Would you like to get a short term loan without financial institutions involved as intermediaries? Yes, me to. Is it possible? Yes, in some countries (USA, Russia, Kazakhstan), but soon (after ICO) the number of countries will be enlarged.

SURETLY

Suretly is Russian fintech startup with offices in Moscow and New York. It got its first investments from the Russia's largest economic research institute. Team was also one of the finalists in Generation-S (Europe's largest business accelerator) and in February 2017 become a part of Starta Accelerator.

What are they doing?

New platform SURETLY have made a huge step and revolutionized the whole concept of money lending. It is based on CROWDVOUCHING, unique practice of financially securing a loan repayment. It “allows customers to make money vouching for people who need an urgent loan” which is similar to pear2pear lending. BUT, customers do not lend money to each other directly. Instead, they guarantee that borrowers will repay their loan.

Eugen Lobachev, a CEO of Suretly once noted:

“Our startup solves two problems at once: we give a financial instrument for short-term investments of small funds, and also we give the opportunity to have a short-term microloan cheaper than before to subprime borrowers.”

How it works?

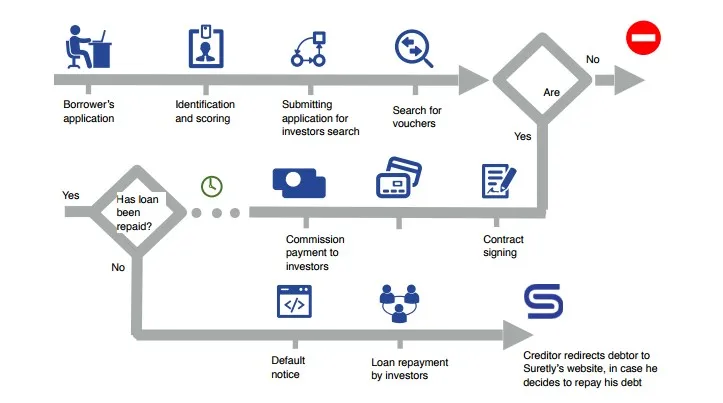

The voucher can check the borrower’s profile and choose whether to vouch for the borrower if their default risk and earning amount suit them. In whitepaper they explain that:

Vouchers act as a collective mind in order to determine whether to approve loans or not.

Liability for each loan is divided among all Vouchers. Each voucher approval serves like an insurance of $10 from the total loan amount. Vouching amount range is limited from $2 to $10, so the borrower has to find out many investors to complete their whole loan amount. Also, loan can be approved, only whet the entire loan amount is guaranteed by the vouchers.

Tinder for microloans

Suretly app looks like Tinder. In whitepaper is even said that they use Tinder’s mechanics. Investors are presented with cards of borrowers’ information (photo, city, age, and sex), the remuneration amount, and the statistical probability of the loan repayment.

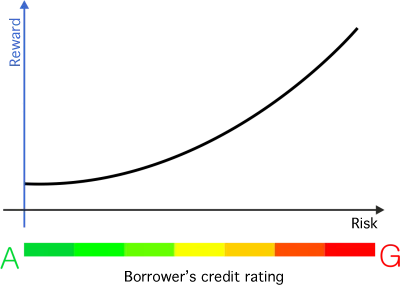

Borrowers are devided into 7 risk groups from A to G based on credit histories and/or other factors, where 'A' means low risk and 'G' means very high risk. So, investor choses if the reward/risk ratio is optimal for him. If he is comfortable with ratio, he moves cards to the right guaranteeing this borrower a small amount. If not, he moves to the left and goes on to the next borrower.

Beta-testing results

Suretly has already tested their business model in Eastern Europe. First crowd vouched loan was issued 5 months ago, and statistics show that 21% of customers earned a profit that is higher than 10% a month and also that 76% of customers earned a profit. So it looks it has a potential.

ICO

The project previously held a pre-ICO that collected over $350,000 in less than 48 hours (about 270 investors). This absolutely is indicating clear demand.

ICO is going to be launched on 11th of July and will be offering 15 percent of the total shares. The targeted raised funding lies in between $1.5 - $10 million USD in the next round. Initial rate is 1 ETH = 10 SUR or equivalent in bitcoin, litecoin or waves. The first hour’s participants will also get 70 percent bonus. No tokens will be offered after this ICO, hence, investors must keep an eye to participate in the platform.

This money will help to accelerate penetration into new countries and markets.

Limitations

Every country’s legal restrictions must be individually checked. Also, a separate legal entity should be set up for each country.

Loan is pretty risky if a person is a new borrower. Also, even if borrower belongs to A or B risk group it can borrow two or three times and repay but then get a money and never pay beck.

Follow @cryptogirl1

Sponsor my addiction to coffee and upvote

Keep in mind that 10% of earnings are going to charity.