With BTC having broken major support levels twice in the last few days, the market has changed a bit.

Let's look a little broader at what related things are happening.

BTC price drop - Implications, odds and ends

Downward pointing spikes are interesting!

Of significance is the downward pointed spike that BTC price is forming.

Made by Bit Brain with TradingView

Historically we have seen such spikes just before BTC launches into a protracted and usually steep climb.

Made by Bit Brain with TradingView

This is in keeping with what the "capitulation theorists" were saying all along (the ones I disagreed with, but who were ultimately proven to be right): BTC must first dip sharply in order to climb strongly again. Right now they're all very happy, and I think that they have good reason to be.

As fellow Timmian @heyimsnuffles says: "Bitcoin Broke...and is Entering the BUY ZONE!!!"

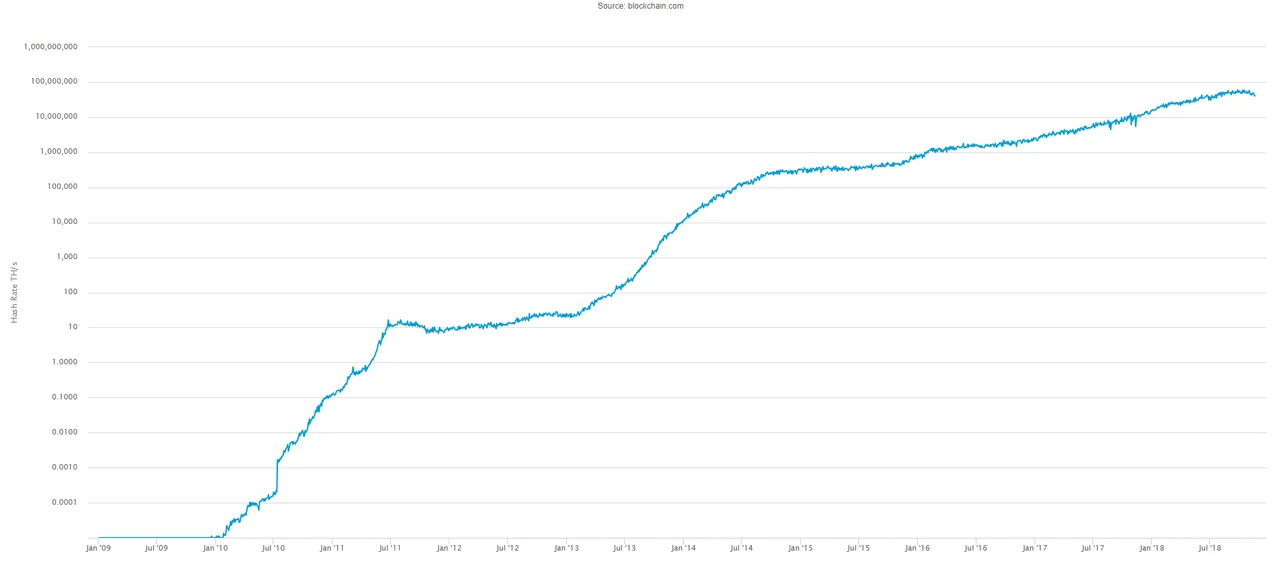

Mining is having a hard time

Increased competition combined with low prices in 2018 has taken a heavy toll on miners. In fact it's been so bad that hash rate has been dropping since late September. BTC block difficulty has actually now decreased twice out of the last three adjustments! The last time that that happened was, ironically enough, in November 2017. The third difficulty adjustment, the one which wasn't a decrease, was an increase of only 0.02%, so it doesn't even count as an increase! Despite the latest difficulty adjustment being only two days old, block time has already increased perceptibly, an indication that miners are really struggling to make money and that we could even expect further downwards difficulty adjustments if price doesn't pick up significantly soon.

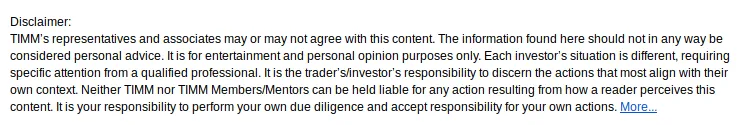

Long-term BTC hashrate. Source: https://www.blockchain.com/charts/hash-rate

Medium-term BTC hashrate. Source: https://www.blockchain.com/charts/hash-rate

I lost my own BTC cloud mine earlier this year after two months of sustained unprofitability, and that was some time ago. However, those who do stay in the mining game for the long-term will reap the rewards of having less competition. If they hodl the products of their mining instead of selling them, they stand to make great profits on them in the future, even though mining is not profitable right now.

There must be a lot of idle ASICs standing around at the moment! (That which is not caught up in the Bitcoin Cash hash wars!) At least the Mempool is so empty that BTC transactions are very cheap! If you are mining and you can keep doing so, then I recommend that you just hold whatever you make. Miners are still dropping out (as seen by the decrease in hashrate). The more they drop out, the more you score.

Altcoins

Altcoins continue to get punished at an increased rate compared to BTC. They're still acting like BTC superchargers, enhancing the effect of any BTC price movements. I think that the alts are a very good place to be once the bulls return in force. The alts have lost such a high percentage of their value since January that there are the most incredible deals available on what are essentially a form of pseudo-shares tied to the value of many well-founded tech start-up companies. I'm tempted to put more of my own BTC into the alts, but I fear that my BTC total is already as low as I should let it become.

FANG

The FANG stocks have mirrored the performance of BTC in November, albeit at a greatly reduced scale. This indicates that people are generally moving money out of the modern stocks and into more stable assets which retain value better. One would hope that BTC would be seen this way (as it has been in some countries which have been through recent crises), but alas, adoption of BTC is still too low for it to be trusted globally in that role. One day that will change...

Stock market indices are also dropping, also mirroring BTC to a degree, only much less so (and also less than the FANG stocks are). With the gold price increasing slightly, it looks as if seeking safe refuge and liquidating risks is again the order of the day for investors.

Foot Notes:

I need to take a look at my long-term BTC projections again. With only the long-term now providing support for BTC, the long-term is more important than ever. Once I have something more solid to share then I will do so.

My recommendation to all is that you should not let current events panic you. I'm holding (as usual) and I will continue to do so. Don't give in to a hasty knee-jerk reaction because you are scared right now. Unless you really need money instantly, liquidating crypto investments now would be a very poor call in my books. Hold. Prices will rise! A lot!

Yours in crypto,

Bit Brain

Bit Brain recommends:

Published on

by Bit Brain