Research is the most important part of investment, but where to start? Here are 10 areas to dig into, before getting involved with any cryptocurrency.

1. Platform/Product/Service –

A company should have something to offer customers, even just as a prototype or beta. The closer the team is to finishing development and launching their platform, the better. Technical expertise should be the first consideration in evaluating a blockchain company. Functionality and necessity are critical focal points; the product/service must offer something people need, or want, at a price consumers are willing to pay.

It's important to question whether the business should be on a blockchain. Some industries have jumped at adopting the new technology, but don't have a strong use-case for distributed ledgers or smart contracts. Still, other industries could benefit from this revolution but haven't converted.

So many new blockchain businesses were launched in 2017, the markets have been filling with companies offering like-products. A strong marketing plan will emphasize the things that make them different from their competition.

2. Sector –

Breaking into an existing market presents a business with several challenges, and the burgeoning company must account for, and overcome, pressures from established competition. To gauge the value of a new company, find how large the global sector is and estimate how far the company can reach.

Marketing methods will be different for start-ups in new sectors. Companies should promote knowledge of the technology, and avoid hyping the novelty of a product.

3. Initial Coin Offering –

How a company performs during the ICO phase is an important measure of how well they will do over the lifetime of a company. Financially, this period is where the business can raise the capital required to operate. How these funds are allocated to departments within the company, determines the focus of the leadership. More resources should be provided to research and development than marketing during this early stage.

The length of the ICO can illustrate demand for the product. Quickly reaching a hard cap, or getting fully funded by large investors, can signal high market value. If a company struggles to reach their ICO goal, or have a prolonged investment schedule, it should be scrutinized closely for weaknesses.

Having too many coins on offer, or too few, can directly affect performance when the company finishes the ICO. Coin or token distribution should be monitored immediately after an ICO ends, to watch for misallocation or pump and dump hype. A maturation date should be in place to prevent large investors from purging their shares.

4. Financial –

The operating costs and size of the company should be considered when evaluating the market capitalization. If a small business launches their product, and receives a large increase in their profitability, they should be looking to expand to prevent stagnation.

Improvements and innovations are key in developing in-demand products. Resources should be allocated to research and implementation in higher proportion than marketing and administration.

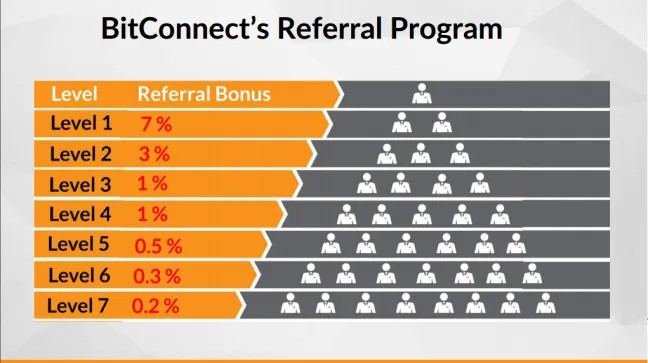

All regulatory and ethical standards must be upheld. Auditing and oversight are necessary to keep governments and investors assured of legality. Pyramid or Ponzi schemes should be denounced and ostracized at a community level.

5. Team/Advisors/Partnerships –

A dedicated group, of any size, can produce amazing things. Having a foundation of members that are passionate about the project is essential. The more experience these individuals have the better, obviously, but drive and vision can often make up the difference. Whatever a team may lack, advisors should be on board to guide the company through challenges.

The cumulative knowledge and experience of the team and advisors should be diverse across the spectrum of management. Technical expertise and business experience are a must. Legal and financial experts keep a company compliant with various laws and regulations. Marketing campaigns and social media presence will grow the community around a project.

Partnerships with major industry and blockchain players give credence to the value of the project. Partnering with legal and financial firms offer assurance to the community and regulators.

6. Community/Social Media –

Developing a community to back a product is necessary to promote growth. There are a number of platforms to support a large following, and companies should utilize as many as possible.

The size of the community following a project is a measure of the demand for the product or service. If a large number of followers actively participate in online forums, this can be a metric for future sales projections.

A company should actively participate as well. Having a representative to answer questions and allay concerns of the general public is a good way to solidify a positive reputation. Interactions with community members can also provide market testing data and influence the direction of a brand to make it more appealing.

The marketing style presented on these social media platforms is also an indicator of the values a company holds. Using honest and transparent marketing campaigns can bring high-value members into a community. Resorting to sensationalism or appealing to emotions, and making exuberant promises, are all schemes to be avoided.

7. Whitepaper –

A whitepaper is like a business plan, and should explain the function and necessity of the project. Focus should be placed on recognizing an existing problem, and outlining the ways in which the company plans to fix it. This should include technical examples and financial models, in detailed writing, as well as logical reasoning for sustainable growth predictions.

8. Roadmap –

Having a definite plan for development, implementation and expansion is vital to establish longevity. Announcing future goals is a way to update the community on the progress, and also hold the company accountable for meeting deadlines.

Events listed on the roadmap indicate order of importance and is an easy way to judge the direction of a business. The estimated time between events should be reasonable for successful launch, but not so far in the future to impede interest.

Future events should focus on adaptation and innovation. The technology behind the blockchain is advancing at a rapid pace. Companies should be preparing to implement new mediums when they become available.

9. Exchange Listings –

Having a presence on multiple exchanges allows a company to gain more exposure to wider markets of investors and speculators. Getting listed on markets in multiple regions can expand the business, and the community, to attain global reach.

Trading between fiat currencies and cryptocurrencies, will increase the reach of a company even further. Though, this may subject the business to more regulatory obstacles and legal considerations.

Some ERC20 tokens are currently only exchangeable for Ethereum, excluding those without ETH holdings.

10. Optics –

With so much competition, a company must conduct business in a professional manner. Any campaign or leadership decision that drives controversy should be avoided. Team members or representatives that use bogus marketing schemes or scandalous behavior to create attention, damage the reputation of the company. Outright scams cast negative light on the crypto community as a whole.