What are the bases to launch and / or invest in an ICO? Everything you need to know is in this article.

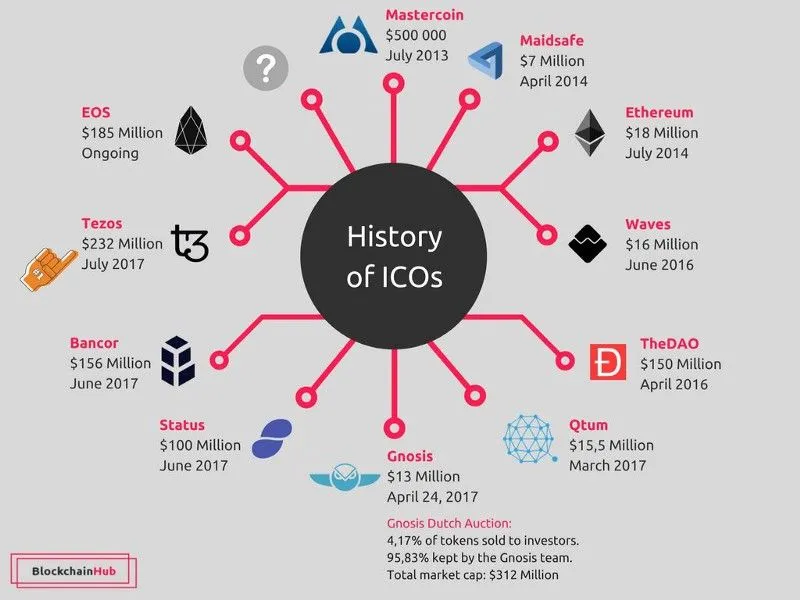

Source: BlockchainHub

How does an ICO work?

ICOs are usually carried out in the early stages of the project. Initially, ICOs were introduced with the idea of pre-selling coins / tokens to investors and financing new projects.

A whitepaper is presented by the company describing the technical specifications and the business model of the project. A timeline is established and a distribution of currencies and a target budget is decided. In the crowdfunding stage, new tokens are purchased with established cryptocurrencies such as Ethereum and Bitcoin

Bases to launch your ICO

Adequate infrastructure for the project

Roadmap and technical document

Check the regulations and ensure there are no safety violations.

Management and maintenance of the account

Marketing and public relations

We have summarized the main steps that will give you an idea about "How to start a successful ICO"

Step 1: Create a new cryptocurrency in a protocol such as Openledger, Ethereum or Counterparty.

Step 2: The team assigns an arbitrary value based on the value of the network at this time.

Step 3: Determination of price dynamics based on market demand and supply.

The token division is made on the basis of a person's individual investment, that is, more tokens are allocated to the person who has invested the most. It generates more awareness about the new cryptocurrency to encourage participation and reached a point the real price exceeds the price of the ICO (If the ICO is successful)

Mechanisms for ICO pricing

Price not determined: In such ICO's, initially the developer can not sell his chips allowing investors to take the new tokens proportionally based on their investment. Such ICO allow 100% ownership of the new tokens by a single investor.

Fixed Price: The developer set a price or exchange rate for the new token. This provision allows the purchase of multiple tokens at a fixed price. Fixed-price ICOs are usually accompanied by a freeze period, which is a period in which their tokens can not be traded. After the freeze period, investors can list and exchange their tokens.

Dutch auction: In such ICO the symbolic sale begins with the highest price and the symbolic price decreases proportionally until the end of the symbolic sale.

ICO with rising prices: a fixed exchange rate is set by the team and the first investors get the best price per coin quotient as the rate increases steadily over time.

How similar are the ICOs with IPOs and crowdfunding?

Like an IPO, in an ICO, tokens are offered to raise funds within a predefined timeframe. The tokens when purchased can be exchanged in publicly accessible exchanges.

ICO are also similar to crowdfunding and in fact in the initial stages it is known as "crowdsales".

10 Things to keep in mind before choosing an ICO in which to invest

1.Codebase Codebase helps make the process more transparent and allows investors to analyze achievements, issues and the current status of the project.

2.Whitepaper

The technical document must provide all necessary information explicitly and clearly so that potential investors can make an informed decision.

- Experience of the development team

This determines the viability and fruition of the project. The team must be technically sound and must have the necessary skills to develop the project. The team must be really involved in each stage to ensure that the milestones decided are achieved within the agreed period. - Projected value of the token

Investors should check if the token they are about to acquire would give them a return on their investment eventually and it would really be useful. They should astutely check the distribution strategy to evaluate long-term incentives.

5.Beta Preview

A beta preview is a test of an early version of the product and is a great guarantee. - Projected launch date

A clear roadmap and launch date are vital elements. Establish responsibility and calibrate commitment. - Freeze or blockage

period Is there a period of freezing or blockage? Will you have access to the new chips or coins within 3-4 months of the ICO? These questions should serve to make your investment strategy - Capitalization in currencies / tokens?

Adequate information must be given about the number of coins to be created. Some teams choose to create more coins if necessary. It is advisable to have a limit so that the offer is fixed and the demand can be regulated. - Financial application of the Fund

Potential investors should check and evaluate the allocation of tokens - Do not ignore red flags

If there are many red flags and unresolved concerns then the investor should probably reconsider risks and decide accordingly