In this world, nothing is certain except death and taxes (Benjamin Franklin)

Hi Everyone,

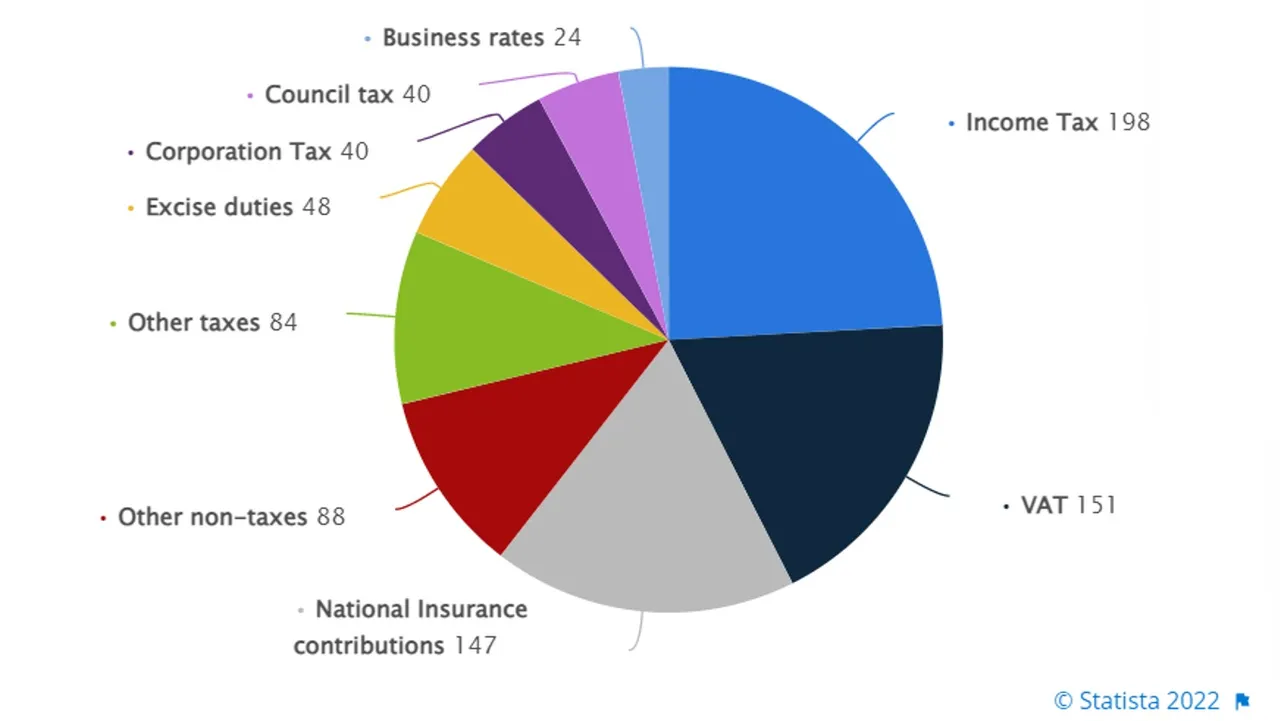

For many, paying taxes is considered an inevitable part of life. If tax was not collected, it is widely accepted that society could not function. For most countries, the value of the amount of tax collected is sizeable. For example, in 2022, the United Kingdom’s Government are expecting to receive £820 billion in revenue. Almost 90% of this revenue is generated by some form of tax. See figure below.

Expected public sector current receipts in the United Kingdom in 2021/22, by function (in billion GBP)

Source: Statista

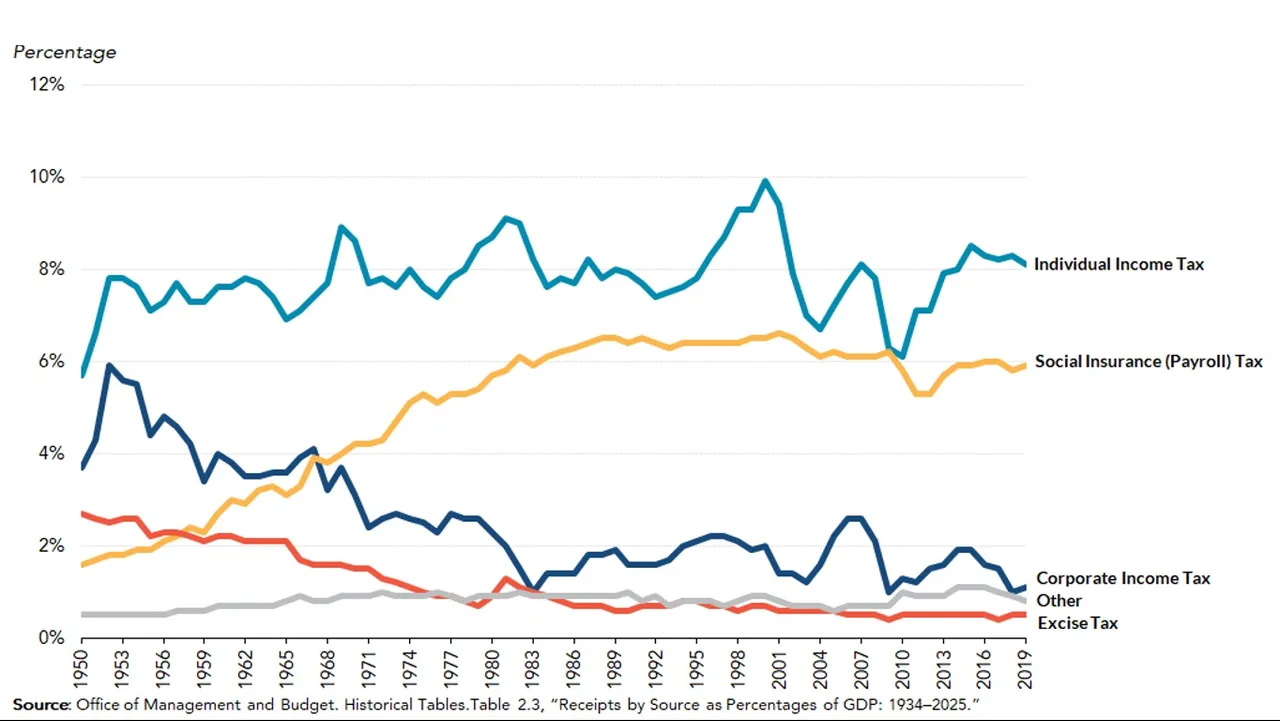

In the USA, Federal Government revenue (not including State or local revenue) is approximately 17.5% of GDP. It has remained consistently around this level since the 1950s. Sources of revenue have changed slightly over time. As a percentage of GDP, excise taxes and corporate taxes have fallen and social insurance tax has increased.

Sources of Federal Revenue as share of GDP (USA)

Source: Tax Policy Center

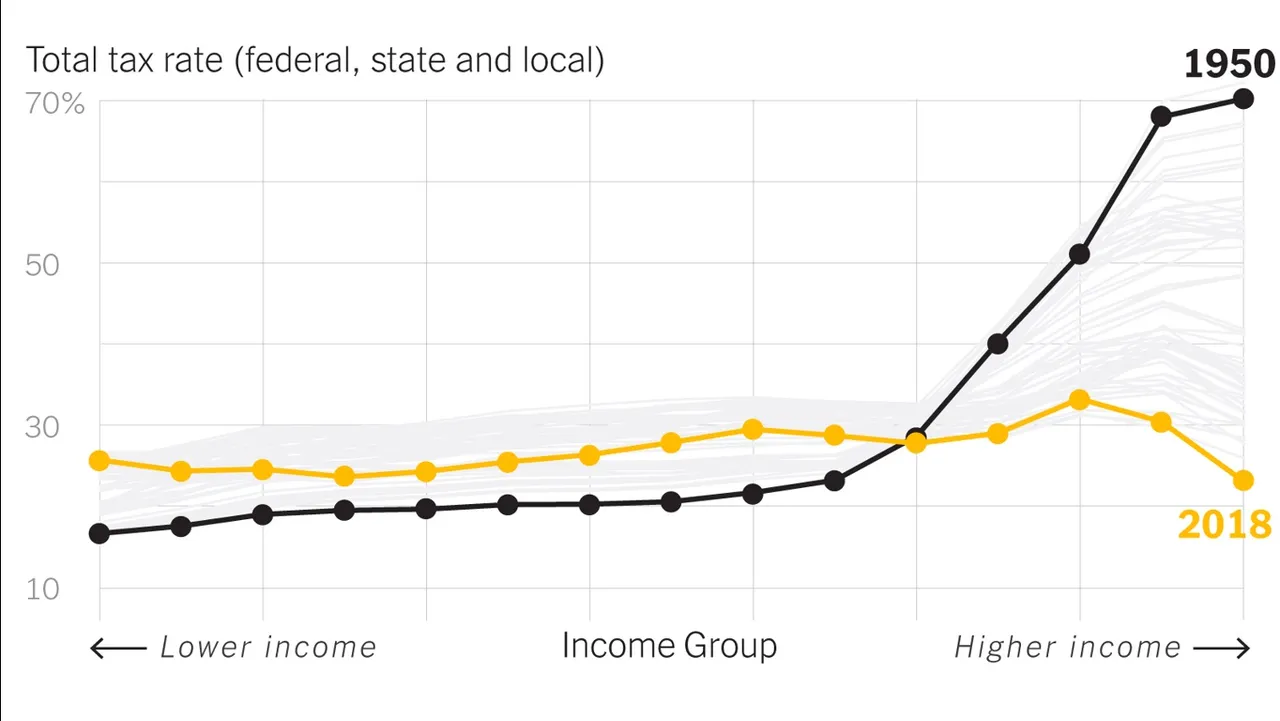

The shifts in sources of tax funds is most likely responsible for the tax burden shifting away from the highest income earners to the lower and middle-income earners.

Total Tax Rate (Federal, State and Local)

Source: New York Times

Tax money is used to finance Government expenditure on goods, services and infrastructure. Tax money funds critical services such as education, healthcare, law enforcement, social support, and national defence. Tax money funds critical infrastructures such as transport, energy, water and sanitation. We could not operate as a society without the services and infrastructure typically provided by Government expenditure, which is mostly funded by tax money. However, this does not mean that these services could not be provided nor the infrastructure could never be built, if they were not funded by tax money. The existing systems prevents alternative funding for these critical services and infrastructure. There is little desire for Governments to move away from existing systems as doing so reduces their power. From the perspective of the people, there is a fear of the unknown. Tax funded services and infrastructure offers a sense of security.

In my post, Oligopoly – The market structure that does not let the market decide, I discuss how the privatisation of Government run industries has often not improved efficiency or reduced costs. This is because privatisation often creates oligopoly market structures where large companies profit from market control and subsidies rather than improved efficiency or increased innovation. However, the failures of particular market structures (oligopoly or monopoly) is treated as a failure of private provision of services in general. Therefore, Government run services look better by comparison. This fuels the argument that Governments should offer services instead of the private sector.

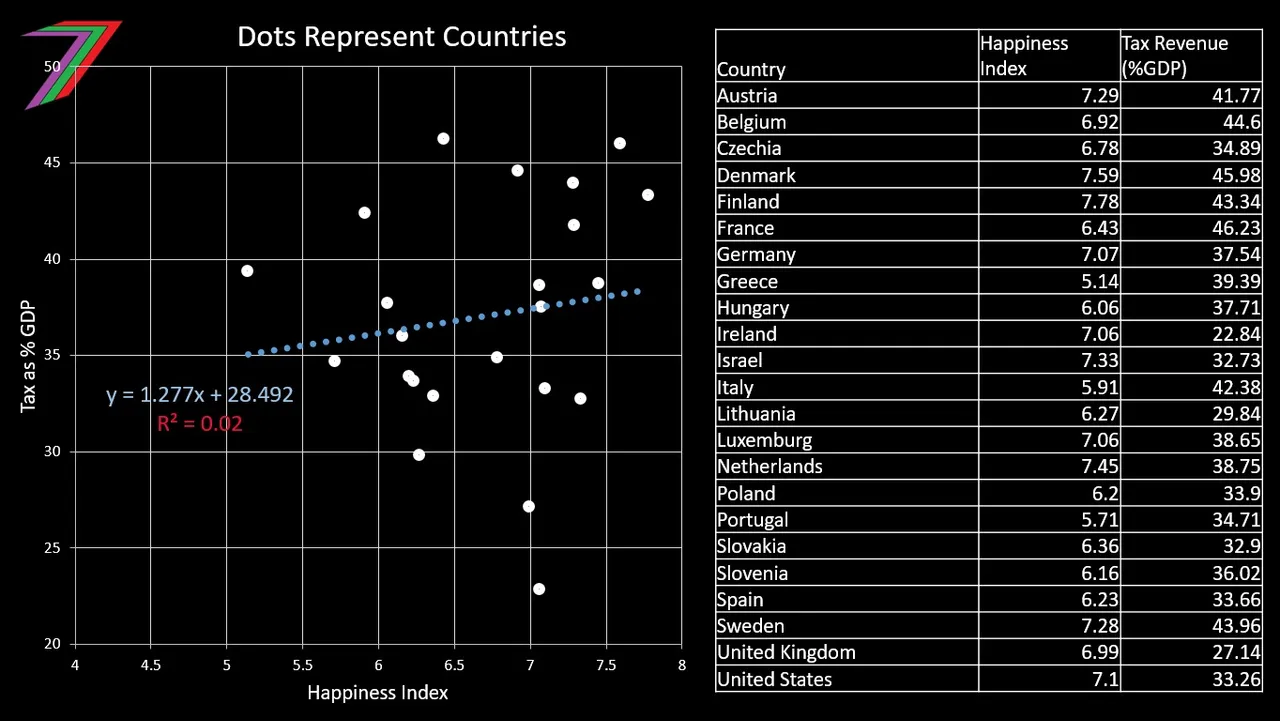

The Happiness Index is an indicator of subjective wellbeing. The happiness index could be compared with the tax rates (i.e. tax collected as percentage of GDP) of countries to determine if higher taxes increases or decreases quality of life. See figure below.

Relationship between tax as a percentage of GDP and Happiness Index for selected OECD countries (2017)

Source: Research Gate

Note: The above graph does not include the impact of other factors such as income. The very low R2 indicates more variables need to be considered as determinants of happiness before a regression analysis could yield relevant results.

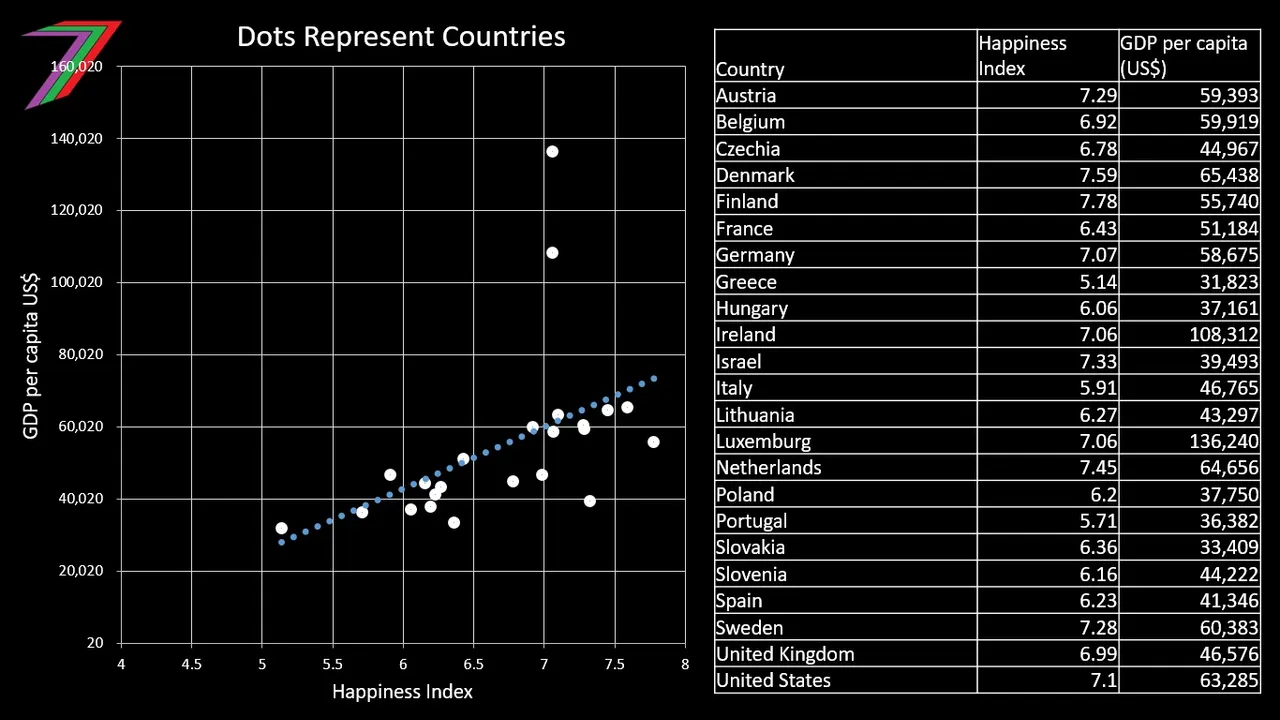

A moderately positive trend (linear) can be mapped in the figure. This perceived positive relationship between happiness and tax rate could be argued to suggest that paying more tax increases happiness (Live Science). However, the large variance in values as shown by the widely dispersed points is a much stronger indication of no correlation between happiness and tax rate. There is a considerably stronger relationship between GDP per capita and happiness. See Figure below.

Relationship between GDP per capita (US$) and Happiness Index for selected OECD countries (2021)

Source: Research Gate and Data OECD

There are several arguments that, at least on the surface, suggest Government expenditure improves quality of life and is in many cases superior to private funded alternatives. Therefore, we could argue that paying tax is not only necessary but also an obligation to achieve a greater good.

In this post, I want to explore tax funded Government expenditure from two different possible scenarios. In the first scenario, I consider Government/leadership as benevolent. They intend to spend tax money in a manner they perceive as in the best interests of the public. In the second scenario, I consider Government/leadership as self-serving. They intend to primarily use tax money to gain more power and wealth.

Benevolent Government/Leadership

Can benevolent Governments/leadership exist? This depends on how decision-makers are determined. In my post, Power, Money and Me Me Me, I discuss how existing “democratic” (representative) systems cannot produce benevolent leadership. It is possible that changes can be made to existing systems that could enable but not necessarily guarantee benevolent leadership. Such changes could include:

- Replacing political parties with independent candidates.

- Greatly increasing public involvement in decision-making (move towards direct democracy).

- Holding separate elections for legislative and executive branches.

- Changing voting systems (changing first-past-the-post systems to preference voting systems such as a Condorcet system or a Borda Count system or combination of the two).

- Removing media and campaigning bias (e.g. all legitimate candidates invited to debates and caps on campaigning budgets).

- Ensuring all major decisions are transparent and decision-makers can be held accountable at all times.

These changes should enable a wider range of candidates to gain opportunities to achieve positions of leadership as well as reduce party and media bias. Therefore, let us assume we live in a society that has benevolent government/leadership. Leaders genuinely want to act in the best interest of the people they represent. Tax money would be used to support services and build infrastructure the leaders believe to serve the best interest of the public. Leaders would engage with the public to obtain genuine input and feedback on decisions.

We could argue good intentions combined with responsible actions will lead to good outcomes; the type of outcomes that our tax money should be supporting. However, a relatively small number of people are responsible for the majority of decisions made in Government. The decisions are made based on perceptions of leaders. These perceptions could be informed based on public engagement but representation will be limited even under good circumstances. Therefore, some decisions will lead to outcomes that address the needs of the public while others will not and some may even do the opposite.

Even if Government/leadership have benevolent intentions and are able to make good decisions, the delivery of these decisions may fail to reach desired outcomes efficiently and effectively. The problems of large bureaucracies such as lack of motivation and innovation will remain regardless of the intentions of leadership. However, a benevolent Government/leadership will eventually realise the shortcomings of the predominantly centralised system they operate. This realisation will lead them to initiate change in an attempt to fix these shortcomings. The likely success of these attempted changes are difficult to predict but they will ultimately require the loss of power of their own Government. Hence, this could be a good indicator of the benevolence of a Government/leadership.

In my post, Blockchain Government – Part 2: Leadership from the Blockchain, I discuss decentralised governance using the blockchain and how decisions can be made without anyone holding any significant power. I would expect an informed benevolent leadership to utilise blockchain technology or something similar or equivalent to increase decentralisation of decision-making.

If we ever have a benevolent Government/leadership, paying tax can be justified. The biggest problem is identifying a truly benevolent Government/leadership. For one to be possible, our political systems needs to change radically. Even with radical change, we may not get a benevolent Government/leadership immediately. When we do get one, it could be brief. Once we have a benevolent Government/leadership, it could take some time to be confident that they are truly benevolent. A good indication that they could have benevolent intentions is their approach to change and willingness to decentralise power and control.

Self-serving Government/leadership (the more likely scenario)

The benevolent Government/leadership scenario is not going to occur on its own. People need to insist on change. The existing systems need a massive overhaul. Neither the incumbent Governments nor official opposition will be open to discussing any changes of such magnitude. The people will need to insist on it. The people can take control and insist on change because they have the numbers. I believe the biggest problems that the public have in being able to force changes are as follows:

- creating a sufficient amount of awareness amongst people to force change

- obtaining agreement about what changes are necessary

- coordinating an effort that will force change to occur

Until significant positive change happens, we are left with the existing systems that continue to push power and wealth into the hands of the few.

The two years of internationally coordinated Covid-19 oppression followed by the internationally coordinated response to Russia’s invasion of Ukraine, demonstrates Governments’ complete disregard for their own people.

Covid-19 was used to:

- implement draconian laws that increased the powers of Governments

- force people out of work so that they become dependent on Government handouts

- transfer wealth from small businesses to large businesses through the use of restrictions

- transfer tax payers money to pharmaceutical companies in exchange for dangerous ineffective experimental drugs

- coerce people into taking these drugs by threatening their freedom and livelihood

- censor any opinions that even question the effectiveness and safety of Covid-19 drugs (vaccines)

- restrict and ban protests opposing Government actions

- create health passes that are used to monitor people’s medical procedures and will likely be used to monitor other activities in the near future

- increase money supply by an excessive amount, which would inevitably lead to inflation in the medium and long run

So far, Russia’s war with Ukraine has been used to:

- freeze or steal people’s assets based on alleged links to the Russian Government

- restrict import of essential energy such as oil and gas, which has worsened supply chain problems and inflation

- attack another countries economy in a deliberate attempt to bring poverty and death to a nation of people because of the actions of their Government

- pressure other countries to adopt the same aggressive approach

- encourage hate towards others based on nationality

- arm and train military groups that openly support Nazi ideology (e.g. Avoz Battalon)

- spread pro-Ukrainian and pro-Western Government propaganda, and anti-Russian propaganda

- ban media that may present an alternative view regarding the war

The tax money we pay to Governments is being used to our detriment and to the detriment of others. It is being deliberately used in this manner and it has been done openly. Anyone who takes the time and effort to find out about what is really happening will encounter the same information I have. Below are several posts where I elaborate about the approach to Covid-19 and the Russia Ukraine war.

- My Concerns about the Covid-19 Vaccines

- A Peripheral look at the Great Reset and Fourth Industrial Revolution

- The fall of Australia plus my experience prior to the fall

- Covid-19 Assault: Have the Establishment made the Right Moves? (Part 1)

- Covid-19 Assault: Have the Establishment made the Right Moves? (Part 2)

- Covid-19 Assault: Have the Establishment made the Right Moves? (Part 3)

- Russia Invades Ukraine: What is going on?

- Russia-Ukraine War 2022: Winners and Losers (Part One: Losers)

- Russia-Ukraine War 2022: Winners and Losers (Part Two: Winners)

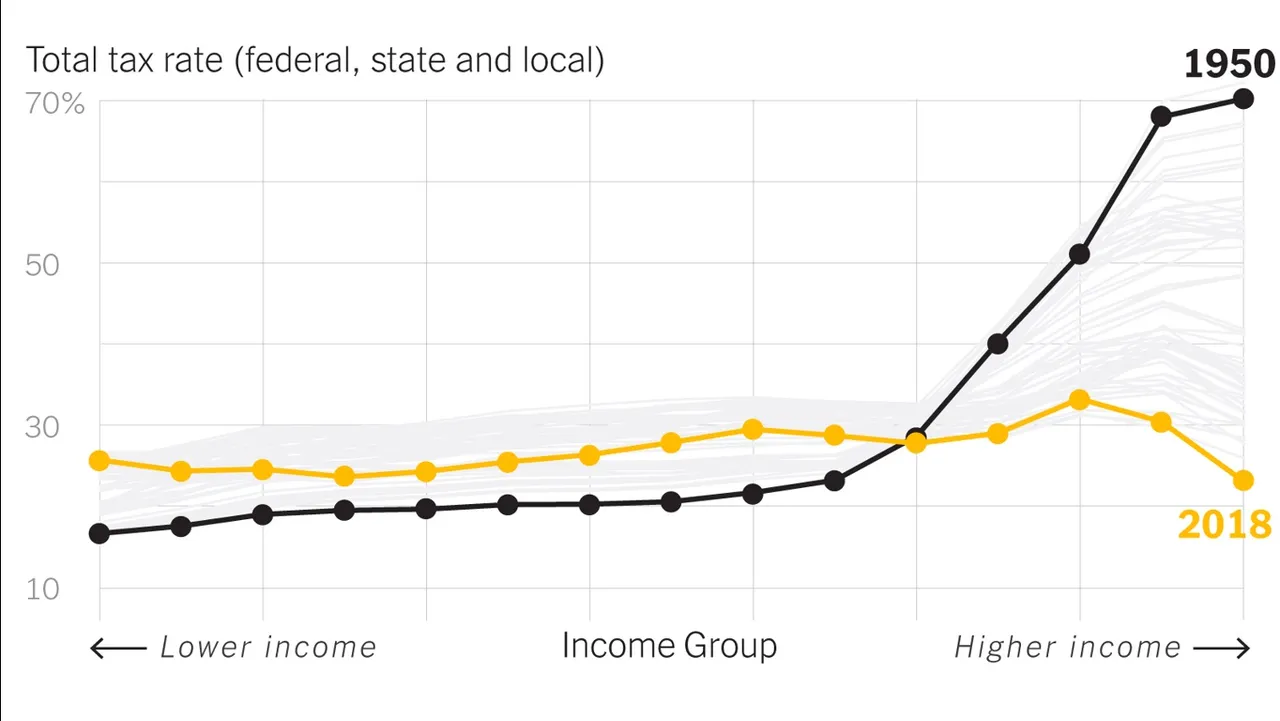

Most of the tax money that is used to fund Government tyranny comes from the working and middle classes, see the figure below for an example of the USA (figure also used earlier in this post).

Total Tax Rate (Federal, State and Local)

Source: New York Times

Responsibility for how tax money is being used does not just fall on the people in Government who spend this money; it also falls on the people who pay this money to their Government. If Governments are committing atrocities and the taxpayers are aware of these atrocities, the taxpayers should acknowledge that they share some of the responsibility for these atrocities. Continuing to pay tax under these circumstances could be considered as unethical.

In most countries, refusing to pay tax owed is illegal. Tax payments are often beyond the control of the taxpayer. For example, income tax is deducted before a person receives their income or a value added tax is included in the price of a good. Governments have made it difficult for people to avoid paying tax.

People could try to reduce their tax payments by homesteading. Becoming mostly self-sufficient on a plot of land in the middle of nowhere is a great way to reduce your tax burden legally. Another possible way of avoiding tax is through cryptocurrency. Holding cryptocurrency for over a year reduces tax burden from possible capital gains in some countries. Holding cryptocurrency indefinitely should enable people to avoid tax. Some countries are considering taxing unrealised capital gains (Bloomberg). However, taxing unrealised capital gains would be very difficult as value is held in assets and money (fiat) may not be available to pay the tax. Another way of reducing tax burden is donating money to charity. This enables a person to have more control over how his or her income is used. Earning income through cash-in-hand payments is a possible way of avoiding tax payments. Tradesmen often request payments in cash. This approach to tax avoidance is not legal but does not appear to be heavily policed.

My Opinion

Our existing systems must change. We are going down a path where Governments are becoming more authoritarian and power is becoming centralised at the top. The power is likely to continue shifting towards the few as global governance is growing. We have seen this unofficial shift to more global governance with the coordinated response to Covid-19 and now the coordinated response towards Russia. The World Economic Forum strongly backs global governance and want more decisions made on a global level. Below are two of my posts regarding the World Economics Forums plans for global governance.

- My summary and opinions regarding ‘The Great Reset’ – Part 6: Conclusion

- A Peripheral look at the Great Reset and Fourth Industrial Revolution

Global governance is and will be funded by tax. People will be giving more money to the few while having less say on how it will be used.

At an individual level, for most of us, not paying tax is currently not a viable solution. Tax is mostly taken from us without our consent. Not declaring income that should be taxed is a way of avoiding paying tax but it is risky as you could be caught and be required to pay the amount of tax owed plus interest and possibly fines.

At a collective level, not paying tax or paying less tax might be possible. Collectively, people can force Governments to change policies. They can force Governments to become smaller; therefore, requiring less tax. They can pressure Governments into not transferring huge sums of money to private companies that are working against public interest to make profit. They can pressure Governments into changing existing systems that centralise power in the hands of the few. They can force politicians who do not support the interests of the public out of office. If you are unhappy about how your tax money is being used, you should make yourself heard. You might be surprised by the number of other people who feel the same way.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These 'Collection of Works' posts have been updated to contain links to the Hive versions of my posts.

My CBA Udemy Course

The course contains over 10 hours of video, over 60 downloadable resources, over 40 multiple-choice questions, 2 sample case studies, 1 practice CBA, life time access and a certificate on completion. The course is priced at the Tier 1 price of £20. I believe it is frequently available at half-price.

Future of Social Media