Big block proponents often blame the Bitcoin Core devs for the network congestion of last year, some even go further and say that they keep the capacity small on purpose. Reality is that the amount of users is growing faster than the technology safely can be expanded. It sounds like a simple solution to increase the blocksize, but this short term solution will change the properties of Bitcoin permanently and decrease the likelihood that Bitcoin can function as a long term Monetary standard without being corrupted as happened to EVERY kind of money through history.

Maintaining decentralisation is the key to become a new global monetary standard.

Yes, in the short run Bitcoin might be adopted faster when the block size is increased, but it will greatly decrease the likelihood that it is able to function as a new monetary standard for centuries without being corrupted. Do you want to be able to pay your coffee with Bitcoin two years earlier or do you want a decentralised world reserve currency that will greatly enhance peace and prosperity on earth for centuries? The Core devs have chosen for the latter.

I couldn’t resist to react to this:

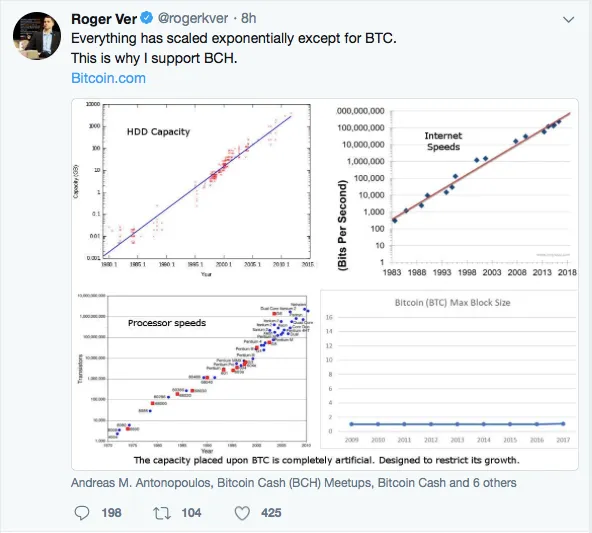

This post came to existence because I read this tweet this morning:

Roger is trying to accuse the development team behind Bitcoin for keeping transactions expensive and slow on purpose, while he and his team copied 9 years of hard work of Core, made only some easy changes (bigger blocks, EDA, old dangerous op-codes) that a child could do and claims it is the real thing. Even worse, he claims that the devs who wrote 99,9% of the code of his alt coin to be evil, instead of thanking them. On top of that he tries to hijack the Bitcoin brand. A dirty parasite if you ask me.

There is a reason why the blocksize is not increased and why the op-codes are taken out and will probably not be re-introduced. Trying to spread the narrative that Core devs are slowing BTC down on purpose without mentioning the heavily with him discussed reasons is outright sickening, he got rich over the back of the people he is bashing now.

Roger Ver is an enemy of Bitcoin and Crypto, with his misinformation and manipulation he did already much more damage than he ever did good in the early days. Also, his Bcash is the biggest threat of the moment, because:

Being another coin with the same PoW algorithm destroys the earlier existing game theory that it would be stupid for miners to attack Bitcoin because it will make their hardware obsolete.

An ultra rich attacker could pump the price of Bitcoin Cash to make the miners leave BTC and attack the weakened BTC chain.

Bitcoin Cash is Asic Boost compatible and more sensitive to miner centralisation because block propagation is slower and thus will miners that find a block most often have the shortest waiting time to start building a new block. Since BTC and BCH use the same mining algorithm the centralisation will flow over to BTC too.

Bitcoin Cash is sold by it’s promoters as a version of Bitcoin. Bitcoin is nearly unhackable while Bitcoin Cash is very easy to hack (6 biggest mining pools can 51% attack). It is not the question if but when Bitcoin Cash will be 51% attacked and common people who think it is a version of Bitcoin will think that Bitcoin is hacked. This while the fact that it is almost impossible to hack BTC is one of the main features.

The need for a new monetary standard

Today we are living under the USD standard: The power over money and politics are connected, wars are easy to fund, half of the world population is not connected to financial services and people get robbed from their value to enrich the chosen few.

In the entire history hard money has always come with prosperity and when someone was able to increase the supply at will the mentality of people worsened, wars increased and finally the entire civilisation collapsed. The world is in a really sad state at the moment and the only way to solve it is the introduction of hard money that isn’t controlled by anyone.

Please watch this and when you get interested (you will) order his book, it perfectly explains my points above.

Decentralisation is the only way

Bitcoin is better money than fiat and economic law describes that people will always hold the best money. Bitcoin will connect billions with the financial system who would never have be connected otherwise and in all the countries that go under because of (hyper) inflation the only way out will be Bitcoin.

Therefore I am totally not worried whether Bitcoin will be adopted, the free choice of the people will make it the new monetary standard. The effect of cheaper fees or faster transactions will be irrelevant in the big picture. The important issue is to guarantee that decentralisation is maintained, because every powerful entity in this world will try to compromise the new monetary standard because it will make them extremely powerful if they succeed.

This will harm decentralisation:

Hardforks

Hardforks lead to centralisation because people who disagree will be kicked off the network, so obviously a community with one certain way of thinking will evolve (it is hard to get rid of 60% different thinking community members in one time, but kicking out 10% in 6 times via a hardfork with smaller changes is easy). Also, making it easier to change one basic rule will make it easier to change the next one until the cryptocurrency is perfectly formed to take control.

On top of this, a hardfork will destroy the store of value proposition because investors can never be sure whether the coin they buy today is still the same coin in the future, and as you can read HERE, store of value is the fundament of the security system.

Read here more about hardforks

Big blocks

Big blocks lead to centralisation in different ways: Firstly, block propagation will become slower so the biggest miner will gain advantage over the smaller ones and certain attacks like selfish mining will become more easy. Secondly, it will become more expensive to run a full node, so the node count will decrease and so will decentralisation. When this worsens the entire layer of decentralisation brought by the users will disappear and the cryptocurrency will be controlled by miners and corporations.

Like free money doesn’t exist, free block space doesn’t exist either. Printed money comes on the expense of the savers and extra block space comes on the expenses in the form of decreased monetary sovereignty on the users

Core has scaled Bitcoin to the technical maximum without harming decentralisation.

It is true that Bitcoin would have scaled faster when the block size was increased, but it would have increased centralisation too in a non reversible way. When issues arise because the block size is too small you can instantly increase it, but damage done by a hardfork to increase block size can never be reversed.

The path that Core took was maybe not perfect on the surface: Transactions were expensive and slow for a while. But it is the perfect path to build the new monetary standard that will survive every attack and take over attempt for centuries. Simply said, Core sacrificed one or two year of being perfectly suited for merchant adoption for a much bigger likelihood of a prosperous and peaceful world for centuries.

Bad choice? Up to you to decide, but I fully agree with them.

Delay caused by big block community

It is very contrary that the big blockers complain about slow and expensive transactions while they are the ones that at least partly caused it. Today we have Segwit around ten months and Roger Ver and his (miner) friends blocked it for around one year, this means that we could have reached today’s level of scaling a year ago, even before Bcash split off.

Bitcoin is really scaling now through Segwit, batching and Lightning network. We could be here a year ago before the congestion started to become really bad if these actors had never blocked Segwit. Without Roger and his friends we would have had blocks with a capacity of 2MB these days (double) and an alternative for the smaller payments (LN). The problems Roger is crying about every day maybe wouldn’t have existed without his involvement!

Conclusion:

Bitcoin is not about fast and cheap transactions (it will come too, but is not first priority), the highest level of decentralisation possible have to be maintained to increase it’s chance to become the new global monetary standard and bring more peace and prosperity on earth.

Bitcoin is the only cryptocurrency that succeeded to maintain decentralisation, Bitcoin Cash and all other alt coins made a trade-off. Roger should respect and thank the devs for this instead of stealing their work and treating them like shit. Please avoid misinformation on sources like Bitcoin .com, Reddit r/btc and the @ bitcoin twitter handle.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!