What are the drivers of economic cycles? What could trigger the next big crash? Why the current economic model is unsustainable, and why bitcoin may be the solution.

Ivar Duserud recently held a presentation for BitSpace at Gran Canaria, where we hosted BizzWeek together with Liberland and Intrahouse. In this post you'll find a video of the presentation as well as an accompanying article. Check out the Facebook group for the event, and the lineup of speakers at Liberland's website here. Ivar is also applying for a Scholarship to Anarchopulco - hope to see you guys there!

Video of Presentation: Old and New Economies

Article of Presentation: Old and New Economies

The state of freedom has always been closely tied to the state of the money. Money is in many ways the lifeblood of an economy, as it in its most perfected form serves as a means of barter and store of value - being durable, divisible and fungible. Historically the optimal solution has been precious metals, predominantly gold and silver. Though metals also have their drawbacks, they have served impressively well as a means of limiting state control of money. Through scarcity and decentralization, these metals limit Governments' and central banks' abilities to print currency and inflate the money supply, and in turn limit the atrocious influence such institutions can have on an economic environment, especially to create destructive boom and bust cycles.

Now, with the advent of Bitcoin technology, we may be facing what could be the next revolutionary step in monetary progress, leading us towards a healthier economic environment without these devastating cycles. Satoshi Nakamoto, the Bitcoin creator whose identity is still unknown, initiated the first ever Bitcoin transaction on January 3rd 2009. The transaction included a link to a news article on the topic of bank bail-outs in the aftermath of the recent financial crisis.

This may among other reasons have been intended to shed light on the instability and unsustainability of the current fractional reserve banking system, and fact that Bitcoin could potentially, over time grow into a viable replacement. A replacement fully based on supply and demand, with immunity from the wrath of centralized political influence. The current monetary system is one that is constructed with the intent to favor the political class, and serves as a tool to funnel money into certain sectors and away from others. The beneficiaries of the status quo want to keep it so and therefore knowledge about the way the monetary system works is not accurately presented to the public in the mainstream.

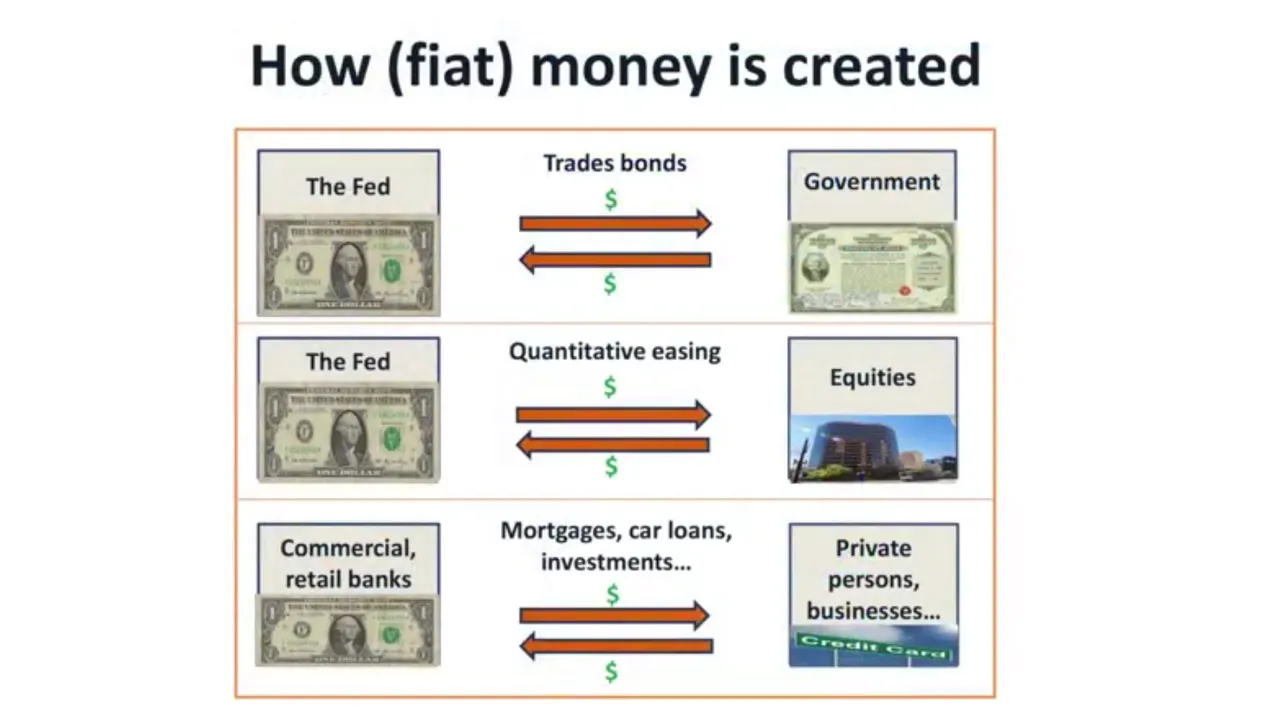

Most people are very surprised when they figure out that their Dollars and Euros are created into existence whenever a loan is issued, whether it is by a central bank buying government bonds, or a commercial bank issuing a mortgage. The money does not exist before it appears in the account of the borrower. The borrowed amount is expected to be paid back with interest on top. This begs the question of how the total debt can ever be paid down as all currency in existence is less than the total debt owed. The answer is that it can't. On top of that, there is no limit to how much money can ever be created!

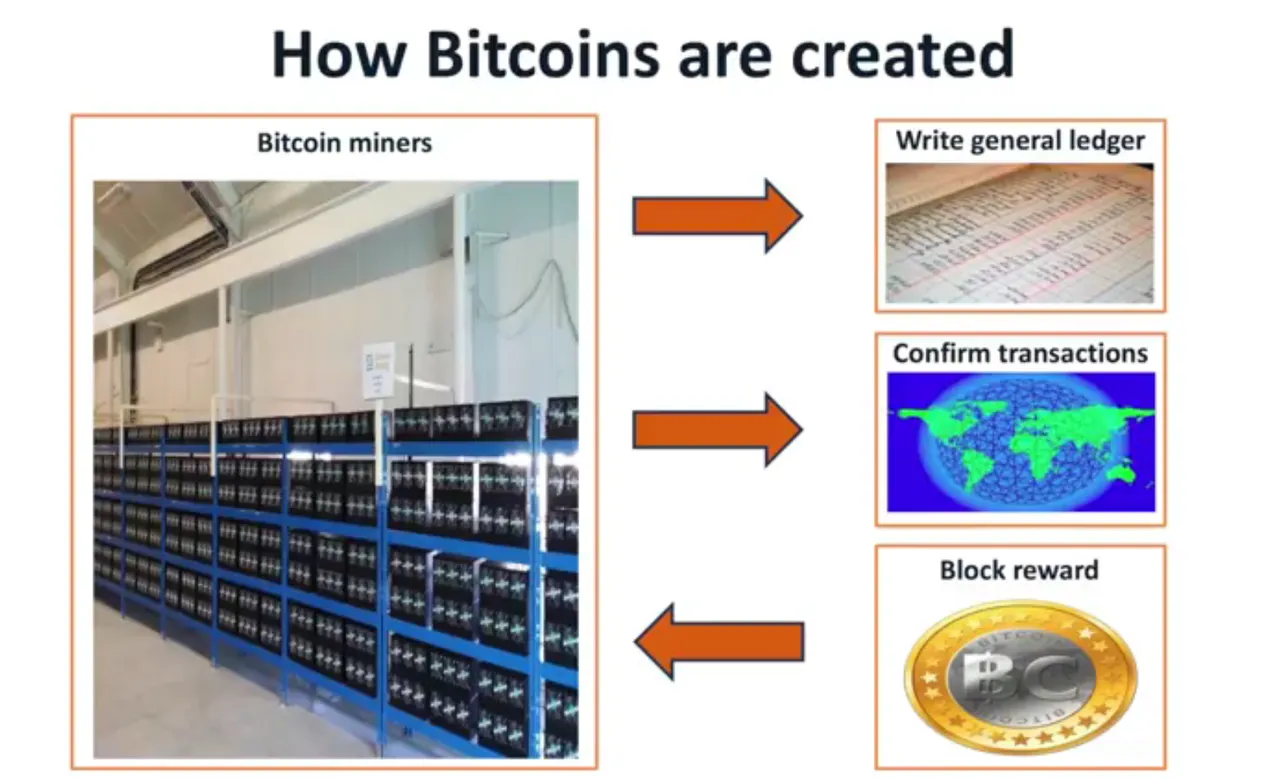

Bitcoin on the other hand is limited to a total 21 million Bitcoins supply. The inflation rate is predetermined and available to see for anyone who wants to know. Bitcoins are created and given directly to Bitcoin miners, which receive the Bitcoins for writing the general ledger known as the blockchain, and for confirming transactions. This way the reward incentivizes miners to do what is needed, to keep the network functioning.

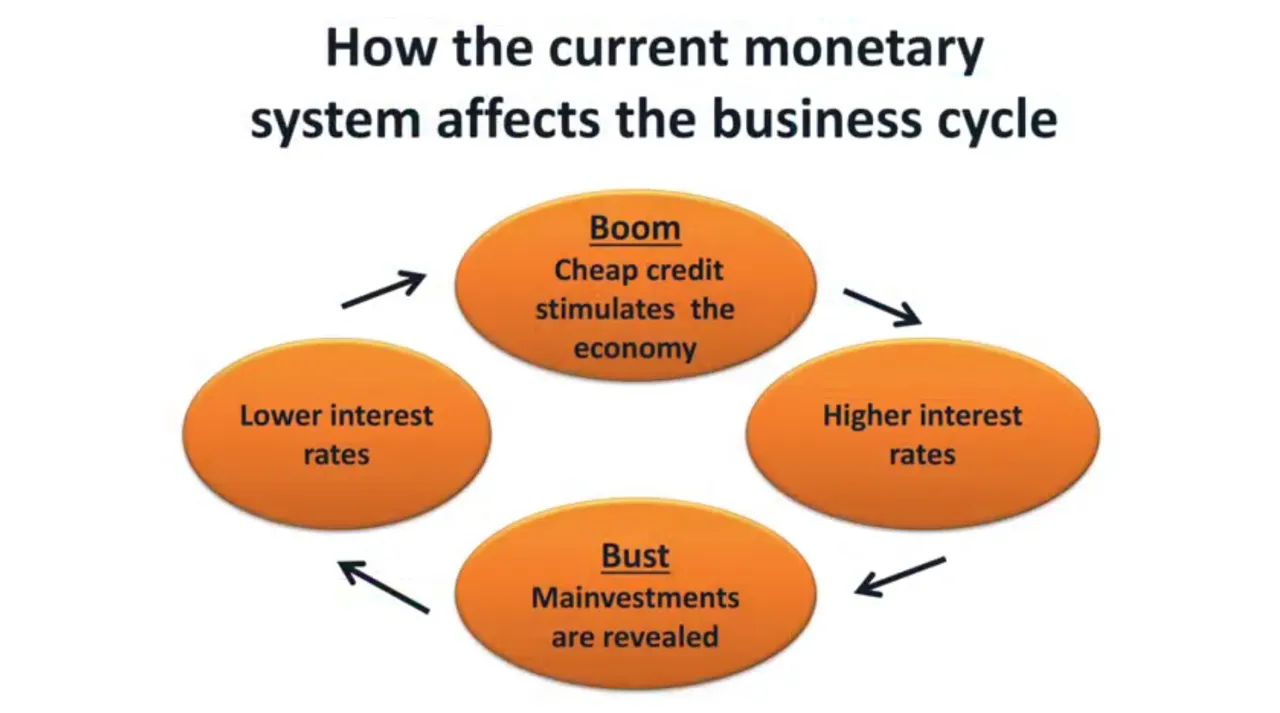

Some of the most horrific effects of Government or central bank controlled monetary systems, is that they are the main factor in causing financial destruction through the control of interest rates, which sends misleading signals to market participants. Typically the cycles starts when interest rates are lowered in order to stimulate economic growth. In short term, this is very effective as businesses now can afford doing projects that formerly would not be profitable at higher borrowing costs. Likewise, home buyers can afford bidding more for housing, thus driving up the price for housing. In short term, all looks good in this economic boom. The problems however, are glaringly visible when the interest rates are moved back up, or when the market simply gets fed up with loaning money. At that point, the businesses that were operational because of the access to cheap loans are now not profitable anymore and will have to lay off people and maybe declare bankruptcy. Housing prices will have to come down as home buyers cannot bid as much for housing anymore. This is the bust period, where markets face the inevitable correction and resources are moved away from the sectors and businesses where they should not have been in the first place.

Unfortunately, the response to these economic downturns are generally to lower interest rates even lower, thus igniting the next boom cycle, just as unsustainable as the last one. It is only a matter of time before the credit growth stops, at which point the boom will as well. The lower the interest rates and longer the boom period, the worse the inevitable crash will be. Now, under a different monetary system, I would not argue there would be a utopia without financial downturns. We would still see them in other forms, but they would appear for different reasons, like when disruptive technologies outcompetes old solutions and people have to reorganize. Another reason can be when natural disasters hit, and harm local regions for a certain period of time. The impact of these can be serious, but they will be limited in scope, and will not be able to harm entire continents like the most severe financial crisis we have seen before through history. They have been, without exception, a result of interest rates manipulation, and the following malinvestments as a result. We don’t even need to go far back in history to see examples of these malinvestments.

During the early 2000 we witnessed a huge stock market bubble, known as the dot-com bubble. This was after interest rates had been lowered more or less continuously since the 1980s. When interest rates were hiked in the early 2000 the credit growth stopped and so did the credit fueled stock bubble. In 2007/2008 we saw the collapse of the US housing market. This bubble was a direct result of the lowered interest rates designated to stimulate growth after the dot-com crash. When interest rates rose again in 2007 the bubble could not be sustained and we got another crash, which shook most of the western world. We are now in 2017 at record low interest rates, and record high stock market, and of course, this is not sustainable this time either. There are only two options. Either the central bank keep rates low and continue the credit growth, which over time will completely devalue the currency, or hike rates which will save the currency, but crash the stock markets. The problem is that the mistakes are already made, and the only way to proceed with real, sustainable economic growth in the future is to have a correction, though it will be extremely painful in the short run.

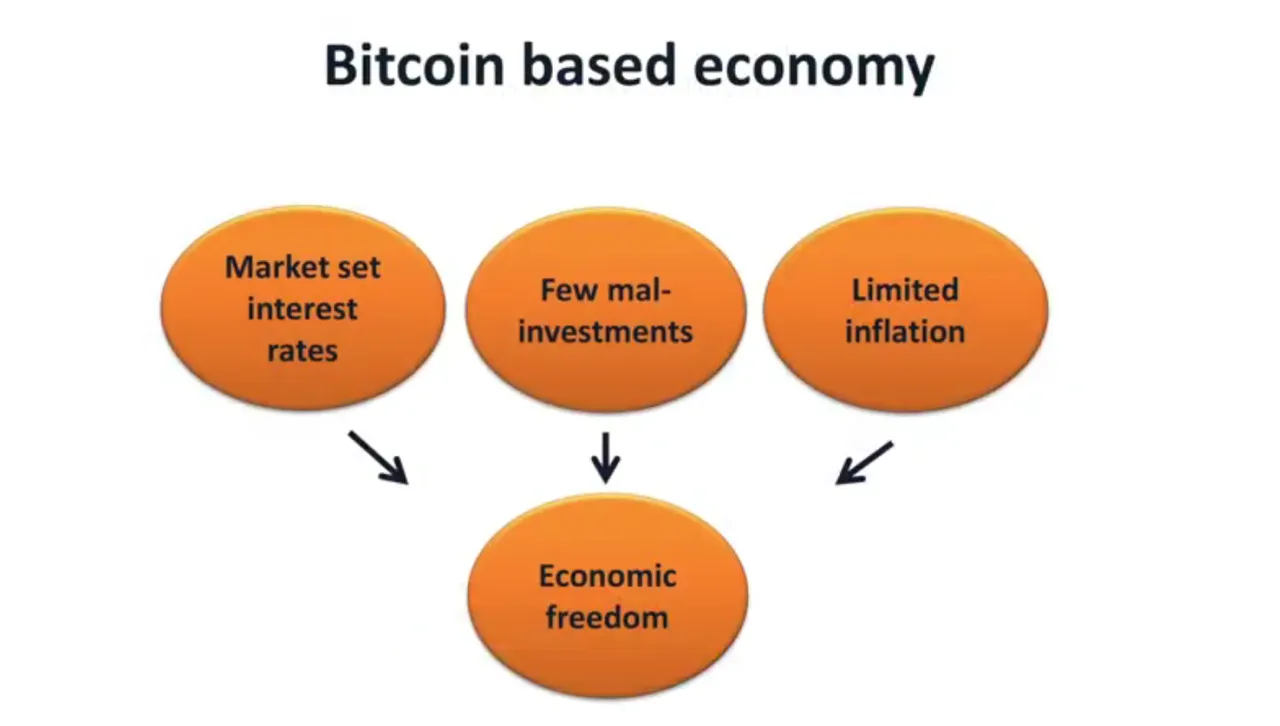

So, how can Bitcoin be the solution to these devastating cycles that seem to haunt us every so often? Well, unlike the current monetary system, there is no single entity that can control interest rates in the Bitcoin ecosystem. Interest rates are whatever supply and demand drives it to. The cost at which you are able to borrow Bitcoins is dependet on how much is saved and how great the demand is, and will change according to what happens in the real world, and thus effectively lead the scarce resources in society to where they are most effectively put to use. This will in turn lead to fewer malinvestments, and less waste of resources into projects that aren’t profitable. Last but not least, there is no entity able to print Bitcoin in the way it's done in the traditional system.

This means that the Bitcoin supply won't be excessively inflated over time, which means the currency is more likely to hold or increase its value over time as more people adopt it. By being a viable, and healthy monetary alternative to the current fiat currencies, Bitcoin and Bitcoin adoption gives people more economic freedom, and with that more prosperity.

The more traction Bitcoin gets, and the more people choosing Bitcoin over fiat, the less impact the old monetary system will have, which means the business cycles will be less severe. This is why I see Bitcoin being in the early face of moving the world as a whole more towards a state of freedom.

Hope you Enjoyed this!

Here's a picture from my recent trip with BitSpace to Gran Canaria, where I held my presentation and got to interact with Liberland. In the picture is the BitSpace team as well as Hans Lysglimt, organizer of BizzWeek.