Introduction

In my daily and weekly update, I have said that I am expecting another low, as the consolidating triangles where formed on all of the major cryptos.

These are the charts from this morning:

BTC/USD

ETH/USD

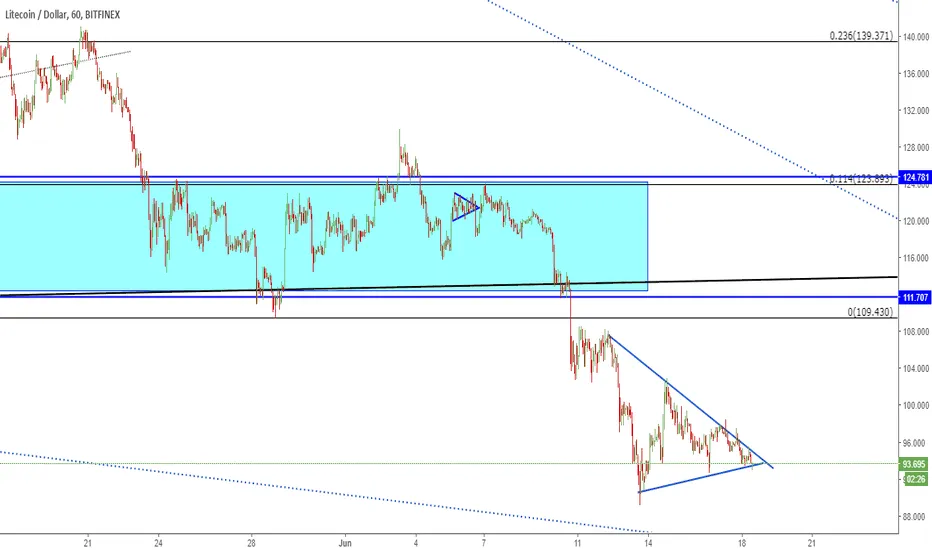

LTC/USD

As you can see all of the cryptos are strongly correlated, and the chart pattern that I was expecting is called a bearish pennant and is knows as a continuation pattern.

After a steep decline, a price consolidates usually in a symmetrical triangle before it continues to go down.

However, this didn’t happen, which caught me off guard. As I have searched for news and other relevant factors and I have found nothing that could significantly impact the market, which leads me to believe that this current rise cryptos are experiencing is fake.

My takeaway

Check out the correlation. This price action cannot be real, as demand cannot be this correlated. If you scroll down the coinmarketcap you will see that this pattern is everywhere.

This all leads me to believe that there some kind of manipulation going on, or not manipulation in the strict sense that whales are pushing the price, but what I think its currently going on is certainly linked to exchanges.

Last time we have seen this fake rise was on 12.04.2018 and it was a ‘short squeeze’.

A short squeeze is a situation in which a heavily shorted stock or commodity moves sharply higher, forcing more short sellers to close out their short positions and adding to the upward pressure on the stock. It implies that short sellers are being squeezed out of their short positions, usually at a loss, and is generally triggered by a positive development that suggests the stock may be embarking on a turnaround. Although the turnaround in the stock’s fortunes may only prove to be temporary, few short sellers can afford to risk runaway losses on their short positions and may prefer to close them out even if it means taking a substantial loss.

On the chart below I have compared the BTC/USD short vs longs on Bitfinex exchange and labeled the 12.04.2018 with a rectangle.

As you can see from the chart, short positions suddenly dropped while longs suddenly rose and are now intersecting similarly like last time.

Looking at the Bitcoin chart you can see how this impacted the price last time and that Bitcoin went on to almost 10k. But as this rise was fake and demand has only short-lived, the price eventually came back to the levels of prior lows from which it rose, and then went even lower.

Conclusion

We are currently seeing a similar price action, which leads me to believe that something similar is about to happen. This situation is very peculiar as it came after days of stagnation, and I think this is an artificial rise whose purpose is to signal that the bottom is in, as indecision was starting to rule the market. Those who are not aware of this may get burned as I am pretty confident the price is of Bitcoin is going lower than the current low at 6100$ considering the amount of resistance that is above 6700$ level. Be aware and careful in the following days.