We maybe in a bear-market, but the good news is lining-up. Check-out the Whale Alert Twitter account.

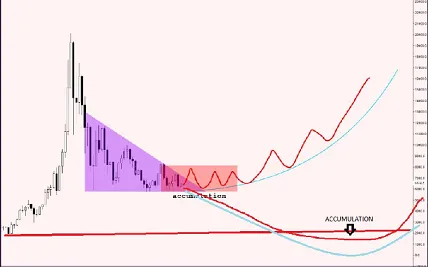

Opinion is divided on Bitcoin’s next move, with a descending triangle on the monthly charts, forming since last December, a bearish pattern that typically completes with a decisive lower move below the flat-line, but some see a period of accumulation to form a bottom before the next market cycle;

If we look back at the monthly’s, we also see a head and shoulders pattern that began forming in June;

This coincides with a probable ETF delay looming from the SEC and there’s a possibility we could be about to break the $6000 long-term support level, although the expectation of an SEC announcement to delay VanEck approval may already be largely priced into the market and we could trade sideways, as happened in 2014, the only other comparable data-point to which we can refer.

Of course, the SEC could be about to surprise us, or give us an indicator that they are warming to the idea of VanEck approval at a later date, but in the meantime, we have the NYSE’s Bakkt platform coming in November, which reportedly only needs approval from the CFTC, so this is very likely. Some commentators believe that this is bigger for the crypto space than an ETF approval and Bakkt’s stated aim is to make Bitcoin “more liquid and trusted”, apart from their other unstated, but rather obvious aim of making lots of money;

In an attempt to compete with this, Nasdaq is making preparations to launch its own cryptocurrency trading desk, scheduled for Q2 2019, targeting institutional money and offering them custody solutions, which is conditional on there being guidance in place from the regulatory bodies, but Nasdaq’s conversations with the SEC and CTFC appear to be moving towards a positive outcome with this timeframe in mind, according to Nasdaq insider sources;

More good market news that might also trigger the next Bitcoin parabolic is that Citigroup is in the early stages of a plan to launch a Bitcoin Digital Assets Receipt (DAR), a financial instrument so similar to an ETF, many are now wondering whether we need an ETF at all, as it gives investors the same opportunity to speculate on the future price of Bitcoin without owning Bitcoin itself, since Bitcoin would be owned by Citibank on behalf of the investors in the DAR. Ciitigroup is racing to be the first to do this, so others will no doubt follow suit.

Fidelity, the fund management firm with $2.5 trillion under management is planning to offer its investors exposure to Bitcoin with the introduction of cryptocurrency products by the end of Q4 2018, according to CEO Abigail Johnson. This follows news that Blackrock, which has over $6 trillion in funds under management and is also the world’s largest provider of ETFs is teaming-up with Coinbase for an ETF proposal.

So, whatever happens to the price of Bitcoin in the coming weeks, all of the above should have the positive impact on the market we’ve been waiting for in 2018.

A new Twitter account called Whale Alert is aiming to provide more transparency to cryptocurrency traders, by detecting unusually large real-time transactions, whilst seeking to identify the sender, before tracking it to the deposit wallet of an exchange and monitor the activity of the wallet for any possible market changes.

Whale Alert will focus primarily on transactions involving BTC, Ethereum, ERC20 tokens and USDT, which has been the subject of many rumours regarding manipulation and speculation. Whale Alert will only tweet transactions it is monitoring, if they are over $8,000 USD for Bitcoin and $2,000 USD for Ethereum, such as the two movements of 15,000 BTC last week;

https://twitter.com/whale_alert

https://www.cryptoglobe.com/latest/2018/09/nasdaq-rumoured-to-be-listing-cryptocurrencies-by-next-year/

https://bitcoinexchangeguide.com/which-is-better-for-bitcoin-etf-approval-or-bakkt-by-ice-and-starbucks/

https://www.ccn.com/citigroup-is-the-latest-bank-to-offer-crypto-custody-heres-how-it-will-affect-the-market/

https://www.newsbtc.com/2018/09/19/fidelity-ceo-teases-crypto-product-announcement-by-end-of-the-year/

https://bravenewcoin.com/news/why-a-coinbase-and-blackrock-crypto-etf-might-be-approved/