I have known the Bitcoins and the principles behind them since the end of 2012, where my interested cousin introduced me to the concept. At that time, a bitcoin was around 40 dollars.

I think the whole cryptocurrency thing is right now what i want to call a generations' gold fever , an investment that a generation is afraid to miss.

The foundation of bubbles

Fear of missing is when you buy something without research, you are afraid that you do not get along with the wave. If Bitcoin was worth $ 100 today and people knew it would rise a lot, everyone would buy it. It was originally used about the young people's use of social media and the need to constantly be online because they fear that others experience something they are not part of.

Earlier bubbles where I can draw clear parallel are the Tulip bubble, Mississippi bubble, Beanie Babies bubble and Dot-com bubble

There have been many other bubble's where people because of fomo ended up losing everyting because of no knowledge but bought because of recommendations from friends, media etc.

I personally think that the market will always be here. There has already been so much infrastructure built and so great interests in these cryptocurrencies.

Photo: images.google.com

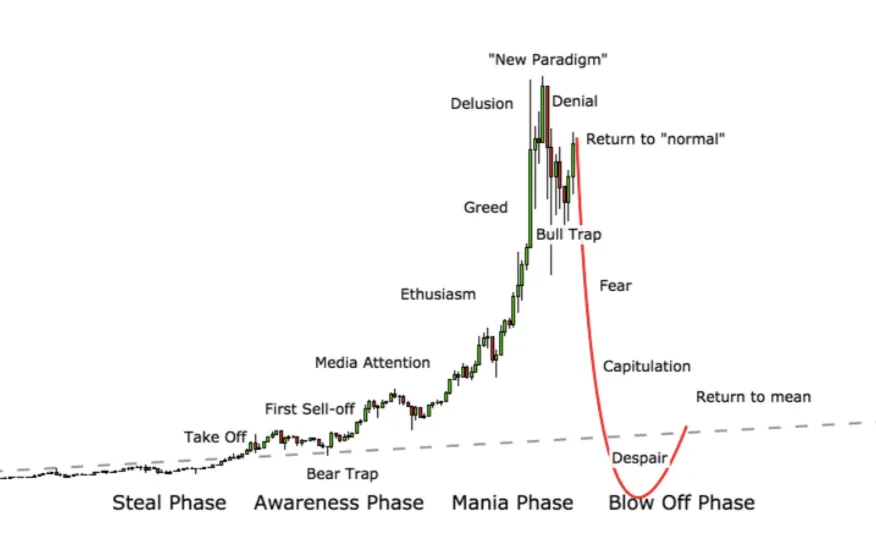

In this graph of the "phases of a bubble" as Dr. Jean-Paul Rodrigue has made can you see almost all previous bubbles have behaved. A graph that also largely fits the price of most cryptocurrencies.