Investing in cryptocurrency can be both exciting and risky. One promising idea is to focus on decentralized finance (DeFi) projects that offer yield farming opportunities. Yield farming allows investors to earn interest on their crypto holdings by lending them to others or providing liquidity to decentralized exchanges.

Start by researching established DeFi platforms like Aave or Compound, which allow you to lend your assets for interest. Look for newer projects with strong fundamentals and active communities, as they may offer higher yields but come with increased risk.

Diversifying your investments across multiple DeFi protocols can help mitigate risk while maximizing potential returns. Additionally, consider staking popular coins like Ethereum or Cardano, which can offer steady rewards.

Always conduct thorough research and stay informed about market trends, as the crypto landscape can change rapidly. Remember to invest only what you can afford to lose, as volatility is a significant factor in crypto markets.

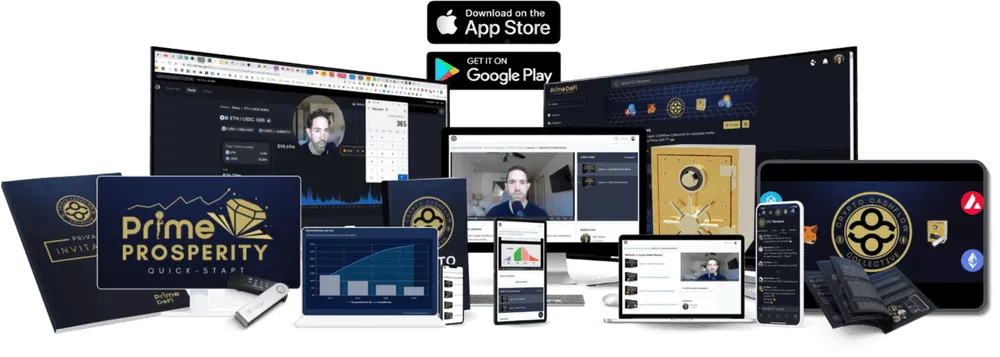

Click more information

https://secure.primedefi.com/checkout-openenrollment-select-plan-ds24#aff=Heryjons