Disclaimer: I'm not for sale. I don't take on services and I don't take on personal requests. I don't accept payments nor donations. I'm not a shill, and I will speak my mind. Opinions are my own, and I will not reply to comments. I'm here to expose the truth, what's behind the organized "crypto-mafia" tasked to disrupt what the crypto-community is building.

It's no surprise that fraudsters and scammers plague this industry. It's no surprise that shilling services are a profitable business. In this article, we're going to tap into the world of "Organized FUD".

What does "FUD" mean?

“FUD” stands for "Fear, Uncertainty and Doubt", it's a well-known disinformation strategy that plagues all industries, but specifically the crypto-industry as a whole, for its volatile nature. Taken from Wikipedia, "FUD is generally a strategy to influence perception by disseminating negative and dubious or false information and a manifestation of the appeal to fear".

There are some notorious players in the industry who operate on a larger scale and that are specifically tasked with guaranteeing that you are misinformed. I'll introduce several of them in this serious of investigations in trying to uncover the truth being "FUD", their "Modus Operandi", “Sensationalist Journalism”, their “vectors of distribution” and “active agents” that help disseminate the "FUD" throughout the industry.

The FUD Mafia – The “Shilling” Truth of Organized FUD

It goes without saying that the stablecoin “Tether” has been suffering scrutiny for over a year now. Their operations are opaque and their constant struggle with getting reliable banking is a concerning factor for the crypto-community as a whole, and until big auditing firms can step into this industry and provide a framework for auditing stablecoins, one should trade any stablecoin with extreme caution.

Not All Critics Are Paid Shills

Before we put our tinfoil hats, we’re not accusing all parties involved in this series as being paid shills. We genuinely believe that these people are either misinformed, personally invested and/or have a grudge against Tether and its sister-company, Bitfinex. Also, some of them just want attention and/or have the “hero syndrome”, while others just want to profit out of its name. But one thing applies to all – they are being played by established, seasoned investors, “just like the pied piper led rats through the streets”.

Active Agents

This whole “Tether and Bitfinex" campaign has been targeted with “surgical” precision to boost its negative sentiment. You have “active agents” like the fraudsters and FUDsters James Edwards AKA CryptoMedicated/ProofOfResearch and Spencer MacDonald AKA Bitfinexed (read Part 1 & Part 4 of our series), which are accompanied by “passive agents” and “distributing agents”, which are blind sheep that jump any current (negative) narrative about Tether that “active agents” will spew.

They invest most of their time in shilling, investigating, fabricating and overall manipulating information that builds towards a negative sentiment on Tether and Bitfinex.

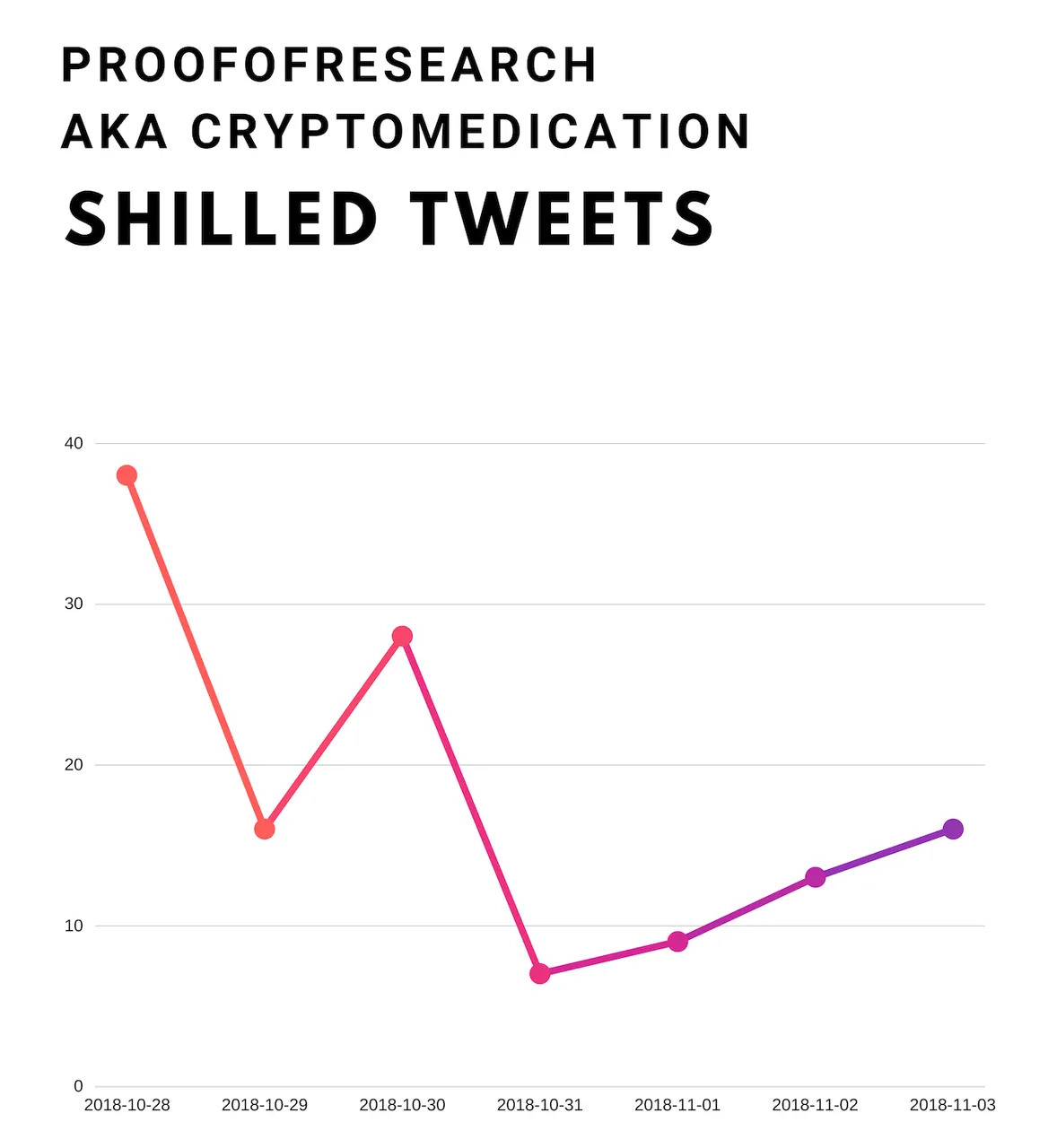

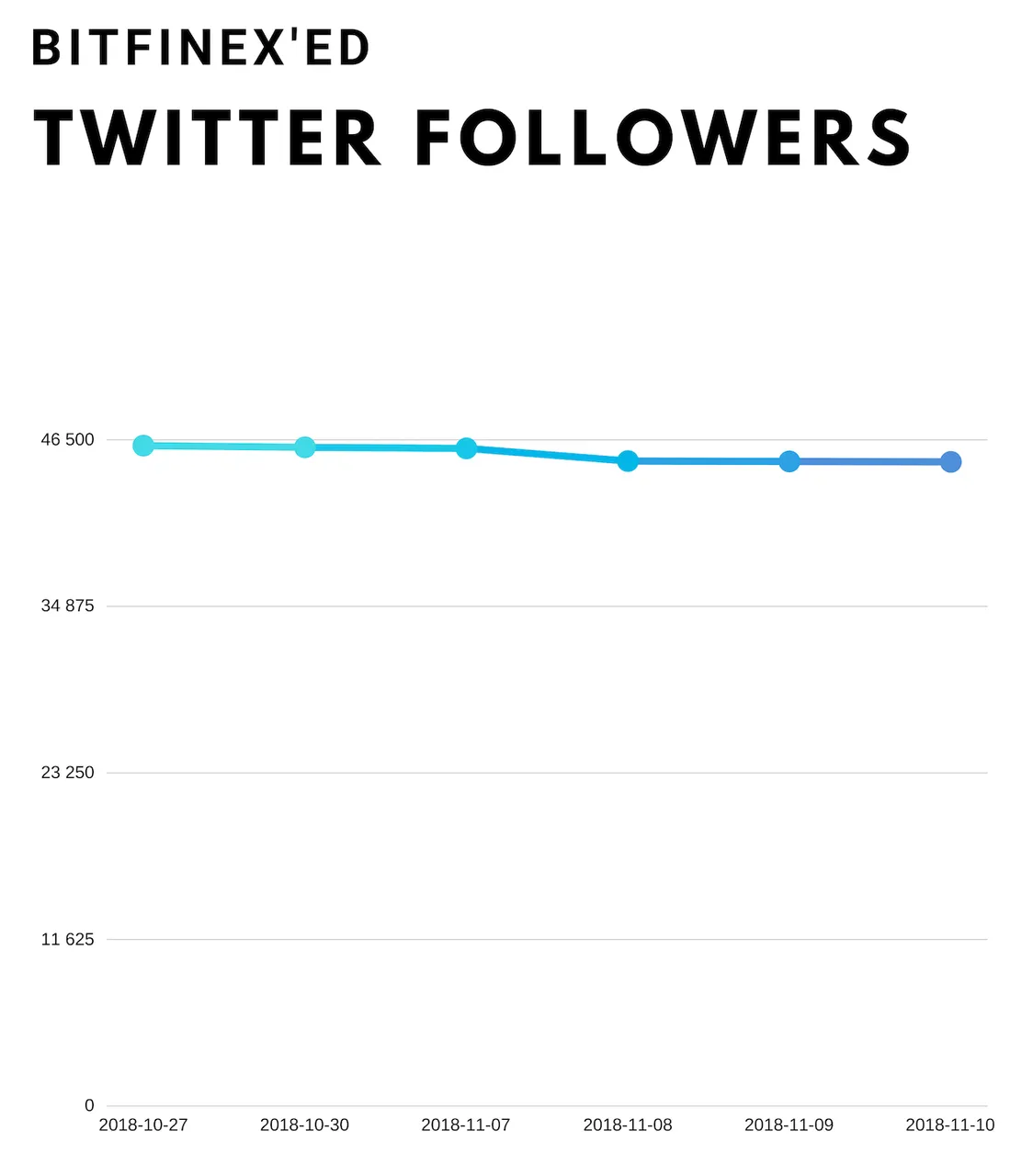

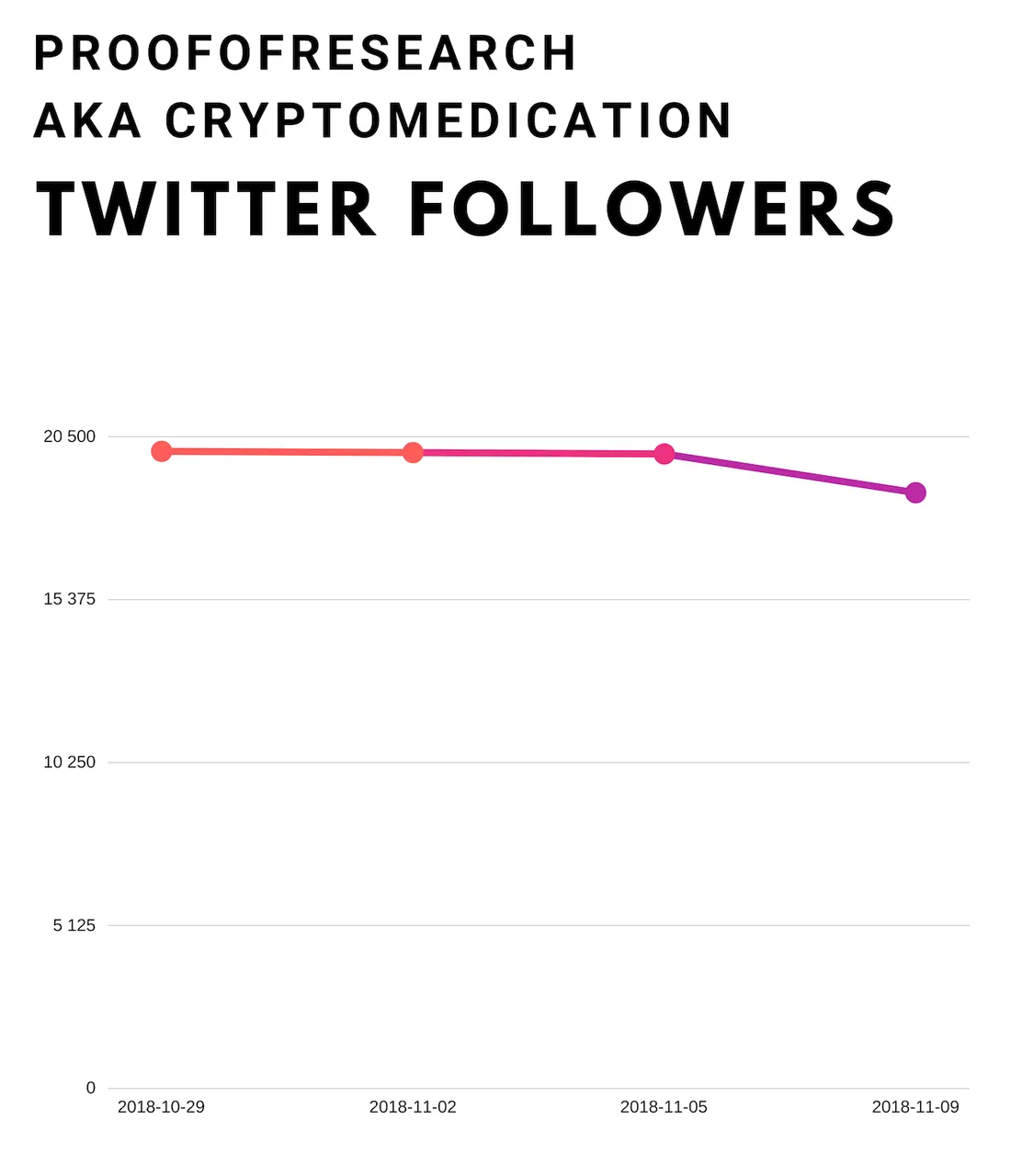

The following graphic(s) are a demonstration of how much time and effort these “active agents” spend in acting as detractors for Tether and Bitfinex.

source: https://twitter.com/Bitfinexed/with_replies

source: https://twitter.com/ProofofResearch/with_replies

source: http://mathforum.org

source: http://mathforum.org

From our estimated calculations, based on tweets that mentioned and/or made reference to Tether and/or Bitfinex, we could conclude that Spencer MacDonald AKA Bitfinexed spent 31.13 hours in a week in shilling, investigating, fabricating and overall manipulating information that builds towards a negative sentiment on Tether and Bitfinex.

As for James Edwards AKA CryptoMedicated/ProofOfResearch, our estimated calculations, based on tweets that mentioned and/or made reference to Tether and/or Bitfinex, we could conclude that he spent 10.75 hours in a week in shilling, investigating, fabricating and overall manipulating information that builds towards a negative sentiment on Tether and Bitfinex.

Altogether, both “active agents” spent 41.88 hours in a week in shilling, investigating, fabricating and overall manipulating information that builds towards a negative sentiment on Tether and Bitfinex.

If we calculate the average (salary) of a social media specialist (working remotely) from Florida and Maryland, states where they’re based, and divide it by worked hours (both “active agents”), they would be getting a total of $1.047,00 and $361,56 per week, each.

That’s how much they’re missing, if they’re not getting paid.

Yet, we do know that they have vested interests. For Spencer MacDonald AKA Bitfinexed, he made around $20,000 from collecting donations for a lawsuit that never materialized (read Part 4). He also became anti-crypto (which is ironic, since he requests donations in bitcoin, and liquidates them at the Gemini Exchange) after failing miserable in shorting bitcoin, which coincidentally is around the time he created his @Bitfinexed account on twitter (he got liquidated in late March, 2017 and created the account on the 10th of April, 2017), on which he blames Tether and Bitfinex for manipulating the price of bitcoin (which liquidated his shorts). It’s too shameful for him to admit it, so read his main account, user/Voogru, on reddit, and apply a simple chronology to the events. He masks his guilt and shame with the fake statement that he is not involved nor trades crypto because it would be a conflict of interests (yet ironically accepts donations in crypto). If he deletes his comments there, we have the backups of all his messages. Also, he has vested interests together with his lawyer, Stephen Palley, which is buddies with Jeff Bandman from the CFTC (read Part 4). They are the ones who feed lies and manipulated information as third-parties to the regulators, mainly the CFTC. That’s possibly what got Tether and Bitfinex subpoenaed back in December of 2017. Also, Spencer MacDonald AKA Bitfinexed has stated multiple times that he will write a book explaining how he “helped bring down the biggest scammers in the world”, and that’s why he wants Tether and Bitfinex to fail – he invested all his eggs into one basket (like what he did when shorting bitcoin), and for the second time, he is most likely wrong and will fail. And when that happens, he will most likely face a legal nightmare.

As for James Edwards AKA CryptoMedicated/ProofOfResearch, he jumped on the bandwagon in hopes of advertising his subpar blog, zerononcense.com, borrowing the narrative to gain some ads impressions and boost traffic. He has been paying shills to write articles about Tether and on his telegram channel people pay for every tweet you make with negative sentiment towards Tether and Bitfinex (read Part 3). He has vested interests in using the Tether narrative for his own profit.

Active Agents Are Losing Engagement

Even after dedicating a tremendous amount of time in shilling against Tether and Bitfinex with fabricated lies and FUD, their social media engagement is rapidly declining, as seen in the following graphics.

source: https://socialblade.com/twitter/user/bitfinexed

source: https://socialblade.com/twitter/user/proofofresearch

As seen in both graphics, there’s a rapid decline in followers, which means that possibly their content is not appealing enough to new users. And according to data, it isn’t appealing enough to retain existing followers.

source: https://twitter.com/Bitfinexed/with_replies

source: https://twitter.com/ProofofResearch

They have blamed low engagement, and the ability to retain followers and gain new ones, in the fact that they’re (supposedly) being targeted with mass-reporting bots, which would affect their overall tweet placement. Yet, according to https://shadowban.eu/, their accounts are good enough to passed on all shadow-ban checks, which we can only conclude that their engagement is declining due to poor content, obvious shilling, uninteresting narrative and the same old stories being twisted and fed into their audience. At some point, their audience is going to desert them, and only their hardcore circle-jerk AKA blind sheep (“passive agents”, “distributing agents”) will remain and engage with them, which help as detractors.

Active Agents Most Common Weapon: The Association Fallacy

The association fallacy, which is also known as guilt by association, is a logical fallacy that occurs when a person or a belief is supported or attacked because of its relation to some other person/belief. It is, to an extent, a version of a non sequitur.

This fallacy can be done in either a positive or negative (derogatory) way. In both cases, it is equally fallacious. This is best demonstrated by the following examples:

“The process of burning coal to generate electricity contributes to global warming. Bitmain mines their cryptocurrencies using electricity generated from power plants using coal burning. Tether is used to buy cryptocurrencies. Therefore, Tether is to blame for global warming.”

Matter of fact, this can actually by compared to the narrative that “active agents” were spreading recently:

“The baking sector has been used to launder money. Deltec Bank & Trust Limited was used by a criminal company that laundered money. Tether is a client of Deltec Bank & Trust Limited. Therefore, Tether is a criminal company that launders money.”

This is a fallacy, an ad hominem attack by “active agents”, and one that they constantly repeat. It’s guilt by association, which pairs Tether and Bitfinex with any negative event which is remotely connected to them, as the de-facto point of comparison. This technique has been used in politics, finance, etc., and is constantly being used against Tether and Bitfinex in the crypto-sphere. It’s an amazing technique used by “crypto-journalists” as a revenue generator for crypto-media outlets like TheBlock, Bloomberg, CoinDesk, BitcoinExchangeGuide, and others.

Sensationalist Journalism

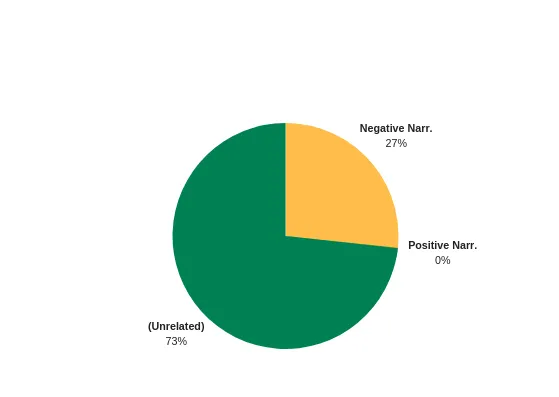

Crypto-news outlets and its “crypto-journalists” know that feeding negative sentiment through writing and manipulating narratives about Tether and Bitfinex will generate a massive amount of revenue to their platforms, that’s why they perpetuate that negative sentiment towards Tether and Bitfinex. But among many, there are (4) “crypto-journalists” that have exploited the name of Tether and Bitfinex to maximize their profits. We’ve analyzed between 8 and 15 random articles from the following (4) “crypto-journalists”, and rated them as “Negative Narrative”, “Positive Narrative” and “Unrelated”.

David Floyd (CoinDesk)

source: https://www.coindesk.com/author/dfloyd/

Matthew Leising (Bloomberg)

source: https://www.bloomberg.com/authors/AGfq0QVqo0I/matthew-leising

Bitcoin Exchange Guide News Team (BitcoinExchangeGuide)

source: https://bitcoinexchangeguide.com/

source: https://www.theblockcrypto.com/author/larry_tb/

Out of (53) random articles written by these “crypto-journalists”, about (22) were fomenting negative sentiment towards Tether and/or Bitfinex, which means that over (40%) of all content is about harboring negative sentiment towards Tether and/or Bitfinex.

Again, using the name of Tether and Bitfinex has proven to be a profitable venture, regardless if you’re an “active agent” exploiting its name to collect donations from fraudulent causes; a scammer trying to rebuild his reputation by jumping on the Tether bandwagon so he can funnel traffic to his blog; or a “crypto-journalist” spreading sensationalism for impressions (AKA ads revenue).

This all amounts to spreading FUD – because FUD is a profitable venture.

You should always investigate your sources thoughtfully, and take your conclusions from your own investigations.

(We will Continue Our Work in Part 6)

Think!