Hi Everyone,

In Part 1, I introduced the book ‘Covid-19: The Great Reset’. In Part 2, I introduce the ‘Macro Reset’, which is the most important section of the book. I also cover the first two sub-sections of the ‘Macro Reset’. These are the ‘Economic Reset’ and the ‘Societal Reset’. After describing each section and sub-section, I provide my own commentary. I discuss the aspects of the content I like and dislike as well as where I agree or disagree with the views expressed.

Introducing the Macro Reset

The ‘Macro Reset’ section of the book is the largest and most important section of the book. In this section, three forces are described as shaping our world. These forces are:

- Interdependence

- Velocity

- Complexity

Interdependence is described as the extent of connectivity between various risks. These risks span across the economy, environment, geopolitics, etc. These risks are also global. The book recommends a global response to global risks as these risks affect everyone. Velocity is described as the speed of activity in the world. We live in a world of immediacy. The book provides the example of the internet and the rapid extent of adoption. Complexity is described as what we do not understand or find difficult to understand. Complexity is measured by three factors.

- The amount of information content or the number of components in a system.

- The interconnectedness – defined as the dynamic of reciprocal responsiveness – between these pieces of information or components.

- The effect of non-linearity (non-linear elements are often called ‘tipping points’).

My Views on the outline of the Macro Reset

The three key areas discussed are relevant. We live in an ecosystem, where everything is connected in some way (interdependent and complex). The authors believe global risks should be met with global responses. I would argue that this would depend on how these global risks affect different countries and regions. The initiation of a global response would involve a top down approach. This implies centralisation of control. I would argue that responses could be made when they are needed or desired; therefore, decisions, even to global risks, can be made at a local level.

Velocity is something that is self-imposed upon ourselves (Perpetual Motion Economy). Moving at a slower and more stable pace would be beneficial for us all. A change in velocity is not something that can be imposed upon society. Instead, it should occur naturally, as we become more efficient and productive. For example, we could become 10 times more efficient, which could result in us working 1/5th the time and thus twice as productive. This could occur through free market forces, if Governments stop promoting oligopoly market structures.

Economic Reset

In this sub-section of the book, the authors are very critical of existing economic systems. Below are some of their key criticisms and concerns.

- They question the use of Gross Domestic Product (GDP) as a measure of national income.

- They are greatly concerned about levels of inequality (wealth, income, opportunity, etc.).

- They are greatly concerned about the lack of resilience of existing businesses to shocks such as Covid-19.

The book also states that there should not be a trade-off between saving lives and protecting the economy; the two should come together. The book praises Governments use of lockdowns to combat the virus. They state that acting soon would enable the economy to recover faster. The book states that without intervention the economic impact would be worse as people would change their behaviours out of fear.

During Covid-19, Governments and Central Banks have implemented massive monetary and fiscal policy responses. Central Banks have lowered interest rates and commenced large quantitative easing programmes (i.e. massively increased money supply). Simultaneously, Governments have engaged in massive amounts of spending. This spending included:

- Efforts to increase healthcare capacity.

- Research on drugs and vaccines to combat Covid-19.

- Funds to prevent businesses going bankrupt and support for families with reduced income.

- Stimulus to maintain aggregate demand to keep the economy running.

The authors expect debt-to-GDP ratios to rise by as much as 30% in wealthier countries and for debt-to-GDP ratio to rise by as much as 20% on a global basis. However, the authors consider these extreme policies to be necessary to prevent economic disaster. Fiscal and monetary policies have become more coordinated. Governments have become more able to pressure Central Banks to fund Government spending activities. The authors suggest that more Government control is necessary to resolve problems. This control would lead to an increase in support and security for workers, projects to build better infrastructure and more support for green initiatives.

The authors do not believe that wide scale spending and quantitative easing will cause strong inflationary pressure. However, they had concerns that handouts would become expected as money is so easily acquired.

My Views on the Economic Reset

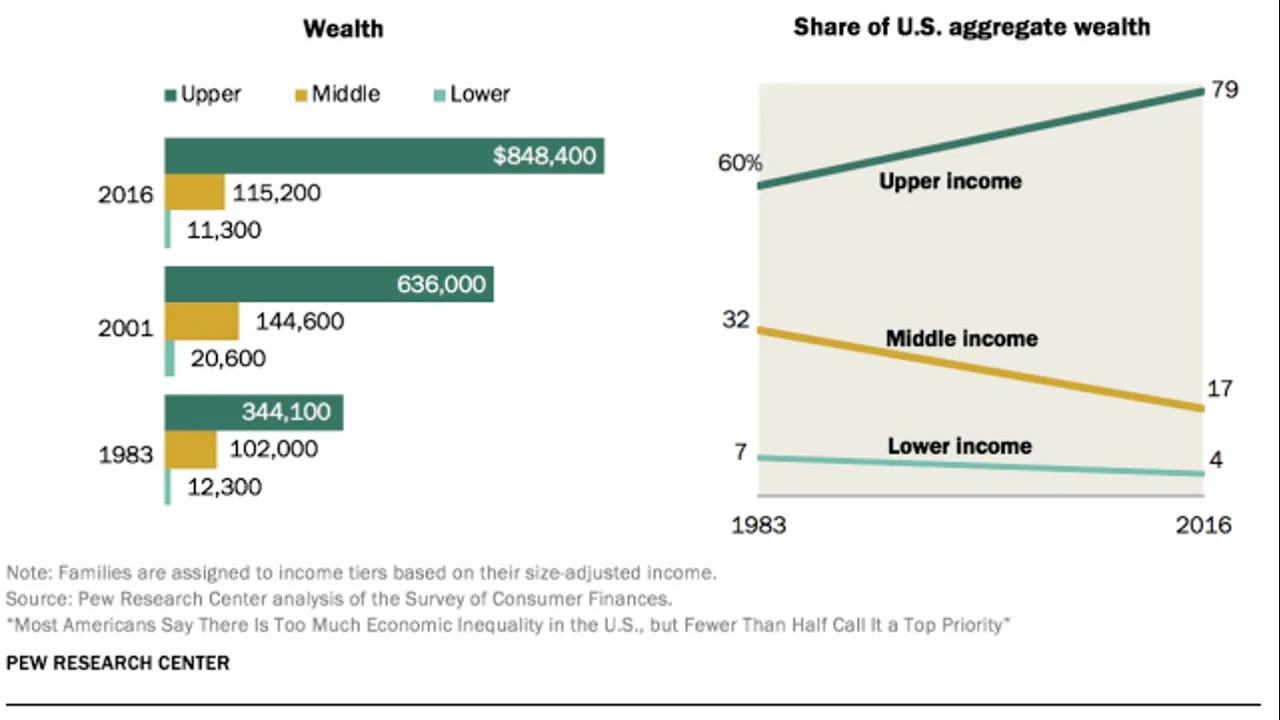

I am also very critical of existing economic systems but for mostly different reasons than the authors of this book. I agree in regards to the use of GDP, real GDP, or real GDP per capita. They are poor indicators for measuring income changes for the majority of the population, as outliers (e.g. increase in the income of the mega rich) can inflate these numbers. Median income or median wages per hour would be an improvement. A wider use of happiness indices would also add value as indicators of standard of living.

I agree that inequality is a problem. The wealthiest are becoming richer while the wealth of the majority of the working and middle class has stagnated or fallen. Figure 1 contains an example of changes in wealth in the US.

Figure 1: Changes in US wealth (1983 to 2016)

Source: Pew Research Centre

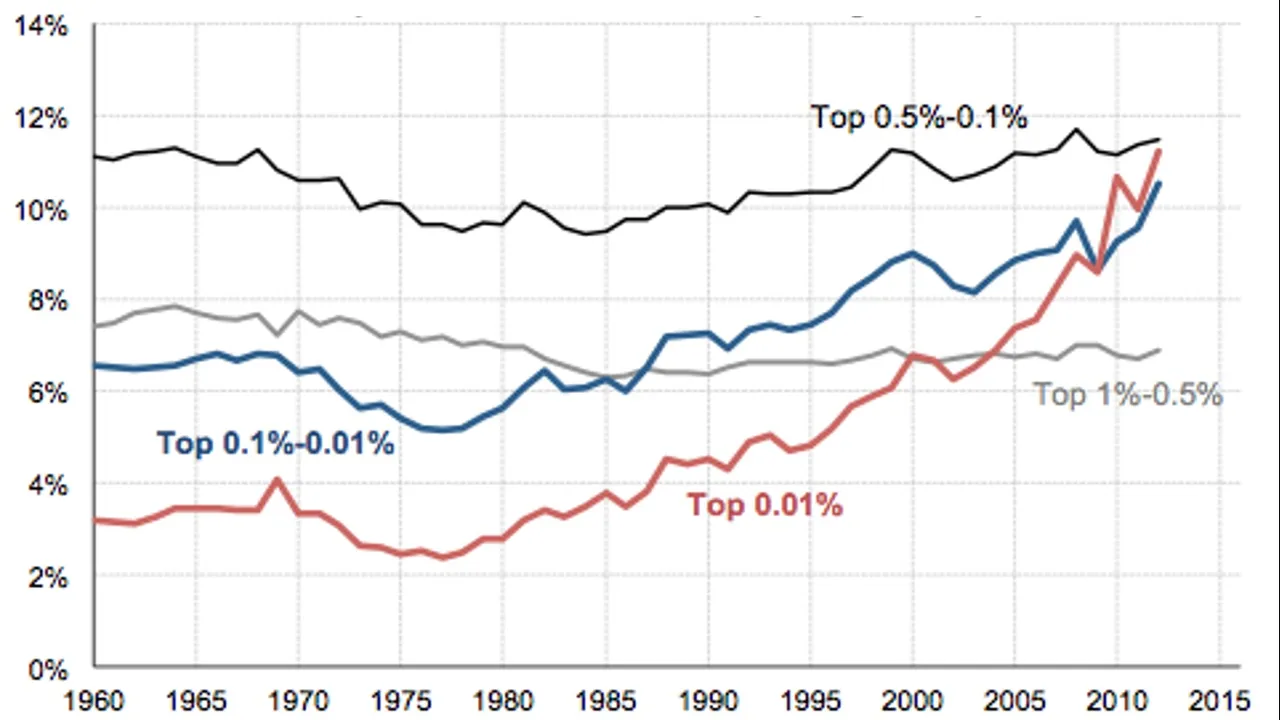

The increase in wealth inequality is not because the top 1% are becoming wealthier but because the top 0.01% are becoming much wealthier. The wealth of most of the top 1% has increased only marginally when compared to the rest of the population; see Figure 2.

Figure 2: Wealth of the top 1% (1960 to 2015)

Source: Outside the belt

I agree that the economy is not resilient to serious shocks. However, the Covid-19 shock has come from Governments and the not the virus. Governments instructed lockdowns. Without Government intervention, businesses would have remained opened but most likely would have operated at a lower capacity. Regardless of the origin of the shock, many businesses are merciless to the requirement to be in perpetual motion in order to survive.

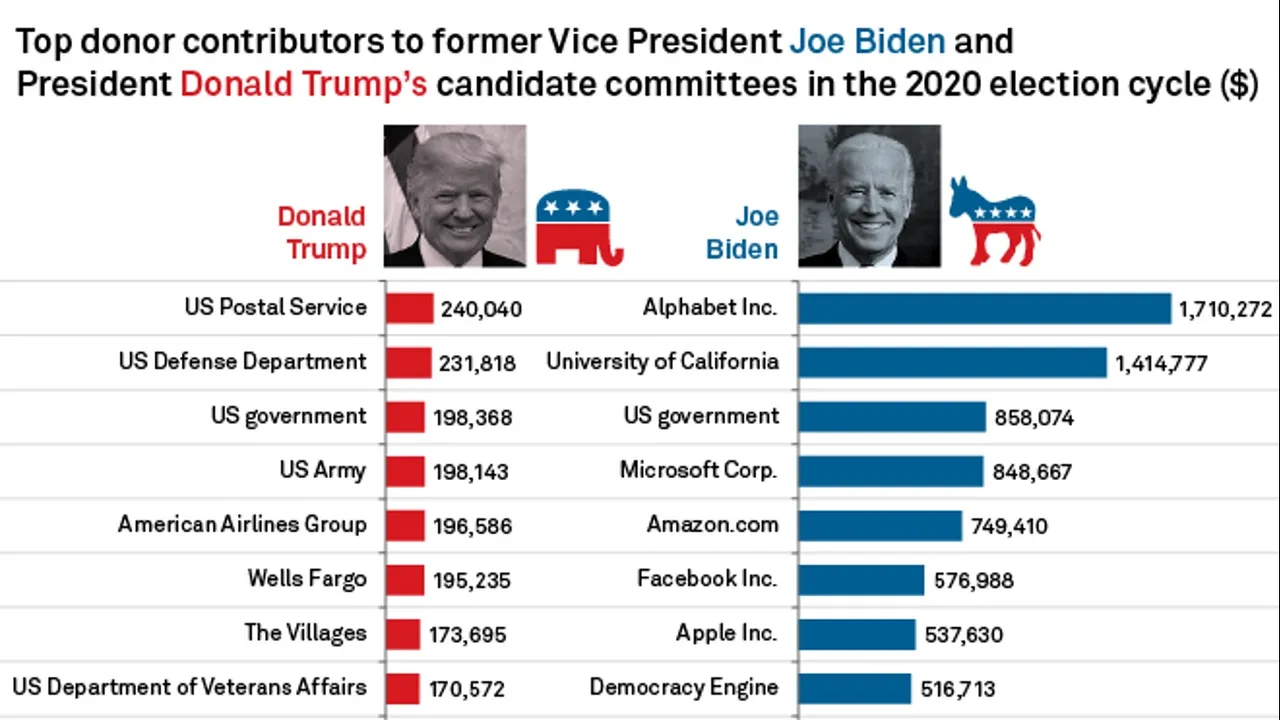

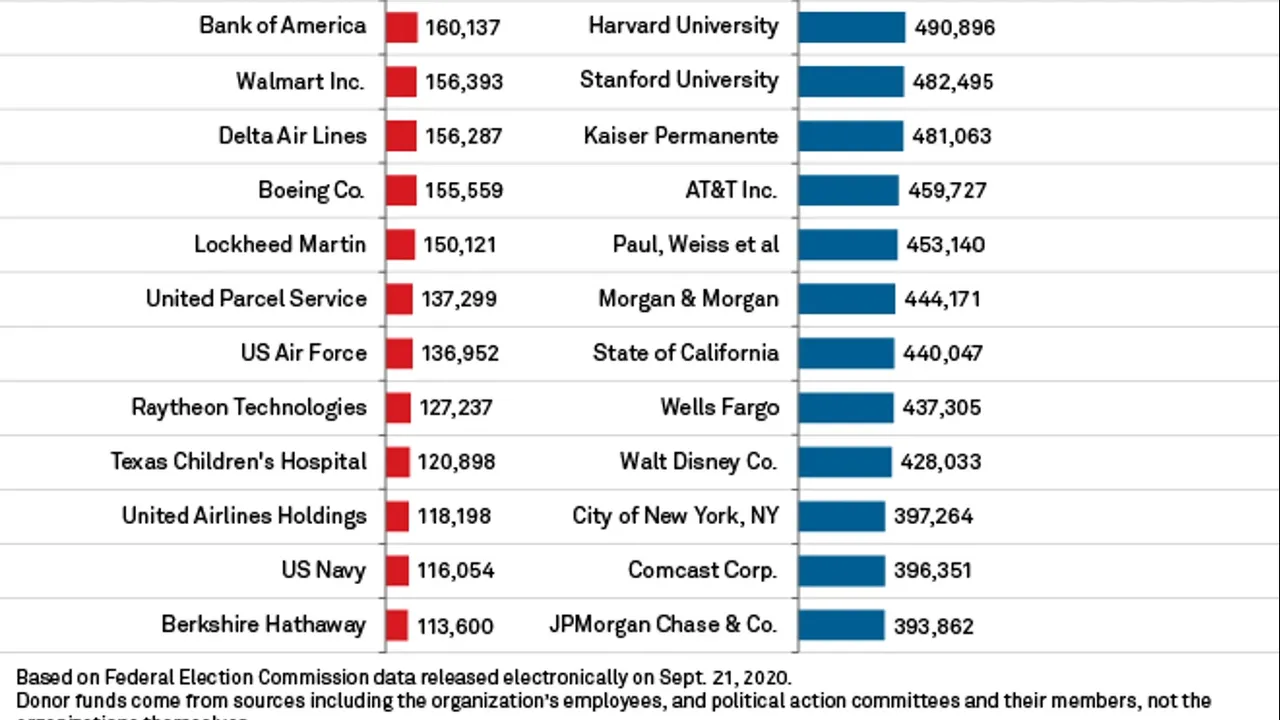

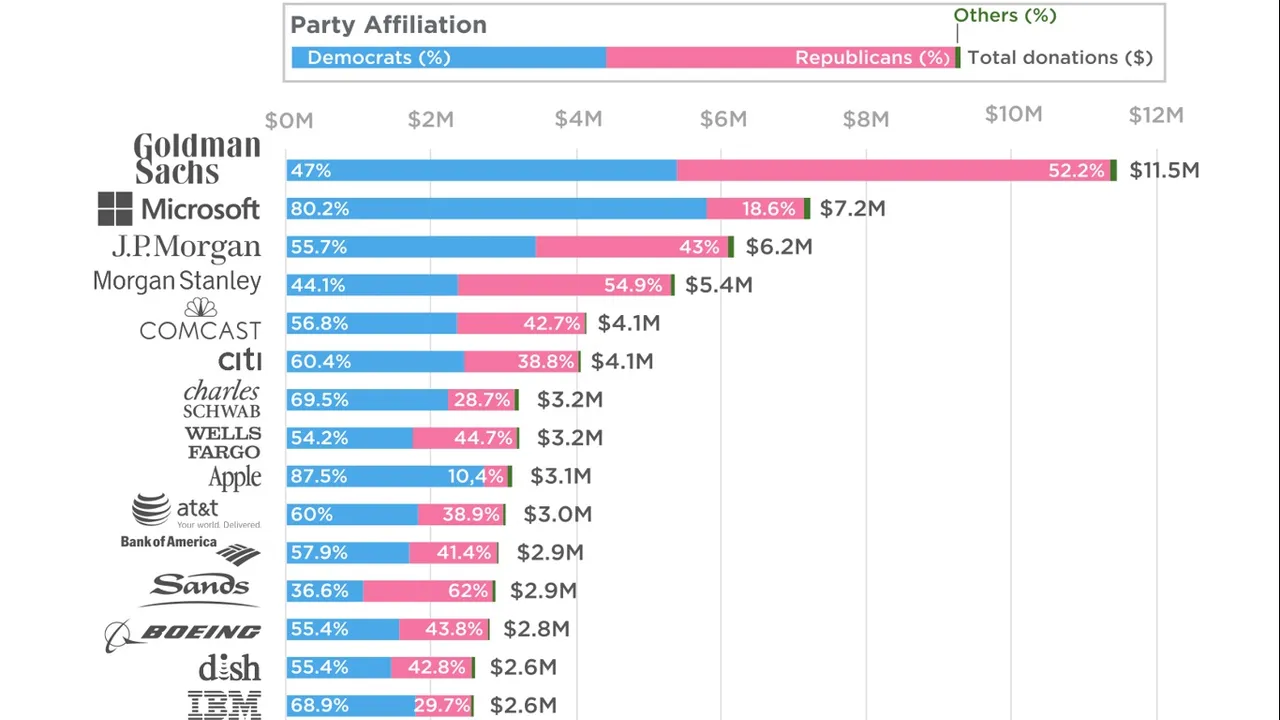

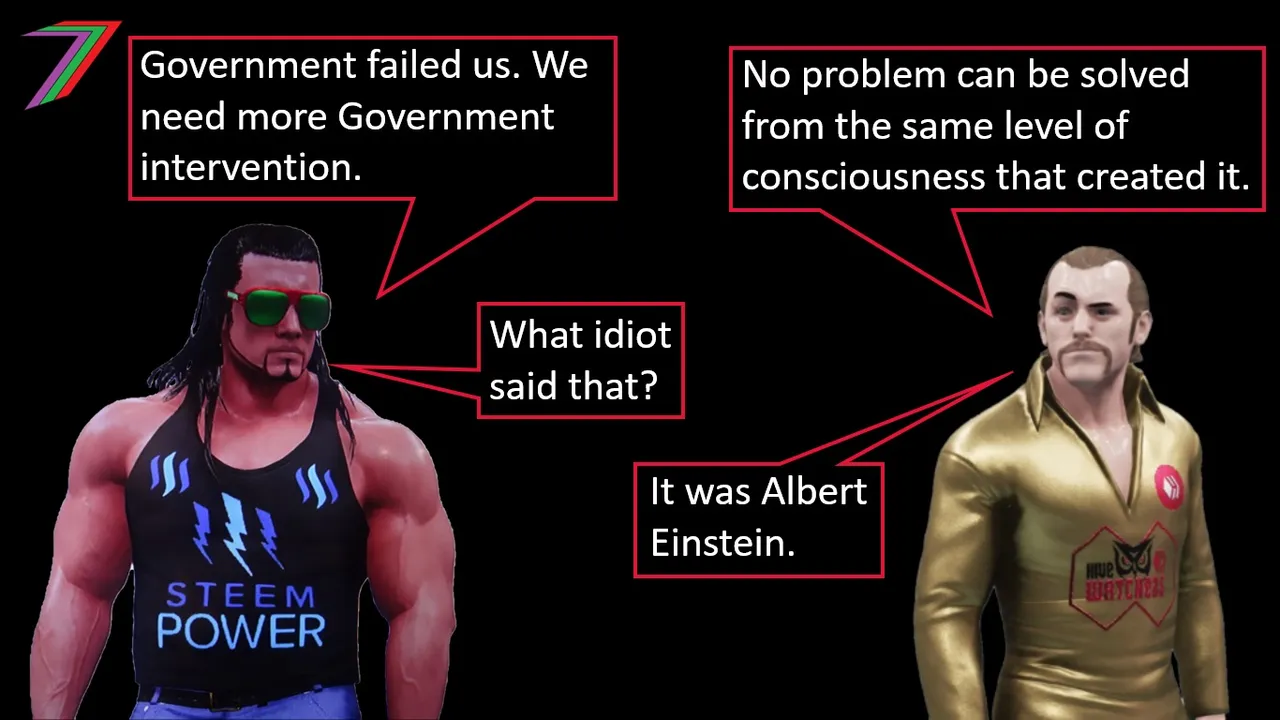

I strongly disagree with proposed solutions, which involve more Government intervention and control. Government intervention is often the cause of many economic problems. For example, the Covid-19 lockdowns have greatly benefited large companies over smaller companies. Other examples of anti-competition regulation includes trade tariffs, patents and copyright laws, costly additional bureaucracy (barriers to entry), and subsidies and bailouts given to large companies. Many large companies have significant influence in Government through donations and lobbying. See Figures 3 and 4 for information regarding donations to Republican and Democratic parties and candidates.

Figure 3: Donations to Trump and Biden 2020 Campaigns

Source: S & P Global

Figure 4: Top 15 Donors to Political Parties (2007 to 2017)

Source: How Much

In regards to inflation, if demand is very low, it is possible that expansionary fiscal and monetary policies will not lead to inflation. Covid-19 has greatly reduced demand. However, restrictions have also greatly reduced supply. As more businesses permanently close, supply could be effected in the medium-run. If demand increases sooner than supply, there will be inflation. If large businesses replace smaller businesses, they will gain greater monopoly power, which will also cause an increase in prices. If excessive spending and money printing continue, the chances of high inflation is very high.

Societal Reset

The authors made comparisons between countries that they perceived have handled the pandemic well and countries that they perceived have handled it badly. They highlighted five areas they believe made the greatest difference to how well countries have performed in addressing the Covid-19 pandemic.

- They were “prepared” for what was coming (logistically and organizationally).

- They made rapid and decisive decisions.

- They have a cost-effective and inclusive healthcare system.

- They are high-trust societies in which citizens have confidence in both the leadership and the information they provide.

- They seem under duress to exhibit a real sense of solidarity, favouring the common good over individual aspirations and needs.

The authors predict that the 'Societal Reset' will cause a switch in wealth distribution from the rich to the poor and from capital to labour. They also predict the collapse of Neoliberalism (i.e. an ideology that supports free market operation). Solidarity and social welfare will gain prominence over competition and economic growth. The authors use examples of the USA and UK (Governments that the authors believe to be following Neoliberal ideology), which have a high number of people dying with a Covid-19 diagnosis relative to other countries in the world.

The authors dispel a claimed myth that Covid-19 would create greater equality. They explain that lower income families are more vulnerable to both the virus and the measures taken to combat it. Many frontline workers have lower income jobs such as cleaners, nurses, delivery drivers, and workers in food factories. Higher income jobs can often be performed from home, thus removing people from direct danger of infection. However, in the post-pandemic world, this trend is expected to be reversed. People would demand improved and readily available healthcare. Governments would increase the wages of lower paying but essential jobs. Contracts would be replaced with permanent positions that would offer greater security.

The authors predict that one of the greatest risks in the post-pandemic world would be social unrest. Lack of jobs, income and prospects could lead to violence. The authors link social unrest to inequality. They briefly discuss Black Lives Matter and the likelihood that their cause will go beyond race-specific issues.

The authors persist to advocate for a larger role for Government and greater centralisation of control. Government will adopt the role of deciding what is in the best interest for society. Governments will intervene to improve social welfare. Health and unemployment insurance will be improved. Businesses will be held to account in regards to environmental issues. Government and private enterprise will work on joint initiatives to mitigate global risks. Taxes will increase to fund and support Government objectives.

My Views on the Societal Reset

The 'Societal Reset' is one of the most unnerving sections of the book. Societal problems have been framed as being caused by lack of Government control. Therefore, the proposed solutions involve larger Governments and greater Government control. I strongly disagree with both the framing of the problems as well as the solutions. The vast majority of Covid-19 related problems have been caused by Government interventions. These interventions have been both poorly timed and poorly executed. When they have been executed, they have been extreme and ineffective.

There are three key areas to consider when addressing a problem.

- What is the extent of the problem?

- What is the effectiveness of the proposed solution/s?

- What are costs of implementing the solutions/s (direct, indirect, short-run, long-run, etc.)?

The problem was Covid-19; it posed a mild health risk to the majority of the population and a more serious health risk to the elderly with existing medical conditions. There was a wide range of potential solutions. These included lockdowns, various enforced restrictions, recommended guidance, cures, treatments, vaccines, technology responses (tracking and tracing), distribution of protective gear, etc. All of these potential solutions have different degrees of effectiveness and cost. Government lacked the expertise and knowledge to determine which courses of action would produce the greatest net benefit (i.e. effectiveness - cost). Independent panels of experts from various fields would be in a better position to make this assessment. They would garner more trust than Government officials, which would likely result in an appropriate voluntary response from businesses and the general public.

I agree that Covid-19 has increased inequality. Large businesses are more able to survive long periods of closure than smaller businesses. Several large businesses have thrived because of being able to remain open because of their capacity to operate online, which has been more difficult for many smaller businesses. I do not agree that people will demand more action from Government. Instead, people would prefer fewer restrictions to reduce the threat to their livelihood.

I agree that social unrest is likely to be a problem in the post-Covid-19 world. I disagree that social unrest is caused by inequality. Social unrest is more likely to be caused by the perception of oppression (i.e. this could be actual oppression or the manipulated collective belief of oppression). The oppressors tend to be authority (formal or informal). The oppressed tend to be minorities (e.g. race, ethnic, religious, and cultural minorities), marginalised (e.g. based on sexual orientation and gender) impoverished, disabled, etc. Governments can reduce oppression by not being the oppressors. Forcing equality does not reduce oppression. Instead, enabling equal opportunities, by reduced intervention would reduce oppression and reduce social unrest.

Continued in Macro Reset Part 2 (Geo-political, Environmental, and Technological Resets).

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These 'Collection of Works' posts have been updated to contain links to the Hive versions of my posts.

My New CBA Udemy Course

The course contains over 10 hours of video, over 60 downloadable resources, over 40 multiple-choice questions, 2 sample case studies, 1 practice CBA, life time access and a certificate on completion. The course is priced at the Tier 1 price of £20. I believe it is frequently available at half-price.

Future of Social Media