What is CREDITS?

CREDITS is an open blockchain platform with autonomous smart contracts and the internal cryptocurrency. The platform is designed to create services for blockchain systems using self-executing smart contracts and a public data registry. You can watch their 1-minute introduction video on the following link

CREDITS currency is used as an internal means of payment for the use of the platform (so it is classified as a utility token), and it won't require mining (all coins are issued in advance, during and in conclusion of ICO period).

ICO & Token Distribution

They had PRE-ICO in Decemeber 2017 (raised 3mln hard cap), and their ICO started on February 17th and it has completed in less than 17 hours, where they raised 20 000 000 USD hard cap. In order to be sure to participate in ICO you had to apply to be in their whitelist, as during the ICO period the token buyers who have registered on their whitelist have been served first, and of those people small investors were served first. In the following interview (on the Crypto For The People Youtube channel) CREDITS CEO Igor Chugunov explained that it is because a lot of people were interested in ICO, and due to their low hard cap they wanted to give opportunity to small investors to invest and that they thought it is good for the project that many people are invested in it, rather than few heavy investors. He also said that the reason for low hard cap is that they didn't want to just promise something big without delivering and they wanted to present real things as fast as possible.

During the ICO price of one CREDIT was ~20 cents, and you can see about their token distribution at the picture below.

High Volume, Transaction Speed & Low Cost

They claim that CREDITS will be able to handle more than 1,000,000 transactions per second, with future scalability to 10,000,000 per second(as the network grows, so the number of transactions and speed, alpha version is showing 200k-500k transaction per second) .Transaction speed will be as fast as 0.01 seconds per transaction(depends on the internet connection, so does Visa's and Mastercard's transaction speed), and fees as low as 0.001 USD per transaction .

To put that in perspective: Ethereum can handle 300 transactions per second , with a transaction speed from 30 seconds to 5 minutes and fees about 0.1-1$.NEO can handle up to 10 000(theoretically) transactions per second, with no fees(even though some exchanges charge fees), and EOS team claims that EOS will handle up to 1 milion transactions per second, also with no fees.

On the link below you can see one of the users testing the alpha version and showing how fast it was(you can test it yourself on their website).

Autonomous Smart Contracts & New Capabilities

CREDITS platform is the first completely autonomous blockchain system that can function completely autonomously and without the need for external systems participation(e.g.if you want to develope something on Ethereum network, you need to have additional server but if you want to create something on CREDITS network, you don't have to).CREDITS platform is using JAVA programming language(they are planning to add support to more languages) instead of Solidity, which Ethereum use, and that is another benefit since JAVA is the most popular programming language and it is also most used language in financial industry(because it is very secure), where lies one of the use cases of CREDITS.

CREDITS smart contracts support cycles and schedules, which is very important since for the logic of a financial contract to fully reside on a blockchain, smart contract must be able to “wake” itself up reliably in the future in order to generate the correct cash flows and perform other life cycle events on schedule and there is no easy way to do it on a platform like Ethereum’s.CREDITS contracts also supports API, which allows to connect from smart contracts to other outside systems, and you can't do that directly with Ethereum's contracts.

Use Cases & Roadmap

Some of the use cases are:

1.Financial and Banking Systems-financial institutions will be able to significantly reduce their transaction costs, exclude intermediaries while simulataneously securely protecting their data.

2. Internet of Things IoT- The CREDITS platform and smart contracts will allow for the connection of various IoT devices into a single network and effectively manage them: smart cities, smart homes, smart cars, smart businesses etc.

3. Crediting- Credit robots will be able to issue loans with the most optimal terms, regardless of countries and continents. Globally, with any person in any country through the CREDITS platform.

4. Insurance, Medicine, Tourism, Logistics,Online Games...-you can find more about those on their website.

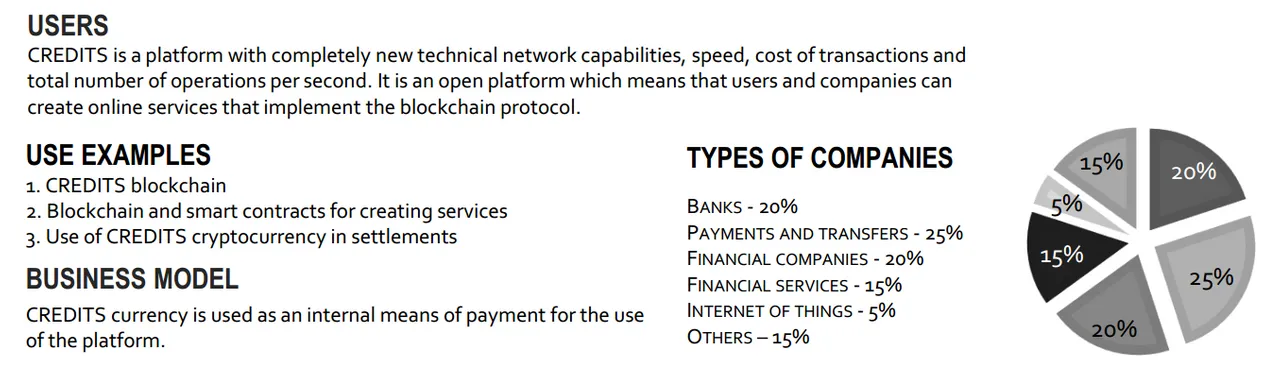

Their main focus is in financial industry as you can see at the picture below(from their '3-page teaser')

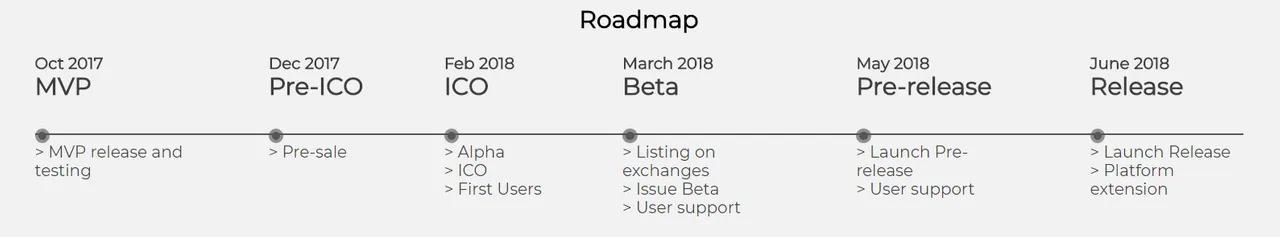

Their roadmap(you can see more about each version on their website):

Team, Strategy, Concerns & Conclusion

They have big project team which includes two advisors from IBM(you can see at their website),they also have legal audit from Consilium Law Corporation and technical audit from Entersoft(they are acknowledged by over 50 brands for responsible disclosure, including Microsoft,Yahoo,Lenovo...) and they registered company in Singapore(like many others do, since it is business friendly and has low tax regime...).They already have 100+ users(companies) that are ready to implement CREDITS platform for developing their DAPP services on the blockchain system.

With these abilities(if they deliver on what they're promising), CREDITS could definitely be used both as a platform and as currency but at first they will promote it only as a platform and focus on increasing popularity of their platform for developing services and they won't compete with Ethereum for ICOs(as Ethereum takes almost whole market) but later they will(and possibly promote it as a currency also).

Now, there are some concerns whether they will succeed to deliver on what they are promising and how will their new consensus protocol based on DPoS + BFT perform and some people are concerned because their code is not published on GitHub(they stated that after they finish developing it they will publish it, you can find more about it on https://medium.com/@credits/were-frequently-asked-why-we-still-haven-t-shared-our-program-code-on-github-c8672ac39bbb or watch interview at 52:00).

I think that it is definetely not a scam(as some are claiming) and yes we don't know whether they will deliver on what they are promising, but based on their alpha version(3 products:node,monitor and wallet-similiar to myetherwallet) and it's current results, I believe they will succeed. Even if they don't, I think it may reach much higher price than it is now, as they get noticed more in crypto community(e.g. as bigger Youtube channels start talking about it...) and they start more actively promoting it(they haven't run any big marketing campaign for ICO, and instead they went on more than 20 conferences...) and hype creates around it(it is worth mentioning that e.g. EOS has $5,386,203,546 USD market cap and they are still in a testing phase, as CREDITS is...and many coins have high prices without a working product).To finish, I will say that I haven't invested yet, but I will as soon as I have some spare money because I think that it is very good buying opportunity and if You are also planning to invest, as always do your own additional research and don't invest more than you are willing to lose :)

NOTE-They just got listed on KuCoin exchange.

Useful Links

Website https://credits.com/en

Message Board https://medium.com/@credits

Telegram Chat https://t.me/creditscom

Twitter https://twitter.com/creditscom

Coinmarketcap https://coinmarketcap.com/currencies/credits/#charts