Bitcoin has scaling issues. It’s almost by design at this point. Not sure was there a vision in the very early days when the network was started by Satoshi Nakamoto, but after the block wars of 2017 the path has been chosen. The path is small blocks on layer one, limiting the amount of data that can be stored and transacted on the network. The scaling solutions for Bitcoin are now left to Layer 2s.

The Lightning Network is one of those solutions. It is not the only one though. There are other solutions like Liquid, Fedimint, Drivechains etc. Even Hive can be a scaling solution for BTC if we implement a sufficient enough integration with it.

Here we will be looking at the data for the Lightning network. A short explanation from ChatGPT:

The lightning network operates through the creation of payment channels between users, which allow for transactions to occur off the main blockchain. These transactions are only settled on the blockchain when the channels are closed, reducing the burden on the network and enabling the consolidation of many transactions into one. This system relies on smart contracts to ensure the security and fulfillment of transactions without the need for third-party intermediaries

In theory everyone can run a lightning node, there is now a custom Raspberry Pi that does this. The process starts with opening a channel to another wallet that is on chain transaction with fees. But after the channel is created the two wallets can transfer sats for a tiny fee of usually one sat per transaction (0.00067 USD currently). You can open a channel to some of the major nodes that are connected to a lot of the other nodes and indirectly have access to all those nodes. No need to open multiply channels if you are an individual.

Building the lightning network is a slow process, nodes are opened one by one, as well as channels. This takes time.

Here we will be looking at:

- Number of nodes

- Number of channels

- BTC balance on lightning

- Number of channels per node

- Capacity per node

- Top lightning nodes

- Transactions

The data is collected from sources like bitcoinvisuals.com, 1ml.com, lightningnetwork.plus etc.

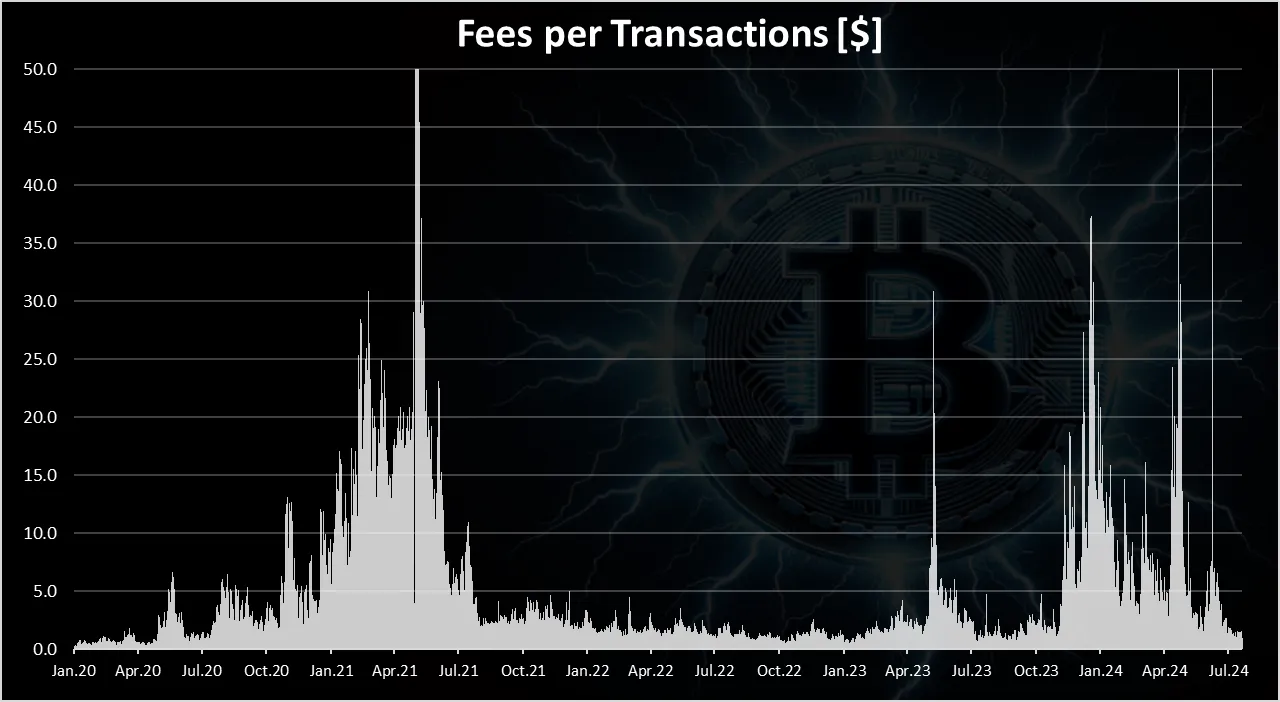

Bitcoin Fees

Before going into the data on the lighning network lets take a look at the fees on the Bitcoin base chain.

Fees is what is making users to use L2 solutions. When they are high users avoid transacting on the base chain. It also makes no sense for everyday use like buying coffee with Bitcoin.

We can see the spikes in the chart above in the previous bull market in 2021 when the fees reached more than 50 USD per transactions. Another spikes happened recenlty at the end of 2023 and begining of 2024, when there was some hype around NFTs and tokens on Bitcoin.

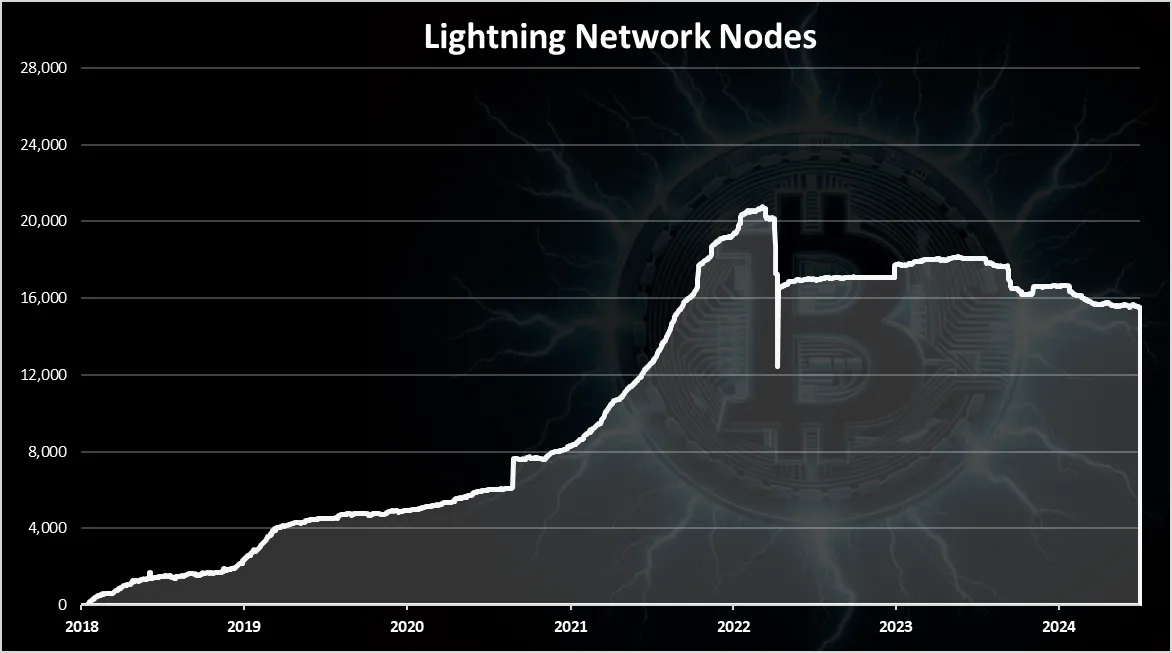

Number of Lightning Nodes

Here is the chart for the historical data for the number of lightning nodes.

This chart shows the number of nodes with and without channels.

We can see that since its launch in 2018 the number of lightning nodes have grown. They have grown more aggressive in 2020 and 2021 reaching an ATH of 20k nodes at the end of 2021. Then in 2022 a sharp drop to around 17k, since when the number of lighting nodes has remained constant around that number in the last two years. At the moment there are around 16k lightning nodes.

As mentioned, running a node is quite easy for a little bit technical people. You can do it on a small home computer or Raspberry or choose some cloud provider.

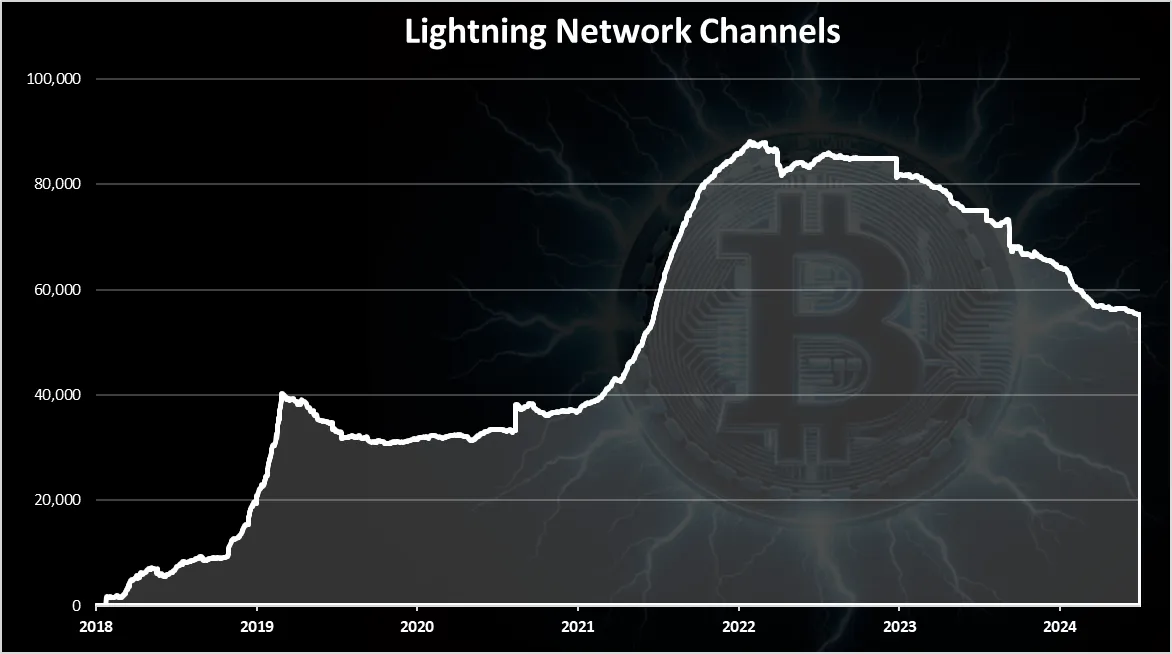

Number of Channels

Each node can open multiple channels to other nodes, meaning the number of channels is greater than the number of nodes. The more channels the better the network is interconnected. Here is the chart.

This chart follows the node chart to some extent with more aggressive numbers. The number of channels has grown aggressively in the 2020-2021 period, reached and ATH to 84k, and started going down in 2022. At the moment there are 58k channels. Will see does this number will increase in the future as we are now in a small bull run, while the fees on layer 1 have increased in the period.

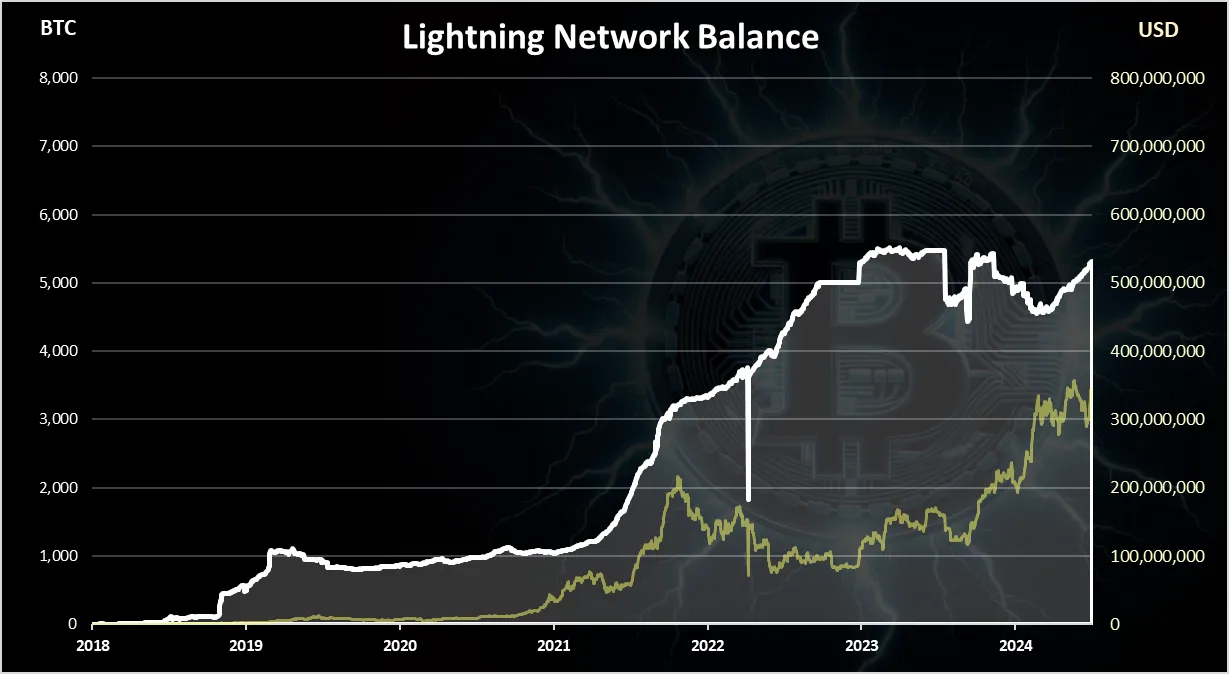

BTC Balance on Lightning

When a node is created and channels opened, they are usually funded with Bitcoin transferred from layer 1 to lightning. Each channel has some amount of Bitcoin on it. The collective amount of Bitcoin on all the Lightning channels represents how much BTC is transferred to the network. This is usually referred as lightning capacity.

Here is the chart.

The chart above has the info for BTC and USD value.

In terms of USD value, the lightning network is now close to ATH high with more than 300M worth of Bitcoin deposits. In terms of Bitcoin, in the last period it has been around 5k BTC where it is now.

In terms of share of the total supply this is a relatively low number to 0,025%.

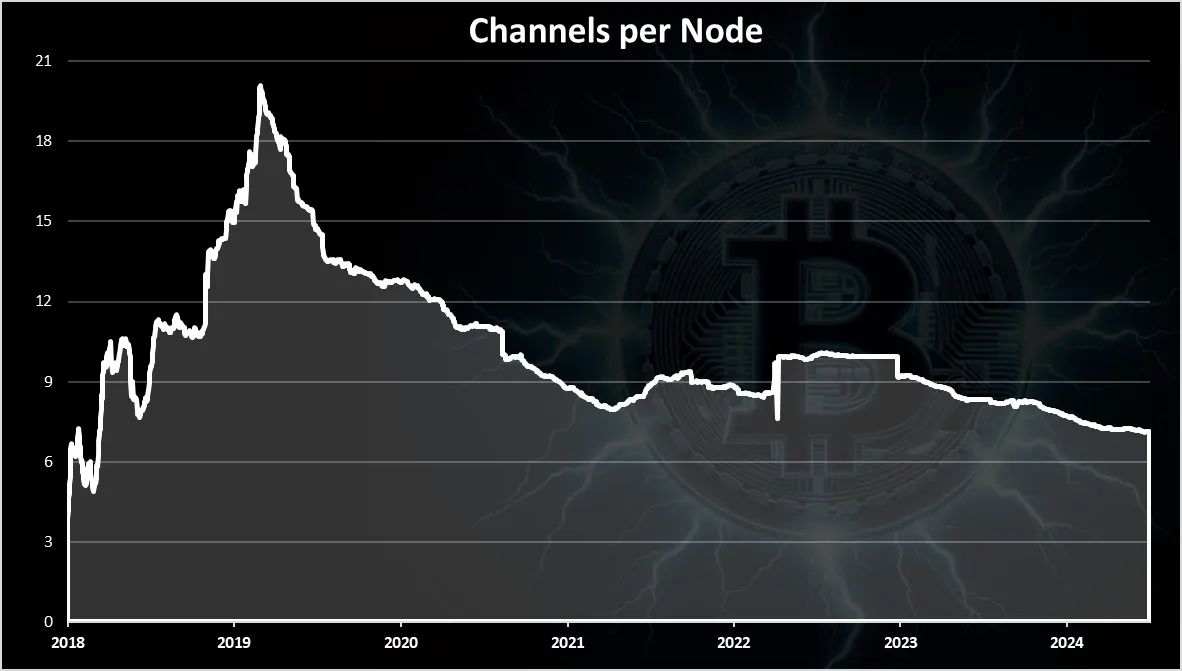

Number of Channels per Node

How many channels each node has opened? Here is the chart.

We can see that in the beginning the number of channels per node has grown to 20 channels per node. This is due to the fact that at the beginning there were not a lot of nodes. As the network grew, the number of channels per node dropped, since some of the nodes don’t have opened channels, or have just one channel. In the last years the number of channels per node has stabilized around the 8 channels.

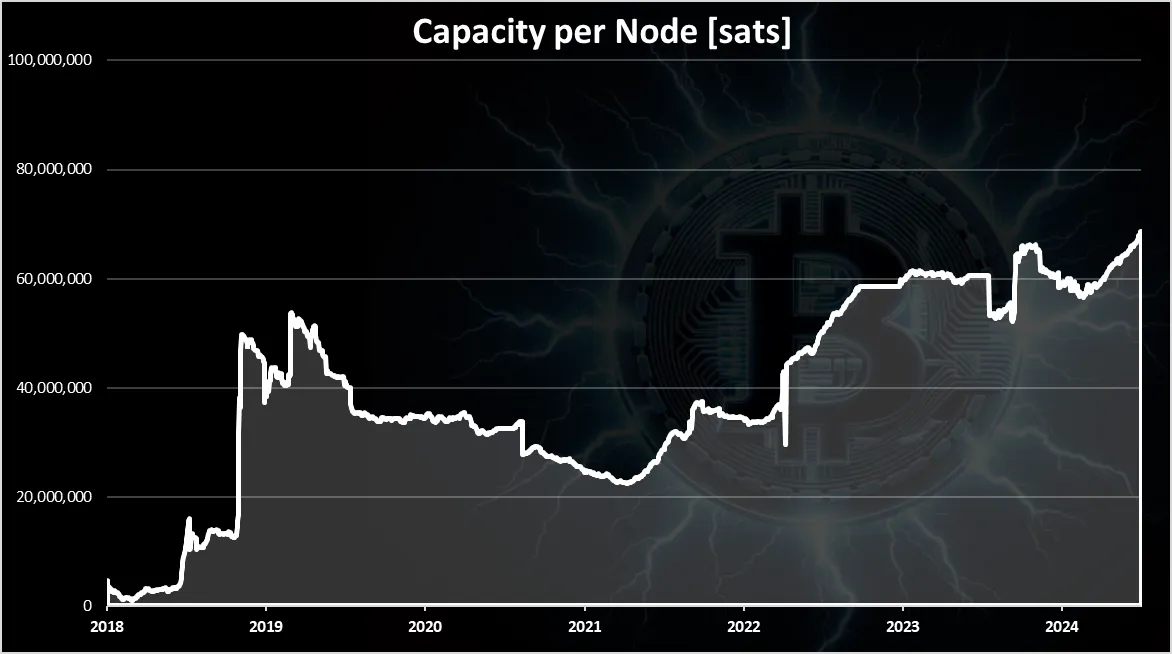

Capacity/Balance per Node

Each node funds its channels with Bitcoin/Sats. Here is the chart.

This is the average amount of SATS per nodes.

As we can see there has been a sharp increase in the beginning to 50M stats per node, then a drop towards 20M stats per node and a growth in 2022 and 2023. Interestingly, the amount of average SATS per node has increased in the bear market, probably due to more node shutting down in the bear market, leaving only the well-funded nodes.

In the last period the capacity per node has been growing and is around 70M SATS per node, that is equivalent to around 20k USD with today’s BTC prices.

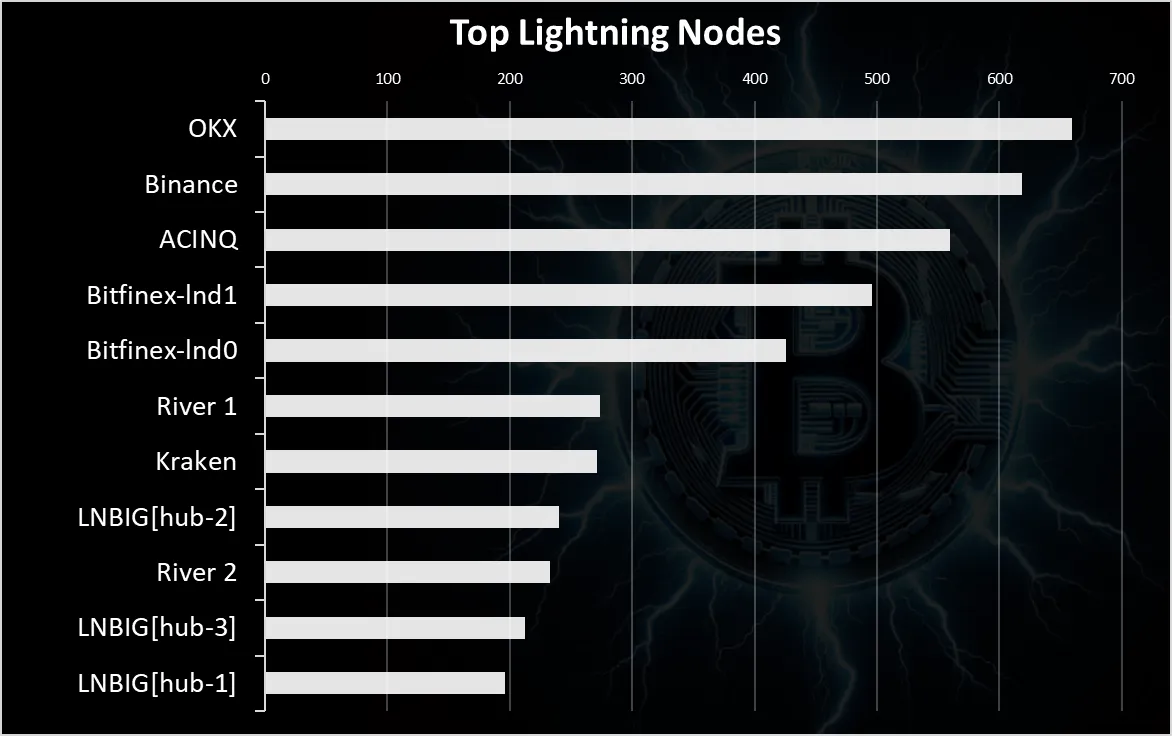

Top Lightning Nodes

Which lightning nodes hold the most BTC. Here is the chart.

The OKX node is on the top here with 660 Bitcoin on its lightning node. For those unaware it’s a exchange node. Binance also another exchange on the second spot with more than 600 BTC.

Bitfinex has more than one lightning node and if we sum them up it will be on the top.

Some of the other exchanges in the top lightning nodes as well, like Kraken and the WalletOfSatoshi that is the simplest lightning wallet, but its custodian.

Overall, the lightning network seems to have grown a lot in 2020 and 2021 but slowed down a bit in 2022-2023. Meanwhile, most of the top exchanges have implemented lighting, Coinbase included, but it is still not in the top 10. More companies are building infrastructure, and the network is much more developed than a few years ago. More companies are accepting lighting as payment as well. We are now at the beginning of the next Bitcoin cycle, and we will see how things will evolve and will lightning will emerge as the network for mass user adoption.

All the best

@dalz