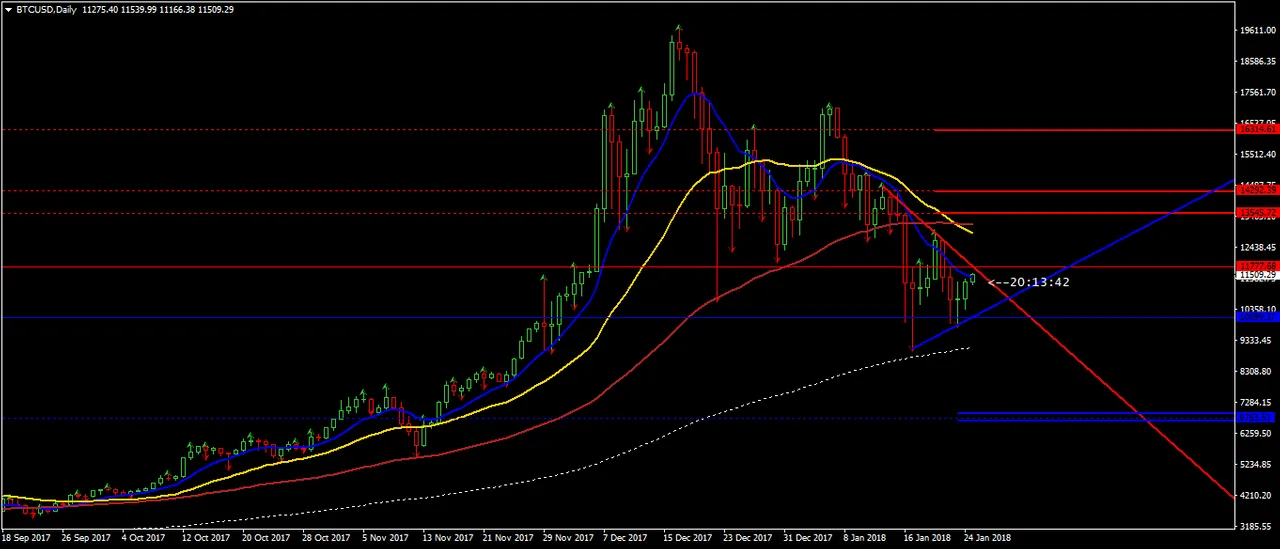

is going to be made before Bitcoin CBOe near month futures expiration date on the 26th of January.

If we go to medieval times when BTC was priced @ $163 (11th of January 2015) and then come back to the 17th of December 2017 when BTC achieved all time high of $19704 (SimpleFX pricing) the middle between these 2 extremes is going to be (163 + 19704)/2 = $9933.5.

50% is a pretty strong Fibonacci level and that's where in case of Bitcoin we have been bouncing from since the 16th of January. Plus $10K is a very psychologically strong number. In other words, at this stage we are witnessing a locally established pretty strong support and now comes the time to test the opposite site - i.e. resistance provided by the joint together 34 (yellow) and 89 (brown) days WMAs.

The upside trigger level ($11778) is set to be crossed in my view and I expect BTC to continue to at least to 89 days WMA (currently @ $13160) with possible overshoots to 13545 or even to $14292.

The key question that I can't answer is whether or not on the 26th of January the near month BTC futures are going to be dumped as previously or rolled over. And therefore whether or not we will see a daily close above 89 days WMA with following continuation to the top volatility implied target of $16315. If we do, then the entire technical outlook will change.

https://www.mql5.com/en/charts/8215764/btcusd-d1-simplefx-ltd

All major ALT coins are positively correlated to BTC and will follow its path.

BCH

https://www.mql5.com/en/charts/8215774/bchusd-d1-simplefx-ltd

DASH

https://www.mql5.com/en/charts/8215809/dash-d1-ava-trade-ltd

ETH

https://www.mql5.com/en/charts/8215821/ethusd-d1-simplefx-ltd

ETC

https://www.mql5.com/en/charts/8215827/etcusd-d1-simplefx-ltd

LTC

https://www.mql5.com/en/charts/8215833/ltcusd-d1-simplefx-ltd

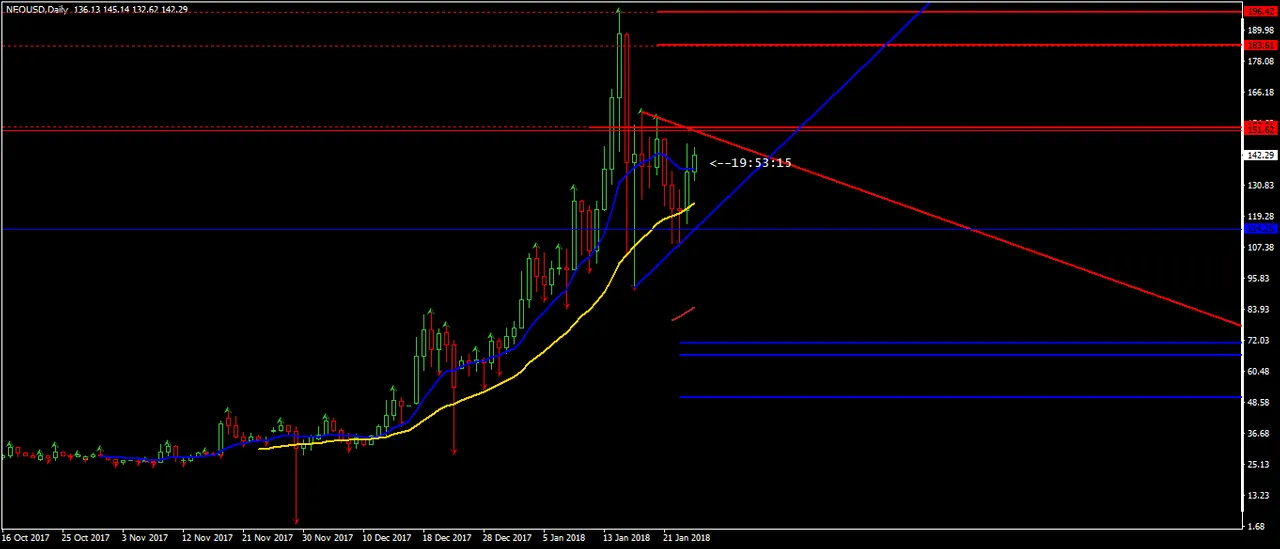

NEO

https://www.mql5.com/en/charts/8215840/neousd-d1-ava-trade-ltd

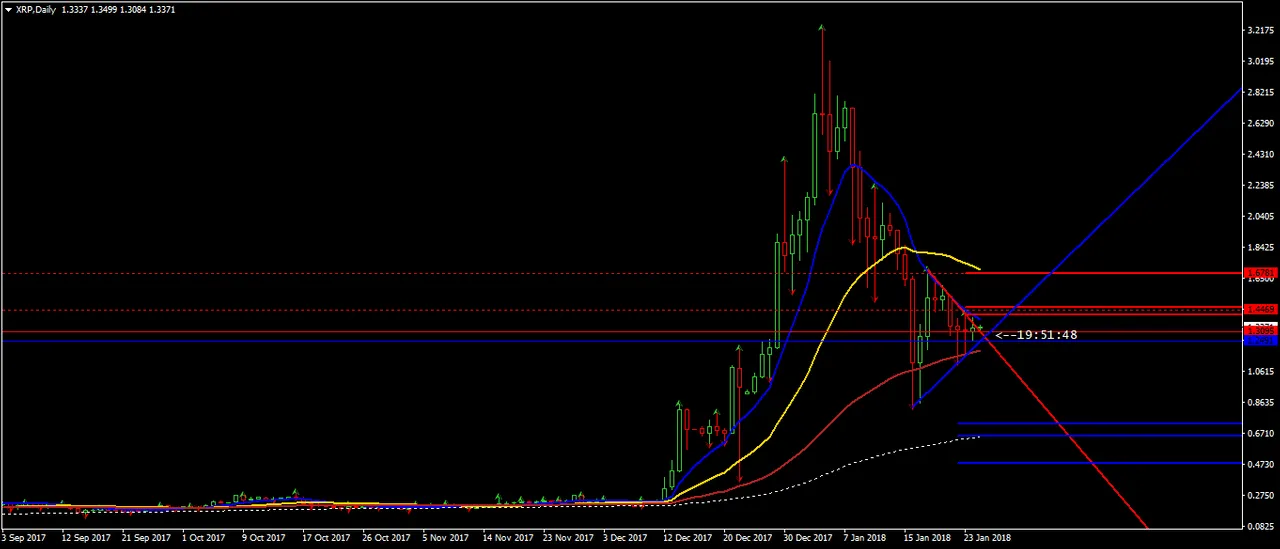

XRP