If you’re new to the Bitcoin space, the last few months have been pretty crazy. There have been some steep climbs and heart-stopping drops making for a roller coaster of emotion that’s not easily controlled. The price action is both thrilling and at times, painful, so it’s easy to lose sight of what you’re investing in. All the coins seem to be running together, so what’s the difference? How is one coin to be distinguished from another? And more importantly, how is an investor to know what the long term value of a coin will be?

In this article, I’m going to make the case for what makes Bitcoin different, how Bitcoin is a system that, despite all the cloning, has yet to be truly replicated.

Real Innovation

To really understand the value proposition of Bitcoin, it helps to look at a bit of history. It’s tempting to think that the newest ICO or altcoin is the one that will finally “improve” Bitcoin and fix all of its problems and that Bitcoin will be relegated to the dustbin of history due to its lack of some “feature”. Indeed, nearly every altcoin, ICO or hardfork thinks that they’re being innovative in some fundamental way. What’s missed is that the biggest innovation has already happened.

Decentralized digital scarcity is the real innovation and Bitcoin was the first, and, as this article will make clear, continues to be the only such coin. All the other so-called innovations such as faster confirmation times, changing to proof-of-whatever, Turing completeness, different signature algorithm, different transaction ordering method and even privacy, are really tiny variations on the giant innovation that is Bitcoin.

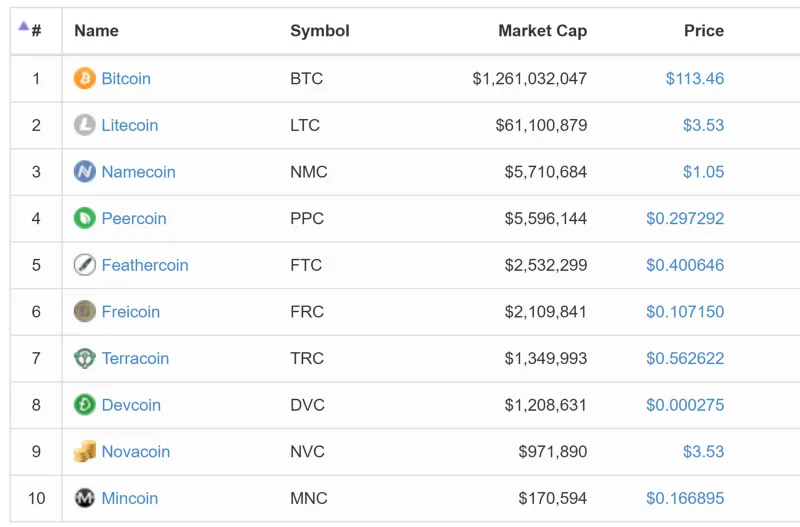

It’s important to remember here that alternatives to Bitcoin have been proposed since 2011 and none of them have even come close to displacing Bitcoin in terms of price, usage or security. IxCoin was a clone of Bitcoin created in 2011 with larger block rewards and a premine (large number of coins sent to the creator). Tenebrix was an altcoin created in 2011 that tried to add GPU resistance and again had a large premine. Solidcoin was another altcoin created in 2011 with faster block times and again, a premine. About the only ones that survived (and not living out a zombie existence) out of that early altcoin era are Namecoin and Litecoin, which distinguished themselves by NOT having a premine.

CoinMarketCap circa May 2013

CoinMarketCap circa May 2013

ICOs are also not new. Mastercoin did an ICO in 2013 with, you guessed it, a premine, and raised over 5000 BTC at the time and had to rebrand themselves to Omni because the ecosystem around it was so anemic. Factom did an ICO in 2015 and raised over 2000 BTC and had to raise multiple rounds of additional financing because they ran out of money. In other words, all these “exciting” new tokens have generally done very poorly and didn’t actually provide much utility.

Altcoins and ICOs have tried many different “features” and most have not been useful or adopted. So what gives? Why does Bitcoin seem to have a special place in the ecosystem? Why is Bitcoin different? We explore two unique aspects that make Bitcoin different than everything else: the network effect and decentralization.

The Network Effect

Because Bitcoin has the largest network and gains from the network effect, other coins essentially are playing a giant game of catch-up. Bitcoin is the 7-day week and every other altcoin is a slight variation (Let’s have 4-day weeks! Let’s make the day 18 hours! Let’s rename the days to something different! Let’s vary week lengths according to the whims of a central authority!) Needless to say, these types of “innovations” are, at best, minor and are generally not adopted. This is because the network effect of Bitcoin grows over time and the people using the network optimize toward the standards of the network, locking more and more people in.

As the network grows, what we see is that subtle, unseen benefits accrue to each norm. What may, on the surface seem inefficient actually has second and third order effects that benefit the people conforming to the norm. For example, a car does not fly or go on water because the car has been optimized for use on solid ground. The lack of extra features makes the car more useful since it’s easier to park (smaller size than a theoretical boat/car/plane hybrid), cheaper to maintain and get fuel for, etc.

In addition, these norms have withstood the test of time and have proven their resilience in ways that are not obvious. You would not want to be the first person to fly in a car/plane hybrid, for example, because you wouldn’t know how safe such a vehicle is. Something that’s been around has proven its relative security. Bitcoin, in a sense, has the world’s richest bug bounty to reveal any security flaws. As a result, Bitcoin has proven its security with the only thing that can really test it: time. Every other coin is much younger and/or has proven to be less secure.

Indeed, the dubious nature of many of these “features” become obvious over time. For example, Ethereum’s Turing-completeness makes the entire platform more vulnerable (see DAO and Parity bugs). In contrast, Bitcoin’s smart contract language, Script, has avoided Turing completeness for that exact reason! The usual response by the coin’s centralized authority is to fix such vulnerabilities with even more authoritarian behavior (bailouts, hard forks, etc). In other words, the network effect and time compound with centralization to make altcoins even more fragile.

Bitcoin has the largest network and that means that Bitcoin grows in utility simply from having the most users. It’s a lot easier to get accessories for a popular phone than an unpopular one, for example. The ecosystem around Bitcoin makes getting and keeping Bitcoin much easier than say, your altcoin or ICO of the week.

Decentralization

The other main property of Bitcoin that no other coin has is decentralization. By decentralized, I mean that Bitcoin does not have a single point of failure or choke point. Every other coin has a founder or a company that created their coin and they have the most influence over the coin. A hard fork (a backwards incompatible change) that’s forced on the user, for example, is an indication that the coin is pretty centralized.

Centralized coins have the “advantage” of being able to change things quickly in response to market demand. Centralization is certainly a good thing for businesses as they are often trying to make a profit by providing some good or service to their customers. A centralized business can better respond to market demand and change what they sell for better profits.

For money, however, centralization is a bad thing. First, one of the main value propositions for a store of value is in being something that doesn’t change qualitatively (aka immutability). A store of value requires that its qualities stay the same or get better over time. A change that undermines its qualities (e.g. inflation of supply, decreasing of acceptance, change of security) drastically changes the utility of money as a store of value.

Second, centralization of currency has a tendency to change the rules, often to catastrophic effect. Indeed, 20th century economics is the story of central banks slowly degrading fiat money’s store of value utility. The average fiat currency has a lifespan of 27 years for this reason, despite the backing of powerful entities like governments and near universal usage within an entire country as a medium of exchange. “Features”, ability to react quickly and usage simply do not matter nearly as much to the survival of a currency as scarcity and immutability.

Every cryptocurrency and ICO other than Bitcoin is centralized. For an ICO, this is obvious. The entity that issues the ICO and creates the token is the centralized party. They issued the coin and thus can change the token’s usage, alter the coin’s incentives or issue additional tokens. They can also refuse to accept certain tokens for their good or service.

Altcoins have the same problem, though not in such an obvious way. Usually the creator is the de facto dictator for the coin and can do the same things that a government can. Taxes (dev tax, storage tax, etc), inflation, picking winners and losers (DAO, proof-of-X change, etc) are often decided by the creators. As a holder of an altcoin, you have to trust not just the current leader, but all future leaders of the coin to not confiscate, tax away or inflate away your coins. In other words, altcoins and ICOs are not qualitatively different than fiat. In altcoin and ICO-land, you are not sovereign over your own coins!

This is particularly acute in the biggest “competitor” to Bitcoin: Ethereum. By any measure, Ethereum is centrally controlled. Ethereum has had at least 5 hard forks where users were forced to upgrade. They’ve bailed out bad decision making with the DAO. They are now even talking about a new storage tax. The centralized control was shown early in their large premine.

Bitcoin is different. One of the greatest things that Satoshi did was disappear. In the early days of Bitcoin, Satoshi controlled a lot of what was developed. By disappearing, we’ve now got a situation where parties that don’t like each other (users of various affiliations) all have some say in how the network is run. Every upgrade is voluntary (i.e. soft forks) and does not force anyone to do anything to keep their Bitcoin. In other words, there’s no single point of failure. Bitcoin has a system where even if a whole group of developers got hit by a bus, there are multiple open source implementations that can continue to offer choices to every user. In Bitcoin, you are sovereign over your own bitcoins.

This is a very good thing as there’s no central authority that can diminish the utility of your coins. That means Bitcoin is actually scarce (instead of theoretically or temporarily scarce), won’t change qualitatively without everyone’s consent and is thus a good store of value.

Conclusion

You might be wondering at this point: but there are so many altcoins and they’re starting to eat into Bitcoin’s market cap! First, market cap is a heavily manipulated metric. Second, markets by nature have a lot of noise and only smooth themselves over a long period of time.

Because of the network effect and decentralization, Bitcoin is different than all the pretenders to the throne. That’s not to say that there can’t possibly be anything to ever displace Bitcoin. Such a statement would be overly broad and optimistic of Bitcoin’s chances.

But what is clear from studying the history of the cryptocurrency market is that Bitcoin has a lead that won’t be relinquished very easily. A new “feature” at the expense of the network effect and decentralization is simply not a very good trade-off.

What would it take to displace Bitcoin? Most likely an innovation at least as big as Bitcoin itself or a bug that makes Bitcoin insecure. Tweaking a few variables is not going to be enough for another coin to catch up. Even adding a big feature (e.g. privacy) is likely not enough as the network effect has already created an ecosystem specific to Bitcoin.

Decentralization is also not easily achieved, and altcoins have not figured out how to guide their coin in that direction. Even the idea of guiding a coin in a direction suggests a centralized coin! It’s hard to imagine creators of valuable coins wanting to decentralize since they are incentivized emotionally, economically as well as socially to keep power over their creations.

Bitcoin is different because unlike altcoins, Bitcoin created a new category and has the network effect as a result. Bitcoin will continue to be different because unlike centralized coins, it’s market driven, immutable and unseizable. These happen to be the properties of a great store of value and this gives Bitcoin a utility that no other token has.

As hopeful investors, it’s tempting to believe that we’ve found an altcoin or ICO that will improve on Bitcoin and thus make us early adopters in the revolution. Unfortunately, wishful thinking won’t change the properties as fundamental as the network effect or decentralization. Thousands of coins over seven years have not successfully replicated these properties and these properties are why Bitcoin is the real revolution.