BlockFi is proud to be transparent with our customers and offer a run through of how our loans work and exactly what to expect when taking out and paying for a BlockFi loan. In this post, we’re going to break down a sample loan for you to see exactly what a loan with us would look like.

credit: istockphoto

Loan Example

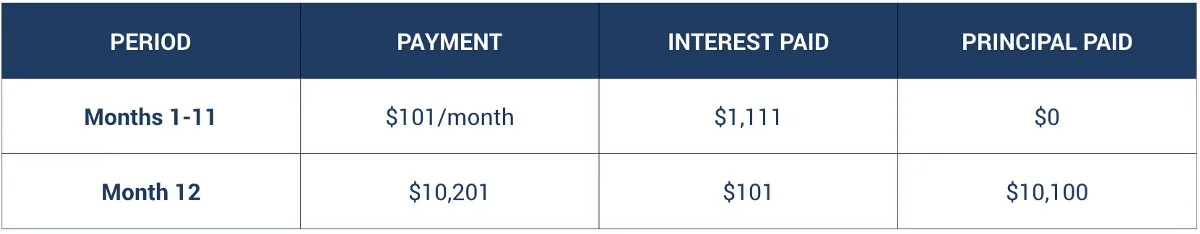

Let’s look at an example of borrowing $10,000, collateralized by Ether.

We will use the following terms which are current as of March, 2018.

Interest Rate: 12%

Origination Fee: 1%

Loan to Value: 35%

Ether Price: $800

Monthly Payment: $101

To receive a loan of $10,000 you would need to post 36.07143 Ether as collateral.

The origination fee is added to the loan balance, so you would receive $10,000 to your bank account and have a loan balance of $10,100 with BlockFi. From there, you make 11 monthly interest-only payments of $101 and a final payment of your principal balance of $10,100, plus your last month of interest.

Loan to Value Ratio

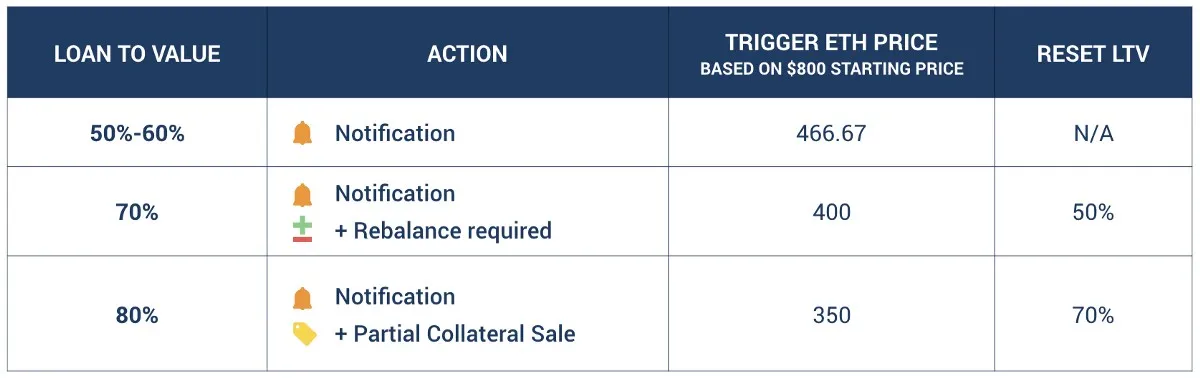

Loan to value ratio is calculated as Loan Amount divided by Collateral Value. We lend at a 35% initial loan to value ratio because our risk modeling determined that this was a sufficiently conservative rate — in order to have a limited number of expected trigger events and provide our clients with breathing room in the event of market volatility.

If the price of Ether declines throughout the course of the loan, BlockFi may take actions to protect its position as a lender. There are two important Loan to Value trigger event — at 70% and 80%. The trigger event actions are as follows:

If a rebalance is required, customers will have a period of time, typically 24–72 hours to post additional collateral or pay down principal in USD to recollateralize their loan. If no action is taken, BlockFi will sell enough collateral to rebalance the loan to a 50% LTV. If during this period the 80% LTV trigger is hit, and a Partial Collateral Sale is required, BlockFi will sell enough collateral to rebalance the loan to a 70% LTV.

We will always keep you in the loop through automated communication via your preferred channel(s). Our platform monitors fluctuations in the value of your cryptoassets by the minute. Should prices drop materially, we have notification triggers in place to protect you and your cryptoasset position. You also have the option to collateralize your loan above our initial LTV at any time.

We’re proud to offer the best rates, most flexible structures and highest degree of security available in the cryptocurrency lending ecosystem.

If you have any questions or would like to learn a bit more about BlockFi, please don’t hesitate to reach out. We couldn’t be more excited at the prospect of working with you! 💙 The BlockFi Team

Twitter - https://twitter.com/TheRealBlockFi

Facebook - https://www.facebook.com/BlockFi/

Telegram - https://t.me/joinchat/I3R7WlHo-dMexqdwCDE2_A