How Much Should you Pay for Tenx PAy

TenX PAY

Let's talk a bit about the project : In three lines, this is a debit card allowing to spend all the crypto currencies in the market with an Iphone App, Android App and Desktop App

So TenX business is to issue payment cards, their coin is PAY

The Team : Great story, one of the co-founders is a previous Medical Doctor, the team is able to deliver and they communicate regularly with their coin holders (should I say coin Hodlers ;-) )

The Market : same as other card issuers, they are playing with the Big Boys.

The Business Model : As any other credit card Issuer, they are going to make money on fees.

To make it simple, let’s say the TenX card is a Visa one. Every time the card is used the merchant that received the money pays a certain amount of fees. For $100, the merchant is going to pay $2 of fees (example), these fees are going to be distributed to 3 stake holders :

The bank the merchant is working with

Visa that has the tech to allow the payment (card and card reading machine)

The Credit Card Issuer (TenX in this case)

The first will take $0.4, the second $0.4 and the third $1.2 (still an example)

Of these $1.2 that TenX gets, they are going to take $0.7 for their company to pay their fees and make some profit, redistribute $0.1 to the card holder (you) and distribute $0.4 to the TenX PAY coin holders in form of ETH. (the real business model, numbers are just for the example)

So this business is driven by volume, the more people pay using TenX cards the more PAY holders receive ETH. The PAY holders receive one third (1/3) of the fees the card issuer (TenX) gets. Great coin, great business model !

So how much one should be willing to pay for PAY ?

Total number of coins in the market : 200 million

Valuation Method :

First let’s take a look at other companies that have similar (similar, not exactly the same) business models in this sector then let’s try to have an idea of the size of the market. From there we can make a certain number of hypothesis to try to have a valuation of PAY

Other companies :

Visa : 7 billion USD in Revenue — 6.3 Trillion USD in transaction Volume (that’s 6 300 000 000 000 USD), 3.1 billion Credit Card Holders (that’s half of the worlds population !) and a Gross Profit Margin of around 80%

AMEX : 34 Billion USD in Revenue— a bit more than a 1 Trillion USD in transaction Volume, 140 million card holders and a Gross Profit Margin around 25%

The difference between Visa and Amex is that Amex is a card issuer operating their own network and taking higher fees (thus the discrepancy between the revenues of the two companies).

We are going to choose two other tech companies to compare with : Paypal and Stripe. The commonality between Visa, Amex, Paypal and Stripe is that all of them charge fees mainly supported by the merchant who receives the payements. The % of fees might differentiate but the way they make money remains the same.

Paypal : The company has roughly 190 million active accounts and processes 400 billion USD in transaction volume with 10 billion USD in revenue.

Stripe : Its transaction volume is evaluated at 45 billion USD and revenues around 1 billion USD

In 2001 Paypal funding was 217 million USD and the company sold to Ebay at 1.5 billion (2002), this was at the peak of the Internet Bubble. Paypal had 13 million active users at the time they IPOed (2002).

Paypal started in 1999 so the example is old, that’s reason why I wanted to take Stripe as well although we don’t have all the numbers for this one.

Stripe was found in 2010 and is valued at around 9 Billion USD with 450 million USD of funding.

Once we collected all these facts and figures, we can start working on PAY valuation.

Simple Valuation method : Value of a user / Cardholder

This method allows us to see how much profit each card holder contributes to the company during his whole lifetime, in other words how much money the company expects to get from each cardholder or user on average in the years the user/cardholder remains with the company.

Visa : 3.1 Billion card holders and total company valuation 233 Billion USD, 233B/3.1B = 75 USD per card holder

Amex : 140 Million card holders and total company valuation 76 Billion USD, 76B/140m = 540 USD per card holder

Paypal : 190 million active users for a valuation of 77 Billion USD, 77 B / 190m = 405 USD per user

Stripe : we don’t have the numbers but we will use it later

So this is one way of valuing a boring company (established, everything published, clear streams of revenues and profits). TenX is a startup and it has maybe around 5 000 card holders, we can not compare it to a boring company because we are looking at the future revenues. Yet we have one important piece of data, PAY value is directly available on the market :

PAY varied between around 50 cents and 6 dollars since the ICO.

There are 205,218,256 PAY tokens in the market. This means that the total market cap of PAY varied between 100 million USD and 1.2 Billion USD and that 1 PAY = 1/3 of TenX revenues as a “dividend”

Now let’s remember that PayPal had 13 million users when it was acquired by Ebay for 1.5 Billion and that it took Paypal 16 years to get to 190 million users.

Two additional informations :

Coinbase has 10 million users (total) for a recent valuation at 1.6 Billion USD. Let’s assume there are 50 millions people owning crypto currencies worldwide (I think it is more around 20 million people)

PAY token holders are by the number of 17259

At a million cardholders coupled with some terrific growth numbers, I would be happy to enter at a billion USD market cap and Hodl some PAY for 5 years to see it grow and be profitable. Stripe has a valuation of 9 Billion usd 7 years after its inception.

TenX is 8 months old.

With the crypto world numbers, I can not see TenX having a million card holders by end of 2018. Thus the Token is overvalued at the max price of 6$ and actual price around 4$. For 2017 and 2018, I would not pay more than 1$ for PAY until I see at least their first 100,000 card holders.

I am not going to talk about the competition, other more recent ICOs and possible bigger companies taking on this market because the numbers speak for themselves for now. To get one Stripe or one Paypal many other startups FAILED.

Yes, failure is an option.

As crypto-investors, we are here to support the tech so it is important to mention that the COMIT protocol project is a game-changer (more details here). However its success is closely tied to TenX success. The project relies on its use and adoption by institutions and businesses which is a (very) slow process. We also would like to avoid ending up in a crypto-bubble so my piece of advise would be to avoid following the bull runs and to invest and hold for the long term. If you see PAY at 1$ or 1.5$ and if the projects continues to progress the way it is doing right now, then go and get some.

Doing this research allowed me to have an idea of the target levels at which I will be reasonably willing to buy some PAY. Since I spent this much time on the company and that I watched hours of interviews / weekly updates, I grew to really like Julian Hosp’s (co-founder) style and communication :). So I am getting 1(one) PAY at 3.5 USD and will wait to see what’s coming next ;-)

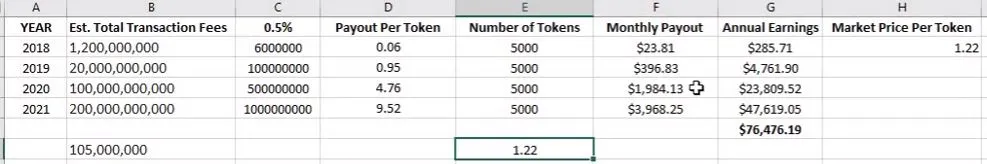

A rough estimation on value if Tenx succeeds

Its a very high hurdle

As usual this is for reference only do your own due diligence as I am not a Professional advisor.

If you like my post please feel free to donate some

BTC : 1PkjVmYVwAHfAHUW1q9yjN9HVjSZB3GJiU

ETH : 0xb02776a1d7ba9dbc0cdacaa00fe368e12ffe7166

ZEC : t1dorDAEVhH4Eyq1UERaKSZtdyKouw1weih

Waves : 3P8X2J6up8ragNk47cfCXvzch6YYdjayzNx

Please upvote it if you are able to and love the blog :) or Resteem would nice :) thank you

( ͡° ͜ʖ ͡°)

will upload more info in the future!!