Cryptocurrencies Outlook | BITCOIN

Monday, 16th July 2018

Note: I use New York Close Chart for all my Trading Analyze.

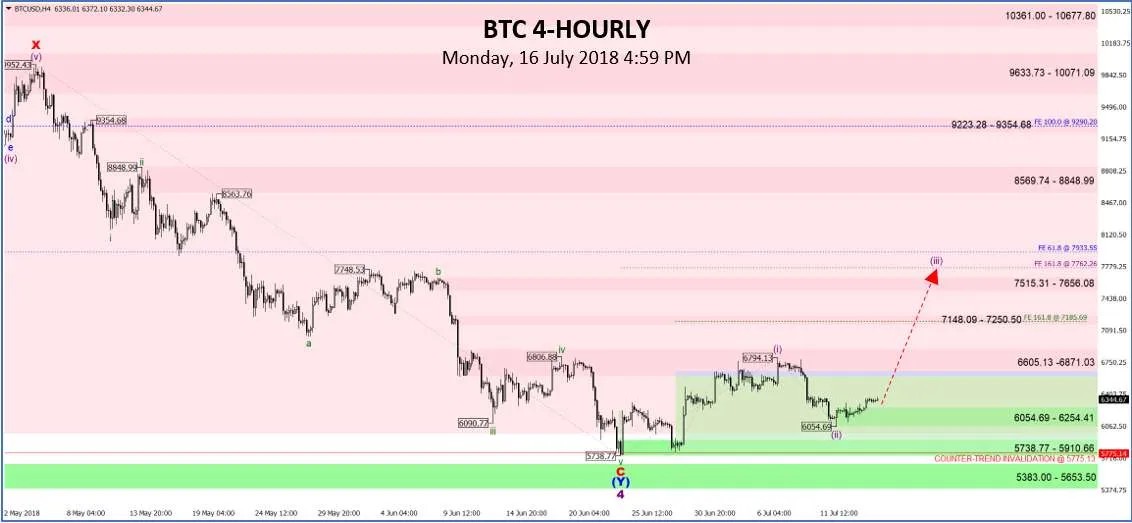

BTC/USD

Overall, the rebound in BTC is developing nicely despite the deep pullback from the July 8 high of 6794.80.

In fact, 10 days ago, this nascent counter-trend that first developed in the hourly time frame on June 24 was also confirmed in the daily time frame.

Now we have three separate time frames that confirmed this counter-trend rise – bolstering the near to medium-term bullish bias.

Going forward, if 5738.77 holds, odds favor continued strengthening of BTC. In the daily time frame, the major hurdle is the counter-trend line from 11734.82.

In the 4-hourly time frame, the initial push higher in the counter-trend rise was capped at the supply zone at 6605.13 – 6871.03.

While the pullback from there was rather deep, it is still within the counter-trend parameter.

In so long as 5775.14 holds, bias is still to the upside.

In terms of wave count, it is possible, BTC is getting ready for a push higher having completed an (i), (ii) sequence from 5738.77 to 6794.13 from 6054.69.

If the count is correct, we could be seeing a rally towards 7762.26 or at the supply zone at 7515.31 – 7656.08 in the days ahead.

In the hourly time frame, the decline from 6794.13 has probably bottomed out at 6054.69 last Thursday.

The initial surge from there suggested buying interests are back in the market.

However, the supply zone at 6036.03 – 6383.62 is proving to be a rather solid barrier so far. A breach of this barrier is crucial; failing which profit-takings may set in once again.

In the event that this barrier is breached, the next barrier is located at 6544.17 – 6590.20.

Going forward, if the wave count is correct, we could see an aggressive surge above the 7000 level towards the 7500-7600 target zone in the current installment as depicted in the 4-hourly time frame.

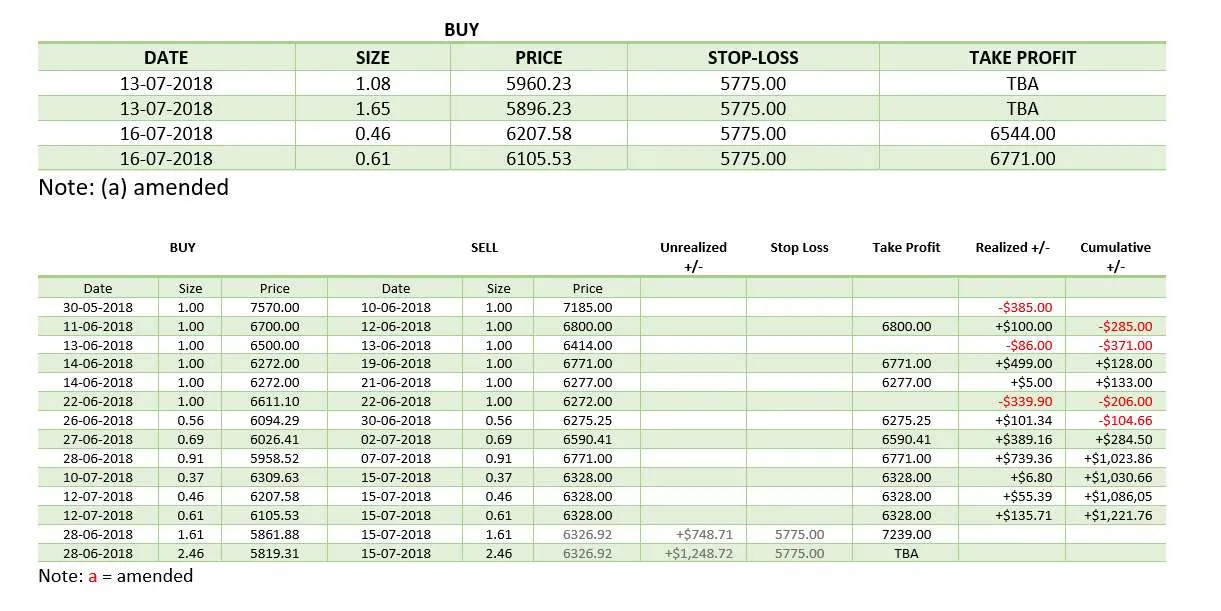

TRADE IDEAS

Follow Me

Disclaimer:

Any Advice or information on this blog is General Advice Only. It does not take into account your personal circumstances, please do not trade or invest based solely on this information.

By Viewing any material or using the information within this blog you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by Traders Academy International, it's employees, directors or fellow members. Futures, Options, Index, Cryptocurrency, Commodity and Spot Currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in those markets. Don't trade with money you can't afford to lose. This blog is neither a solicitation nor an offer to Buy/Sell Futures, Spot Currency, CFD's, Options or other financial products. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this blog. The past performance of any trading system or methodology is not necessarily indicative of future results.

High Risk Warning:

Futures, Options, Index, Cryptocurrency, Commodity and Spot Currency Trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in Futures, Options, Index, Cryptocurrency, Commodity and Spot Currency trading and be willing to accept them in order to trade in these markets. Futures, Options, Index, Cryptocurrency, Commodity and Spot Currency trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this blog is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results.