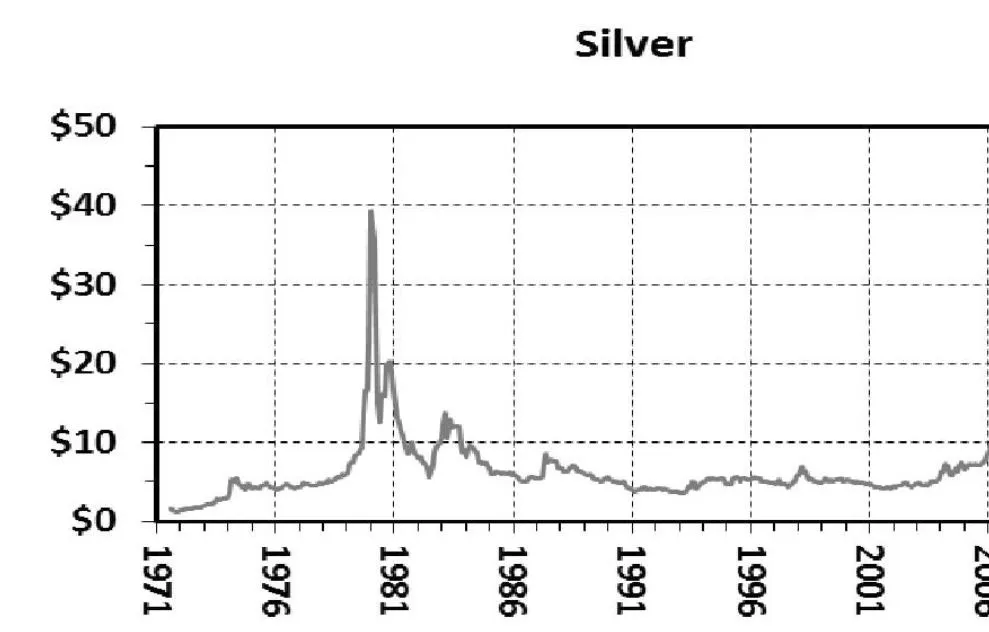

We completely forgot about the silver. So I want to ask the opponents of alternative theories the question whether there is a centralized, pre-planned manipulation of the market on a global scale? You have to be completely blind or a fool not to say yes.

The history of the Hunt Brothers in the 1980s became the most famous in the history of the case of manipulating futures in the silver market. It is known that the Hunt Brothers made significant investments in silver and silver futures contracts in an attempt to monopolize the formation of prices for this metal. As a result, they managed to consolidate more than two-thirds of the global silver market and raise its price by 700%.

To fulfill this plan, the brothers took a huge amount of loans to buy silver futures secured by silver. But world bankers have passed a law in the US Government that changes the terms of lending secured by silver, and the Hunt Brothers were no longer able to increase their loan portfolio, as a result they reduced the purchase of futures, and when they were unable to fulfill their margin obligations, causing panic in the market, the price of silver collapsed from 48 to 11 dollars in just 5 months.

Does that sound familiar? If you know the historical charts of the price of the cryptocurrency, you can easily recognize the pumps and dumps cycles, which are characterized by many cryptocurrencies. Let's take a look At the Ethereum/Bitcoin price chart.

Well or Dogecoin/Bitcoin.

By the way, all pump and dump operations on Dodge held a trader under the pseudonym WOLONG, who later wrote the so-called “God.pdf”, which described in detail his strategy of manipulating the price of Dogecoin.

Well, in the end, let's look at Bitcoin Cash.

"So what" you might say, why look at this? Because the cryptocurrency markets behave as well as the silver market, when the bankers drove the Hunt Brothers to the corner.

- The previous part - Will the History of Bitcoin be the same as Gold? [Part 1]

- The next part - Will the History of Bitcoin be the same as Gold? [Part 3]