Oh another post predicting the market top for bitcoin... No, this analysis is far from it, today I'd like to present the facts surrounding the technical aspect of bitcoin to help provide a better understanding of the asset.

Today I'm analysing the weekly chart on BTC/USD.

As mentioned I'm using a logarithmic scale which presents prices in the proportional amount of percentage increase or decrease, providing us a fair representation of where bitcoin was, is and could be.

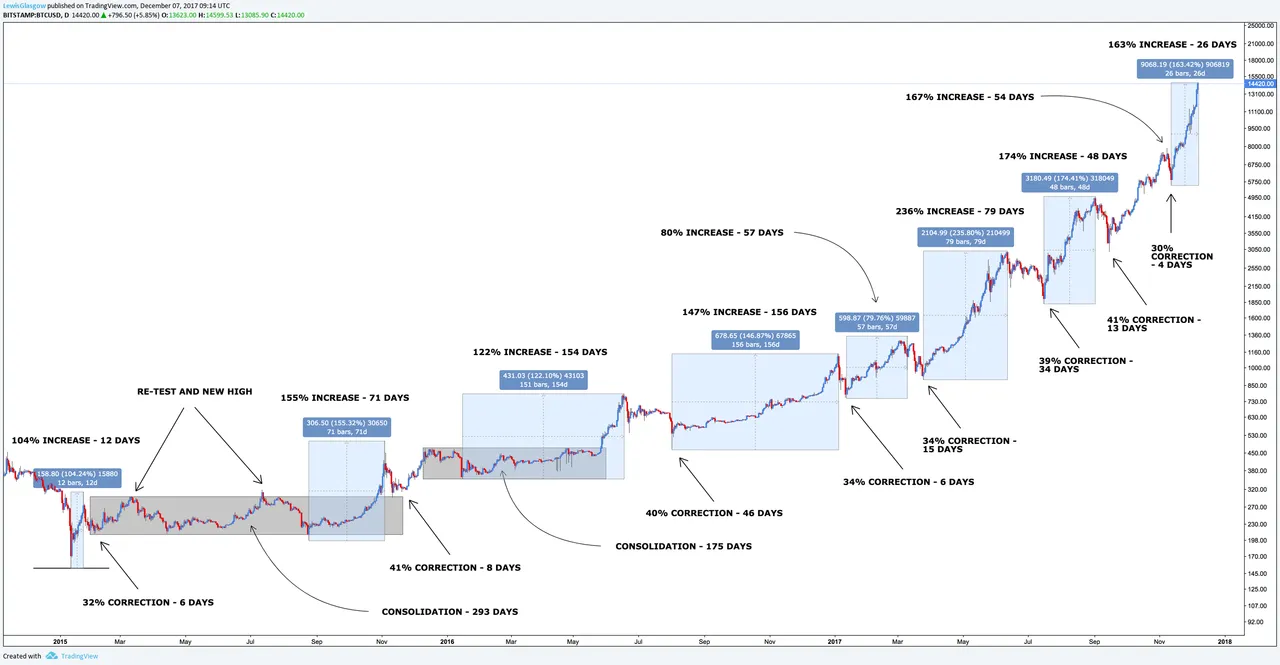

I've broken down each cycle measured from the breakout of an all time high to a new all time high being the market top.

Also detailing the percentage increase upon achieving targets at $20,000, $50,000 and $100,000 as there seems to be a lot of financial articles relating to these figures as the predicted long term value of the asset.

This month will be interesting as CME and CBOE launch bitcoin futures.

Below I have detailed the increase throughout each phase of the market from low to high on the weekly chart.

The median trendline seems to be acting as a support and resistance level as price returns to it over time, I would pay attention to this going forward.

As a general rule, the greater the amplitude of price during the major phase... The greater the correction will be.

The first major phase we experienced was an increase of 11729% throughout 2011-2013.

The correction that followed was 82%.

Our second major phase was an increase of 2472% throughout 2013.

The correction that followed was 87%.

We're now in our third major phase at a current growth of 8697% from 2015 to present.

Correction phase, yet to establish itself.

I believe the correction to follow the next top will be of similarity to previous cycles, being a minimum of 50% and a maximum of 93%.

I'd like to present the works on major bull trends by H.M Gartley who wrote Profits in the Stock Market (1935).

How to recognise a bull market ending.

1. The daily volume has risen to an all time high.

2. Wide daily fluctuations are a regular occurrence.

3. Nearly everyone you meet appears to be in some way interested in the market.

4. Most financial news writers and financial commentators can see no reasons for any important decline.

"The thought of a bear market being around the corner is not seriously considered".

"A bear who presents what appear to be sound and logical reasons why a collapse is imminent, is considered to be either an out-and-out dyspeptic, or at least a very unpatriotic citizen."

"He can count on being very unpopular".

"Each bull market breeds a crop of traders who fail to recognise the unmistakable signs of a storm."

The above is relevant to bitcoin, you should always be analysing both sides of the market.

If we do achieve $20,000 I believe we'll see a major reaction.

Below is the daily chart for BTC/USD showing the cyclical measurements on a smaller scale.

The average correction is 36% at 16.5 days.

The average increase is 150% at 73 days.

To further filter this down I'll show the averages for only 2017.

The average correction is 36% at 16.5 days (the exact same average).

The average increase is 164% at 53 days.

What can we expect to see from this data? A correction of 36% after the current impulsive move ends.

From the current price this means price would drop to $9,300.

This post is open to discussion, feel free to leave your own analysis below.

Click here to view my original post on TradingView.

Don't forget to upvote, resteem and follow me for in-depth market analysis and investing education.