Did you know that the money we pay every month to SSS could serve as our Retirement Fund?

Have you ever wondered how much we could get from our government-mandated retirement fund? or Did you know that we are already paying for it from our salary deductions?

Well, do not worry if you haven't had the idea because even I myself, I knew about this just last year. So, I am here to share the knowledge and good news (is it really?) with you.

Disclaimer: The following post is according to the current facts provided by the Social Security Law in the Philippines and it may vary from nation to nation and also, it may change in the future. If ever I have delivered something that is not right, please feel free to correct me in the comments section so that I could edit my post for it to bring more valuable content. Also, the rest of the post is according to personal study and research that I have incorporated in this post.

Before anything else, let us define Retirement Fund.

When we say retirement, we could already imagine ourselves as old people that could no longer work for a job. Yes, we could take that also as a definition of retirement and that's how we should perceive retirement in this post.

From the word itself, it is the fund that is intended for the days when we are no longer qualified to have a job or the fund that we could use to finance our daily needs in the future. Simply put, retirement is the day when we reach 60-65 years old, the age that is no longer qualified to work.

So, let's get back on track.

Let’s tackle how viable our SSS as an investment to finance our retirement days. Would it be able to take care of us when the time comes that we leave the workforce and spend the rest of our lives with the people who matters the most?

Thinking about our retirement makes us feel,

“We are too young to think about that matter now…”

Yeah! I felt that way too when I first encountered an article telling, “Prepare for your retirement on your 20’s”. It was something futile for me to understand why I should prepare for it knowing that it is 30 to 40 years away. (let's say, I am 25. Hahaha!)

Well, if we are now employed, passively, we are preparing for our retirement through SSS. We are funding our retirement that is 30-40 years away! This may not apparent to us because every time we receive our paycheck, all we can see are “Deductions”.

But here, we will go beyond the percentage taken away from us, and let’s examine how well that amount of money could work for us during the time we retire.

Moving on, let's have the Definition of Terms.

The following terms are defined from the Social Security Law. I only include words that are used in this post. You can view the rest of the Social Security Law or the Republic Act No. 8282 from here

Monthly Salary Credit

The compensation base for contributions and benefits.

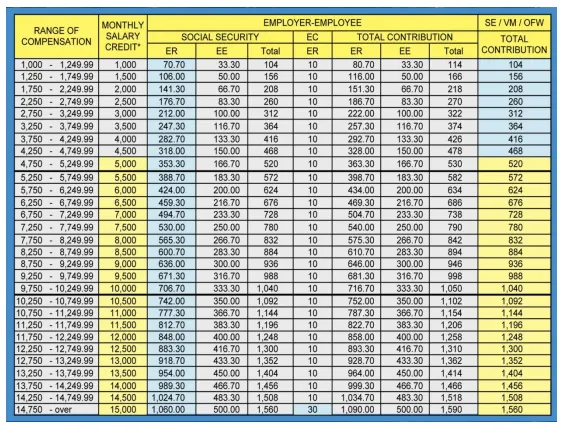

This is the equivalent amount that would serve as reference in calculating the money you are going to accept during retirement basing from the salary range you have while paying the monthly of SSS. Please refer to the table 1.0 for the Monthly Salary Credit as of this writing.

Average Monthly Salary Credit (AMSC)

The result obtained by dividing the sum of the last sixty (60) monthly salary credits immediately preceding the semester of contingency by (60).

Why AMSC is important? Because sometimes the salary of a person varies over time. (Example: If the current salary one has is Php10000 per month for 5 years and then he switched to other job that pays him/her Php18000 per month for another 7 years). So, the AMSC must be computed for uniformity.

Credited Years of Service (CYS)

The number of calendar years in which six (6) or more contributions have been paid from the year of coverage up to the calendar of year containing the semester prior to the contingency.

Semester

A period of two (2) consecutive quarters ending in the quarter of contingency.

Contingency

The retirement, death, disability, injury or sickness and maternity of the member.

So, now that we are acquainted with the terms which I consider a-must for this post, let us proceed with the requirements that should be met for us to avail the retirement fund we expect from SSS.

Member Entitled for the lifetime monthly pension

Paid at least 120 monthly contributions prior to the semester of retirement

Reached the age of 60 years

Already separated from employment or has ceased to be self-employed

I hope we could agree that this is not hard to achieve given further that it is not compulsory that you pay your contributions STRAIGHT 120 months! Yup! We can still avail the lifetime pension even if we skipped a month or a year for as long as we have completed the required number of months of contribution (which is 10 years or 120 months) during our active membership of SSS.

Cheers for that!

If ever we know someone who have not completed the 10 years or 120 months SSS contribution, worry not! Though it may not be a lifetime pension, we could still get some for our retirement in the future.

Member Entitled for just a Lump Sum Amount

- Has not paid the required 120 monthly contributions.

Are you now ready to go to the calculation part?

Because that's what I am going to share to you at this point.

The highest amount computed shall be the monthly pension of the retiree.

The following are the ways defined by the Social Security Law on how to calculate our monthly pension, whichever gives the highest amount, that method should be the one to be considered.

Note: This is applied to those members who completed the 10 years or 120 months (or more) contributions in SSS.

1. 300 + (20% x AMSC) + [2% x AMSC x (CYS - 10)]

2. 40% x AMSC

3. Php1200 for members with at least 10 CYS; and Php2,400 for those with 20 CYS

Of course, we could not appreciate the methods if I am going to give methods alone. That's why in the next parts, I'll give examples for us to picture out the whole thing.

Let's tackle two different scenarios: above minimum wage earners and the minimum wage earners.

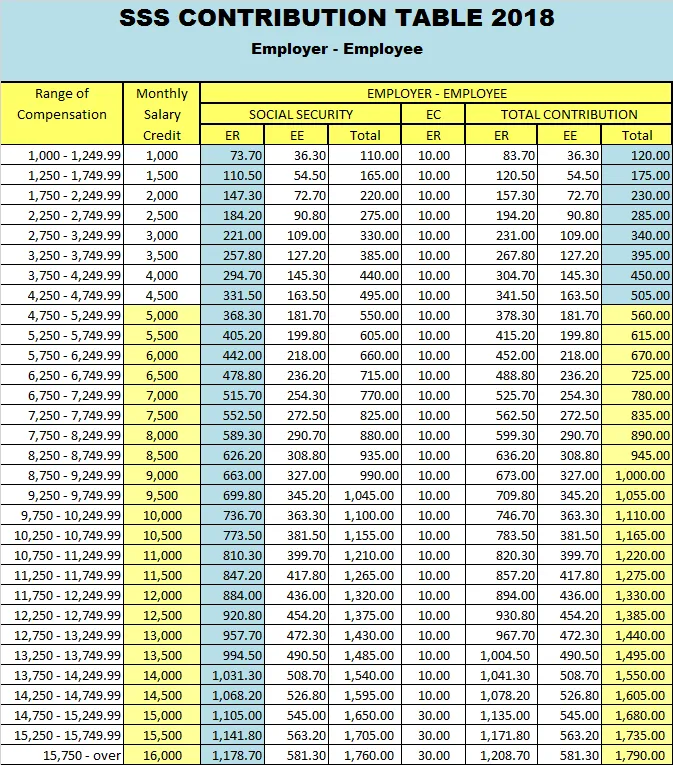

Note: Let's use the updated Table of SSS Contribution for reference and consider that the person has uniform salary through out the years indicated.

Above minimum wage earners

Let’s take an example of a hard-working Juan who was earning P20,000/mo during his 30 years of service at a BPO Company.

Using the first formula:

300 + (20% x 16,000) + [2% x 16,000 x (30 -10)] = 9,900/mo

Using the second one:

40% x 16,000 = 6,400/mo

Juan who was earning 20,000/month for 30 years will receive 9,900/month during his retirement. Amazing, right? However, let's say that his food and other daily consumption is way smaller than on his middle age, all of his children are now earning on their own, and his wife has also a monthly pension of 9,900/month. The Php9,900 per month is still a meager amount considering inflation that compounds at 3-5% annually, plus vitamins and medicines needed for a senior citizen, another for enjoyment and for travel fund(if he wants to). Another thing, what if he lives 20 years more? That’s another compounding of inflation rate, another stack of vitamins and medicines or hospital/medical fees, and things to support his life.

Minimum wage earners

Another example to represent the minimum wage earners, like Pedro who was earning 10,000/mo in 35 years of service.

Using the first formula:

300 + (20% x 10,000) + [2% x 10,000 x (35 -10)] = 7,300/mo

Using the second one:

40% x 10,000 = 4,000/mo

The same applies with Pedro who was a minimum wage earner and a member of SSS. Considering the inflation rate of our country, it would be a bad retirement fund for Pedro who spent his life working for 35 years. How would it turn like if other what if’s come into play, such as his medical expenses?

Going back to the question,

"Is our SSS viable as an investment to finance our retirement days?"

Yes! It is. Computing how much our total contribution and gain would give us as a return of investment (ROI) around 100% - 1000%. Sad to say, it is just not enough. If we only depend on this government-mandated retirement fund, we would end up struggling financially during the last stages of our life (retirement). We do not want to live this life living below our means, do we? Earning great amounts of income during our work days and living on cents during our retirement days is a disaster.

So, to say if we should prepare for our retirement during our 20’s... The decision is ours to decide.

What do you do today to contribute to your retirement?

The answer is yours to keep.

Hoping that this post reminded you to prepare for retirement. Because wether we like it or not, we are on our way towards it. In preparation... the earlier, the better.

til next time,

@namranna