bitcoin prices have fallen painfully by 64.5% since December 17th last year. The combined market value of digital currencies now stands at only $ 130 billion.

This is a very significant drop for any market. However, these price movements are not new to bitcoin or any other digital currency. bitcoin die and come back to life regularly. One Web site estimates that 248 bitcoin prices have collapsed and counting has been going on since 2010. Most recently, 2017 was the deadliest with 109 stories predicting the end of the bitcoin.

What causes the breakdown of the Bitcoin?

A whole series of bad news has led to a significant drop in the digital currency economy. The trading platform "Bitfinex" now ignites the CFTC's anger because its Web site offers its users the option of linking their currencies to the US dollar. It is suspicious that both "Bitfinex" and "Tether" can not necessarily prove that they have sufficient funds in the bank accounts to support the digital dollar "USDT".

On the other hand, India is tightening the screws on traders, as the government of the country to investigate transactions on multiple platforms in an attempt to experiment and collect tax revenues. It is estimated that $ 3.5 million of transactions have been carried out through India in the last 17 months to 2018.

And then there is South Korea, which has no intention of completely banning digital currency trading. But her government has taken a number of steps to remove anonymous accounts from the equation. South Korean traders now have to use their real names. All of these have combined to create a bloodbath in the digital world. The Dow Jones industrial average hit its lowest level in three weeks, thanks to a rise in yields on US government bonds. Digital currency markets alone have not felt the pain of burning.

Find the lowest possible level

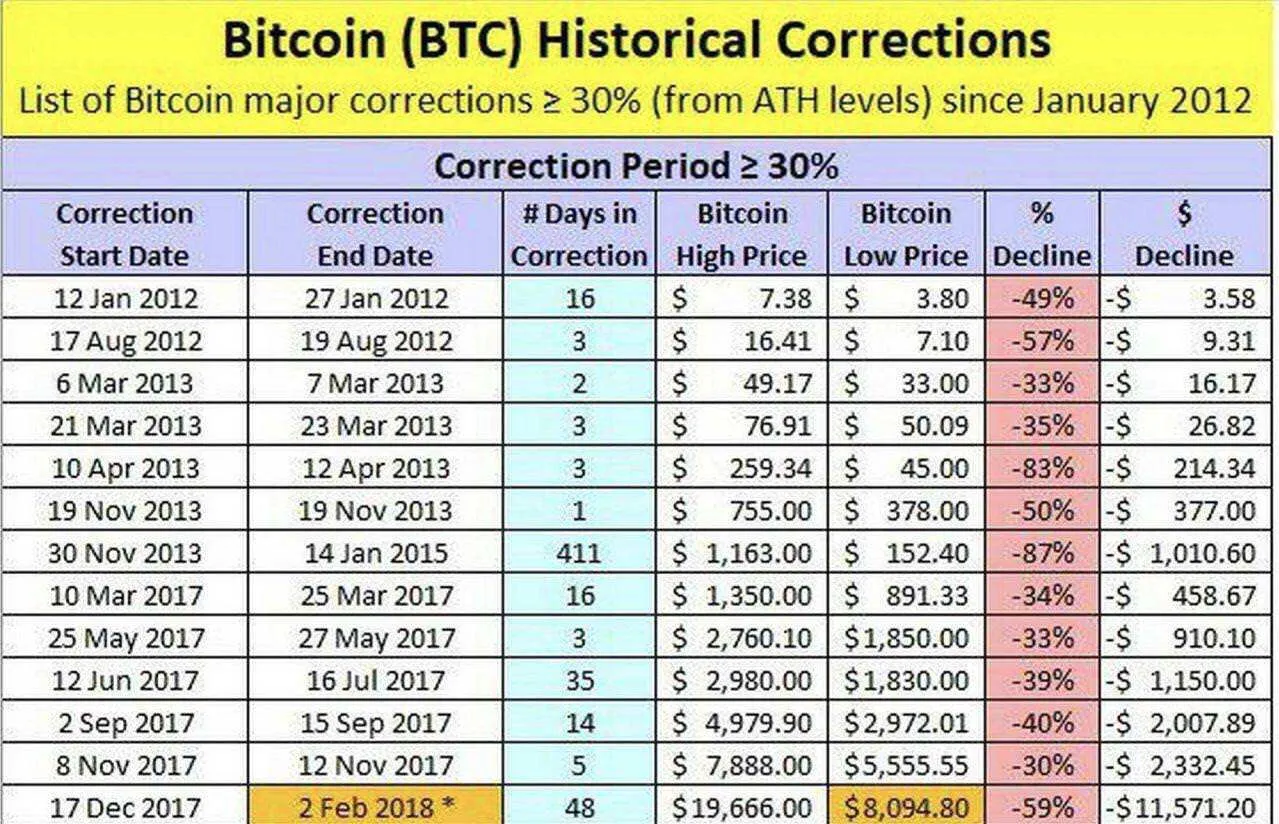

Most novice investors are familiar with the old saying, "Buy at a low price and sell at a high price." But the question remains here, when is the low price low enough? The real thing is that no one knows that. Looking at the tables, the worst 4-day decomposition of the Bitcoin continued, ending in January 2015. This plunge in the prices of Bitcoin led to a 87% decline.

As we see it, the price has fallen 64.5% in the past 51 days. If this happens in the stock market, the news media will call it "2008, which will be perfect again." There is no doubt that the global economic crisis a decade ago was the result of the US government handing over high-risk mortgages to customers who could not afford the houses they lived in. With regard to digital currencies, it is the increased regulation that is behind the collapse. This is certainly bad news for investors in the short term. However, long-term investors see regulation as a necessary step in the struggle to legitimize and advance the digital currency towards adoption and collective adoption around the world.

In the end we wish good luck in riding this wave in this market no matter what the investment vehicle chosen.