Hi Everyone,

Welcome to the Economics Challenge Series for 2024. For July and August, I am running an economics challenge series. The series consists of seven challenges. All the challenges will commence in July and early August. I will publish and announce the results in August.

Six of the seven challenges from last year's Challenge Series are returning. The Tax Game from 2022 is replacing the business version of the Buying and Selling Game. Below is the list of challenges.

- Challenge 1: Ice Cream Game

- Challenge 2: Game Theory Game

- Challenge 3: Pick-a-Door

- Challenge 4: Complement vs. Substitute

- Challenge 5: The Buying and Selling Game

- Challenge 6: Even-to-Win

- Challenge 7: Tax Game

Each challenge could reward winners with as much as 60 Hive Power. The value of the prize will depend on the level of participation. For each new participant, the prize will increase by 5 Hive Power. This will continue until 60 Hive Power is reached (12 participants). The first 12 participants will also receive a 50% upvote from this account.

In addition to the prize money, the top few participants will be given points. These points will be used to determine the overall challenge series winner. This winner may receive as much as 80 Hive Power. The value of the prize will equal the sum of the number of participants across all challenges. This will continue until 80 Hive Power is reached.

For more information on the challenge series, I recommend that you read my post from last year. This year’s Challenge Series is run the same way as last year’s.

Results

Welcome to the results post for the Tax Game Challenge. This post contains the results as well as how they were generated using a Microsoft Excel model.

Winner Determined in this Video

What is the Tax Game Challenge?

For this challenge, participants are required to set the tax rate for a very small country. Tax has been simplified to just a percentage of overall income (i.e., no distinction between different taxes such as income tax, corporate tax, GST, etc.). The current tax rate and national income are provided in the question. The participants are required to set the tax rate yearly for the next 3 years (i.e., rate in Year 1, Year 2, and Year 3). They can choose any tax rate they please (anywhere between 0% and 100%).

Changing the tax rate will have both benefits and costs. For example, lowering the tax rate will raise income, but if tax revenue falls as a result of a lower tax rate, there could be a social cost of reduced funding of services provided by the Government. However, social costs will be reduced in the following year, as it is assumed the market will partially adjust to lower or higher Government spending.

The winner will be the participant who achieves the highest total income across the three years minus social costs from changing the tax rate.

Responses to the challenge are made in the comments section of the challenge post. The total prize for this challenge could reach as high as 60 Hive. The number of participants determines the value of the prize. For every entry, the prize is increased by 5 Hive (e.g., if the challenge has 6 participants, the prize will be 30 Hive (5 × 6)) until a value of 60 Hive is reached. The winner will receive 2/3 of the prize, and second place will receive 1/3. The first 12 entries will be given upvotes. In addition to the winning prize, the first 12 entries are given upvotes. In addition to the prize in Hive, the winner receives 40 points, second place 20 points, and third place 10 points; these points contribute to determining the overall challenge series winner.

The format of the required entry is explained in detail in the challenge itself.

For a more detailed explanation, you can access the challenge post using the following link.

Results of the Tax Game Challenge

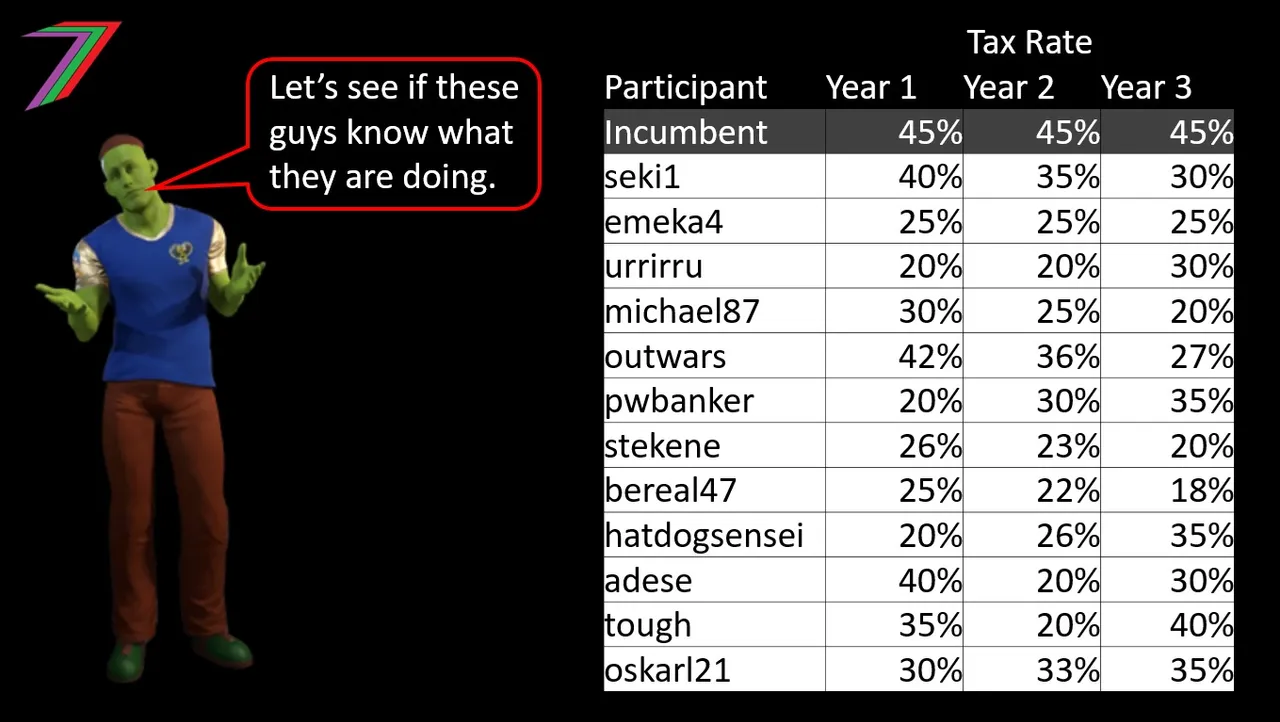

Table 1 contains the participants and the tax rates they proposed for the challenge.

Table 1: Participants and Their Proposed Tax Rates

The model generated three key parameters for determining income’s responsiveness to tax rate, the social cost of reducing funding for goods and services previously funded by Government (tax revenue reduction only), and the extent the market can compensate from reduced Government spending. Table 2 contains the parameters generated in the model.

Table 2: Model Generated Parameter Values

| Parameter | Value |

|---|---|

| Income Sensitivity | 1.34 |

| Welfare Recovery | 1.13 |

| Welfare Penalty | 3.26 |

Note: These parameters have very little meaning without the formulae they are applied to. Refer back to the original question for more context.

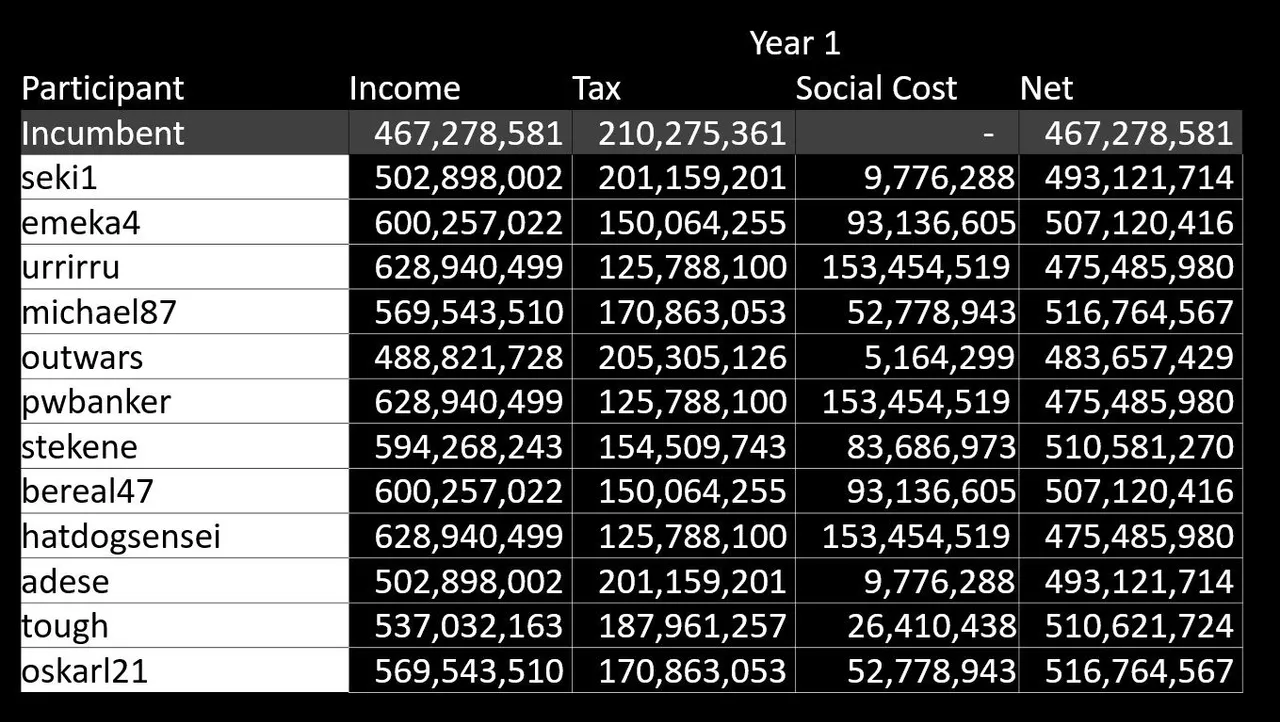

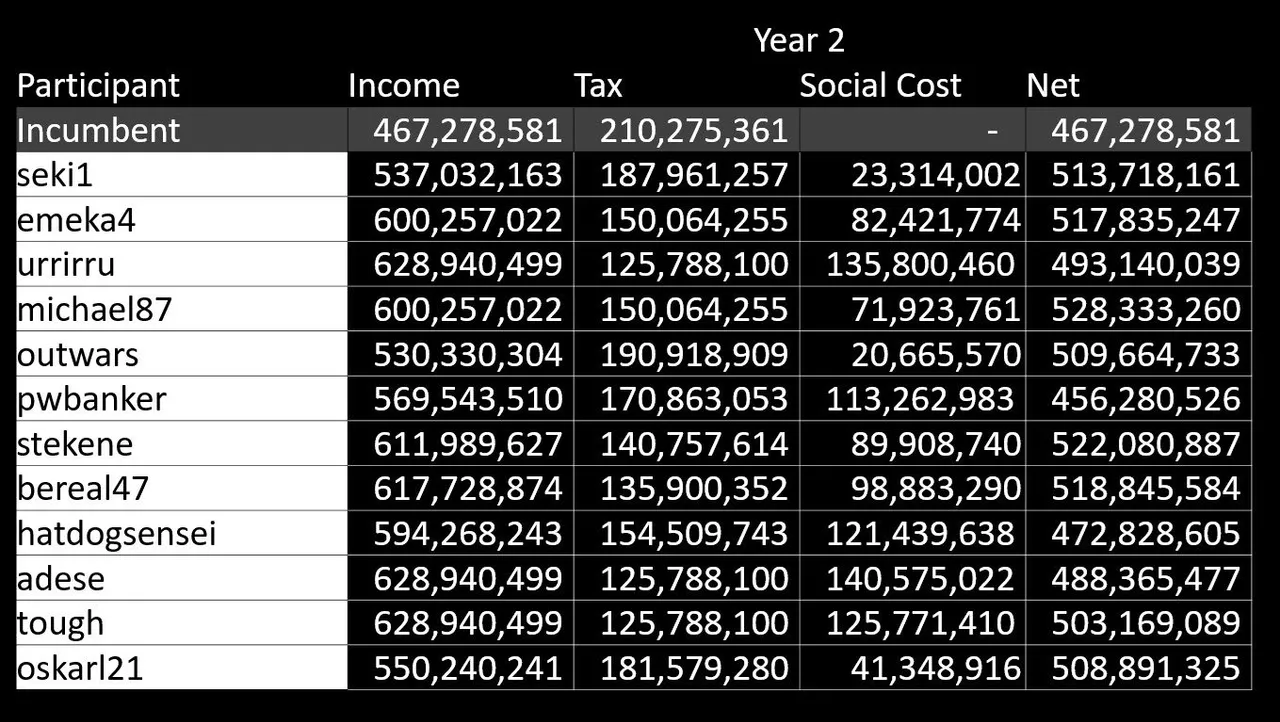

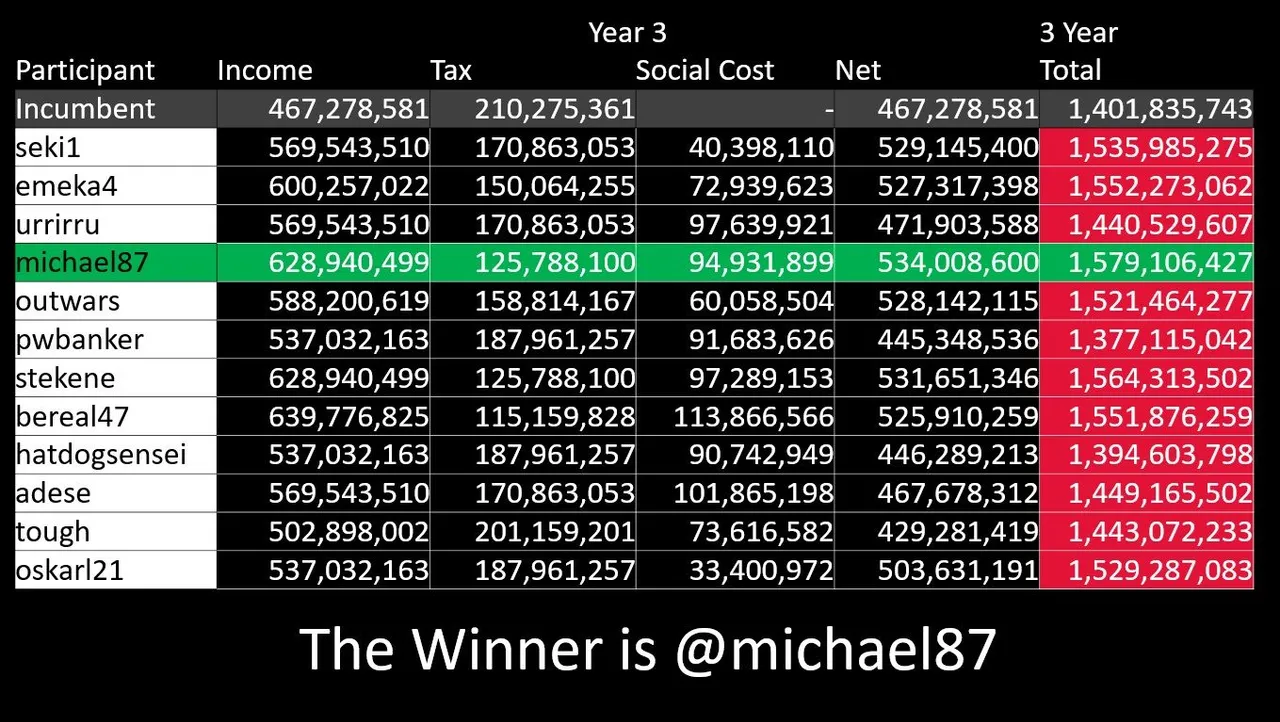

The parameters were applied to the formulae stated in the question to determine income and social costs for each participant. Tables 3, 4, and 5 contain the income and social costs for each participant for each year. Table 5 also contains the totals and the winner of the challenge.

Table 3: Income and Social Costs Year 1

Table 4: Income and Social Costs Year 2

Table 5: Income and Social Costs Year 3, Totals, and Challenge Winner

Congratulations to @michael87 for winning the Tax Game Challenge with a total income minus net social cost of $1,579,106,427. @michael87 wins 40 Hive for this challenge (60 × 2/3) and 40 points. @stekene wins 20 Hive (60× 2/3) and 20 points for second place, and @emeka4 is awarded 10 points for third place.

Challenge Tips and Analysis

This is a difficult challenge to determine the exact tax rates to use. Participants could enter the formulae given into a spreadsheet to gauge what values give better results. This would be a time consuming exercise, and it is possible something could go wrong entering the formulae, variables, and parameters. Studying the figures provided in the question is an easier alternative approach.

The current tax rate of 45% is high and is stunting economic activity. Lowering the tax rate is the first logical approach. Lowering straight to a more desirable level (e.g., 20%+) will create an immediate social cost as tax revenue would fall quite sharply. Lowering tax revenue more gradually would be a better strategy. Several participants adopted such a strategy. @michael87 judged the optimal tax rate best out of the participants who chose to lower it. If the parameters had been different, a lower or higher tax rate could have offered better results. This is a game that involves skill but also requires some luck.

Overall Series Score

The Economics Challenge Series is over. The points can now be finalised, and a winner can be announced. Below is the final table.

| Position | Participants | Points |

|---|---|---|

| 1 | Emeka4 | 95 |

| 2 | Micheal87 | 50 |

| 3 | Oskarl21 | 45 |

| 4 | Outwars | 40 |

| 5 | Urrirru | 35 |

| 6 | Bereal47 | 35 |

| 7 | Theringmaster | 35 |

| 8 | Seki1 | 30 |

| 9 | Stekene | 20 |

| 10 | Adese | 5 |

| 11 | Tough | 5 |

The winner for the 2024 Economics Challenge Series is @emeka4. Well done on such an amazing performance. @emeka4 won two challenges, came second in one, and came third in another. As the total number of participants across all challenges was 78, @emeka4 has won 78 Hive Power. You will receive this 78 Hive Power on the September Hive Power Up Day (HPUD).

My New Book, Sapien Loop

I have published an ebook on Amazon; it is titled ‘Sapien Loop: End of an Era’. The book is fiction. I do not normally write fiction. However, I felt it was appropriate considering what is happening in the world today. Freedom is the most important thing we have, but we are gradually losing it. I have covered this in many of my posts.

In the story, most citizens do not understand the concept of freedom because they have never really experienced it. In essence, the story is about an alien world that might represent our not-so-distant future. There are many other elements to the story that are an abstract and exaggerated version of our reality. I believe this book to be an important read, and I believe it has the potential to change the way you think.

Brief Summary of Sapien Lopp

This story is based on the fictional planet Sapia and its sole country, Sapey. Sapey is portrayed as a form of utopia for all its citizens. No poverty. No war. Almost no crime. Opportunities for all.

This was enough for most citizens, but not all. In one of the small regions, some of the citizens had become discontent. They felt something important was missing in their lives. Their discontent did not go unnoticed. Some of the Sapey elite wanted to weaponise this discontent to gain more power. This created more chaos than they anticipated. This led to further widespread social unrest.

On top of the chaos, ambition and greed provoked another enemy. This enemy was on a mission to settle both new and old scores.

If you want to buy a copy of the book, below are links to the relevant Amazon websites for each country it is available in. The book is priced at approximately US$5.08.

- Amazon USA

- Amazon UK

- Amazon Germany

- Amazon France

- Amazon Spain

- Amazon Italy

- Amazon Netherlands

- Amazon Japan

- Amazon Brazil

- Amazon Canada

- Amazon Mexico

- Amazon Australia

- Amazon India

I am also running monthly contests where participants are required to answer questions based on the book. The prize is 30 Hive Power plus upvotes for the first twelve entries. You can recover the cost of the book with just one win.

Hive: Future of Social Media

Spectrumecons on the Hive Blockchain

▶️ 3Speak