Currently, the hot subject in every financial securities regulatories around the world is how to approach the Regulation of ICO’s. Recent SEC’s comments about the cryptos and ICO’s have made it clear the regulatory agencies believe in the long term benefits of cryptocurrencies and legitimize the cryptocurrencies. Although this is a big relief for the community but it also poses a big question for regulators.

Today Swiss securities regulator FINMA issued the guidelines on ICO’s and how will they approach to regulate the Initial Coin Offerings(ICO’s).

Principles to be applied whether a particular ICO comes under FINMA Regulations

“Circumstances or case basis” trumps the rationale to figure out whether a particular ICO comes under the purview of FINMA or not. The economic purpose and circumstances under which the coin has been issued.

Categories of Tokens

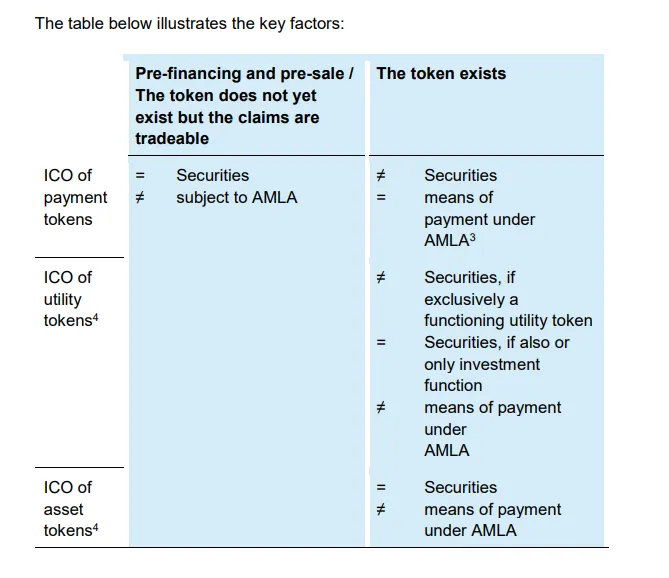

Further, the guidelines categorizes the ICO’s on the basis of economic purpose of the ICO’s:

Payment Tokens: Payment tokens are tokens which are intended to be used, now or in future, as means of payments for acquiring goods or services as a means or transfer of value. These are popularly knows as Cryptocurrencies. Examples are Bitcoin, Ripple or Ethereum.

Payment tokens since are simply means of payment or the primary use of the Payment token is simply for transaction purposes. Payment tokens fails the tests to be considered under the definition of “Securities”, therefore payment tokens will be kept out of the ambit of securities regulator.

Utility Tokens: Utility tokens are intended to provide an holder of the token an access to the digital service or application by way of blockchain infrastructure.

The classification of utility tokens as securities depends on the utility the tokens are providing. If the utility of the token is merely to provide access to particular digital platform or asset, it will not be considered as securities.

Asset Tokens: Asset Tokens represents assets such as debt or equity claim on the issuer. Asset tokens for example promises a share in the future earnings of the company or future capital flows. Tokens which enable physical assets to be traded on the blockchain also falls into the category.

Asset tokens passes the test of being a security and will be treated as such.

Hybrid Tokens: Any tokens which contains the combination of above and are not mutually exclusive can be categorized as Hybrid Tokens. From regulation perspective, it will be considered as both as a security as well as mode of payment.

All the laws and provisions will be applicable for the ICO’s as one which applies to typical IPO’s and all the provisions and laws will be complied upon to issue an ICO.

The above guidelines give the typical overall global regulation framework for ICO’s which can guide other countries to take cues. The regulators accepts the affect or impact blockchain or cryptoassets will make in the future.