Monday | 31th December 2018

Monday | 31th December 2018

Everyday is a Potential Payday if you Master the Art of Trading - Daniel Ang

Good Day all my beloved students & steemians. Inside this daily commentary I will share the short-term technical outlook and trade ideas for Bitcoin, Ethereum and Litecoin.

Previous commentary refer here: http://bit.ly/btcethltc281218

Previous commentary refer here: http://bit.ly/btcethltc281218

My core strategies refer here: http://bit.ly/taicorestrategies

My core strategies refer here: http://bit.ly/taicorestrategies

WARNING

WARNING

Do not attempt to use any of the trade ideas contained within unless you have attended my classes and understood the risk and money management behind these ideas.

Full Disclaimer refer here: http://bit.ly/tai-disclaimer

Full Disclaimer refer here: http://bit.ly/tai-disclaimer

Want to own Bitcoin rather than ETF trading, check the two link below:

Honey Miner : https://honeyminer.com/referred/59hvc

Honey Miner : https://honeyminer.com/referred/59hvc

CryptoTab : https://get.cryptobrowser.site/2402149

CryptoTab : https://get.cryptobrowser.site/2402149

You can also follow my FITS:

You can also follow my FITS:

Facebook - http://bit.ly/danielang_fbpg

Instagram - http://bit.ly/danielang_ig

Twitter - http://bit.ly/danielang_twitter

Steemit - http://bit.ly/danielang_steemit

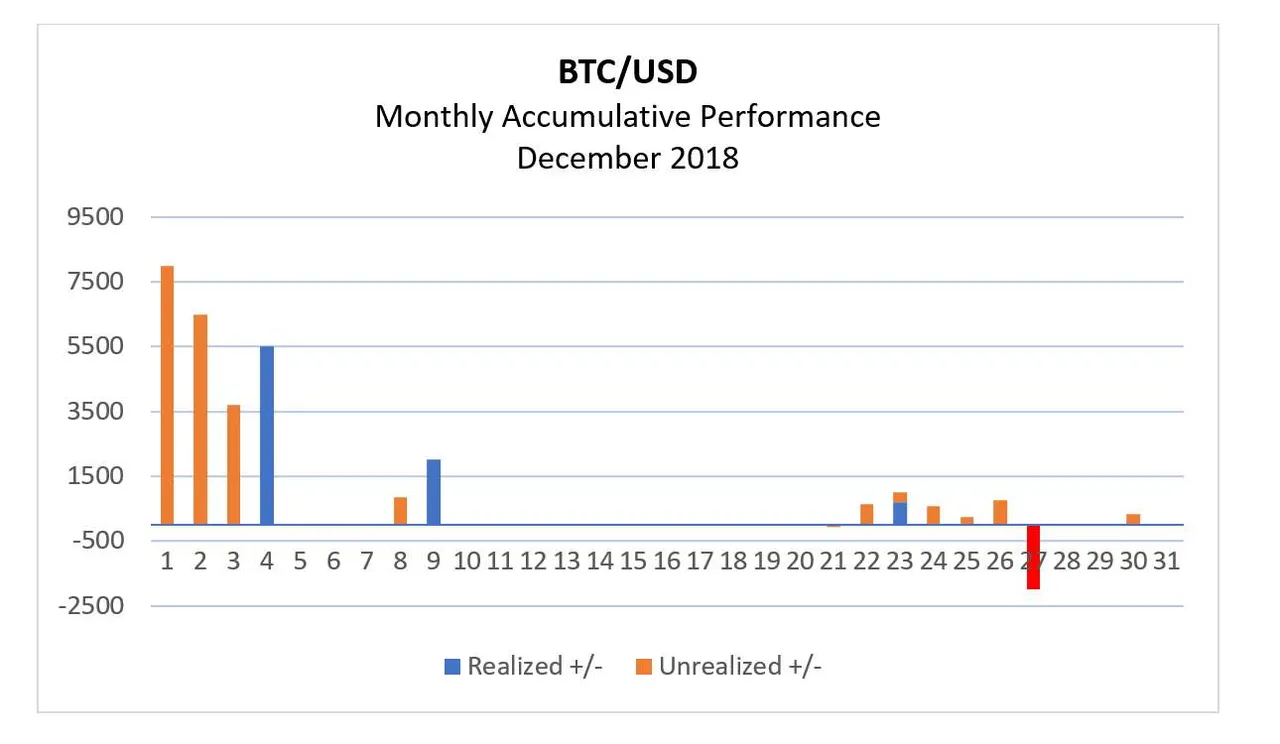

BTC/USD

Other than the slightly more than $250 drop from near the week’s high to $3677.06 on Saturday, nothing material happened over the weekend.

Since then, BTC had recovered more than half of this Saturday’s losses. Structurally, it is possible the corrective decline from $3938.18 could be over, and the near-term bias is for a resumption of the rally from the year’s low of $3113.80 which was registered on December 15.

If so, we could see a sustained rise from near current level towards $172.15. The other possibility is further consolidation but regardless of what happen next, $3575.50 should hold.

TRADE IDEAS

TRADE IDEAS

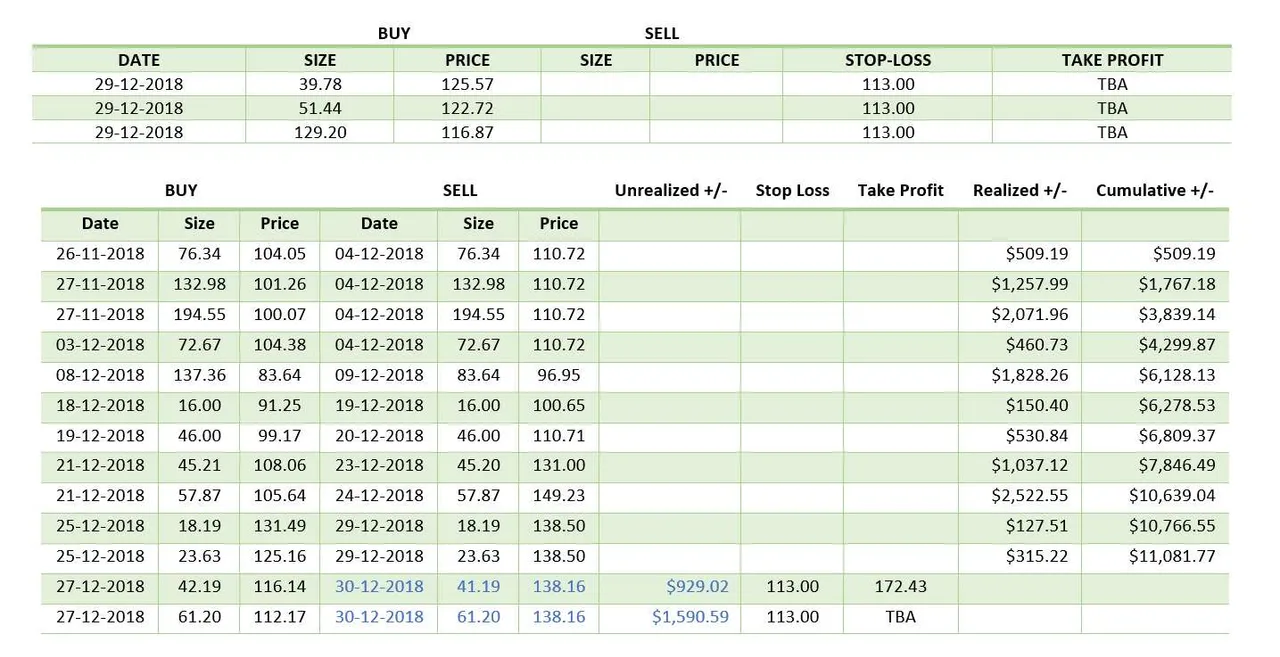

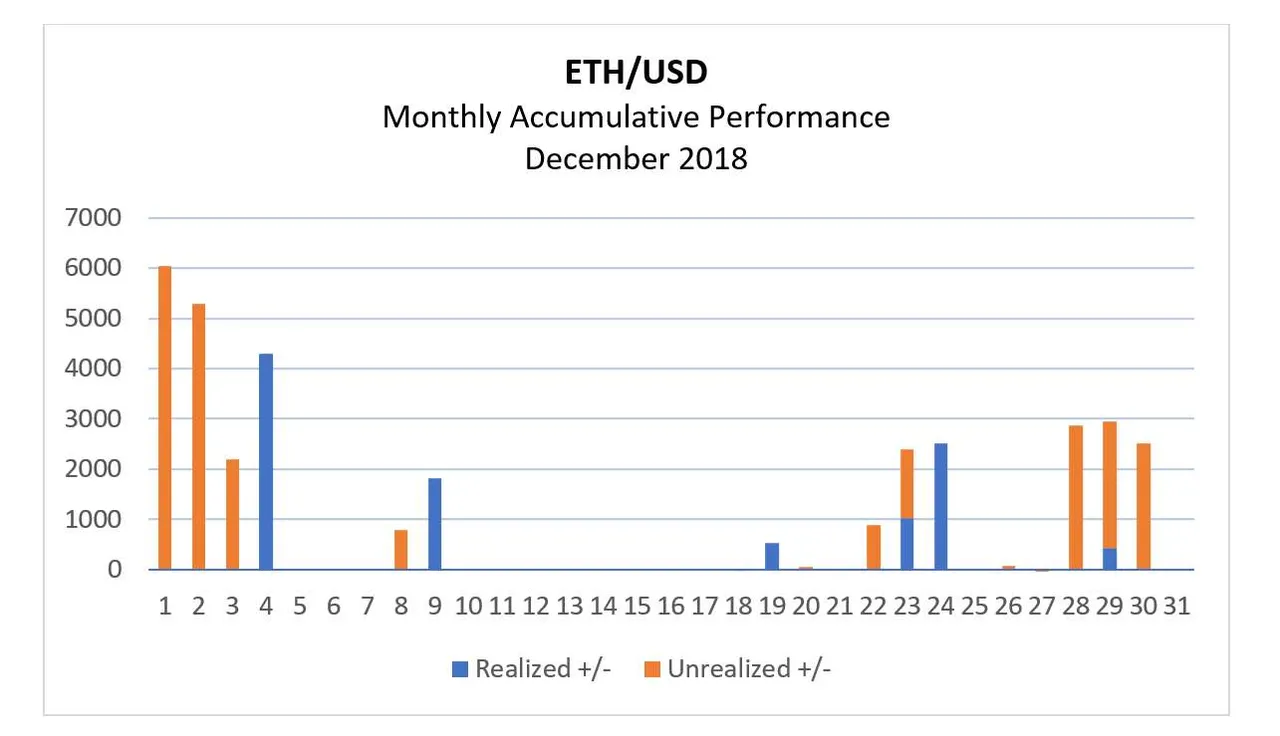

ETH/USD

ETH/USD

While there was no attempt to rally in BTC, ETH managed to edge higher to $146.26 on Saturday before meeting determined profit-taking from within the supply zone at $144.89 - $147.73 which probably caused the $151 drop in BTC.

Going forward, near-term bias for ETH is for the resumption of the reversal from the December 14 low of $80.57. If this is the case, the next move could be a sustained rally towards $172.15. On the flip side, we may see further consolidation, but the overall near-term direction in ETH is clear.

ETH had turned a prominent corner on December 14, and a significant reversal is in the card.

TRADE IDEAS

TRADE IDEAS

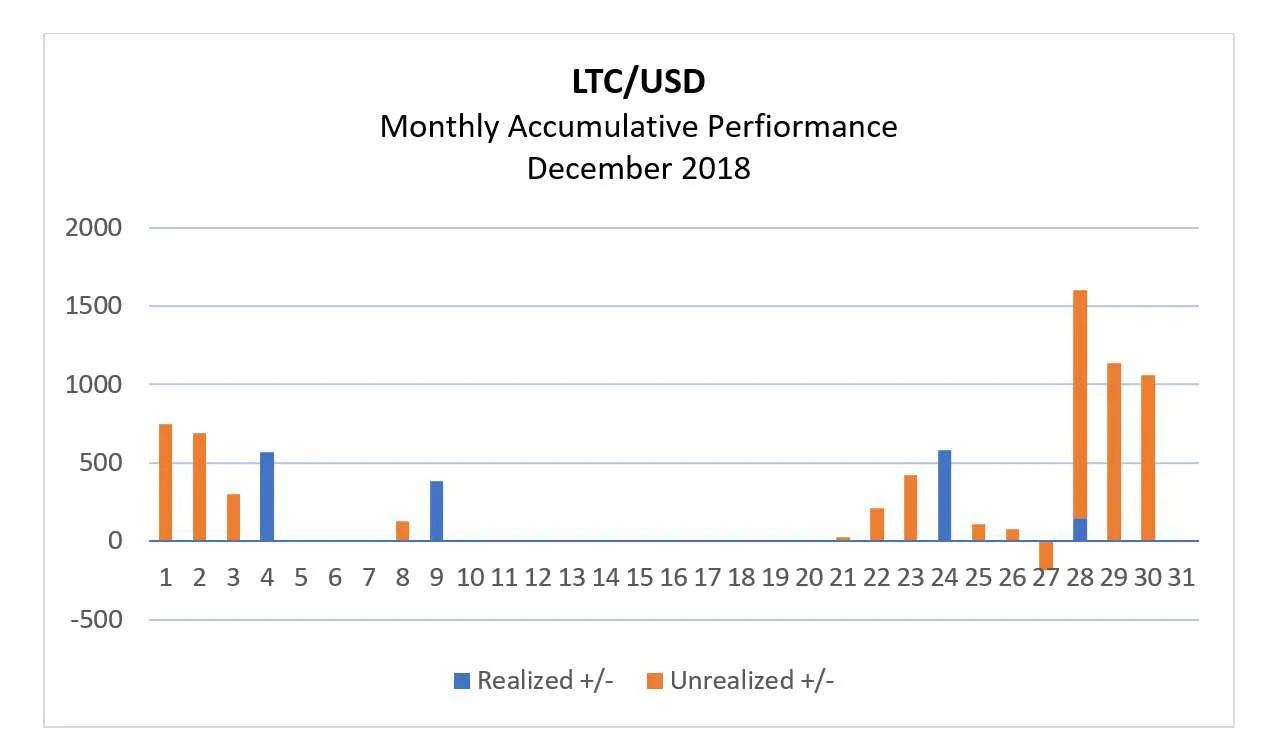

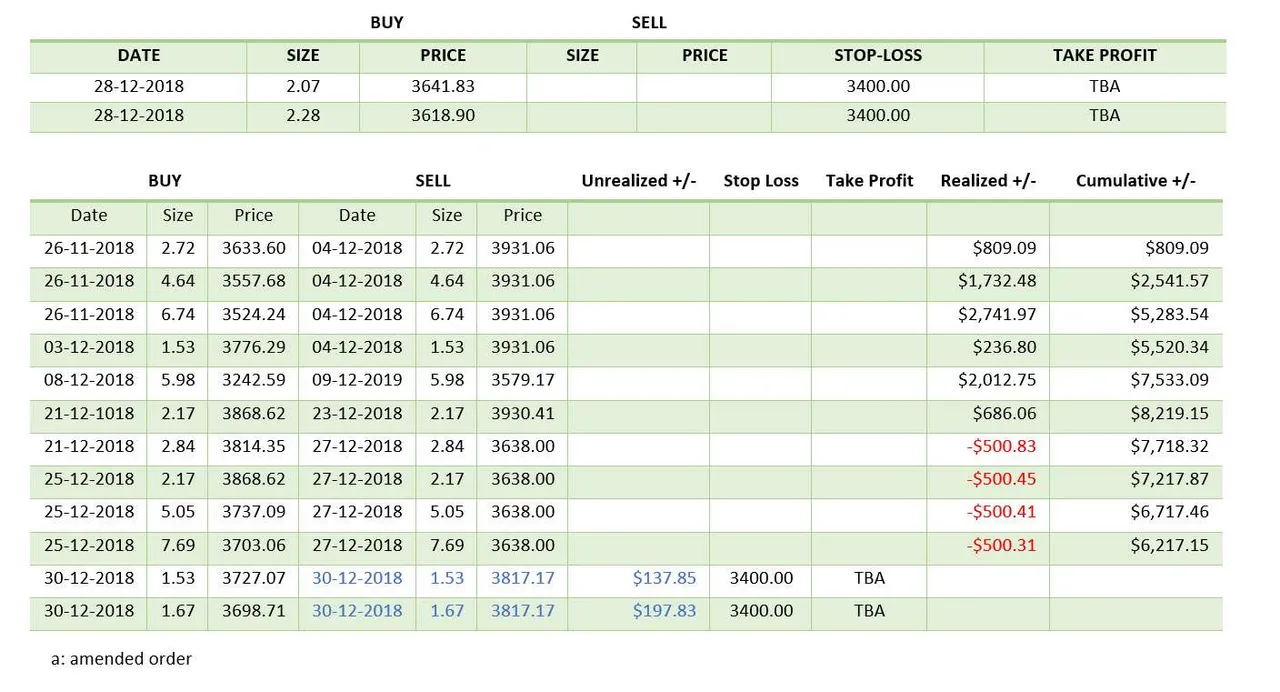

LTC/USD

LTC/USD

Like BTC, LTC failed to register a new high over the weekend. Instead, it came under profit-taking just below the week’s high of $33.29; shedding some $3.00 to $29.81 on Saturday before clawing back half of its losses shortly after.

Just like BTC and ETH, LTC too appears to had bottomed out at $22.08 on December 7. Going forward, LTC is expected to resume its rise from the mid-December low of $22.09 towards $39.50 to possibly the minor supply zone at $40.07 - $40.61.

If, however, LTC dips lower, this may allow the re-positioning of earlier long positions. Either way, buying on dips is the game plan.

TRADE IDEAS

TRADE IDEAS