The identity of Satoshi Nakamoto is unknown. In 2008, someone using that pseudonym published a white paper, and later released a program, that would reshape financial and technological industries. The white paper, entitled “Bitcoin: A Peer-to-Peer Electronic Cash System,” explained the need for digital currencies. In nine pages, the fundamental mechanics were outlined for what would become the blockchain, and Bitcoin.

Summary:

Transferring money online has always relied on banking systems to verify and authorize. This makes consumer information available to 3rd parties, while slowing down the transaction speed. The overhead for using a bank increases the transaction cost, and limits the amount of money to be sent. Using cryptographic digital signatures to verify a publicly distributed ledger over a decentralized, peer-to-peer network, removes the need and expense of trusting financial institutions. The chain of distributed ledgers are verified using Proof-of-Work algorithms to ensure double-spending doesn't occur.

Mechanics:

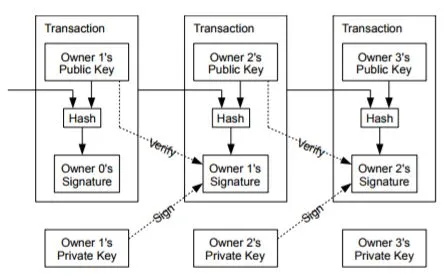

A ledger, or record of credits and debits, is stored on a block where each transaction is given a timestamp and hashtag. These ledgers are made public, while being secured from tampering using cryptographic keys. The block is authenticated over a distributed network of independent nodes, validating receipts and timestamps to prevent double-spending. The network of peer nodes uses computational power to read and validate the accuracy of each recorded transaction and add new ones as they appear, in a process called mining.

When a transaction receives a hash with certain characteristics, a new block is created. The main (root) hash from the previous verified block is recorded with the new block, creating a chain of distributed ledgers. When a new block is created, the validating node is granted ownership of the block. These blocks can be transferred using the cryptographic keys as digital signatures, giving the semblance of a currency. Any balance remaining on the ledger, after a transaction, is kept by the block owner as a transaction fee.

The peer-to-peer network of miners validates the entire chain with each transaction. In order to function as a currency, however, transfer authentication must be processed quickly. In order to accomplish this, every transaction is verified by the network, but once consensus is reached, only the root node of previous blocks must be re-read. Block transactions must also allow for multiple inputs and outputs, increasing the memory requirements. Using a root hash system, based on a Merkel Tree model, stores only necessary information, reducing the data each node must validate.

Security:

The peer-to-peer network creates new blocks in the blockchain based on transaction verification. This occurs at randomly generated intervals, making it difficult to spoof. Since each block is re-authenticated by every node in the network, a hacker would have to recreate the entire chain in order to fool the network. Otherwise, nodes will detect the change and reject the fake block. If consensus is not reached across the network, the block is not authenticated.

Conclusion:

Bitcoin is a cryptographic currency for making electronic payments over a peer-to-peer network of decentralized nodes. This network records timestamped transactions using Proof-of-Work to verify accuracy, then publicly distributes the ledger in an ongoing chain. This revolution in exchanging value will bring a new paradigm in finance and payment systems. The use-cases for a secure public ledger are just being explored, but the blockchain is already changing how we think of money.