $1.11. At the same time, its 7-day all-time high hit $11.14 and after those getting the airdrop liquidated most of the assets, it felt considerable and is trading now for $XXX. What are my plans and thoughts about Arbitrum?

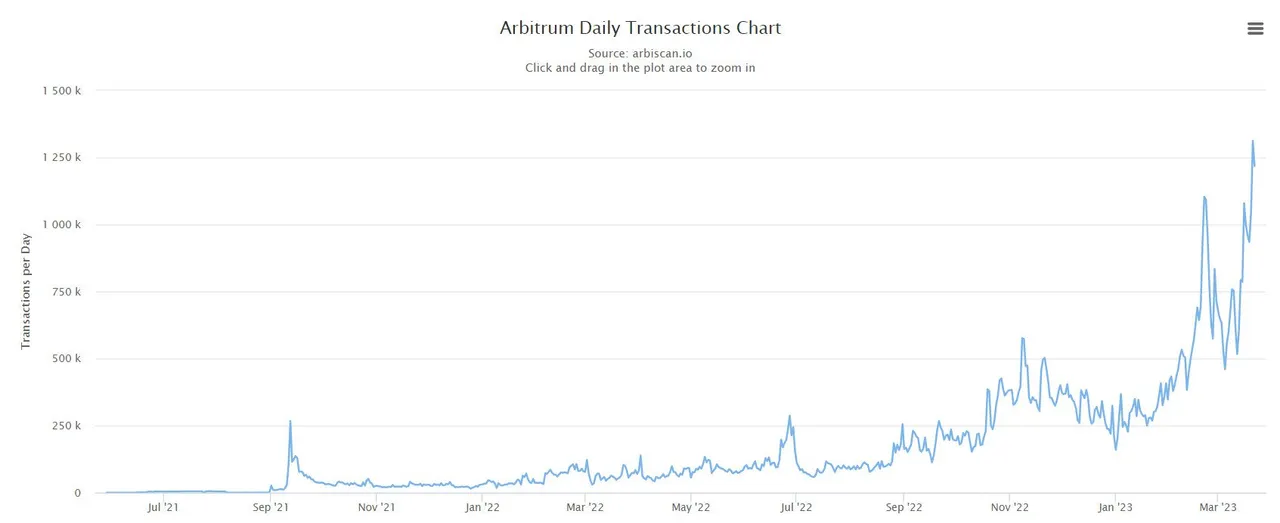

I think that Arbitrum is an impressive, fast-growing protocol, with daily transactions spiking to a new record high this week above 1.2 million. Its fast adoption and getting on the market when we are yet to see considerable bull moves might put it in the right position to be a golden asset when we'll go full sail. There are positive trends around Arbitrum that are likely to continue in the weeks ahead as more and more major exchanges list the ARB token, further boosting the protocol’s hype. While it will not happen overnight, I see it reclimb the $10 market at some point. And to tell you the truth, that would be my exit point on which I will push the trigger.

What about you? Did you get any ARB airdropped or jumped and bought some?

Disclaimer: This post is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.