Hello everyone welcome to this blog, I will like us to discuss the issues affecting most peer to peer funding platform and how the platform am about to introduce to you (VIAZ Protocol) will resolve this issue.

Peer-to-Peer lending (or P2P), is a relatively new asset class in the world of finance that has gained traction within the last decade. Most recently, the past 5 years have seen an explosion of p2p lending platforms offering different investment options, rates of return, business models and the assets they invest in. As the baby of the alternative finance world, Peer-to-peer lending platforms have paved the way to a fair and competitive marketplace that challenges the traditional monopolization held by the high-street bank giants.

INTRODUCTION of Viaz

Viaz" which is A decentralized lending platform. There are so many Decentralized lending platforms but "Viaz" has some unique features that make "Viaz" different from others. Stick with this article you will get the information what makes "Viaz" unique from others.

Features of "Viaz" that makes it unique.

Viaz" is made on the highest of Tezos, If you don't recognize Tezos then let ME tell you Tezos is another blockchain that investigates new thoughts and frameworks to convey a safer, more and more hearty chain. supported OCaml, a helpful programming non-standard speech used for different cash connected primarily based undertakings, Tezos executes associate degree appointed confirmation of stake accord technique. this is often a lot of power-proficient what's more, provides a a lot of grounded accord instrument than the proof-of-work

VIAZ Platform will represent the bridge between the cryptocurrency and fiat currencies. Each user will have a separate crypto and fiat currency wallet on the platform, which will allow separate monitoring of assets. The user will have to pledge amount of cryptocurrency to obtain a loan in a fiat. At first, they only planning to use Bitcoin (BTC) and Ethereum(ETH), which are the most widely used cryptocurrencies, but in the future, they also plan to use a Tezos token(XTZ) and their native VIAZ token

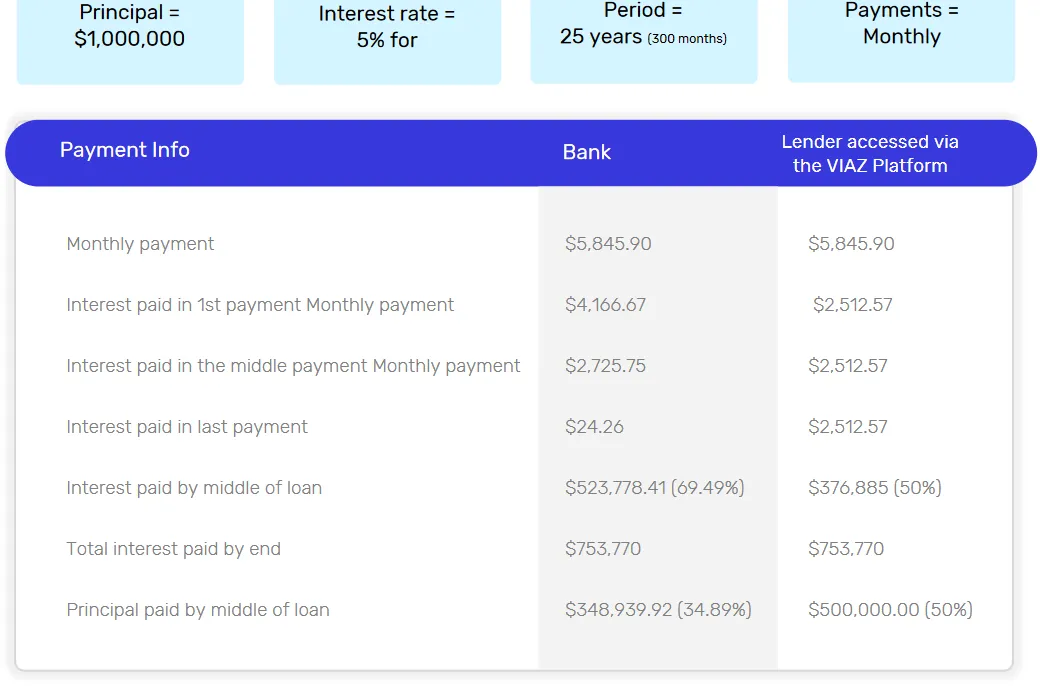

Interest on the platform will depend on loan providers. What distinguishes them from the bank is that interest is repaid on a regular basis depending on the duration of the loan so that the borrower can return less money in case of early return of the money. A comparison between a loan on the VIAZ platform and a classic bank loan can be found in the table below, which is available on their Whitepaper Which is below this article

Comparison between loans on Bank and on VIAZ platform

viaz is the first DAPP (decentralized application) to be compliant with the Tezos blockchain technology, individuals who use VIAZ will be able to borrow, lend, and transfer cryptocurrency/FIAT between themselves, VIAZ envisions to exterminate intermediaries because of the fact that some challenges faced by borrowers and lenders are caused by them, intermediaries often charge extortionate fees from their clients.

The viaz network uses DAI (decentralized account identity) a wise contract that allows people to possess full management of their on chain identification. the employment of DAI technology is important as a result of it provides customers who lost their non-public keys or people who got phished the flexibility to regain access to their accounts, VIAZ integrated DAI to interchange the restriction or loss of account access with this secured protocol wherever all identity of users remains at intervals the sensible contract.

Viaz token will be used as the driving force of the platform, it was created on TEZOS blockchain because it delivers a safe and more robust algorithm. With TEZOS there is an implementation of delegated proof of stake consensus protocols for seamless transactions which has proven to be more efficient to existing blockchain technology protocols.

SOLUTION OFFERED BY VIAZ

(1) Lenders can settle for digital assets as collateral from borrowers.

(2)Loans are accessible in any quality of alternative by lenders.

(3)Assets may be deposited by borrowers & they'll, in turn, receive a loan from lenders.

(4)Deals are created visible to borrowers, lenders & viaz to exterminate fraud from any party.

BENEFITS OF USING VIAZ

1.User-friendly & simple to navigate the platform.

2.Reduced service charges compared to ancient banking ways.

3.Elimination of chargeback fraud.

4.Users have total management of their funds.

5.Provision of full support and order execution.

6.The use of viaz tokens attracts bonuses & discounts.

7.High-tech infrastructure.

8.24/7 client care support service.

9.Decentralized, clear, seamless, quick & secured deals accessibility.

10.Peer to look transactions

TOKEN DETAILS.

TOKEN NAME: VIAZ

TICKER: VIAZ

PRICE: $0.0652c

NETWORK: TEZOS COMPLIANT

TYPE: UTILITY TOKEN

TOTAL SUPPLY: 1.5 BILLION VIAZ

SOFT CAP: $5,000,000

HARD CAP: $30,000,000

KYC: MANDATORY

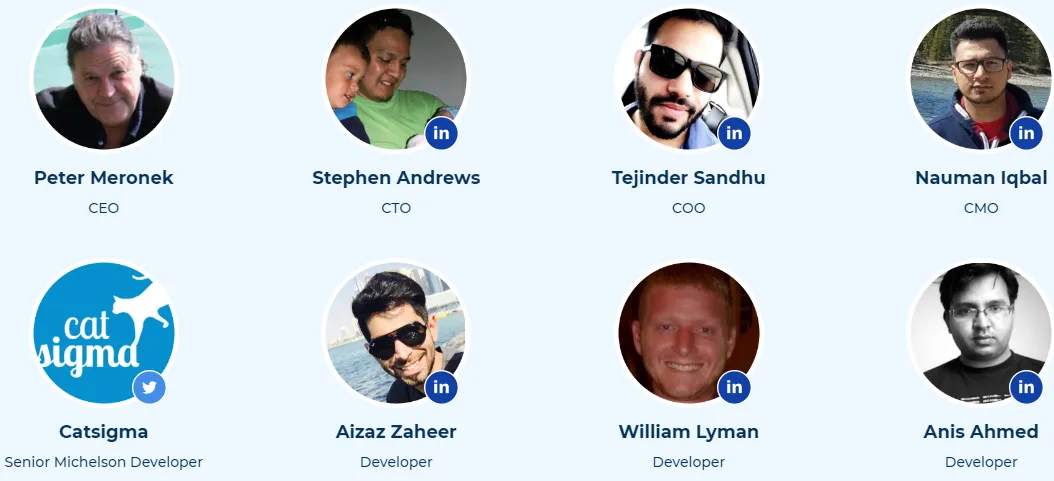

TEAMS.

Useful Information You can find more about this project here are the links below :

♦ WEBSITE: https://viaz.io/

♦ WHITEPAPER: https://viaz.io/documents/Viaz-Whitepaper_EN.pdf

♦ FACEBOOK: https://www.facebook.com/viazofficial

♦ MEDIUM: https://medium.com/@ViazOfficial

♦ REDDIT: https://www.reddit.com/user/ViazOfficial

♦ TELEGRAM: https://t.me/ViazOfficial

♦ TWITTER: https://twitter.com/ViazOfficial

Bounty0x Username : livingstone9