COVID19 has brought uncertainty to every sector. The financial industry has not been spared. There are vital concerns that are emerging for the Banking & Capital Markets. Economics Summit 2020, held on 2 November 2020, gathered a panel of industry experts to discuss current challenges and share future insights on the topic. Anndy Lian, one of the panelists, shared insights on Central Bank Digital Currencies (CBDC) and its form in the future.

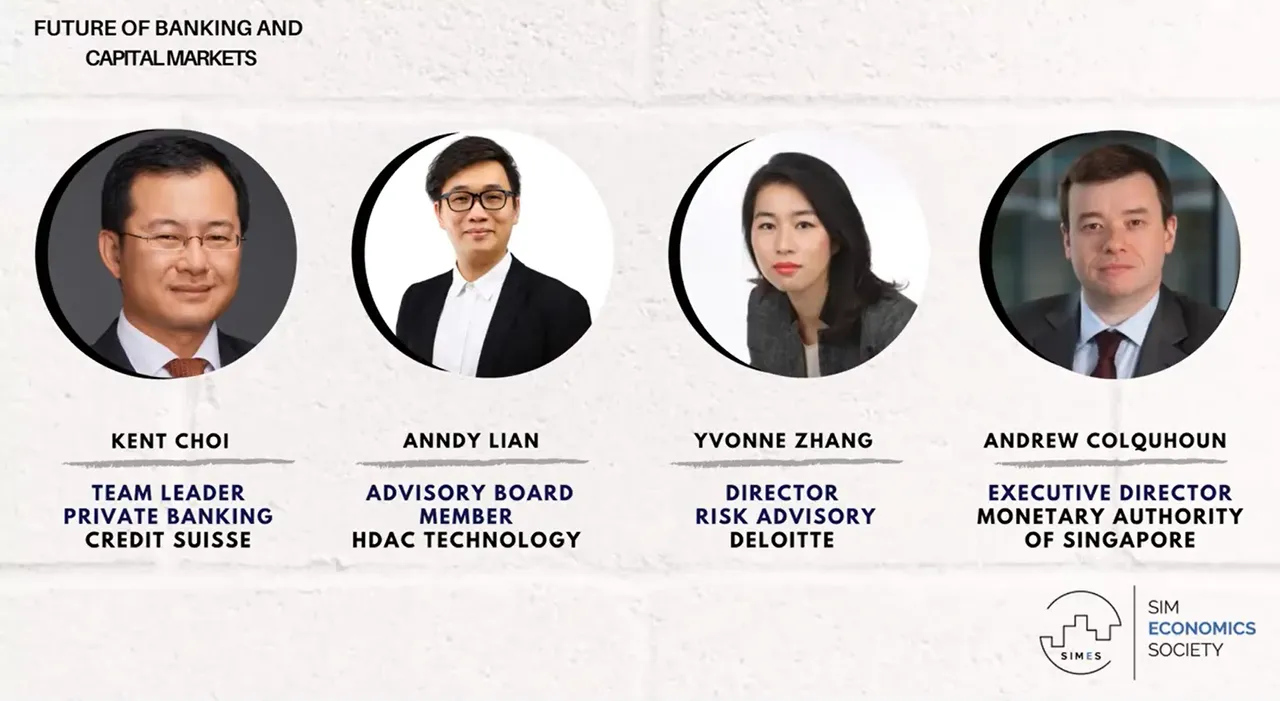

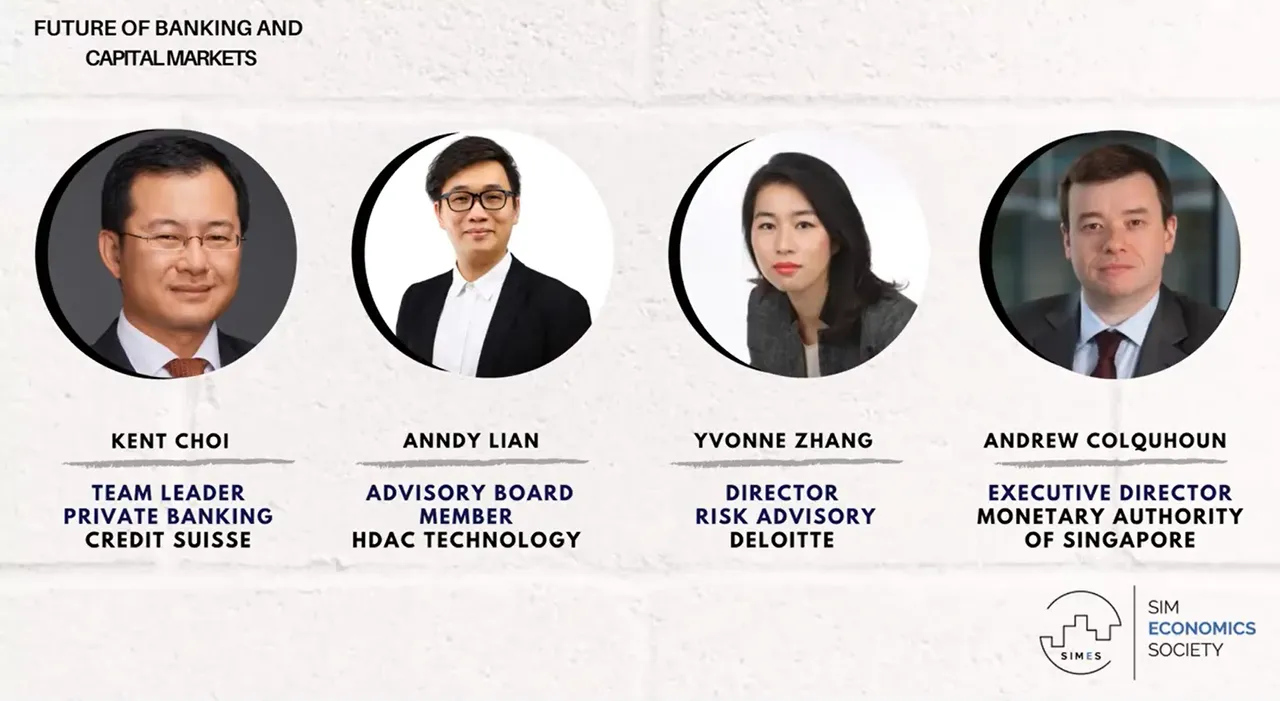

The panel consists of Kent Choi (Team Leader, Credit Suisse), Yvonne Zhang (Director, Risk Advisory, Deloitte), Andrew Colquhoun (Executive Director, Monetary Authority of Singapore), and Anndy Lian (Advisory Board Member, Hyundai DAC) and moderated by Pau Khua Mung.

The topic of Central Bank Digital Currencies (CBDC) came up during the discussion. CBDC is known as a new type of currency that governments around the world are experimenting with. It is issued and controlled by the central bank is managed on a digital ledger or blockchain, the same technology that underpins cryptocurrencies such as bitcoin. CBDC also aims to expedite and increase the security of payments between banks, institutions, and individuals.

Andrew Colquhoun, MAS, mentioned that: "Digital currencies are a key area for MAS and central banks globally. Consensus views across different institutions show no immediate urgent use case for CBDC in this region. Many central banks are adopting a wait and see approach and still on a consultation basis."

Further accelerating central banks' considerations for the issuance of CBDC, Anndy Lian, Hyundai DAC added: "CBDCs are very early-stage and I believe CBDC is here to stay. CBDC is a form of digital fiat powered by blockchain for many, is traceable and accountable. It works 24/7, nonstop around the clock." He also went on to clarify that CBDC is not a cryptocurrency. "We must be clear on this and not lumped this (CBDC) into the bucket of cryptocurrencies. There are also crypto companies looking at adding cryptocurrencies on top of CBDC and acting as a bridge. But this is a different concept."

Digital currencies are still early. It is essential to understand the pros and cons behind it. Digitalization has prompted both regulators and the public to demand increased privacy. Same for CBDCs. Many technologists believe that the right design structure for CBDCs will ensure privacy. "There are many misconceptions on the technology and concept. It will take time to design a suitable model. In my opinion, CBDCs complement and not replace cash. Cryptocurrency recreates the future of finance." Anndy sums up.

Economics Summit 2020 is an annual event organized by SIM Economics Society (SIMES). SIMES is a student-led society at the Singapore Institute of Management (SIM) committed to learning and researching global economic challenges.

Kevin Kristano, VP in Marcomm, SIMES thanked all the speakers and his colleagues for making this event possible and told the reporter: "Covid-19 has accelerated a vast array of technology adoption and digital transformation in several industries, like banking and finance. I believe that this change is imminent, regardless of the pandemic. I look forward to how this technological shift would affect the global economy."

The two days summit ended on 2 November 2020. To view the video recording for this panel, go to  .

.

Media Contacts:

Name: Jenny Zheng

Title: Editor

Email: contact@blockcast.cc

Website: www.blockcast.cc

Posted from www.anndy.com : https://anndy.com/event/anndy-lian-spoke-at-economics-summit-2020-future-of-banking-capital-markets-cbdcs-complement-and-not-replace-cash-cryptocurrency-recreates-the-future-of-finance/