Hey folks, in my last article I covered ways to farm Sonic’s testnet — an opportunity that has a whopping $130+ million dollars worth of incentives. As lucrative as Sonic may be, the reality is that with so many people farming the $S token, no matter your level of engagement the piece of the pie might be relatively small.

In today’s article I’m going to be doing a deep dive into Genie Dex, a much more under-the-radar project still in testnet that has significantly higher upside potential. How much under-the-radar is it? Well literally with one successfully made trade, currently I am already in in 348th place:

But first of all, what is Genie DEX?

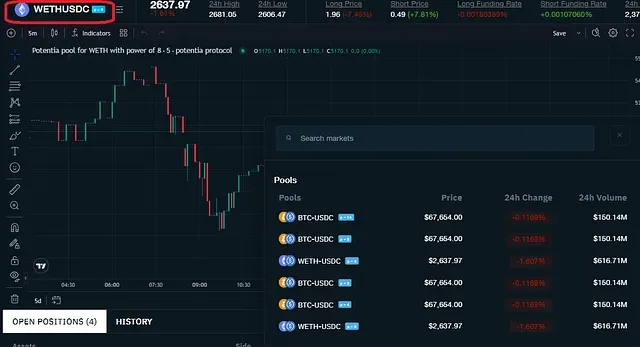

On the surface, Genie DEX will look and feel like your average derivatives trading DEX, however with Genie, there are a couple of features that really sets it apart from the others:

Power derivatives as opposed to normal derivatives: Perhaps the most distinguishing feature about Genie DEX is its use of power derivatives, where literally the price of the underlying asset (either $ETH or $BTC) is tracked by a power of either 2, 4, 8, or 16.

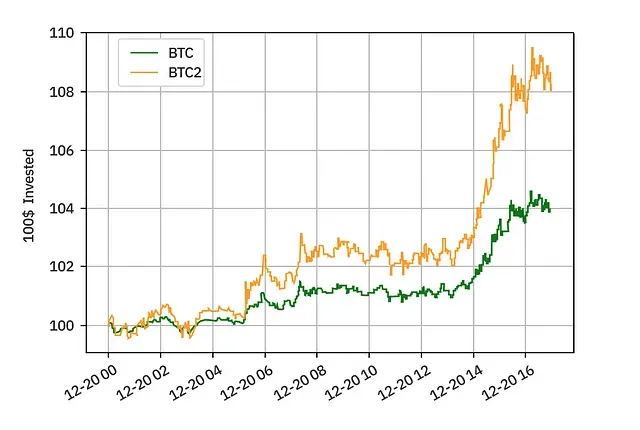

In other words, if $BTC increased in value by 4%, then a power derivative of $BTC ($BTC²) would see returns of 8% (1.04 x 1.04 = 1.0816):

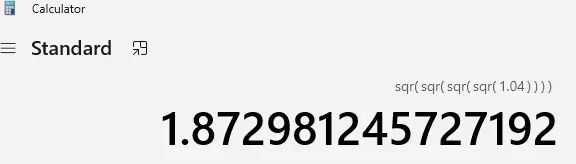

Extrapolating this even further, if you were to trade BTC¹⁶, if the price of $BTC once again increased by 4% (or if you were shorting and prices decreased by 4%), you would see gains of more than 87% :

Softened Losses: Even though profits might be amplified, an interesting feature about Genie is that losses are tempered through a significant amount of positive convexity — where negative movements in price will produce increased yield that outpaces the actual price depreciation of the underlying asset. Although of course this doesn’t make the trader to immune to losing money, this sure beats losing everything when getting liquidated on leverage:

No Liquidations: Speaking of liquidations, a unique feature about Genie is that it offers traders the ability to make power derivative trades without the risk of getting liquidated. As I mentioned before, this does not make people impervious to losing money on bad trades, but through Genie’s AMM known as “Potentia,” as long as the underlying asset doesn’t actually go to zero, your position will still have value as well too.

The Based Genie

Perhaps the factor that I’m most bullish on for Genie is that currently it’s testnet is on Base, which in relative-chain economics is an empty desert of derivative trading. According to DeFiLlama there’s barely $62 million in TVL across all derivative platforms currently on Base:

To put things in perspective, GMX V2 on Arbitrum, a singular perpetual trading protocol currently has nearly $380 million dollars in TVL — more than a 6x of everything that’s on Base’s entire L2. Now I’m not saying that it’ll get to GMX’s size and scale, but seeing the current landscape on Base, I think it’s primed to have someone fill that void.

Farming G Points

As I mentioned before, Genie DEX currently is still in testnet and it’s still massively underfarmed. Announced just this past week, currently you can earn ‘G’ points for every position that you close, with an extra 2 points for every 2% of profit you make on your trade, whether it be long or short. At time of writing there’s still less 1,000 participants, which is how by getting 100 G points can almost land you in the top 25 on the leaderboard:

How to get started:

Claim testnet tokens on Base Sepolia:

Choose your market, each with a corresponding power derivative:

And then fill out your trade order:

My strategy: Given that that there’s no limit to how many testnet tokens for you to claim, my strategy is simply to open and close as many positions as possible, both long and short — waiting to close each one until it reaches at least +2% in profit.

Wen TGE?

Although a token release date hasn’t been officially set, according to folks in their discord, an announcement regarding Genie’s mainnet launch will be released “in the coming weeks.”

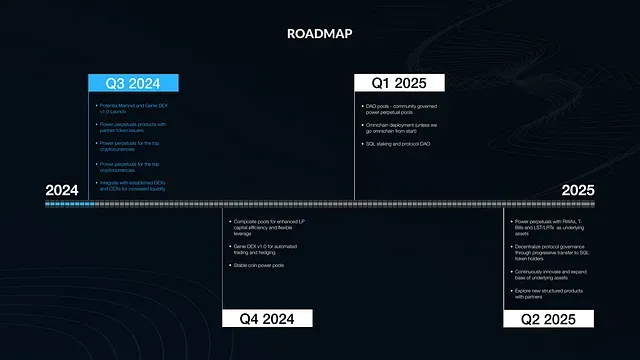

Additionally according to their roadmap, several new features and integrations (including with Solana) are scheduled for the next upcoming months going into 2025:

Conclusion

As with any early stage for any protocol that’s in testnet, the biggest sacrifice you’ll make is opportunity cost from you time. The majority of crypto-backed projects won’t make it, and there’s always a chance that Genie DEX may be no different. In my opinion forever, the time is worth the potential upside, especially if Genie truly has cracked the code to help amplify gains while softening losses, truly reducing the risks of trading in a manageable and scalable way.

Have any more questions about Genie or its AMM Potentia? Hop on to either their Discord or Telegram and ask one of the guys on the team. In the mean time, time to rack up some more G points…

And as always thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: This is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone!