Hi Everyone,

Welcome to the ‘Buying and Selling Game’ (Business Version) Contest 32 results post. This post contains a video of the ‘Buying and Selling Game’ Excel Model generating the demand for each good, quantities sold, and profits for each participant for this contest.

Winner determined in this video

What is the Buying and Selling Game (Business Version)?

For the benefit of those who have not entered this contest, here is a brief explanation of how the game is played.

The participants are required to buy or produce goods with an allocated budget. They are given a choice of three types of goods to buy or produce. They are required to buy or produce these goods in combinations specified in the question. The participants are required to set the prices of the goods they have bought or produced. All costs are provided in the question. However, demand for each good is not provided.

The demand for the goods are determined with an Excel Model, which uses triangle distributions. The participants are informed of the minimum, maximum, and mode values used to determine these distributions in the contest question. The Excel Model uses the calculated demand and prices entered by the participants to calculate the number of goods they have sold. The prices, costs, quantities bought or produced, and quantities sold are used to determine the profit for each participant.

The participant with the highest profit after selling his or her goods is the winner.

Responses to the contest are made in the comments section of the post. If several participants make the same profit, the person who entered (commented) first will win. The account with the winning entry will receive 30 Hive and the first 12 entries will be given upvotes. The winner will win an additional 5 Hive if he or she has a profit higher than the profit generated by the model estimator. If nobody makes a profit (i.e. zero or negative), the prize will be rolled over to the next contest.

The format of the required entry is explained in detail in the contest itself.

For a more detailed explanation, you can access the contest post using the following link.

Results of the contest

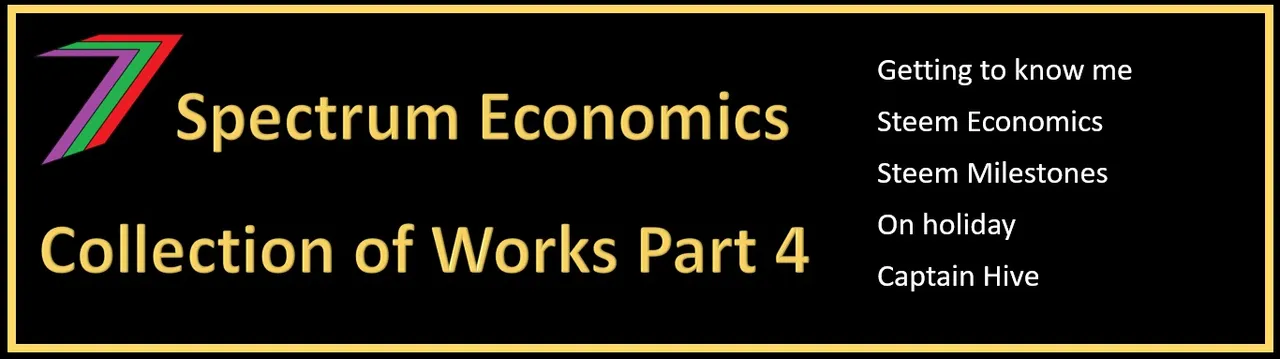

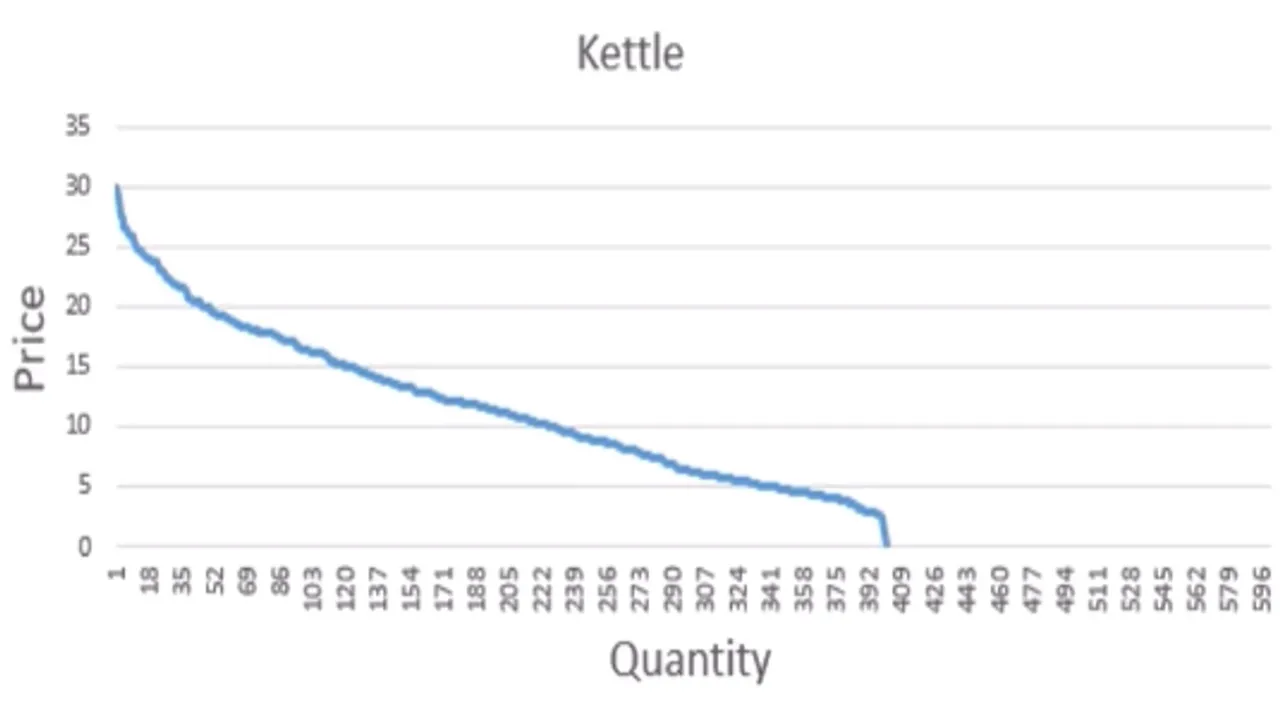

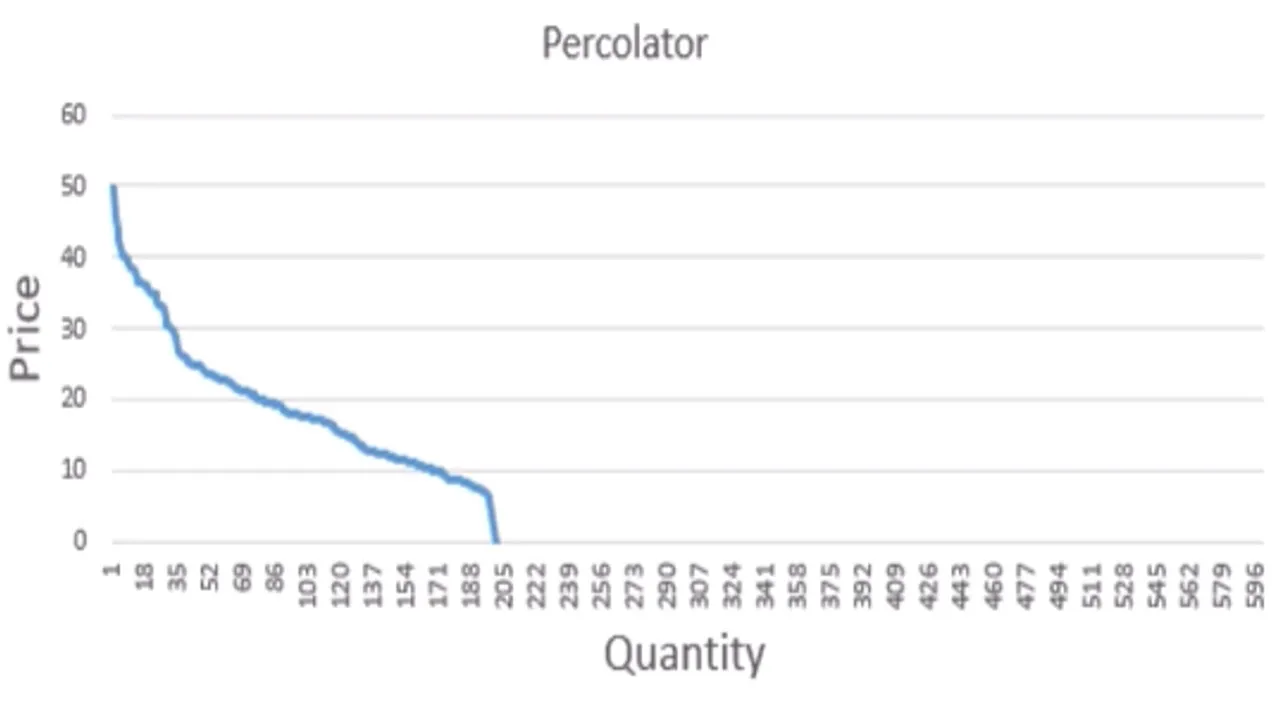

Figures 1, 2, and 3 contain the model-generated demand curves for kettles, percolators, and pod machines respectively.

Figure 1: Model Generated Demand Curve for Kettles

Figure 2: Model Generated Demand Curve for Percolators

Figure 3: Model Generated Demand Curve for Pod Machines

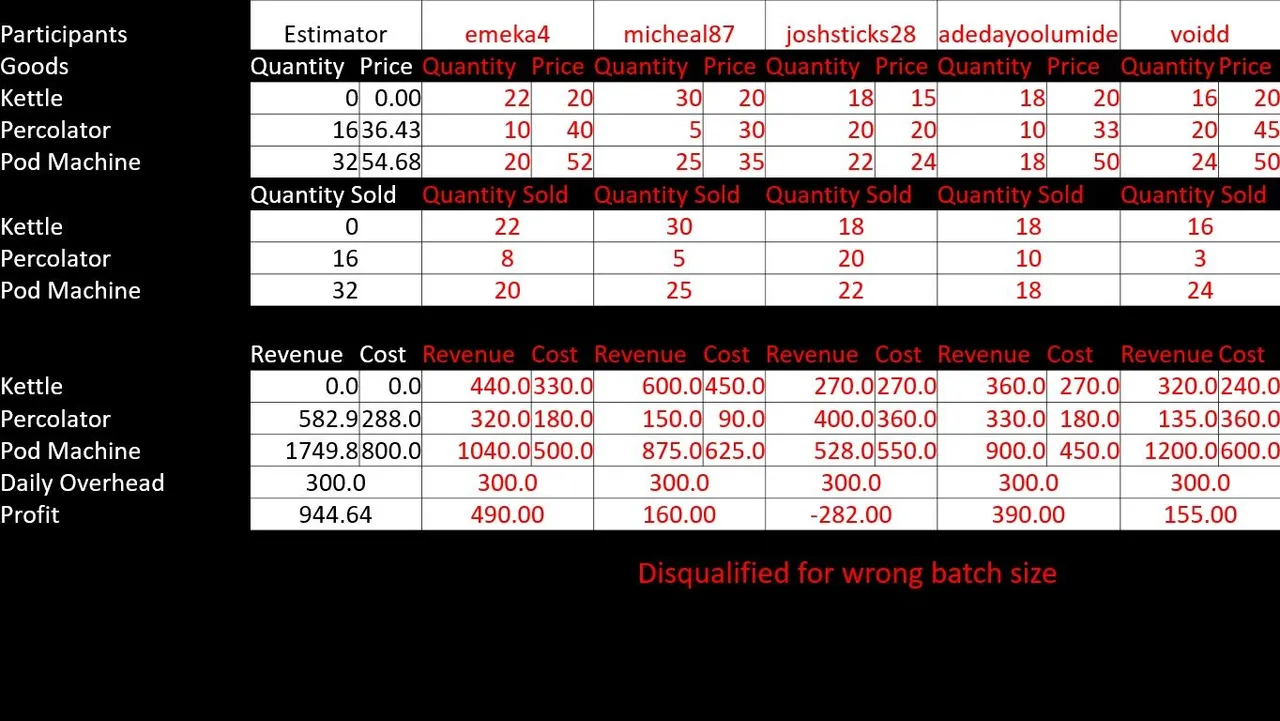

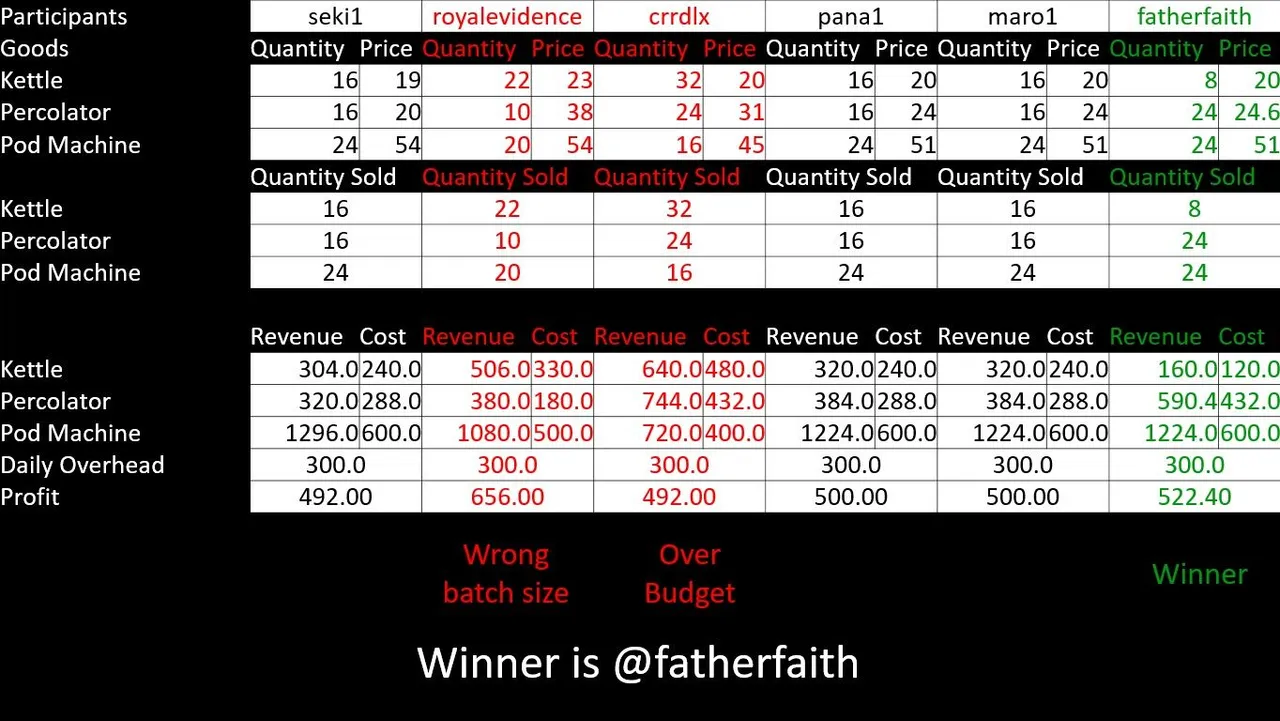

Tables 1 and 2 contain responses, quantity sold, revenue, and the profit made by each participant.

Table 1: Participant responses and profit (Participants 1 to 5)

Table 2: Participant responses and profit (Participants 6 to 11)

Participants in red font have been disqualified for not buying goods in batches of 8 or for exceeding the contest budget. Out of the 11 participants, only 4 have valid entries.

Congratulations to @fatherfaith for winning Contest 32 of the 'Buying and Selling’ Game (Business Version) and 30 Hive.

@fatherfaith purchased 8 kettles at $15 each, 24 percolators at $18 each, and 24 pod machines at $25 each. They were priced to sell at $20, $24.60, and $51 respectively. At those prices, all the kitchen appliances for making hot drinks that were bought were sold. A total revenue of $1,974.40 ($160 for kettles, $590.40 for percolators, and $1,224 for pod machines) was generated. The total cost for buying these appliances was $1,452 ($120 for kettles, $432 for percolators, $600 for pod machines, and $300 for daily overhead). @fatherfaith’s total profit was $522.40.

@fatherfaith was unable to achieve a higher profit than the estimator. The estimator bought more pod machines, less percolators and no kettles. The estimator priced the percolators significantly higher and the pod machines slightly higher. The relatively low budget favoured a strategy of buying goods with inelastic demand while selling them at higher prices. The low budget at most only enabled a maximum of 42 (only pod machines) to 80 (only kettles) out of a demand that could have enabled as many as 800 (400 kettles, 200 percolators, and 200 pod machines) of all appliances to be sold if the budget had been larger.

@fatherfaith’s low prices ensured all the appliances were sold but was sufficiently high to make some profit. Pricing was clearly reactionary to responses made by other participants. Kettles and pod machines were priced the same as participants who entered earlier and the percolators were priced only $0.60 higher. A lack of relevant entries made this strategy very effective and almost guaranteed victory before the results were calculated in the model. Commendable use of game theory.

I would also like to thank @emeka4, @pana1, @crrdlx, @seki1, @royalevidence, @micheal87, @joshsticks28, @voidd, @adedayoolumide, and @maro1 for participating.

Contest Tips

For the business version of the Buying and Selling Game, a participant needs to understand three areas. These areas are:

- Impact of working under a budget.

- Relationships between costs, demand and price.

- Shape of the demand curve.

The size of the budget plays an important role in determining how much of each good should be purchased or produced.

If the budget is large, production of goods should be more widely distributed across all three available types of goods. Generally, goods with elastic demand should be bought in higher quantities than goods with inelastic demand. Goods should be bought close to the point where new customers’ willingness-to-pay (i.e. marginal revenue) is almost at cost (per unit).

If the budget is small, goods with inelastic demand and high maximum price should be favoured over goods with elastic demand and lower maximum price. Prices should be high to capture as much consumer surplus from customers with high willingness-to-pay. If the budget is exceptionally small, it might be optimal to produce just one type of good.

Understanding the relationships between cost, demand, and price is essential for optimal pricing of goods. Goods must be priced above cost to make profit but if the prices are too high, insufficient customers will buy the goods, which will reduce profits.

The maximum, minimum, mode, and diminishing marginal utility determine the shape of the demand curve. High diminishing marginal utility increases inelasticity of demand. A large difference between maximum and mode price, increases inelasticity of demand in the top portion of the demand curve. A large difference between minimum and mode price, increases inelasticity of demand in the bottom portion of the demand curve. The top half of the demand curve is most relevant when the budget is small. The bottom half of the demand curve is normally more relevant when the budget is large.

Other important things to consider are batch size and costs of goods. Large batch sizes may force participants to focus on less goods, as the optimal number of some types of goods may fall short of the number in the batch. If the business is dealing with very low cost goods, a participant is more likely to make a higher profit by spreading purchases across all available goods. If the business is dealing with high cost goods, a participant is more likely to make a higher profit from focussing on one or two goods. This is because quantity demanded for high cost goods is normally lower than for low cost goods.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These 'Collection of Works' posts have been updated to contain links to the Hive versions of my posts.

Hive: Future of Social Media

Spectrumecons on the Hive blockchain

▶️ 3Speak