SEC Commissioner Disagrees with Agency’s Winklevoss Bitcoin ETF Rejection

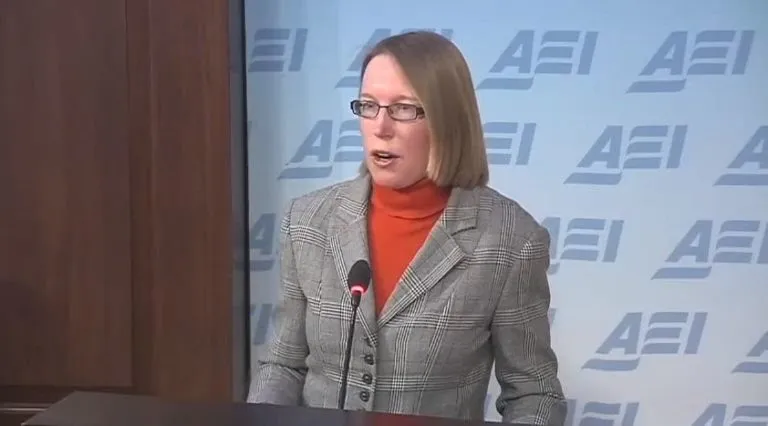

SEC Hester Peirce Bitcoin ETF

Featured Image from American Enterprise Institute/YouTube

Advertisement

The Securities and Exchange Commission (SEC) on Thursday shot down the Winklevoss brothers’ bid to bring the first bitcoin ETF to a regulated U.S. exchange, dashing the hopes of many investors that the agency was warming to this nascent asset class. Notably, though, that ruling was not only controversial among cryptocurrency enthusiasts but also within the SEC itself.

Commissioner Says SEC Exceeded Authority in Denying Bitcoin ETF

Writing in a formal dissent published on the agency’s website, SEC Commissioner Hester M. Peirce argued that officials not only erred in denying the Winklevoss ETF but also exceeded the limited scope of the agency’s role in regulating securities markets. Specifically, she alleged that the agency allowed the state of the underlying bitcoin spot markets to carry too much weight in how it ruled on the Winklevoss Bitcoin Trust.

She wrote:

“The Commission’s mission historically has been, and should continue to be, to ensure that investors have the information they need to make intelligent investment decisions and that the rules of the exchange are designed to provide transparency and prevent manipulation as market participants interact with each other. The Commission steps beyond this limited role when it focuses instead on the quality and characteristics of the markets underlying a product that an exchange seeks to list.”

Peirce, a Trump administration appointee who took office in Jan. 2018, criticized the agency for engaging in “merit regulation.” The jury may still be out on whether cryptocurrency will prove to be long-term viable, she said, but it is not the SEC’s job to attempt to peer into the future and divine whether the bitcoin experiment ultimately succeeds or fails.