How are you enjoying bitcoin right now? Loving the trip to the moon? I’m sure you are. I want to discuss cryptocurrency with you. I want to tell you how bitcoin has changed trust forever. I want to be that irritating, annoying, little prick that goes: “fiat money is crap, bruh”. Like any proper villain would say, with a twisted smile on his face and a lust for power in eyes: “I have waited a long time for this moment, my little green friend”.

For now boys and girls, let’s get schwifty in here!

“I know what bitcoin is but I really don’t know what it is”

--This article only represents my opinion. Don’t dive into cryptocurrency trading or long term investing without fully understanding how coins work, their purpose and technology. White papers are a great source of information. Speaking of sources, you can find them at the end. As always, comments are welcomed and encouraged. May the force serve you well--

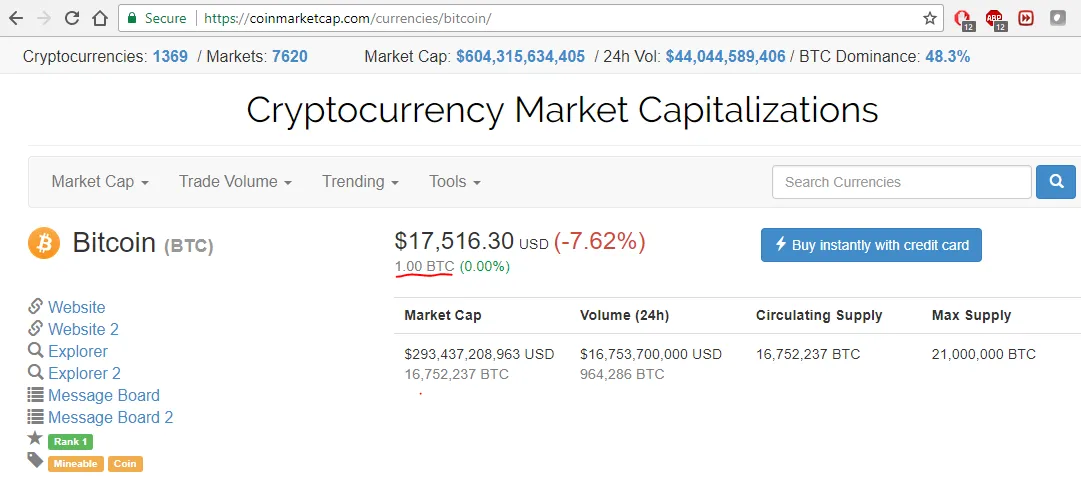

Bitcoin is many things. It’s money, a protocol, a simple message. But most of all, bitcoin is a language, like any other currency. Bitcoin lets you express value for something. Right now that something seems to be other currencies but, like the guy who paid 10.000 bitcoins for a couple of pizzas in 2010, you too can use it not only to hold and store value, but to trade and buy… things. Bitcoin is not static in terms of dollars, or euros, as dollars are not static in terms of euros. That’s just an exchange rate. How much of a certain currency buys of another. How many bitcoins do I need to buy 1 usd? Right now is about 0.0000540 btc.

“Yeah yeah, but how do you value bitcoin? It’s based on what? Answer that!”

In order to set the value of some coin what do you do? You measure the overall supply and the price of each coin. How many usd are there? What is the price of 1 dollar in USD?

“The price of 1 dollar? It’s 1 dollar, what an idiot”

Right. Why is 1 bitcoin USD18.000 or USD20.0000 and not 1 bitcoin? Why is the price of bitcoin set on dollars or euros or pounds? Why the fuck would you do that? Well, because as it happens with any language, what do you do when you start learning? You translate it into a more familiar language, one that you feel more comfortable with.

“Oh. Ok. That actually makes sense”

Yes, that’s right, it makes sense. How long do you think it takes for people to adjust and start expressing value in bitcoin? We can use Portugal’s example. When we joined the Euro in 2001, it took a couple of years (maybe two or three? Let me know in the comments) for people to adjust to the new currency. Prices doubled and salaries remained the same too. Hilarious. Anyway the point is that whenever a new currency is introduced, it takes time for people to adjust.

“Is that why people don’t trust bitcoin?”

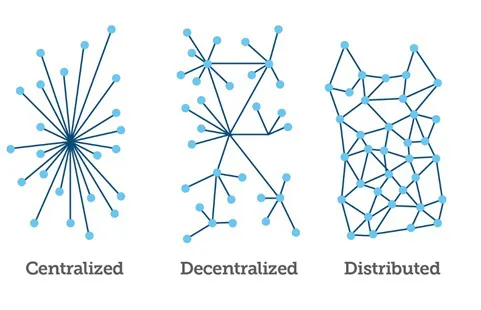

Yes, that’s definitely a heavy reason. The second is usually because no one owns bitcoin. There isn’t someone or a group of people responsible for bitcoin. Well, there is but Satoshi is anonymous. Can you think of anything that either doesn’t belong to you, a third party or the government? Ownership is pretty much essential for people to have trust. Or is it? What happens with bitcoin is that people, who use the network, keep it alive by paying fees. And those fees go into other people maintaining the network. What this means is that people around the world, mainly in China, offer they computer power to validate transactions and to store the blockchain, which is the distributed ledger where bitcoin operates that holds all the transactions ever created.

And there are thousands of miners around the world. No one really owns the network. It belongs to all those who actually have it. And you can have it too by downloading the blockchain. Just keep in mind you’ll need some space. So it works something like this:

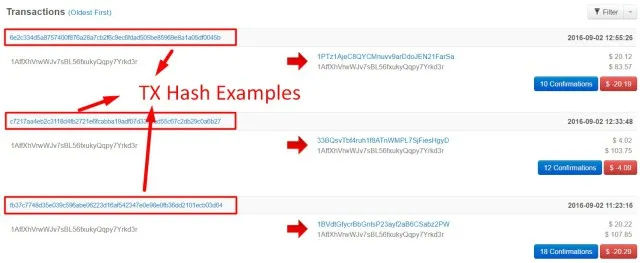

A) Ani wants to send Luke 1 bitcoin

B) Ani creates a transaction and encrypts it with his private key

C) Now for Luke to receive the transaction, it needs to be approved first and decrypted

D) Miners simply try to figure out a mathematical problem to approve the transaction by decrypting the message from Ani to Luke

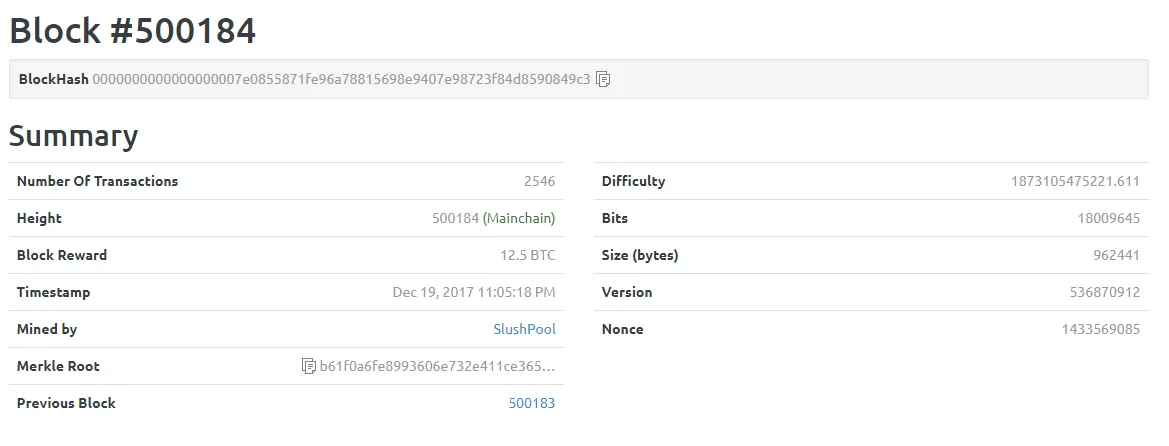

E) They compete to solve a hash* and get a reward for spending computer power and energy

F) The reward is the cryptocurrency they are mining, which in this case would be 12.5 bitcoins

G) The reward is cut in half every 4 years as less coins are available

*hash: is an encrypted message that is part of the blockchain hashing algorithm, which writes transactions into the blockchain.

In bitcoin mining, miners try to solve a hash of multiple transactions via proof of work. Now, proof of work (or PoW) is nothing more than the process of validating a block. In order for PoW to work, the cryptographic algorithm needs to be strong enough that it makes probabilistically impossible for the same miner to validate multiple blocks in a row. Otherwise you could have a trust problem I discuss below. That is also why the block creation time is set for 10 minutes; as it literally takes 10 minutes on average for miners to approve a block; and each block contains hundreds of transactions.

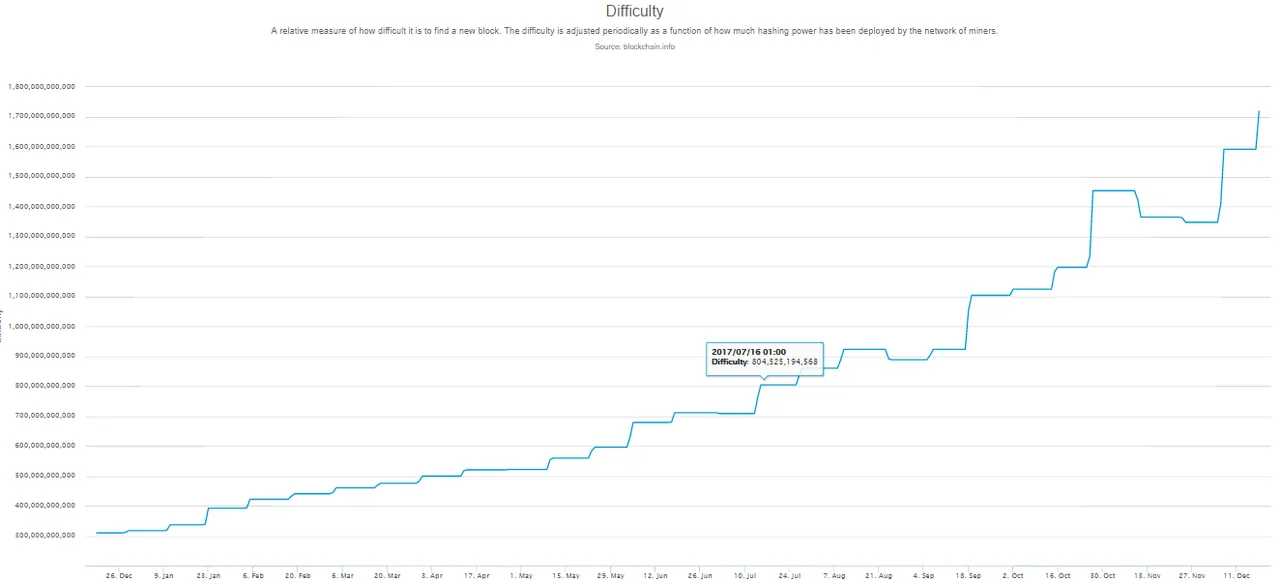

“What happens if many miners join? Or simply go away?”

That’s a good point. The cryptographic algorithm that dictates the rules of the blockchain (and mining), also take that into account. Basically the algorithm adjusts every 2 weeks, which means that:

If there are many miners mining, the algorithm will increase its difficulty, so it will take a longer time to mine each block

If there are fewer miners, the algorithm will make it easier to mine by adjusting the difficulty level of the hash to something simpler (so your chances of getting a reward per transaction validated increase)

Let me ask you guys a question: do you think is it possible to predict what will happen and move accordingly into different coins? As in mining different coins?

Most of you would say yes. I can also say yes. But there is another, bigger, problem. See, although you can in fact predict how many miners are coming and going (you don’t need fancy regressions or anything, just look at the blockchain graphs available), the real challenge is doing the below math:

a) If the adjustment algorithm increases I should maybe go to a coin where the chances of validating a block are higher.

b) But I need to make sure (1) I can mine the new coin with my hardware and (b) the price of the coin is worth my energy and time spent

c) If the adjustment algorithm decreases then you should stay in the same coin. Especially considering this would be bitcoin, so you could expect higher profits due to bitcoin mooning.

There are many websites that already tell you how profitable mining is for a certain coin. The numbers average energy spent and energy consumption. If your country has cheap energy (or you know a way of stealing the neighbour’s) then mining can be a good option to make some extra cash. And you would be helping the network too!

This makes the network extra safe, in the same way that if you have all your data stored in your laptop and, by the cruelty of the gods, you manage to spill hot broccoli soup all over it and it breaks, you’ll most likely lose all data. So obviously you do backups. To the cloud, a hard drive an usb drive, whatever you choose. The good think about bitcoin? Because the blockchain is stored in the miners machines and people who download the blockchain (thousands already), I can guarantee it’s incredibility safer than any central entity.

Oh and if you’re worried about multiple points of entry, let me ease your spirit: no one can make changes to the blockchain. If someone gets your details, they can steal your money. They cannot make changes to anything you’ve done before. So yeah, there is a danger of information being misappropriated. But that’s the same problem as credit card or identity theft. Not a very common problem nowadays, right? Lolol.

“Is that why bitcoin is distributed? But is that safe? Can THEY hack bitcoin?”

Asking if bitcoin can be hacked is like.. like asking if you can hack a protocol. You’re basically asking if you can hack a bunch of rules, much as the internet protocol IPv6.

The short answer: “nope, dude/dudette!”

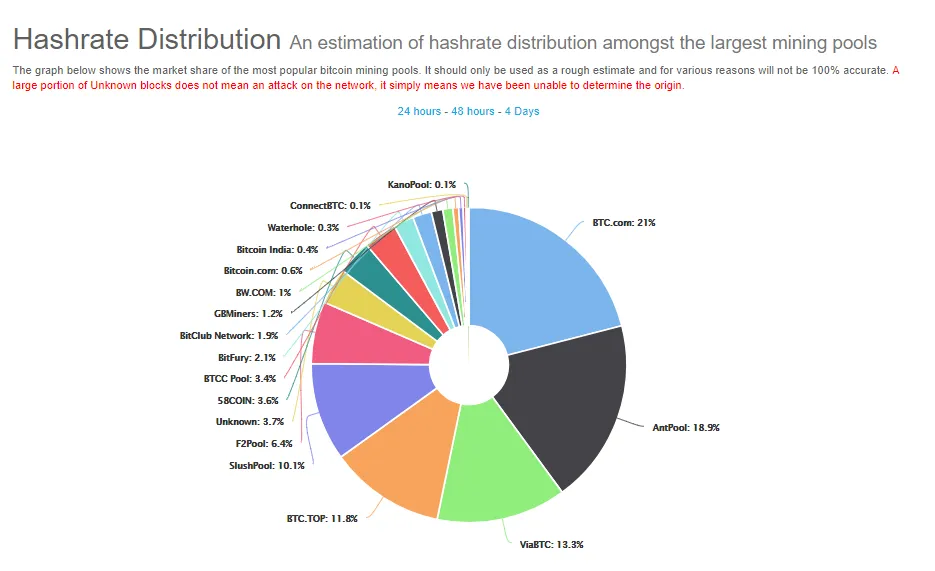

In bitcoin’s case because the protocol (the blockchain) is immutable, hence anything that gets posted into the blockchain can never be changed. There is, although, a way to control the network. For that you would need to have at least 51% of the hashing power, in order to validate transactions “at will”. So you could, for example, change the amount of bitcoin being received or sent, in a certain transaction. Again, you would need to have the power of 51% of all the people using the network, which is (probabilistically) impossible.

In terms of safety you’re pretty much working with the safest technology there is. But, there is a catch. The catch is distribution. Don’t get me wrong, the concept of distribution is brutal. I agree 100%, as you can read on my previous articles. What currently is happening is what’s worrying me a bit: the number of mining corporations and their mining power.

Exactly, it’s insanely concentrated in three groups. This means that true decentralization isn’t happening. Is there a chance the network is overtaken by these groups? That’s quite unlikely as the decision of the transaction to be changed and at what block would have to be approved by everyone. And that, again, seems to be (probabilistically) impossible.

“How can you stop that then? How can I trust bitcoin?”

Let’s discuss how bitcoin works and you’ll see for yourself how unlikely these events are to happen. In my view there are 3 key features that make bitcoin quite unbeatable:

Security

Distributed governance

Value storage

Bitcoin is money, and it holds value. It’s unbreakable and doesn’t need a central institution or third party to receive and send transactions between people. Actually, people accept it and you can use it to store value, like your salary or your investments. Maybe your house? Yes, you can already store deeds with the power of smart-contracts. We’ll get there don’t worry. Bitcoin makes a mobile application your money.

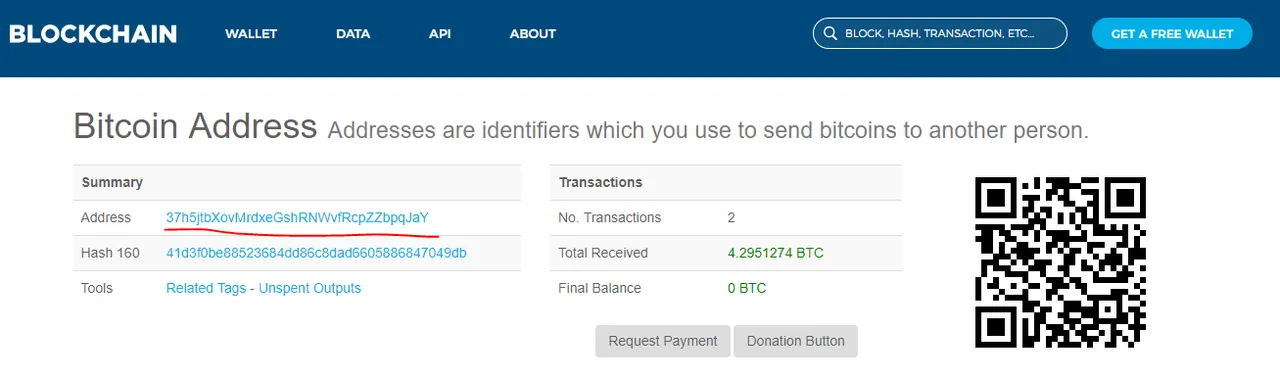

Do you understand how serious this is? Download the blockchain wallet to send, receive, store and buy bitcoin. No banks. No identity. You are simply a random 65 bytes hex number, something like: 0x83FEAda3c0b7630AE11F216DB2342AaCDdb0B857

Although it seems obvious the numerous advantages of distributed currency, people seem afraid to dive into it. Let’s see, more in-depth, some of these so-called advantages:

a) Cheaper fees when sending money (who wants that!)

b) Send money faster (1 hour + -, terrible idea)

c) You just need internet access on your phone (relying on the internet? Are you crazy!)

d) You can store value. Any type of value. (until a bad man comes into your house and gets it all! Never, banks are very safe and transparent)

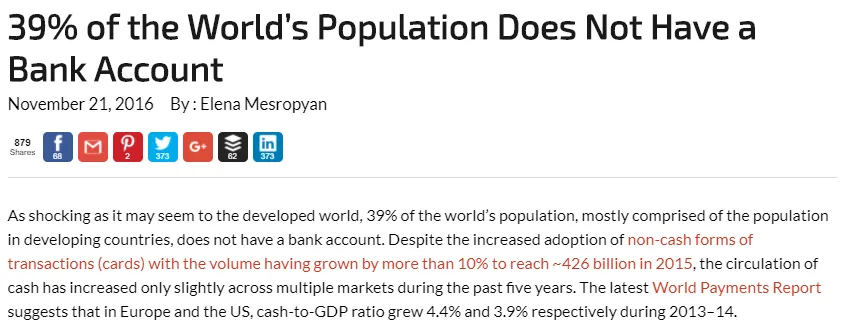

You become 0 dependent on any financial institution to manage your money and your accounts for yourself. Does it make sense you cannot choose what money to accept or not? Why would you be forced to use currency attached to a country? Or an economy? Bitcoin does not necessarily mean people must use it. But it offers another option for people who do not have access to bank accounts (just look below) to store value. Currently this number still represents around 2 billion people in the poorest parts of the world.

If you don’t really understand how it’s different from a bank, just imagine how the number of people who don’t have access to a bank account can store value. Imagine if you didn’t have access to a bank account. I know, you take it for granted. But what if you didn’t? How would you receive your salary? How would you make purchases? What about when you travelled? Just imagine, if these minor and insignificant problems could affect your life immediately, can you think how impossibly hard it is for people who are not even able to have a digital identifier of their money and assets?

Most of us are quite hypocrite. Myself included of course. It took me months to truly understand that it doesn’t matter the price of bitcoin or any cryptocurrency. It doesn’t matter if you and I like it or agree with it. We’re making money out of it. Some people, on the other hand, might need this to start a life, as if they do not have access to banks and to transfer value to other people. I mean, can’t you see the apocalyptic change cryptocurrency will cause?

We can all agree bitcoin is a solution that does not necessarily mean traditional fiat-currency needs to cease to exist. Both can coexist. Keeping in mind bitcoin cannot be prohibited, as it cannot be blocked.

--much like your government or service provider trying to block a website, like those disgusting, terrible, absolutely shameful porn sites I have never ever watched (wink wink).What would you do? Stop watching porn, or use any VPN to access it?--

At the end of the day, if you learn how the cryptographic algorithm works, you can write down a transaction signature that sends money to someone on a piece of paper. If that person goes into the blockchain and writes down the correct transaction hash with the correct signature you provided, it will actually work, and the funds will be transferred.

In terms of value, you can store not only money, but other things. You can set remittances payments, you can set workflows to check information on certain products and where they come from (wabi), you can create smart-contracts (eos, ethereum, neo) to store deeds, like your house (propy), you can create autonomous organizations where members vote on different topics and decisions (wings DAO) or where members just create news and other people validates the truthfulness of statements (clearpoll) or you can use it as a means of payment, even privately (monero, ripple). Some cryptocurrencies already have means to fund different projects related to distributed ledger technology and are celebrating partnerships with institutions like IBM (stellar), others are looking into quantum cryptography security (quantum resistant ledger) or simply creating machine-to-machine payment mechanisms via different types of distributed ledgers, like the Directed Acrylic Graphic, or DAG, used in the tangle (iota)

Can you see how many different purposes exist?

I would like to conclude with the following thought: if 39% of people who do not have access to bank accounts today, can now store value with cryptocurrency, saying bitcoin is a bubble is failing to understand its purpose. Bitcoin clearly isn’t a bubble, either you like or not (sorry Jamie). We are the bubble. We have been living in it since our birth, you pricks!

Basic ref

(guy who bought two pizzas for 10.000 bitcoin) http://uk.businessinsider.com/bitcoin-pizza-10000-100-million-2017-11

(value of bitcoin) https://coinmarketcap.com/

(adjustment explained) https://bitcoin.stackexchange.com/questions/855/what-keeps-the-average-block-time-at-10-minutes

(adjustment clock) http://bitcoinclock.com/

(how mining works) https://www.coindesk.com/bitcoin-hash-functions-explained/

(bitcoin nonce) https://en.bitcoin.it/wiki/Nonce

(block hashing algorithm) https://en.bitcoin.it/wiki/Block_hashing_algorithm

(DAG – Directed Acrylic Graphic) https://en.wikipedia.org/wiki/Directed_acyclic_graph

(Miner pools locations) https://blockchain.info/en/pools

(blockexplorer) https://blockexplorer.com/

(blockchain mining difficulty) https://blockchain.info/charts/difficulty

(global findex) http://www.worldbank.org/en/programs/globalfindex

(nr of people without a bank account) https://letstalkpayments.com/39-of-the-worlds-population-does-not-have-a-bank-account/

(Crypto Daily) https://www.youtube.com/channel/UC67AEEecqFEc92nVvcqKdhA

(Andreas Antonopoulos) https://youtube.com/user/aantonop

(DataDash) https://youtube.com/channel/UCCatR7nWbYrkVXdxXb4cGXw

(Ivan on tech) https://youtube.com/channel/UCrYmtJBtLdtm2ov84ulV-yg

(Decypher Media) https://youtube.com/channel/UCrYmtJBtLdtm2ov84ulV-yg https://youtube.com/channel/UC8CB0ZkvogP7tnCTDR-zV7g

(Boxmining) https://youtube.com/channel/UCxODjeUwZHk3p-7TU-IsD

(ICO Reviews, crypto info) https://hacked.com/

(Crypto info) https://cryptocoinsnews.com/

(ICO Reviews, crypto info) https://crushcrypto.com/

(ICO Reviews) https://icorating.com/

(Crypto info, graphs) https://coindesk.com/