401K in 2025 - Max Saver benefits

Now it is time to look at what 2025 means for investors. I want to look at the #401K changes in 2025. Understanding how #retirement plans work and what it means is a bit more complex but you don't need to understand everything.

https://www.cnbc.com/2024/10/16/catch-up-contributions-change-2025.html

Old Limit in 2024 - $23000

Old Limit in 2025 - $24000.

Age 50 and over:

Old Limit in 2024 - $30500 (23000 + 7500 catch up)

Old Limit in 2025 - $32000 (24000 + 8000 catch up)

Age 60/61/62/63 Special Rule --> 2025.

Old Limit in 2024 - $30500 (23000 + 7500 catch up)

Old Limit in 2025 - $35250 (24000 + 11,250 catch up)

The first thing we need to look at is the "MAX" saver population. Most studies put that number at under 15% of people hit the max.

The problem is if you making between 20K-150K, it is hard to hit the 23K (2024 limit) or the 24K (2025 limit). You will need to save 15% or more to hit that limit. Here is an Excel chart to show this:

If you were making:

$75K - you need to save 30% of your income to hit the max 401K limit

$90K - you need to save 25% of your income to hit the max 401K limit

$120K - you need to save 19% of your income to hit the max 401K limit

$150K - you need to save 15% of your income to hit the max 401K limit

If you were age 50+, your limit is higher but do we think this helps the general population or does it only help a small group of high-income earners?

These benefits are not designed to help the lower and middle-class income earners. They are not even helping the US Government because of the loss of tax revenue.

For example:

Joe Bob makes $120K a year. Joe's wife is a SAHM.

Joe saves 10% in his 401K --> 12K is tax-deferred until he retires.

Joe's tax bracket in 2024 is 22% (for each dollar he saves in a 401K, he does not pay taxes on this).

In 2030, Joe retires and pulls out $120K a year from his 401K plan.

Let's assume that the tax bracket is now 25% (22% --> 25%) because that is what happens in life.

Q: How does Joe win?

Q: How does the US Govt lose?

The answer comes from the weighted average of the tax-deferred vs what would have been taxed.

Joe would have to pay taxes on the 12K (in 2024) at the 22% tax rate. By deferring into a 401K plan, he retired and now his income is taxed at the rate in 2030. In this example, we assumed it was now 25% rate. Because of the way the progressive tax system works, the year the money is deferred is from the "top tax rate" of where your income falls. The income in retirement is the weighted average to figure out what your true effective tax rate is.

In 2024, not using any deductions to make things easy, Joe would have a tax liability of $19290 (or 16% effective rate).

Or because he used the 401K to invest 10% of his salary, his taxable income is now only

$108K or a tax liability of $16250 (or 15.42 effective rate). This move saved him $2640 in taxes, so his 12K contribution only cost him only $9360 out of pocket. It either gives more money to the govt via higher taxes (~19K) or pays the ~$16K and puts $12K into your 401K and deferred that until 2030.

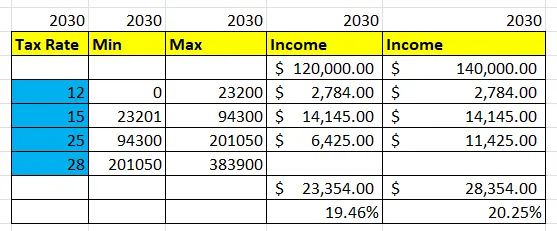

Now let's jump to 2030 and we will be assuming all the tax rates are higher but not the "ranges" of the buckets so the govt will tax us more in the future.

I model two different retirement incomes 1) 120K or 2)140K to see his tax liability with the higher tax rate. His effective tax rate is 19.46% if he withdrawals $120K and 20.25% if he withdrawals $140K. In both cases, that is still LESS than the 22% tax bracket he was in 2024. So this logic of TAX BRACKET higher or lower is often misused to scare everyone to think a higher tax bracket in retirement will ALWAYS be worse than what you were paying in your working years.

The facts are that less than 5% of people will actually in higher tax rate in retirement and will have a LARGER effective tax rate than their working years. This is the group that should consider doing a Backdoor Roth IRA conversation. For other folks, doing a ROTH IRA will give you some more options and hedging opportunities.

US Govt loses tax revenue.

While it sounds great to let people tax defer 25K-35K a year, most middle class can't do this. This is giving a tax break to those that don't need it. The govt will collect less in the future even if you raise the TAX RATE in the future. The progressive tax system is designed to do this. This is why I think catch-up contribution is a bad idea since the people who need help won't be able to take advantage of it.

What do I do today in 2024?

Let's make this simple.

I put 6% in my 401K (enough to get the free matching fund from my employer).

I would max fund the HSA (if you have one available to you) each year.

I would suggest putting some money into a Roth IRA (if you are under the income limit).

I would consider adding $25-100 a month into Bitcoin.

If you still have free cash flow at the end of the month, I will increase the 401K saving percentage to 10% 15%, or 20%.

The majority of people can't and won't max fund their 401K. If you started early, you won't need to do this to achieve over a million net worth.

Let level-up you knowledge to #Level102!

Have a profitable day!