Image Courtesy - YouTube

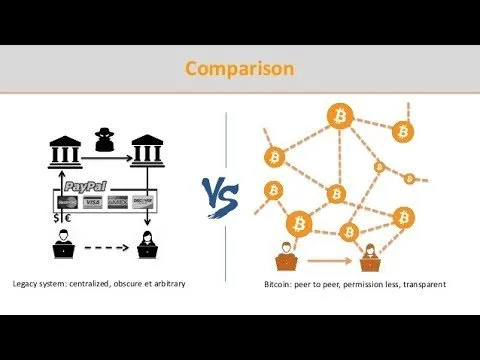

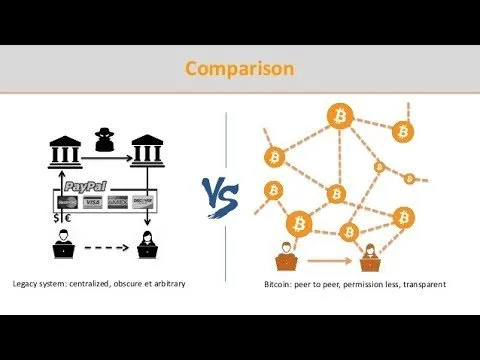

Everyone is talking about cryptocurrencies these days. The modern-day currency has created quite a ripple in the financial world and everybody is interested to try this out. Although Bitcoin was launched in 2009 and was the first cryptocurrency based on the blockchain, it became a common name only recently. Devised by Satoshi Nakamoto, Bitcoin was the first decentralized digital currency.

Although the Bitcoin network is decentralized and was rather invented as a peer-to-peer payment system, some researchers pointed out quite a few centralized flaws in its environment. However, the Bitcoin payment system which is a lot similar to the PayPal is one of the most popular payments systems in the world.

There are two main types of cryptocurrency exchanges in the financial market holding the variety of cryptocurrencies in them. The first type is decentralized and the second one is centralized. So, what’s the difference for a layman?

What is Decentralized Exchange?

Image Courtesy - decentral

In a decentralized exchange, there is no central authority needed. Here the users can transact directly without a third-party or any intermediary involved. Decentralized exchanges do not have a special person, server or, an institution and its key feature would be the fact that it’s trustless. Here it’s only us who are in control of the funds.

Advantages:

- Decentralized exchanges and its services are accessible over the internet all over the world and are not limited to any borders or barriers helping you do transactions and make or receive payments within seconds. Bonus – the transaction fees can be even lower than that in the conventional methods.

- It’s an open-ended software with transparency. Therefore, the transactions, software, and the code are open source.

- No registration and verification required to set up an account, and so, it can be accessed directly without any of your personal information. Simply create an account and start transacting.

- In decentralized exchanges, you do not keep your funds because all transactions happen in real-time and so, it’s a secure process.

- In a decentralized exchange, you have the option to keep your personal information or the credit card details anonymous for the privacy of your account.

- Still less popular compared to centralized cryptocurrency exchanges.

- The ownership of most of the decentralized cryptocurrency exchange founders is kept anonymous that can ring an alarm bell to many looking like as if it’s a scam.

- The lack of regulation also means that such cryptocurrencies will barely receive any third-party support during the crisis.

- The lack of mainstream appeal is one of the major reasons why many fear to get into this. They would rather prefer a more controlled exchange like the centralized one that’s approved by the country’s government.

Image Courtesy - Pieria

This is the most common form of trading cryptocurrencies and is an online platform. Here users can buy or sell cryptocurrencies using fiat and also with other cryptocurrencies. Unlike the decentralized exchange, where users can trust someone else to control their funds.

Advantages:

- Easier to access and use for many as they are more related to our existing life patterns.

- Ability to incorporate the conventional financial world into cryptocurrencies.

- Offer advanced tools that help in the trading process, for instance, lending, margin trading, and stop loss.

- There’s always a big risk associated with your funds.

- Security of your cryptocurrencies is a concern.

- No privacy

- Requires personal information for some features.