Evelyn Cheng

Bitcoin still faces many challenges in becoming a globally accepted currency, Bank of America Merrill Lynch's commodity and derivatives strategist Francisco Blanch said in a sweeping Monday report comparing digital currencies' growth to that of gold, silver and even salt in ancient times.

"A crucial hurdle" for bitcoin is whether major financial institutions will accept the digital currency as collateral, said Blanch, who is considered by many to be one of the best commodity analysts on Wall Street. "But we are not aware of any major institution that takes cryptocurrency as collateral at the moment."

The report is one of a handful from major Wall Street firms and strategists that have recently warmed to bitcoin for its potential as an investment product. The digital currency briefly tripled in value this year, rising from below $1,000 to $3,000 in June. Bitcoin traded near $2,800 Monday.

Beginning with salt in ancient times, Blanch noted how practical needs and new discoveries have led to the development of new currencies:

Salt was "once mined and treasured in the ancient world."

But salt and other commodity-backed currencies often proved impractical and not durable enough, so governments began making coins with metals such as gold and copper.

The Spanish discovered large silver deposits in Bolivia in the 16th-century, leading to nearly 400 years of trade dominated by silver dollars.

Carrying around large amounts of gold and silver wasn't ideal either, so the world started to move to paper money in the last 200 years.

Paper money created huge waves of price increases and declines along with the business cycle. Today, most countries' currencies rely on "full faith of the issuing government" that central banks will comply with their mandate not to let inflation run too high or low.

Given this history of currency development, BofAML's Blanch seems to hint that bitcoin may soon be considered legitimate. He laid out three main criteria that bitcoin must meet in order to become a reserve currency of the world: safety, liquidity and return.

"Bitcoin and other cryptocurrencies score well on some, and not so well on others," Blanch said.

Safety

Bitcoin didn't score that well on this parameter, Blanch said. "The lack of a centralized decision-making process or authority creates risks such as a currency split," he said. "Also, risks such as

hacking, identity theft, or outright scams are a recurring problem."

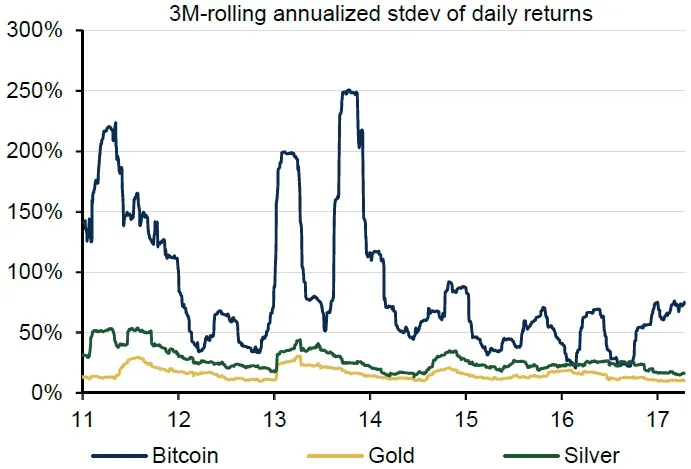

However, when using volatility to measure the safety of bitcoin, the cryptocurrency has actually beat silver.

"Bitcoin's volatility is very high compared to the euro, the yen or even gold," Blanch said. "But it fell twice last year below the volatility of silver, the world's currency for 400 years."

Bitcoin's volatility starting to approach that of silver

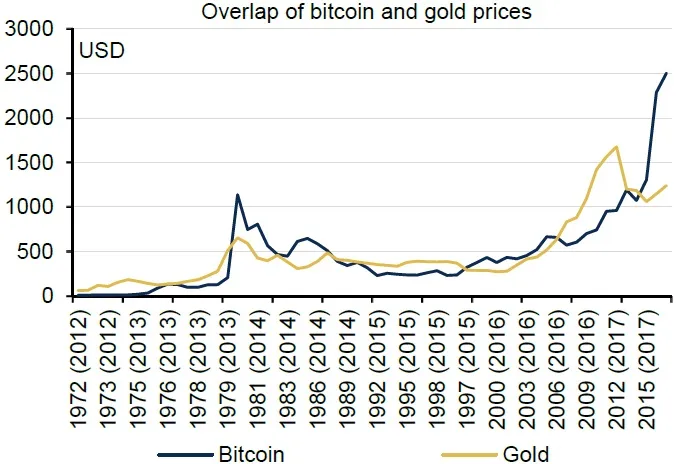

Bitcoin (years in parenthesis) vs. gold

Source: Bank of America Merrill Lynch Global Research

To be sure, short-term appearances of similarities among bitcoin, gold and the development of historical currencies don't imply that bitcoin is here to stay.

"There is no certainty that that [similarity to gold] will continue and, most certainly, no way to predict it," Blanch said. "In our view, cryptocurrency returns will mostly depend on the faith placed by individuals, corporations, and financial institutions on this emerging technology."