Thursday | 10th January 2019

Thursday | 10th January 2019

Everyday is a Potential Payday if you Master the Art of Trading - Daniel Ang

Good Day all my beloved students & steemians. Inside this daily commentary I will share the short-term technical outlook and trade ideas for Bitcoin, Ethereum and Litecoin.

Previous commentary refer here: http://bit.ly/btcethltc090919

Previous commentary refer here: http://bit.ly/btcethltc090919

My core strategies refer here: http://bit.ly/taicorestrategies

My core strategies refer here: http://bit.ly/taicorestrategies

WARNING

WARNING

Do not attempt to use any of the trade ideas contained within unless you have attended my classes and understood the risk and money management behind these ideas.

Full Disclaimer refer here: http://bit.ly/tai-disclaimer

Full Disclaimer refer here: http://bit.ly/tai-disclaimer

Want to own Bitcoin rather than ETF trading, check the two link below:

Honey Miner : https://honeyminer.com/referred/59hvc

Honey Miner : https://honeyminer.com/referred/59hvc

CryptoTab : https://get.cryptobrowser.site/2402149

CryptoTab : https://get.cryptobrowser.site/2402149

You can also follow my FITS:

You can also follow my FITS:

Facebook - http://bit.ly/danielang_fbpg

Instagram - http://bit.ly/danielang_ig

Twitter - http://bit.ly/danielang_twitter

Steemit - http://bit.ly/danielang_steemit

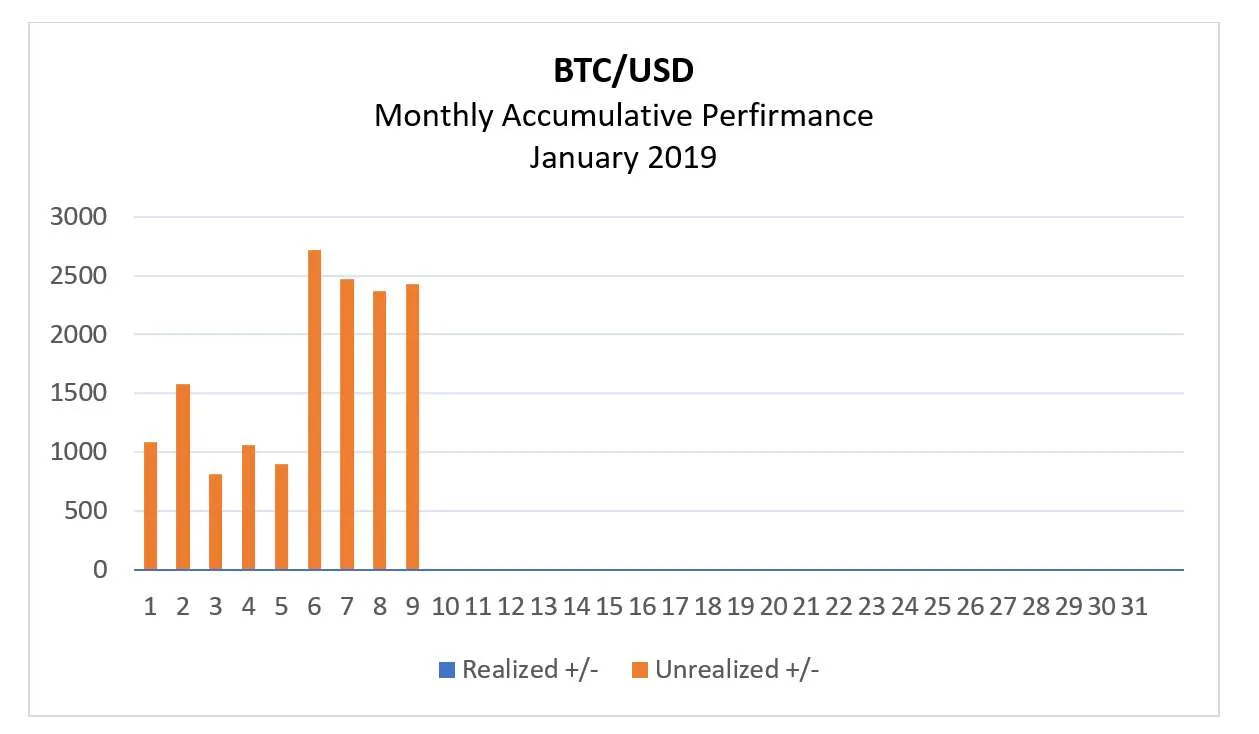

BTC/USD

There is no change in outlook as BTC remains very much in consolidation mode. Regardless, BTC remains on course to edge higher to challenge the Christmas Eve high of $4219.16 next.

If so, another round of profit-taking is expected to emerge from within the supply zone of $4184.78 - $4247.38 (see hourly time frame).

Over the medium-term, as expressed by the 4-hourly chart, the entire rally from $3113.80 may extend towards $5262.00 and perhaps into $5485.50 - $5636.63 before a more robust correction sets in.

TRADE IDEAS

TRADE IDEAS

ETH/USD

ETH/USD

Trading was very subdued across the crypto space in the last 24 hours and ETH is no exception. As noted in recent updates, there is a risk ETH may dip into the minor demand zone at $143.86 - $144.75 before resuming its climb.

Regardless, the next phase could be an aggressive rally towards $181.01. If this rise can be sustained beyond this level, an eventual rally to $239.30 is anticipated (see 4-hourly chart).

TRADE IDEAS

TRADE IDEAS

LTC/USD

LTC/USD

Among the three assets tracked, LTC lost further ground in yesterday’s trading but by and the immediate demand zone at $36.82 - $37.61 is expected to hold.

From there, the medium-term rally should resume with targets at $41.54 and $50.28 respectively.

TRADE IDEAS

TRADE IDEAS