Everything you wanted to know about Blockchain, Tokens and their major use-cases

A few days back, Brave browser raised $35mn in less than 30 seconds through an ICO (Initial Coin Offering) to build the advertising platform of the future that would trade attention using Blockchain. This one news is deeper than what it seem to be from the surface.

Initial Coin Offering — what is that?

Advertising platform of the future — what’s wrong with the current ones?

Trade attention using Blockchain — what exactly again?!

With this post, I hope to break the answers to the above questions down to a level so that anyone with basic understanding of Internet can comprehend them. I run a newsletter called, Unmade, where I talk about the ideas of the future. To curate it, I’ve to read, research and question a lot of things. And this blog post is the nectar of my research on Blockchain, Tokens and the Attention.

What is a Blockchain?

When I first came across this term, I guessed it to be some “chain of blocks.” I wasn’t too far. It indeed is a chain of blocks. The only thing to understand now is, what is a block.

A block is a group of transactions that are held in chronological order and publically.

Thanks to Richard Bradley of Deloitte, we’ve got a plain English explanation of Blockchain that even the non-geeks can comprehend. It goes like this —

You (a “node”) have a file of transactions on your computer (a “ledger”). Two government accountants (let’s call them “miners”) have the same file on theirs (so it’s “distributed”). As you make a transaction, your computer sends an e-mail to each accountant to inform them.

Each accountant rushes to be the first to check whether you can afford it (and be paid their salary “Bitcoins”). The first to check and validate hits “REPLY ALL”, attaching their logic for verifying the transaction (“Proof of Work”). If the other accountant agrees, everyone updates their file…

This concept is enabled by “Blockchain” technology.

Of course, the real implementation is more complicated than this, but we don’t have to dive any deeper than this to understand why do we need Blockchain in the first place. Blockchain allows us to trust strangers without the requirement of a middle-man whom we trust already.

For instance, when you are paid by a stranger for your services, the bank helps you to establish the trust between you two. You don’t trust the stranger, but when your bank says, “Your account is credited with $10” you trust the bank that when you’ll go to a bank to withdraw $10, you won’t be denied your money.

For centuries, middlemen have allowed us to trust strangers. Blockchain removes these middlemen from the equation.

When blockchain was introduced first, it was presented as a protocol for a new currency infamously known as, Bitcoin. It took nearly four years for Bitcoin to gain popularity among the commons. And then it took another four years to get the financial infrastructure for a protocol like Blockchain to work. It’s only a matter of time that more applications get built on top of the blockchain protocol.

Some people believe it to be a new internet and then, some individuals think of blockchain more like Linux. Predictive analogies are always flawed and only time will reveal what use cases humans can think of on top of Blockchains. Irrespective of what it turns out to be, new kind of applications is coming. The ones that are not centrally controlled by an individual or a single organization. Ones that will never suffer a downtime. Ones that has potential to question the fundamental assumptions of our economies.

Whenever we are handed a ten-dollar bill, we appreciate its value. However, its worth is only assumed through the stories that we tell each other — in our imaginations. If we all start believing in another currency — that is distributed, decentralized and always available — the dollar has no hope of survival. If you and I are happy transacting using a new currency, no law can make it mandatory to use a currency that is regulated by them. Note that, laws are also the figment of our imagination.

“There are no gods in the universe, no nations, no money and no human rights — except in the common imagination of human beings.” — Yuval Noah Harari

Just like with the internet, we saw the rise of email, a new medium of communication that was fast, reliable and effortless. The email was one of the many use-cases — popular, however — that made the internet popular. In 2017, Blockchain has found it own use-case that will give it wings. And it’s called Tokens.

What are Tokens?

Tokens are the cryptocurrencies that are meant to be used within a network or an ecosystem. Imagine a website similar to Amazon, but instead of transacting in dollars, it transacts only in a new currency called, AZN. If the network that supports AZN has enough demand, then the token AZN becomes valuable.

If it becomes valuable to hold AZN, the public will do so. If enough public holds AZN, its value goes even further up. And the simple economics of demand and supply fluctuates the value of AZN.

If AZN is just another currency, how is it different from the currencies that we currently use? Doesn’t AZN look like a point system we used to get in the games that we played in our childhood? It certainly is a point/reward system but how it is different from regular currencies in circulation today is that it is not regulated by an organization. It is distributed, decentralized and trustworthy.

In theory, these new cryptographic tokens look flawless. It seems like we should have made a move to cryptographic tokens long back. But in practice, the introduction of a new currency requires the solution to a chicken-egg problem. Without demand of the token, there’ll be no supply, and without supply, there’ll be no demand. In other words, without a lot of people believing in the token, the value of the token will not rise. And therefore, the currency will make its way to the grave.

But, there’s a solution to this problem, and it’s called Initial Coin Offering.

What is an Initial Coin Offering?

Initial Coin Offering (ICO) is made on the similar lines of Initial Public Offering (IPO). A same chicken-egg problem is faced by the companies that are going public. They have to generate demand for the new stock to keep the value of it high enough to raise enough funds for the company to grow.

Instead of stock, companies offer tokens in their Initial Coin Offerings. Unlike stock, owning the token doesn’t provide any sort of ownership of the company. Instead, the tokens are the currency that you can use in the network that the company owns.

Think again of the e-commerce website which transacted on the AZN tokens. To generate the value of the token, the company will put a portion of the newly minted tokens on sale. Early adopters of the website will buy the tokens, therefore increasing the value of the token in the ecosystem.

For instance, the company creates 100 AZN tokens and put twenty of them on the sale. There will be people who would spend thousands of dollars to buy those 20 tokens on sale. You might ask, “Why would anyone buy those tokens?” Simple answer, “Because they believe that the e-commerce website will grow in years to come and then, owning the tokens will be costlier as compared to what they can be obtained for now.”

The story sells.

Owning 1 AZN might cost you $1,000 today, but a year later, the same single quantity of the token might cost you $100,000. Or it might crash right through the ground. That’s the risk these investor bear while buying the tokens.

Remember, these investors do not get any sort of ownership in the company. They only get to be major players in the ecosystem that the company is going to create. Of course, if the value of these tokens keep rising, they can trade these tokens on exchanges to convert them to the regulated currencies, like dollars.

You might ask, “but these tokens are just like experience points in a game; why would any sane person buy these?”

Remember, these tokens are to be used within the ecosystem that the company creates/enables. But these tokens are not regulated in any manner by the company itself. The company cannot tell you one day, “Oops, we deleted the database by mistake and your tokens are gone into the thin air.”

The tokens are maintained on the public Ethereum blockchain in a distributed manner. That’s where the ‘trusting the stranger’ comes in the picture. Blockchain allows you to trust that the company is not going to rip you off.

And that’s what Initial Coin Offering is, in a nutshell.

The Biggest Asset on the Internet

I ask, what are the biggest internet companies you can think of. I would even put a wager that Google and Facebook were among the names that you thought of. And what’s the business model of these two companies? Trading attention on the internet.

Google and Facebook have built products that billions of human beings use every month. For free (or that’s what they are made to believe). Every time we log into Facebook or search something on Google, we are allowing them to trade our attention with advertisers’ money.

And that’s where we dig deeper into what we started with — “…trade attention using Blockchain”. Why do we need to trade attention on the blockchain? What problems is the centralized system causing?

You might think, “Advertiser pays, the publisher gets paid, the user is shown the ad and the ad network makes a small commission from the transaction. What’s so bad about this approach?”

I used to wonder the same. And then I realized how uninformed I was about the advertising industry. In the comments on this edition of Unmade, I was enlightened by a gentleman called Syed on how exactly the system works.

Trading the attention is the basis of all the digital advertising. There’s a website that has the leverage of people’s attention, and it can trade that attention for cash. But that’s just the iceberg. To make it so that you get to see a banner ad on a website, a massive system is at play. And the system doesn’t comprise only of advertiser, publisher and the user (us). There are a few more characters in the game.

How digital advertising works?

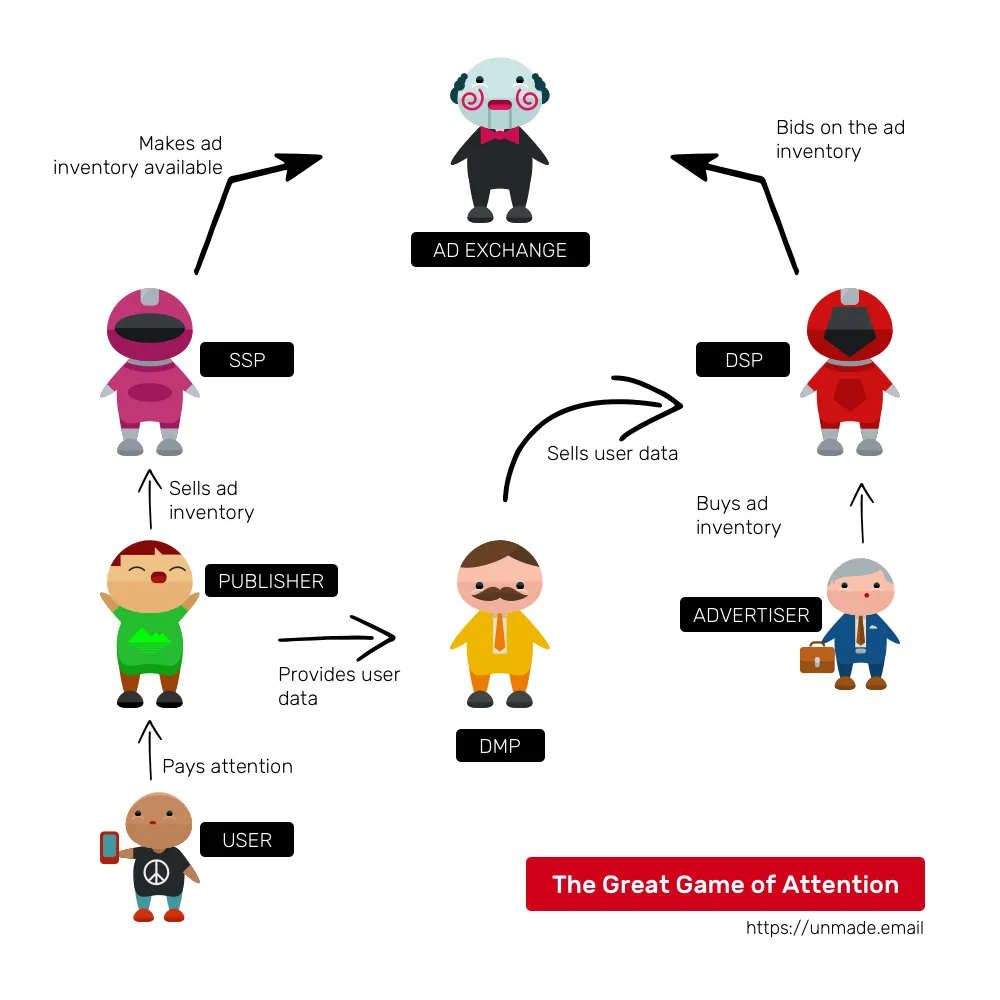

Let’s talk about the different characters that play The Great Game of Attention.

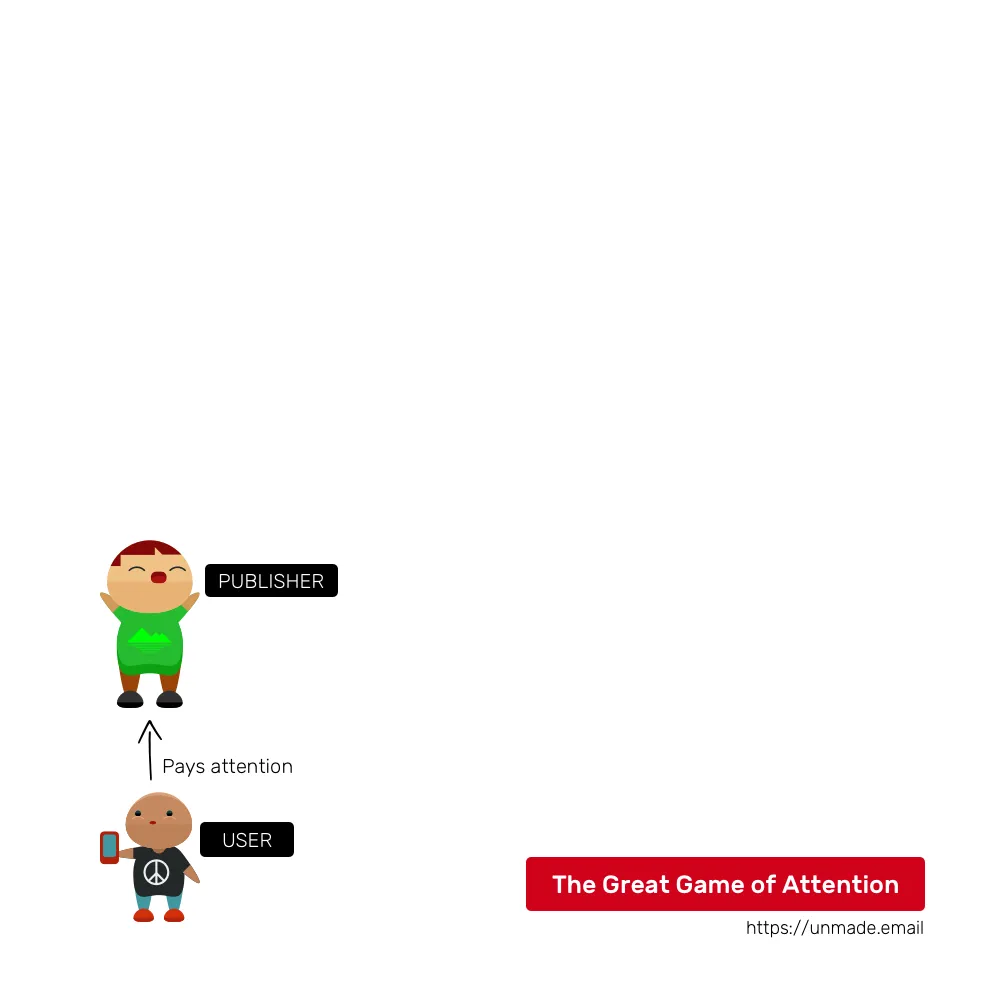

The three on-stage characters that we already know of are -

User — This is you, me and everyone else who gets to see flashing ads all over the internet.

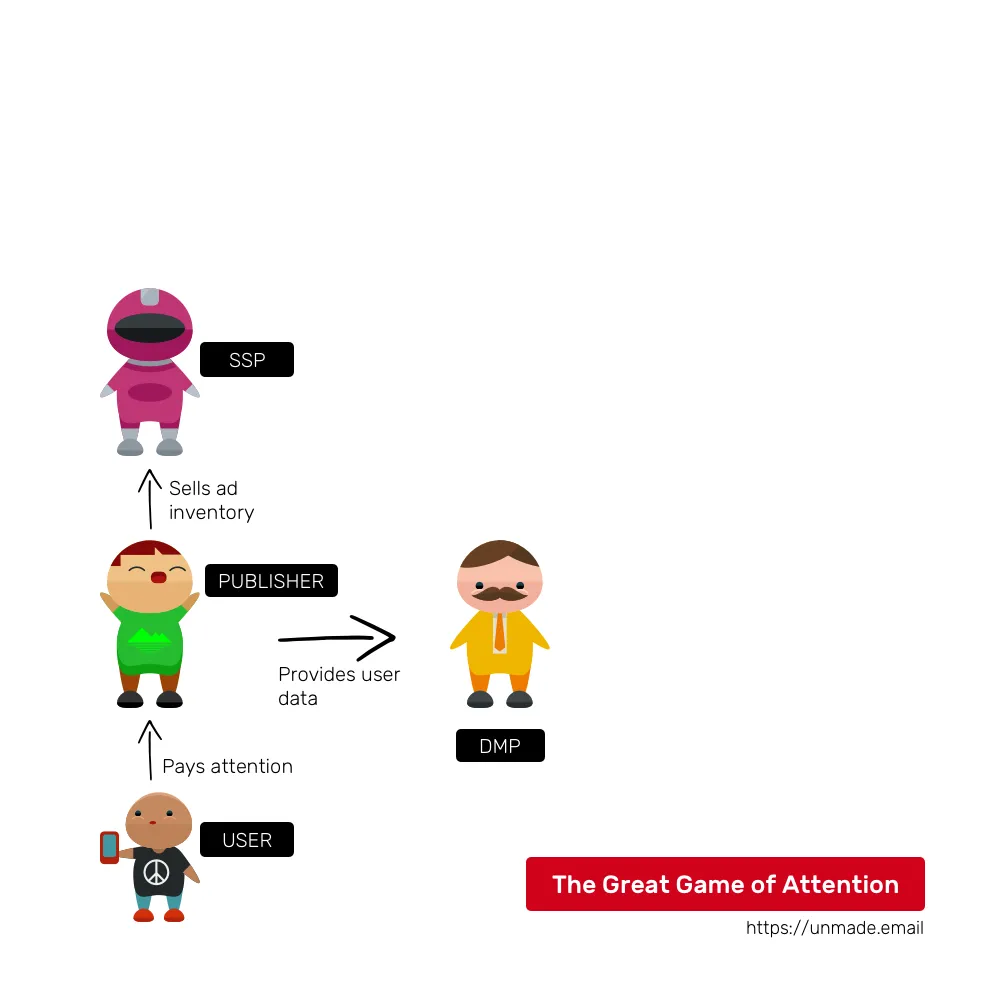

Publisher — This is the website/app that has built the leverage of user’s attention, and ads are shown on.

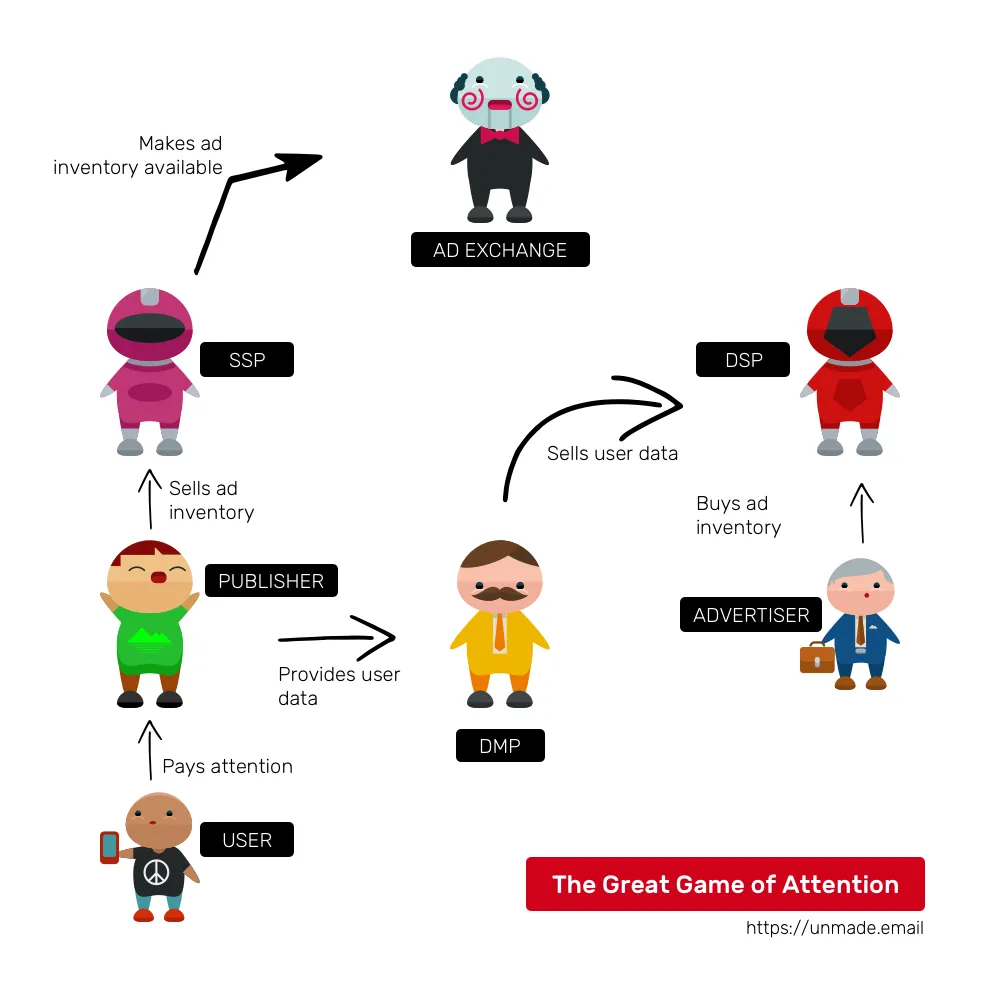

Advertiser — This is the individual or the company that pays to get its advertisement shown on the publisher’s website.

We all know about these. Now, here are the backstage characters that we rarely get to hear about.

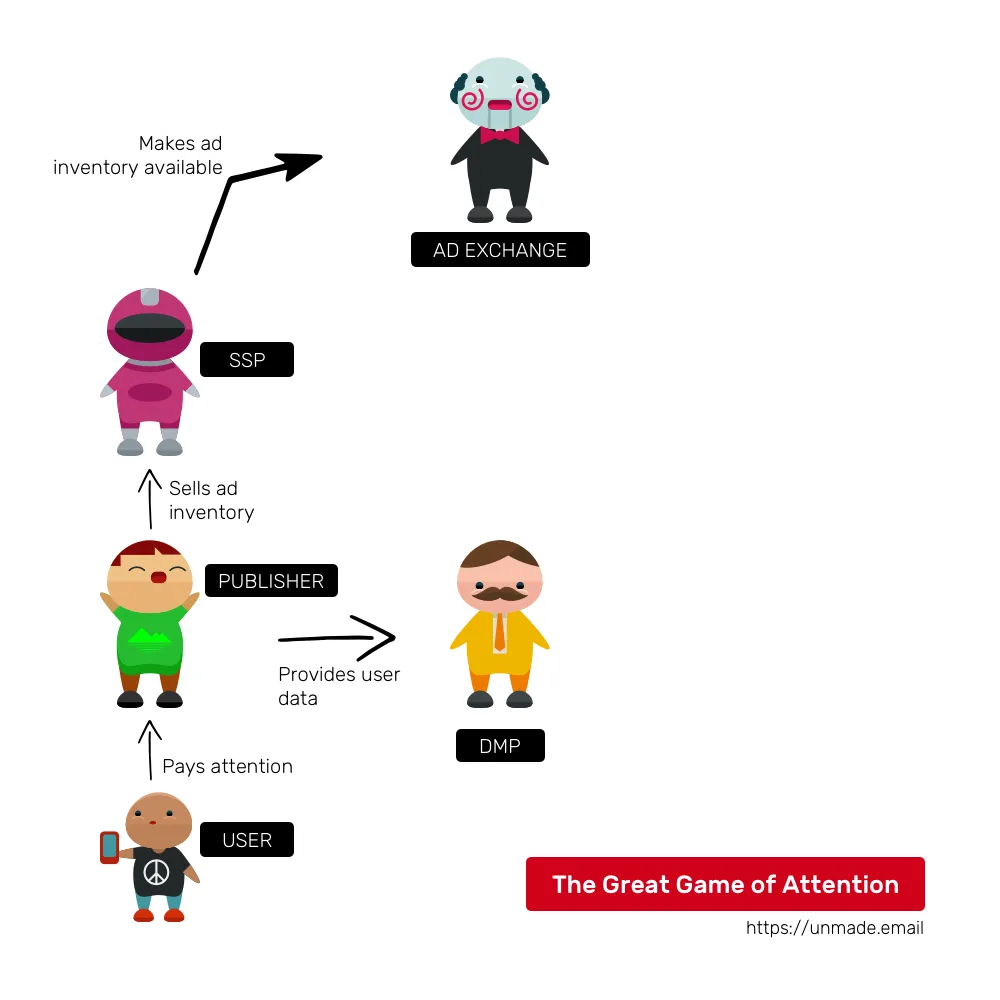

Supply-Side Platforms (SSP) — These are the technology platforms that publishers use to manage their ad inventory and receive revenue. In simpler terms, a publisher tells a supply-side platform that ad spaces are available with him/her.

Demand-Side Platforms (DSP) — These are the platforms that allow buyers of digital advertisers to interact with ad exchange platforms and manage their bids for ad inventory.

Ad Exchange — These are the technology platforms that interact with the supply-side and demand-side platforms and allocate the impressions available on the supply-side platforms to the bids coming from demand-side platforms in real time based on past behaviour of the user an ad is being served to, time of day, device type, and position and more.

Data Management Platforms (DMP) — These are the platforms that contain information about the users, their past behavior, their demographic, etc. From where do they get this data? They claim that they get it from many sources, and these sources include ‘stealing data from the publishers.’ Publishers use several free tools on their websites/apps, and besides serving the publishers, they sell the user data to various Demand-side platforms.

Here’s how it all works —

It all starts with the user paying attention to a publisher. The user’s attention is the ultimate value in the system, and the game begins from there.

The publisher wants to monetize the attention it is getting and to do so, it reaches out to Supply-side platforms (SSP) and uploads all the inventory it has to it.

The publisher also uses several pixels, trackers on the website/app, which provides data to the Data Management Platforms (DMP). Often, the ads shown on the website starts tracking and collecting the user data.

The Supply-side platforms make the ad inventory of the publisher available to the Ad Exchange for Demand-side platforms to bid and buy.

On the other hand, advertiser reaches out to Demand-side platforms to help him/her bid on and buy from the available ad inventory at various Ad Exchanges.

But how do Demand-side platforms calculate the bid amount for a particular user, on a particular device, at a given time, and for a particular publisher? They buy the data from the Data Management Platforms. DMPs sell the collected use data from the publishers to these platforms to allow them to calculate the bid amount that they then can place at Ad Exchanges.

Who pays for buying the user data from DMPs? The advertisers. And here’s a small catch. If an ad has to be shown to the same user on different days, the DSPs will buy the same data twice from the DMP. And therefore, making the advertiser paying twice for the same data. What if an ad has to be shown to the same user ten times? The advertiser pays for the same data ten times. One hundred times? You get the gist, right?

After buying the data, DSP calculates the appropriate bidding amount and makes a real-time bid (RTB) on the Ad Exchanges.

If a DSP wins the bid, the ad impression from the inventory is allocated to him, and the ad is served on the publisher’s website. And the publisher is paid a portion of the amount that the advertiser paid.

But who made the real money?

Advertiser paid several times for the same data. DMPs made massive sums of money by selling the same data. The data that allowed them to make this money came from the publishers without paying them anything for it. The publisher is stolen of the valuable data and is not paid for it. The publisher is paid only for the impression that are sold. And the end-user gets nothing for paying attention. All she gets is a little content surrounded by tens of ads and pop-ups.

The characters that are on the stage — Users, Publishers, and Advertisers are on the losing end of the system. And the backstage players — DSPs, SSPs and DMPs are on the winning side.

Do you know why we have been calling these backstage players, backstage players? Because they don’t come out in the bright light. They are opaque. They like the darkness in which they operate. Also, they are the backbone of the whole game. Without them, publishers and advertisers would be spending hours, if not days, haggling for a deal. Trusting a stranger would be very tough without them. That’s their purpose after all, in the system.

But haven’t we just learned about a new thing that allows us to trust strangers without the requirement of needing a central authority? We indeed have. And it’s called Blockchain.

Trading attention on Blockchain

The problem of overspending advertisers and underpaid publishers can be solved by replacing the DMPs with a Blockchain. The problem exists because there’s no single system to identify a user on the internet. If there can be given a single identity to a user on the internet, the problem would vanish away because DSP will not need to buy the same data over and over again. And it’ll be by design that the system that assigns a single identity to every user on the internet will also be able to measure the attention the user is paying across websites/apps.

At the heart of such a thing will lie a public, open-source and distributed system to attention measuring and trading — all working on top of a blockchain. If you own the tokens that the system transacts on, you’ll be able to use it. That’s precisely the reason why the sale of Basic Attention Token (token sold by Brave browser) garnered over $35million in less than 30 seconds. One token bought today for a few thousand dollars will allow the owners to advertise on the network for hundreds of thousands of dollars in a few years.

Win-Win-Win

With such a system in place, not only publishers and advertisers will win, even the users can win. After all, there must be some incentive for the users to start using a new browser. Using hypothetical numbers, an example could be — if an advertiser pays $10 today, they will need to pay only $5 for the new system to buy the same ad space. And if a publisher is paid $1 today, they will be paid $2 on the new system (because there are no multi-level middlemen to inflate the prices). Also, the users of the new system can explicitly opt-in to view ads on the websites they visit in exchange for getting paid.