Ten years after bitcoin started, I still hear many educated people saying "bitcoin is a Ponzi scheme" or "it has no value" (or both).

Some months ago, I wrote an article called "What's Bitcoin's Value?" discussing several more-or-less plausible "reasons for-", or "sources of-" bitcoin's value. I called the first and most important one "ideological value"

[...] people want to make a statement, to send a message, to protest against a system - the current financial system - seen as deeply flawed, unfair and exploitative.

In a sense, it has been said that bitcoin embodies yet another aspect of the "revolt against the global (financial) elites"

After 2008 and even more so after 2016, nobody will contest a pervasive feeling of decline in our civilization. The level of mistrust has greatly increased. We have lost trust in politicians, in media, in each other. Our societies seem to be tearing themselves apart, to have entered a destructive spiral of hysteria and radicalization.

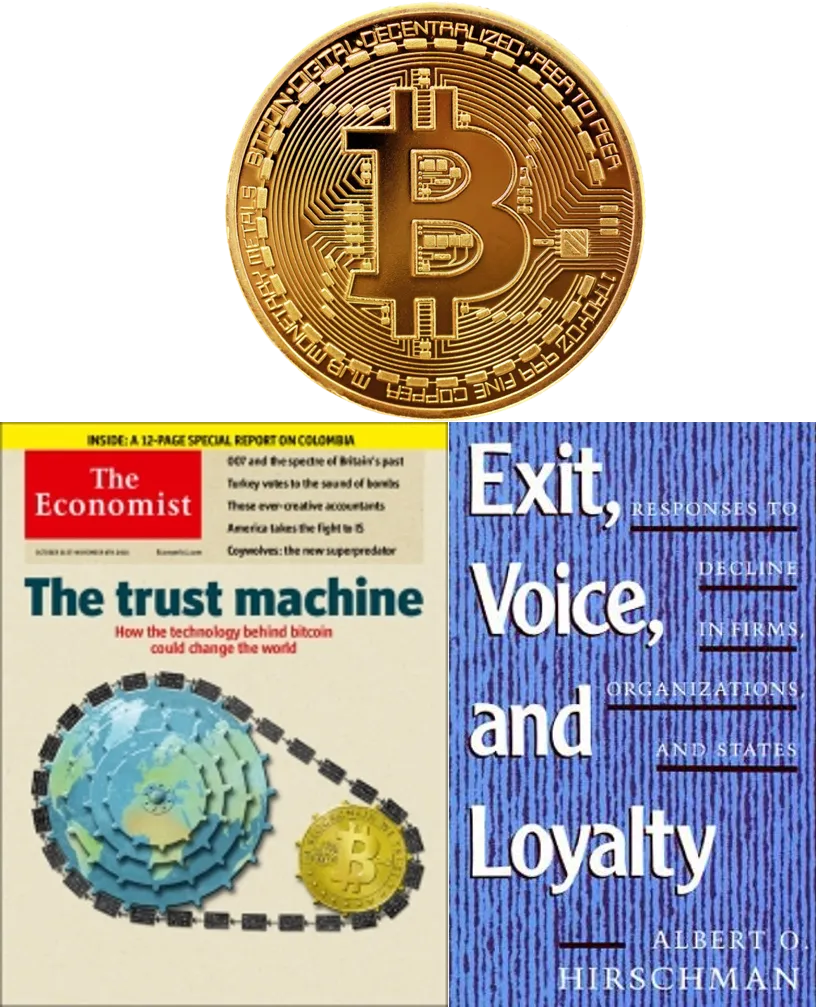

The responses to decline in firms, organizations and states have been famously analyzed and explored in a landmark publication from the 70'-ies by Albert Hirschman, called "Exit, Voice and Loyalty".

If the underlying blockchain technology is a "trust machine", its first and most famous application, bitcoin, uses it to offer an "exit from the global financial system"

Loyalty

Someone who finds himself part of a declining firm, organization, or state can choose to "stay loyal":

"I think things are not going well at all but I trust the leadership: they have noticed it too, they have the right analysis and they will come up with solutions to our problems"

credit: GETTY Images

Voice

Those who trust the capacity of the system to right itself, to heal, even if they might not trust the existing leadership can choose the Voice option: expressing their unease, proposing an analysis, proposing solutions, protesting against the analysis put forward by the existing leadership or against the solutions, agitating for a change of leadership.

credit: "New Mail Nigeria"

Exit

However once loyalty to the leaders is lost and confidence in the "system" as a whole fades, the only reasonable answer is an "exit":

- an employee would seek another job

- a member of a trade union, a political party or another organization would resign

- a citizen of a state would emigrate

credit: Dreamstime

The Global Financial System

It used to be that if one wanted to live a decent (perhaps even prosperous) life, there were a few choices. Then the field narrowed drastically: with "capitalism" victorious, the "market economy" took hold in all prosperous countries, its "flavors" ever closer, its uniformity ever greater.

In practice, this was brought about by increased freedom in capital movement, free convertibility of currencies, closely aligned financial and monetary institutions, with independent central banks all aiming for a 2% inflation rate, all ending up resorting to "quantitative easing" (aka "money printing") when the economy stalled.

With the "rules of the game" the same everywhere, whether in Europe, US or Asia, the recipe for financial success began looking more and more similar all over the world.

The competition field for individual success gradually became global. Those who didn't want to join the "rat race", those not lucky enough or not good enough to succeed in one place found themselves with nowhere to go, with "no other game to play".

The global financial system offered no exit option.

Until the invention of bitcoin, that is...

Conclusion

As such, bitcoin provides a useful "safety valve" for a part of the discontent. The "defensive" narrative of "Bitcoin as the 'knight in shining armor', defending the victims of the 'banksters' from their oppressors" is quite strong and people believing in it justify a significant part of BTC's worth.

These words from my "What's Bitcoin's Value?" article are cast here into a classical, well-known analysis framework, that of Albert Hirschman's 1970's "Exit, Voice and Loyalty".

In a context where, although changing jobs, parties or countries is still possible, people started feeling oppressed by "the dictatorship of the financial system", the dictatorship of money. Indeed, the globalisation of the financial system left no "exit" option, right when it, witness the 2008 financial crisis, entered decline.

However, bitcoin alone cannot compete with the fiat currencies system. As The Economist observed back in June 2011:

Bitcoin is technically sophisticated. As a monetary system, it looks primitive.

source:Bits and bob

Back in March 2018, in another post titled Blockchain Revolution: Money and Credit, I was writing

Bitcoin and cryptocurrencies challenge the monopoly of fiat money thus enabling a new, complementary economy.

As I plan to discuss in a future paper, in order to mount a significant challenge to the dictatorship of the fiat money, bitcoin needs the help of the other blockchain systems with their cryptoeconomies and currencies. Bitcoin needs the "cryptoverse"

If you know what witnesses are and agree that people commited to keeping this blockchain ticking play an important role ...

(by simply clicking on the picture - thanks to SteemConnect)

Related posts

- What's Bitcoin's Value?

- Why NOT buying Bitcoin is completely irrational

- How to buy Bitcoin in the Eurozone - Comment acheter du Bitcoin dans la zone euro

- The Church of Bitcoin

Blockchain, Crypto and Society

- Game Theory 102 - Blockchain and Cooperative Games

- Why Blockchain Is a Revolution

- A New Hope

- Blockchain revolution: Money and Credit

- The Press needs to be Freed from the Tyranny of Money

- The Holy Blockchain

- Understanding blockchain's social impact

- Blockchain and the End of the Western Civilization